Canadian companies are increasingly focused on making long term improvements in their environmental and social performance, in some cases upping the ante to levels never before seen. This is reflected in a range of sizable new investment programs targeting significant advancements in sustainability, environmental impacts and governance. Many of the programs include long term Power Purchase Agreements, an investment category that is likely poised for impressive growth.

Examples include:

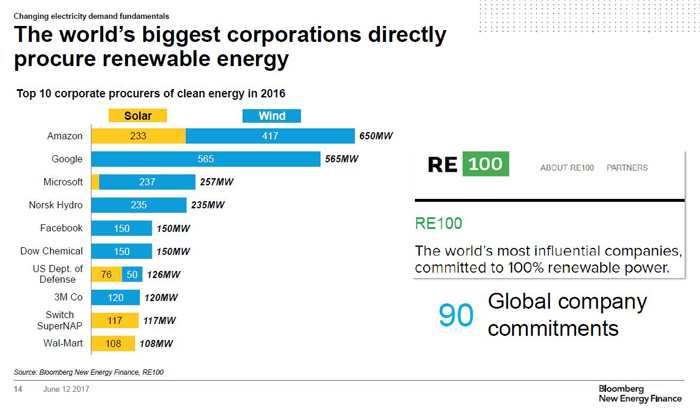

• Google, Apple, Microsoft, IKEA, Walmart, TD Bank, Goldman Sachs and Bank of America have all announced major long term investments in renewable energy.

• Nearly 200 of the world’s largest companies have agreed to set science-based emission reduction targets, and more than 100 firms have signed on with the global initiative RE100, which commits an organization to move toward 100% renewable energy (Winston, Favaloro and Healey, Harvard Business Review, Jan-Feb 2017)

• Companies such as Walmart, Morgan Stanley, and Kendall-Jackson use on-site distributed power (fuel cells or a combination of solar panels and storage technologies) to maintain operations when the grid goes down. (Winston et al, op.cit.)

• In an apparel-sector analyst report, Morgan Stanley recently raised its stock price targets for Nike, Hanesbrands, and VF because they outperformed peers with a “better and more effective sustainability strategy,” including their management of energy issues. (Winston et al, op.cit.)

• Intact, the largest Canadian property and casualty insurer, recently commissioned research on climate adaptation in Canada and subsequently proposed changes in the services offered by Intact, including new products.

• Last year the Las Vegas gaming giant MGM Resorts International paid an $86 million penalty to break its contract with the local utility Nevada Power so that it could buy greener energy on the wholesale market. (Winston et al, op.cit.)

• North American real estate manager Bentall Kennedy took lessons learned from Hurricane Sandy and applied them in Calgary. One of their initiatives was to commission the University of Waterloo to identify opportunities to manage climate change-related risks.

Francisca Quinn, Quinn & Partners

“Because of rapid technology evolution, with falling costs for solar and wind, green energy is now affordable in many situations,” explains Francisca Quinn of Quinn & Partners. Citing Bloomberg New Energy Finance, she notes that, “Levelized costs can be at or below natural gas-fired generation.” Quinn & Partners describes itself as a “sustainability strategy and integration advisory firm.” Its clients include a number of major North American corporations from the Cadillac Fairview Corporation to Manulife Real Estate.

Francisca Quinn, Quinn & Partners

“Because of rapid technology evolution, with falling costs for solar and wind, green energy is now affordable in many situations,” explains Francisca Quinn of Quinn & Partners. Citing Bloomberg New Energy Finance, she notes that, “Levelized costs can be at or below natural gas-fired generation.” Quinn & Partners describes itself as a “sustainability strategy and integration advisory firm.” Its clients include a number of major North American corporations from the Cadillac Fairview Corporation to Manulife Real Estate.

This kind of investment activity appears to be part of a rising tide. Writing in the Harvard Business review in 2016, Tensie Whelan and Carly Fink explain that, “Embedded sustainability efforts clearly result in a positive impact on business performance. ... Mounting evidence shows that sustainable companies deliver significant positive financial performance, and investors are beginning to value them more highly.”

Given that media attention often goes to government programs mandating sustainability, or to households finding new ways to go green, the efforts of corporations to become more sustainable may have been overlooked by comparison in recent years. This could result in significantly greater impact than most people expect, when the programs are rolled out.

Ms Quinn stresses that, “Leading Canadian real estate developers proactively look for opportunities to incorporate renewable energy in new and existing investments.” She cites several examples: Healthcare of Ontario Pension Plan (HOOPP) together with Fortis recently installed a large geothermal system at its new Marine Gateway hub in Vancouver. The Cadillac Fairview Corporation retrofitted an existing office building with a geo-exchange system. Waterfront Toronto’s sustainability framework specifies that developers incorporate renewable energy into design.

Manulife, one of the largest insurance companies in Canada, is targeting renewable energy as a key strategy to lower the greenhouse gas emissions footprint of its 60 million square foot global real estate portfolio, together with energy efficiency. Manulife was also one of the early investors in commercial wind energy projects in Canada.

