In a step that could have major reverberations for the shape of the future energy system, on August 29, the provincial grid operator and a leading power distributor announced the creation of Canada’s first local electricity market. Recognizing that new technology, combined with changing consumer demands, have made it possible to move beyond the standard regional structure for power markets, the Independent Electricity System Operator (IESO) recently decided that its cutting-edge launch of Ontario’s first ever local electricity market will be in York Region, just north of Toronto, with support from Alectra Utilities and Natural Resources Canada. In a region that is seeing rapid growth and pressure to expand its power grid, the wide ranging pilot project is intended “to save costs and find affordable alternatives to building new transmission infrastructure.” It could also herald the onset of a slew of radically new approaches to doing business in the energy industry.

“The implications of this bold initiative are truly historic,” said Tim Short, a Toronto-based energy expert with decades of experience in the gas and electricity industries. “A project like this could stimulate the invention of all kinds of cost-saving new technologies, and lead to the development of energy businesses providing services that could only have been dreamed of in the past.” Although existing power utilities have generally provided very efficient and cost-effective services in recent decades, their options have been limited by the technology they had available, which consistently pushed them to invest in large, regional-scale generation and transmission assets. The large scale assets deliver economies of scale, but come with certain built-in inefficiencies. The new-found ability to generate power economically close to the customer, while managing energy transactions through distributed control technology, is opening the door to a range of opportunities for reducing costs and improving service to customers. “The efficiencies available from local optimization, to say nothing of new kinds of resources, have barely been explored,” Short says.

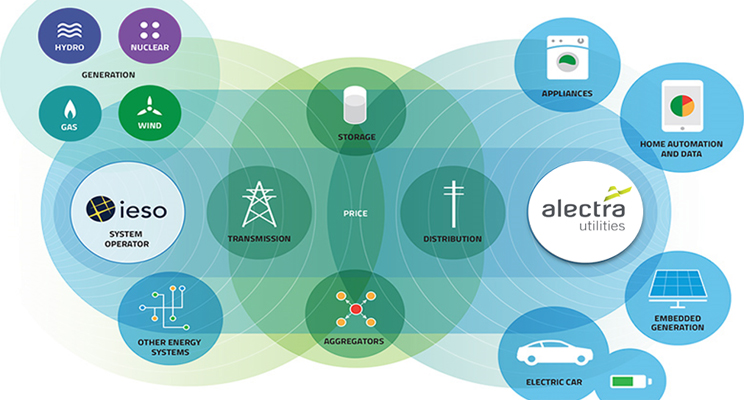

The York Region Local Electricity Market is ground-breaking - and potentially a hot-house for new business ventures. Graphic courtesy of the IESO.

“When we’re out talking to communities, one common theme we hear is a desire to have more choice in how their electricity needs are met,” says Terry Young, Vice-President of Policy, Engagement and Innovation at the IESO. “This pilot will help us learn if we can enable that choice while also reducing costs for Ontarians.” The IESO notes that the local electricity market will allow resources like combined heat and power plants, energy storage, and consumers capable of reducing their electricity use, to compete to be available during periods of high demand. “Leveraging existing local resources could help avoid the need to invest in new transmission lines and stations, while competition will drive down costs.”

The York Region Local Electricity Market is ground-breaking - and potentially a hot-house for new business ventures. Graphic courtesy of the IESO.

“When we’re out talking to communities, one common theme we hear is a desire to have more choice in how their electricity needs are met,” says Terry Young, Vice-President of Policy, Engagement and Innovation at the IESO. “This pilot will help us learn if we can enable that choice while also reducing costs for Ontarians.” The IESO notes that the local electricity market will allow resources like combined heat and power plants, energy storage, and consumers capable of reducing their electricity use, to compete to be available during periods of high demand. “Leveraging existing local resources could help avoid the need to invest in new transmission lines and stations, while competition will drive down costs.”

