Combined heat and power, known also as cogeneration, has experienced a modest period of growth in Ontario over the last two years. Although there has been relatively little media and public attention to these new projects, and despite taking years to come to fruition, they are benefitting from some well-honed, government-led forms of procurement that are producing results and well integrated with the needs of local utilities.

That said, it must be noted that the LTEP announced an end to the conservation incentive programs for behind the meter CHP fuelled by natural gas. The most important item from a CHP perspective is that applications for conservation incentives for fossil fuel based CHP will not be considered starting July 1, 2018. Ontario is somewhat unusual in that one of its primary forms of CHP procurement is “Conservation CHP,” in which local utilities count the electricity from new behind the meter CHP projects towards their regulatory obligations to meeting 6 year conservation targets.

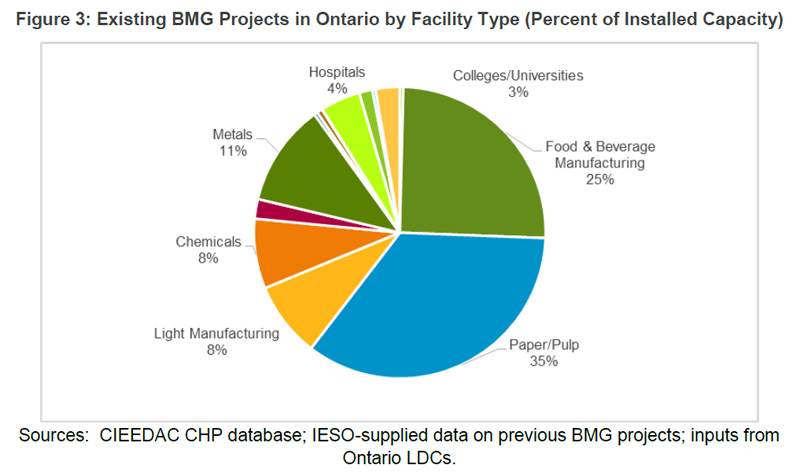

A study prepared this year by Navigant for the IESO, “Conservation Behind the Meter Generation Potential,” identified 107 CHP projects, and three “waste energy recovery” (WER) projects already in operation in Ontario, representing about 1.1 gigawatts of existing behind the meter generation (BMG). By way of a sample, the installations range in size from 30 kW to 160MW. Seven out of the 107, or 6.5%, are transmission-connected. The top three industries represented (in number of projects) are light manufacturing, hospitals, food & beverage manufacturing. Thirty-four out of the 107 (32%) are administered by the IESO.

For its part, the IESO has released the number and capacity figures for existing and contracted but not yet in service BMG CHP and WER. Table 1 compares the figures from Navigant and the IESO’s most recent progress report. The larger number of projects identified by Navigant reflects projects installed under a number of programs, while the IESO figures refer specifically to its ongoing conservation CHP program. In addition, existing installations that Navigant were removed from its estimates before calculating the remaining potential.

Table 1: Behind the meter facilities, present and potential, 2017 and 2025

|

|

Navigant |

IESO |

|||

|

|

capacity, MW |

Number |

|

capacity, MW |

Number |

|

In-service BMG projects |

1,053.558 CHP 9.4 WER1 |

107 |

In-service, PSU2 In-service, IAP3 |

62.347 CHP 38.5 WER |

20 |

|

Market potential, 2017 |

43 CHP 1 WER |

- |

Contracted, not yet in service |

56.899 CCHP4 67.165 WER |

5 |

|

Market potential, 2025 |

147 CHP 4 WER |

- |

- |

- |

- |

|

Potential customers |

- |

27,000 |

- |

- |

- |

1. Waste Energy Recovery

2. Process & Systems Upgrade program, distribution-connected and administered by the local distribution company. Capacity 500 kW to 10 MW

