In February the Electricity Distributors Association (EDA) released a key directional report, titled “The Power to Connect – A Roadmap to a Brighter Ontario,” outlining options for development and possible reshaping of Ontario’s power distribution sector. Like many other players in the electricity industry, electric distribution utilities are focusing intently on how to prepare for the proliferation of new technology that could fundamentally alter key features of the power system. For the distribution sector the changes may be particularly impactful as many of the potentially disruptive technologies are behind the meter or distribution-connected – in the distributors’ back yard as it were. The paper observes that “LDCs are ready to play a pivotal role in three dimensions: as enablers, integrators and orchestrators of DERs.”

The report follows on EDA’s previous Vision Paper from 2017, which proposed a framework for LDC transformation through three dimensions:

1. DER-enabling Platform – development of an intelligent platform for DER integration in

distribution systems;

2. DER Integration – LDC ownership of DERs; and

3. DER Control and Operation – optimize and coordinate usage of DERs.

Recognizing the directions set by the 2017 LTEP, the 2018 report notes that “both documents envision changing roles and responsibilities of LDCs in conjunction with the deployment of DERs.”

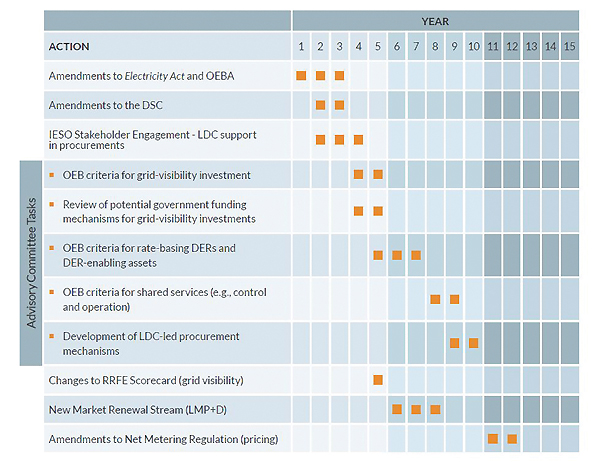

The report catalogues a series of challenges besetting the distribution sector that could act as impediments to appropriate forms of evolution. The following nine high-level solutions were identified:

• Levelling the playing field for DERs;

• Improved definition of DERs and potential services;

• Improving distribution system plans (DSPs) through investments in grid visibility;

• Remove restrictions on LDC ownership of resources;

• Guidelines for rate-basing of DERs and DER-enabling assets that are consistent with DSPs;

• Coordinating and decentralizing procurement of resources and DERs;

• Allowing LDCs to control and operate DER assets;

• Shared services of LDCs with respect to control and operations; and

• Eventual development of distribution locational marginal prices (LMP+D).

Explaining the rationale for establishing FINOs, the EDA report says, “Customers want choice and are increasingly demanding products and services tailored to their needs and goals. An important part of an enabling platform is facilitating third-party energy solutions. An enabling platform not only ensures diverse products are offered, but also their accessibility to a greater share of end-use customers.” (See also our editorial for more information on what might be entailed if distributors act as network orchestrators.)

As part of the solution, the EDA recommends that policy makers and market participants “Investigate an alternative regulatory framework that would incentivize local utilities to integrate DER, where doing so brings economic and/or system efficiencies.” At the same time it notes that, “There will still be a need for investment in traditional distribution infrastructure, hence regulatory reform must be prudently balanced to ensure cost-effectiveness. One of the key challenges will be to develop fair and transparent rules for an appropriate balance between traditional regulated investments and those that enable and accelerate the development of new, competitive markets.”

The regulatory framework will require significant attention to ensure LDCs are encouraged to evolve appropriately, while preserving if not fostering a competitive market for new services. The report says, “The regulatory structure in Ontario will need to be flexible to allow LDCs to adapt. LDCs cite the existing regulatory framework in Ontario as the principal barrier to expansion of business scope. Although the Strengthening Consumer Protection and Electricity System Oversight Act, 2015 enabled the OEB to authorize an LDC to expand business activities beyond electricity distribution, it remains unclear what test the OEB would apply in determining approval. The regulatory process for evaluating infrastructure investments makes it difficult for LDCs to propose and get approval for DER enabling investments. For example, the OEB only considers the impact on distribution rates in its DSP review, not the impact on overall system costs. There is also a lack of mutual understanding of the benefits and risks involved with grid modernization investments.

“The RRFE Performance Scorecard ‘customer focus’ based measures are related only to service quality, results of customer satisfaction surveys, and billing accuracy. Performance measures should be designed to encourage LDCs to address future customer needs and those of third parties who will rely on the enabling platform. LDCs are not encouraged to include technologies beyond the traditional network expansion and asset replacement under the existing regulatory framework. There are limited mechanisms for LDCs to monetize the value of benefits that DERs would bring under the current framework. Regulation must allow for some risks to enable investments in new technologies. If LDCs are compensated for implementing DER solutions that maximizes value in the system, whether it be through incentives or cost recovery, economies of DERs can be achieved earlier and LDCs can earn revenue.”

The report goes further saying, “A regulatory framework should reward LDCs that build their capacity as a DER enabling platform. A potential solution could be to adopt Earnings Impact Mechanisms (EIMs) tied to performance as a platform provider, facilitating the market, and advancing policy goals. Metrics can include peak reduction, energy efficiency, customer engagement and information access, affordability, and timely interconnection. EIMs would supplement LDC earnings and can be reevaluated as the market develops and market-based earnings become a stable source of revenue.”

The EDA highlights that its Vision Paper “provides a goal for LDCs that want to become active facilitators in a transformed electricity market, one that puts customers first and maximizes the utilization and value of electricity assets.” Very likely a range of energy sector stakeholders and observers are considering a number of related issues. To be resolved are fundamental questions including the degree to which distribution systems should become “mini-grids” like the transmission system, with the potential for operating or hosting market functions including pricing. Further questions include the degree to which LDCs should take part in active flow management, and in the development of non-wires resources. In addition, at a higher level, determining what outcomes each of these decisions would entail in terms of the systems required for governance and control.

The report concludes that, “Ontario’s LDCs are well positioned to lead in this transformation as an integral, customer-facing component within the electricity sector. With the appropriate tools, LDCs will be able to plan, operate, and coordinate DERs within their networks for the betterment of the customers they serve.”

For further information, readers may wish to access the following publications on line:

• The Power to Connect: Advancing Customer-Driven Electricity Solutions for Ontario.