Tony Pringle of Quinn & Partners explains that, “Across industries, globally, companies are investigating how sustainability or environmental, social and governance (ESG) factors present risks and opportunities for their business and how to capture the value in corporate strategies. Key drivers for infrastructure and power generation companies include: Investor demands for sustainability, expectations for ESG management and reporting, corporate customer demands for ESG services and solutions, employee preferences about working for good companies and having a positive impact, the changing regulatory landscape, and the fact that climate change, greenhouse gas emissions, Community/First Nations engagement and climate resilience are increasingly material to companies and their key stakeholders.”

Having provided strategic advice to a range of major Canadian companies, Quinn & Partners report that “Corporate customers are starting to treat energy sourcing and management as a strategic issue:

• Global, cross-industry companies are committing to 100% renewable energy (http://REthere100.org/companies) including GM, TD Bank, HP, etc.

• Companies are entering into direct purchasing agreements with power producers

• Corporate buyers make up more than almost half of US PPAs

• More than 40% of Fortune 500 companies now have targets relating to renewable energy procurement, energy efficiency or cutting GHG emissions

• In general, companies look to energy generators to help fulfill climate change objectives.”

The key driver in overall sector growth however may be access to capital driven by changing considerations adopted within the investment industry. Quinn notes that:

“Similarly to companies, investors are incorporating ESG into investment decisions and monitoring of assets, favouring responsible management practices and assets that contribute to a low carbon economy:

• Responsible investing represents 38% of Canadian investment industry (https://www.riacanada.ca/trendsreport/ )

• These investors want to know how companies they invest in manage ESG aspects – they see ESG management as a proxy for good management of risks and opportunities and want measurable outcomes

• Signatories to the Principles for Responsible Investment (PRI) which includes infrastructure reporting, represent most of the world’s largest investors - US$62 trillion

• In terms of yield and matching long-term liabilities, alternative asset classes like energy and infrastructure are increasingly attractive for institutional investors

• Especially for geographically fixed, long-term, real assets, there is a business case for ensuring ESG risks and opportunities are being managed

• GRESB Infrastructure - Global ESG assessment started by OTTP and AIMco (among others) assesses energy generation operators on ESG integration (https://api.gresb.com/infra/home )”

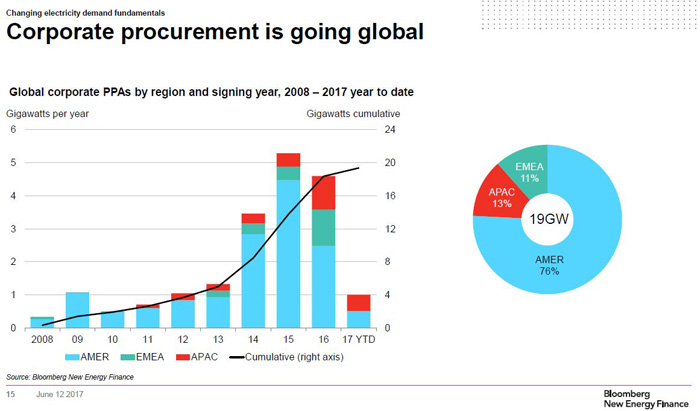

Nathaniel Bullard of Bloomberg New Energy Finance released figures at the June 12 IESO Stakeholoder Summit underlining his contention that, “The world’s biggest corporations directly procure renewable energy,” and that “Corporate procurement is going global.” See figures below.

The budding and increasingly strategic interest in energy initiatives amongst major corporations has made them an important customer group for the power industry to watch. “They are looking for new competencies and access to technology to ensure on-demand, reliable and inexpensive green energy, as well as energy efficiency solutions to bolster their bottom line and demonstrate corporate responsibility,” Quinn says. As power markets evolve, power suppliers may increasingly turn to these kinds of customers for risk management and other reasons.

Ms Quinn explains: “If a company uses power in their operations, they need to show they are directly producing the same amount of renewable power or adding an equivalency to the grid through owning RECs or indirect PPAs.” Apparently RECs are relatively affordable on the international market, currently trading around US$0.70 per MWh. “It is fair to say that companies committing to renewable energy are prepared to pay a premium, at least in the short term, because of green brand benefits and longer term risk mitigation. Energy is still a relatively small expense for most companies. They are also betting that conventional energy will become more expensive through carbon taxes, etc. and are hedging against that through long-term green PPAs.”

Whelan and Fink conclude: “The preponderance of evidence shows that sustainability is going mainstream. Executives can no longer afford to approach sustainability as a ‘nice to have’ or as … separated from the ‘real’ business. Those companies that proactively make sustainability core to business strategy will drive innovation and engender enthusiasm and loyalty from employees, customers, suppliers, communities and investors.”

See related story “Private companies form a new driver for windpower growth,” IPPSO FACTO April 2016.

And “CRS Releases renewables certification,” elsewhere in this issue of IPPSO FACTO.