3. Industrial Accelerator Program, transmission-connected and administered by the IESO. Capacity to 20 MW.

4. Conservation Combined Heat and Power

Navigant went on to estimate, using some sophisticated modeling, the additional amount of BMG that could be put into service by the end of 2017 and by the end of 2025. That modeling exercise came up with several sets of numbers, under a successively restrictive set of real-world considerations: first, the technically possible; then the realistic market potential, then removing those projects that would be restricted by grid constraints. In addition, it calculated the likely effect of the price of carbon under Ontario’s greenhouse gas pricing system, concluding that the carbon price would reduce the market-achievable CHP would be reduced by about 20%, due to the carbon price being added to the cost of the natural gas that CHP facilities almost universally rely on.

The June issue of IPPSO FACTO carried a story (“CHP would reduce Ontario’s GHG emissions”) that predicted this would be the very effect of a price on carbon, and argued that an unintended consequence would be to remove the beneficial effect that CHP has on the efficiency of energy use in the grid.

Market potential itself was further broken down by purely financial considerations, and then further by additional considerations such as the typical payback time for a CHP project in different sectors.

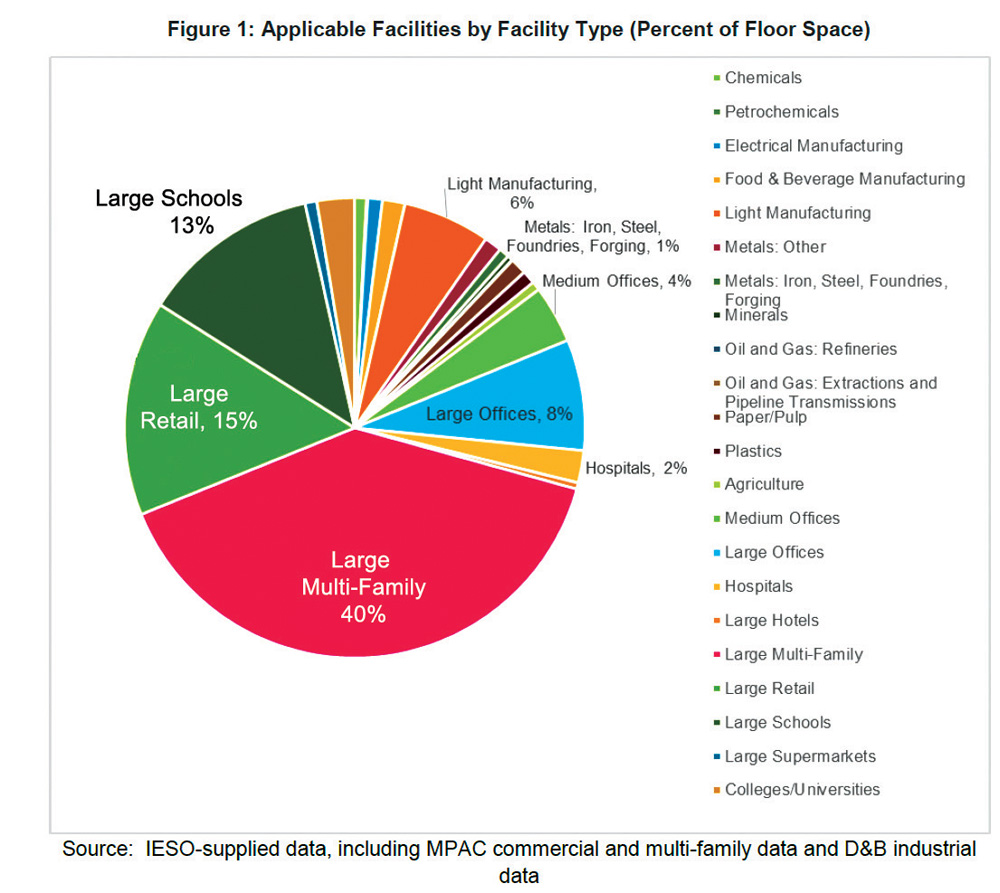

One of the major considerations in what the study called non-financial market potential is the time it would likely take for a project to pay for itself. Different types of business can expect a range of payback periods, depending on how they use energy. A table of payback periods shows a range from 1 – 6 years in the petrochemical industry, to 6 – 14 years for the hospital sector. Retail and medium to large offices were judged to show no potential. “Multi-Family Residential,” i.e. mostly apartment towers, take 10 – 11 years – unfortunate, since as the study’s figure 1 shows, large multi-family structures make up 40% of the floor space out of the total studied, and some indication of the proportion of energy they consume for space heat, hot water and electricity use.

One of the major considerations in what the study called non-financial market potential is the time it would likely take for a project to pay for itself. Different types of business can expect a range of payback periods, depending on how they use energy. A table of payback periods shows a range from 1 – 6 years in the petrochemical industry, to 6 – 14 years for the hospital sector. Retail and medium to large offices were judged to show no potential. “Multi-Family Residential,” i.e. mostly apartment towers, take 10 – 11 years – unfortunate, since as the study’s figure 1 shows, large multi-family structures make up 40% of the floor space out of the total studied, and some indication of the proportion of energy they consume for space heat, hot water and electricity use.