“The IESO, Alectra and Natural Resources Canada are effectively opening up a race to find ever newer and more creative ways to create value,” said APPrO President Dave Butters. “For this, they deserve a great deal of credit.” Although the enabling technology is advancing quickly, there are very few examples of fully functioning local electricity markets anywhere in the world. A few limited trials have begun in Europe where public policy has pushed a small number of early experiments forward. In the United States, the concept of transactive energy markets has received a lot of development attention in technical circles and a few jurisdictions are rolling out limited trials.

Neetika Sathe, the VP of Alectra’s innovation program based at its “GRE&T Centre,” believes the initiative will prove timely: “As DERs become less costly, more sophisticated and more appealing to customers, they will increasingly be able to play a role in the distribution system. Transactive energy is an emerging approach that will help us operate and balance the grid in new ways. These changes must be studied, and reflected in the planning and operation of the grid through higher visibility of DERs, effective communication between the utility and DERs owners, and coordinated operations between the utility and transmission system operator.”

Although the York Region project is still under development, it is moving forward quickly. In the near future, Alectra plans to run local capacity auctions that will “Implement procurement process(es) and select DERs that will receive service agreements.” The IESO will be hosting a webinar to outline the project plan schedule in more detail.

The primary driver for developing and installing distributed energy resources (DERs) has been cost savings for consumers. Most industry analysts expect that DERs will reduce the cost of generating and distributing electricity – a welcome change after decades of stubbornly increasing electricity costs. Although the proliferation of new technology may entail some cost-shifting and transitional costs, overall cost reductions are generally expected. Projects like the local electricity market offer the prospect of savings not just from the lower inherent costs of producing and delivering energy, but also from increasing competition among suppliers. While wholesale competition delivered billions of dollars in savings to consumers where it was introduced starting in the 1990s, competition at the local level holds the potential to deliver even greater savings from competition considering that it leverages a much larger number of active players, and a greater range of technical options for both generation and control of power at the local level.

Alectra is in the process of developing a platform where customers with DERs will be able to register, submit their bids, receive dispatch instructions, and be settled for qualifying offers to provide electricity service. The IESO notes that "Distributed energy resources (DERs) are increasing across North America and currently make up about 10 per cent of Ontario’s electricity capacity." It also stresses that, "This pilot will help us learn how local electricity markets can be integrated with the provincial electricity market."

“We’re excited to join the IESO and Natural Resources Canada in championing innovation, embracing leading-edge technologies and shaping the energy future of our customers and our communities,” said Brian Bentz, President and CEO of Alectra Inc. “This project will help us better understand the potential of using distributed energy resources in place of traditional infrastructure by evaluating them in real-world applications.”

Project design starts in October 2019 and continues through the first quarter of 2020. A more complete timeline will likely be released after further consultation.

“A well-developed local electricity market will serve as an open invitation to inventors and innovators to come to York Region in Ontario,” Mr. Short said. “It could present one of the best opportunities to test out their ideas in a real world setting and find out which ones create the greatest value for the utility and returns for the investors. This could become an internationally recognized test bed for innovation.”

“This could become an internationally recognized test bed for innovation.”

In principle, anyone who can devise a new way to create value anywhere in the electrical system has an opportunity to start a new business in this environment. Such projects would have to identify one or more incremental revenue streams of course. However, that revenue stream could conceivably be outside the proponent’s physical plant, as long as the new business can be credited with actions leading to identifiable units of value creation. The potential types of new energy services are mind-boggling. In a completely unfettered local market, for example, innovators could test out any of the following:

1. Installing equipment for generating power, storing power, or managing power flows as part of local industrial, commercial or residential development. The power service can be designed for one’s own use, for sale directly to other customers, for offering into the market, or a combination of the above.

2. Local businesses, possibly networked between neighbourhoods, sharing the services of a local battery storage systems, to pool the output from their solar photovoltaic panels, or other resources, improving the value of their service, local self-reliance, and reliability.

3. Control hardware and software to help the electric utility reduce congestion on the grid, line losses and outages. These controls can engage the services of underutilized assets or resources in private hands to help the public utility, or simply co-ordinate the use of existing public electrical infrastructure in a more granular or time-sensitive way than was possible before.

