Ottawa-based BluWave-ai announced March 18 the completion of a $3.9M round of seed financing.

BluWave-ai provides “software-as-a-service” (SaaS) solutions enabled by artificial intelligence to optimize investment in and sustainable energy operation for industrial customers, utilities, and electric fleet operators. BluWave-ai’s grid energy optimization platform is designed to balance the cost, availability, and reliability of different energy sources – renewable and non-renewable – with energy demand in real-time.

BluWave-ai provides “software-as-a-service” (SaaS) solutions enabled by artificial intelligence to optimize investment in and sustainable energy operation for industrial customers, utilities, and electric fleet operators. BluWave-ai’s grid energy optimization platform is designed to balance the cost, availability, and reliability of different energy sources – renewable and non-renewable – with energy demand in real-time.

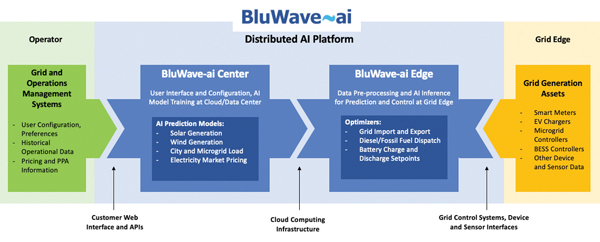

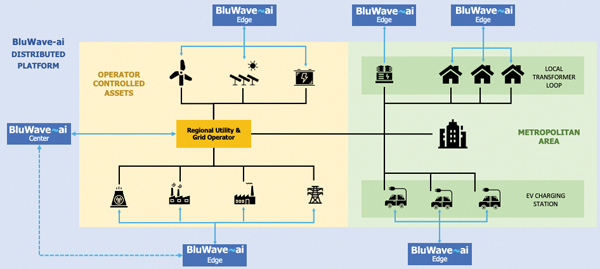

BluWave-ai’s distributed SaaS platform consists of BluWave-ai Edge and BluWave-ai Center, and operates in the cloud. BluWave-ai Edge connects to IoT sensors and meters deployed at the grid edge, using historical and real-time operational data, such as weather patterns and predictions and power pricing, to provide AI-assisted optimization of dispatchable generation and storage assets.

BluWave-ai’s distributed SaaS platform consists of BluWave-ai Edge and BluWave-ai Center, and operates in the cloud. BluWave-ai Edge connects to IoT sensors and meters deployed at the grid edge, using historical and real-time operational data, such as weather patterns and predictions and power pricing, to provide AI-assisted optimization of dispatchable generation and storage assets.

BluWave-ai Center administers the network, including managing BluWave-ai Edge nodes and various IoT and SCADA devices. As streams of new data flow from all these devices, BluWave-ai Center continuously adapts, improving the AI models used by BluWave-ai Edge to predict, optimize, and dispatch control.

Since opening the seed round in Q2 2019, BluWave-ai has landed utility and commercial customers on three continents. In Summerside, PEI, Canada, BluWave-ai deployed the first AI-enabled “optimal energy dispatch” in the Canadian utility market. In Ontario, the company secured a $1M energy optimization project with the Independent Electricity System Operator (IESO). In India, BluWave-ai has partnered with Tata Power, implementing live operational AI-enabled day-ahead dispatch for the city of Mumbai. In the UK, the company partnered with independent power producer Greencat Renewables to optimize the operational cost of a grid-attached waste recycling facility with battery storage, wind, and solar energy resources.

Sustainable Development Technology Canada (SDTC) had the largest proportional contribution to the total $3.9 million in seed financing, with $2.43 million of non-dilutive financing, confirmed in Q3 of 2019. The funds raised will drive the company’s penetration further into the international smart grid and renewable energy markets, build its patent portfolio, and enable its 2020 commercialization roadmap of multiple product releases.