Circumstances have changed since Navigant released its report. In particular, the Fair Hydro Plan has affected prevailing rates for many customers, and the LTEP has announced an end to the incentives for fossil fuel based CHP. Navigant’s estimates would need to be updated, though they can still be regarded as indicative. Their projection for the potential in 2025, for example, should probably be reduced.

Circumstances have changed since Navigant released its report. In particular, the Fair Hydro Plan has affected prevailing rates for many customers, and the LTEP has announced an end to the incentives for fossil fuel based CHP. Navigant’s estimates would need to be updated, though they can still be regarded as indicative. Their projection for the potential in 2025, for example, should probably be reduced.

In particular, with respect to the Fair Hydro Plan, the business case for residential in particular has gotten more challenging as customer bills have declined by 25 per cent. In addition, the government lowered the threshold for class A participants, so many larger customers that previously were not eligible to participate in the Industrial Conservation Initiative (ICI) would now look to less capital intensive options than CHP for reducing their global adjustment costs.

Navigant’s results are shown in table 2. It’s instructive to see how quickly market considerations reduce the strictly technical potential for electricity savings. Table 3 shows the same for potential generation.

Referring just to the potential for electricity savings for industrial facilities under realistic market considerations, Navigant calculated a province-wide potential savings by 2025 of about 1,100 GWh, or about 7 percent, of the almost 16,000 GWh of technical potential for these facility types.

Table 2: Present and projected potential electricity savings (GWh/yr) for CHP under successive conditions*

|

|

Technical |

Market (includes economic) |

Carbon price |

constrained |

||

|

Financial |

Non-financial |

Financial |

Non- |

|||

|

2015 |

22,090 |

112-230 |

63-131 |

91-196 |

51-111 |

59-123 |

|

2017 |

22,397 |

361-742 |

203-423 |

294-634 |

166-360 |

190-398 |

|

2025 |

23,768 |

1,227-2,512 |

691-1,430 |

1,000-2,146 |

564-1,219 |

646-1,348 |

• Each condition subsumes all conditions to the left, except that the constrained potential is based directly on market potential, without the carbon price consideration.

•* depending on scenario. Scenario 1 is existing program.

Table 3: Present and projected generation potential (MW) for CHP under successive conditions*

|

|

Technical |

Market (includes economic) |

Carbon price |

constrained |

||

|

Financial |

Non-financial |

Financial |

Non- |

|||

|

2015 |

5,929 |

15-31 |

9-18 |

13-26 |

7-15 |

8-17 |

|

2017 |

6011 |

50-100 |

28-57 |

41-85 |

23-49 |

26-54 |

|

2025 |

6378 |

174-342 |

98-195 |

144-294 |

81-167 |

92-184 |

Technical potential is the largest technically feasible BMG system beyond which there are no appreciable electricity savings.