4. Establishment of real time local auctions for power service, so that the local electricity distributor or market operator can find the lowest cost source of power at any time, comparing what’s available on the wholesale grid, from local suppliers, and from other resources such as Demand Response. (Demand response is a service provided by electricity customers who are prepared to cut their demand on short notice to alleviate technical problems on the grid.)

5. Online networks of electric vehicles (EVs) and charging stations that offer their assets as standby capacity to support other customers and the grid as a whole, addressing momentary imbalances, in return for financial credits that can be used for other energy services. Technology is already available that enables customers to remotely dispatch EV charging instructions.

6. Brokers who source power from local customers and from other types of preferred suppliers such as green energy, and re-sell it to local customers using agreed-upon pricing structures for their preferred value-added services. Customers could potentially re-sell their green energy certificates on the international market or have a broker do so for them. The market for this kind of green energy service has boomed recently as major corporations such as Google and IKEA make very public announcements of their purchasing commitments. Another kind of broker could remarket surplus power from renewable generation facilities, saving those customers the cost of storage equipment.

7. Traders who arbitrage sources of power and other power-related services (often called ancillaries) between suppliers /customers within a region or between regions, to reduce the overall cost of service. Assuming regulatory concurrence, another category of locally-oriented traders is conceivable, focused on helping the competitive affiliates of local LDCs reduce the cost of their power purchases through active portfolio management.

8. Aggregators who assemble services from multiple sources and re-package them for sale to others for whom they hold higher value. Competition amongst aggregators, and between aggregators and central power system functions, could lead to grid operators like the IESO to source more services competitively, reducing costs for consumers.

All kinds of innovations, from small to large and from local to global, have opportunities to find revenue streams in this environment. Of particular note, in this demonstration project, the distributor has agreed to operate exclusively as a platform provider, overseeing the connections and external impacts of new facilities in the local electricity market. Alectra will not become a developer or owner of new assets that would compete in the local market. This assurance is welcomed by APPrO and many others in the industry because it is seen as avoiding potential conflicts that could arise in situations where an LDC both administers a market and owns assets that participate in that market.

The deployment of any of these business ideas will provide further savings to customers to the extent they enable the local distribution utility to defer or displace expensive capital upgrades. The point is not lost on York Region, where Alectra operates, which is facing the prospect of relatively high cost investment in new infrastructure in the near term. Nor is it lost on dense urban areas like the City of Toronto where DERs present an attractive alternative to new transmission that is proving increasingly expensive to build. Some utilities and policy makers have developed “least cost planning” methods which effectively create an obligation on the utility to determine, before committing to major capital projects, whether a lower cost solution may be available from a combination of local resources or other options.

“This kind of initiative could position the Alectra utility and the region on the front lines of innovation in the energy systems of the future,” Mr. Short says. Although few experts believe that local electricity markets will completely replace regional markets, the growth of local markets is already underway in practice, and for many it is simply a question of when and how the existing industry will recognize their potential. It is entirely possible that with new technology, and services developed through demonstration projects like the York Region local electricity market, future grid operators will look to local energy operations to provide an increasing proportion of the services they require for meeting the demand of other customers on the grid.

The IESO has just released a new discussion paper on some of the key issues it sees emerging in the area: Conceptual Models for DER Integration. In addition, it is preparing to release further discussion papers on Non-Wires Alternative Markets and Transmission-Distribution Interoperability, as part of its “Innovation and Sector Evolution” public consultation initiative. The findings outlined in these reports will help inform the market design. The market design process, being led by the IESO, is expected to be a focus of intense interest in the months ahead. The white papers can be found on the IESO website at ieso.ca > Sector Participants > Engagement Initiatives > Innovation and Sector Evolution White Paper Series, or this location.

For project updates, APPrO encourages readers to watch for releases from Alectra and the IESO, as well as further articles published by APPrO in the coming months.

APPrO will be hosting a range of discussion on these issues as part of the APPrO 2019 Canadian Power Conference and its associated event “The DER Ecosystem” on November 21 and 22. One session on November 22 features Neetika Sathe from Alectra speaking on the development of the York Region Local Electricity Market. For further details, see this link.

A version of this article is also published on LinkedIn at this location, where users can post comments and use other features.