Economic potential is the portion of technically feasible BMG that produces a net benefit from a program administrator perspective.

Market potential represents the portion of economic potential that is likely to be achieved over time. Market potential considers the time required to raise awareness, generate market interest, conduct engineering analyses, and design, develop, and install BMG systems. This is further broken into:

• Financial Potential: Portion of the economic potential that customers would eventually implement based on financial factors alone

• Non-Financial Potential: Portion of the economic potential that customers would eventually implement accounting for both financial and non-financial factors. In principle, non-financial potential could be either higher or lower than financial potential.

Cap and trade potential factors in the impact of recent cap and trade regulations, which as currently defined would reduce BTM CHP by about 20%, because of its effect on natural gas prices. It would result in a minor increase of WER, Navigant projected.

Constrained potential is the portion of the market potential achievable after accounting for electricity system constraints that may limit BMG installations.

In Navigant’s summary, the results of the BMG potential analysis show that:

• The 2025 province-wide market potential for multi-family, commercial, and institutional facilities is very low—only about 23 GWh out of the almost 10,000 GWh of technical potential for these facility types

• The 2025 province-wide market potential for industrial facilities is about 1,100 GWh, or about 7 percent, of the almost 16,000 GWh of technical potential for these facility types

• Scenarios 1 and 2 (40 percent versus 70 percent first-cost incentive) generally result in little or no difference in market potential. This occurs because other scenario constraints limit the incentive paid. For example, for both scenarios, the incentive cannot be higher than the annual electricity savings multiplied by $200 to $230/MWh.

As noted above, Navigant’s analysis was based on conditions that have now partially changed with the publication of the LTEP and the Fair Hydro Plan.

• The Climate Mitigation and Low-Carbon Economy Act is projected to have almost no impact on WER and will decrease CHP potential by approximately 20%

• The constrained potential analysis shows modest reductions in market potential (about 6 percent reduction in CHP potential for scenario 1). However, available electricity network connection capacity, which must be determined on a project-by-project basis and which was not accounted for in this analysis, will reduce constrained potential further.

Not surprisingly, industrial facilities generally present the largest technical potential, but retail and multi-family facilities also present substantial technical potential. Industrial facilities represent 61 percent of the CHP technical potential.

During interviews with 550 commercial and industrial customers, respondents highlighted that they rarely implement a BMG project for purely financial reasons, and are influenced by other factors including operational simplification, reliability and resilience, operational cost predictability, and GHG reductions.

The Ontario CHP Consortium, a diverse group of LDCs, gas utilities, technology/service providers and customers, has made several recommendations in response to the IESO’s mid-term review, notably the following:

“Ontario has drastically reduced GHG emissions from electricity generation through the coal phase-out. The residual emissions are all a result of greenhouse gases from Ontario’s fleet of gas peaking plants. The efforts from a climate perspective should be to address the residual centralized natural gas generating stations. These represent Ontario’s costliest and most polluting sources, and they are often run at a fraction of their rated capacity, resulting in very poor efficiencies – resulting in higher GHGs per kWh as well as higher particulate matter and other high health impact pollutants. Because conservation CHP provides firm peak reduction and electricity conservation outcomes, it is one of the few conservation programs that actually helps reduce the run-time for the centralized gas stations.”

Among other recommendations:

• Extend and expand the SaveOnEnergy Process and Systems CDM program for behind the meter CHP delivered by electric utilities.

• Change Ontario’s energy market rules to allow for distribution- connected behind‐the‐meter CHP projects, individually or in aggregate, to participate in the ancillary services market in an effective and practical manner, including sale to the grid when beneficial. This will allow for CHP and other forms of distributed generation (e.g. solar, storage) to address the “residual 20% of emissions” from grid supplied power.