Speaking at the Canadian Power Conference on November 20, Jan Vrins, leader of Navigant’s global Energy practice, sketched a picture of pervasive change ahead, both conceptual and practical, for the energy sector. According to Mr. Vrins, the energy industry, market participants, consumers and regulators can all expect to face significant adjustments to their respective outlooks. Navigant, through its work in the energy sector globally, has come to this conclusion based on its experience helping utilities, governments, large corporations and industries manage their energy portfolios as a means of empowering their businesses.

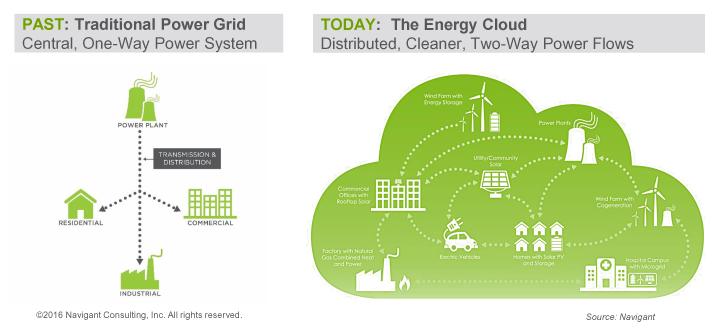

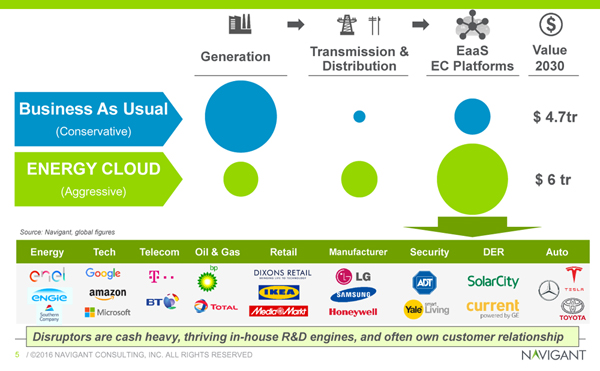

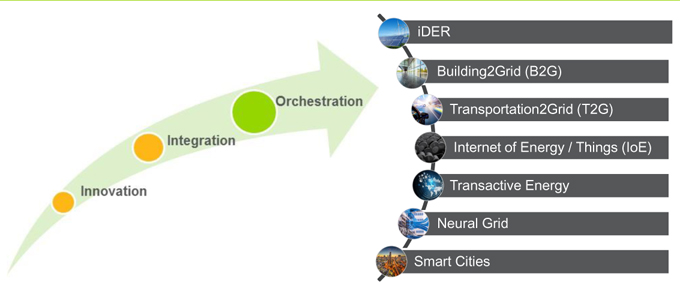

Mr. Vrins highlighted the expected emergence of distributed energy resources (DER) and the Energy Cloud – a platform of distributed, two-way power flows and intelligent infrastructure. He noted that value is shifting within the Energy Cloud across generation, transmission, and distribution sectors, and that the opportunities for stakeholders and customers are changing as the energy transformation accelerates. Mr. Vrins outlined factors driving new utility business models. His key takeaways included:

• The integration of renewable resources, DER, and electrification in transportation are rapidly affecting the ways in which energy is produced and consumed, and this pace is not to be underestimated. Customer preferences, technology evolution and public policy are driving this transformation.

• With this energy transformation, conventional generation requirements, load, voltage, price of power, and distribution system operations will no longer retain fixed values. As a result, both market structures and regulatory frameworks will need to be redesigned.

• There will be shifts in what customers and shareholders value, and different utilities will need to take different approaches, depending on the region they serve and roles they play. Mr. Vrins suggested that instead of a 30-year integrated resource plan or a 5-year strategic plan, utilities will need to develop an Energy Cloud Playbook. This playbook takes a 10-to-12-year view of where the business should be going, and a 3-to-6-month cyclical look at opportunities, threats and new products and services for customers.

Mr. Vrins also touched on the growing importance of sustainability and reducing greenhouse gas emissions. Citing the UNEP Emissions Gap report, Mr. Vrins said current Nationally Determined Contributions will amount to just one-third of the required global greenhouse gas emissions reductions, but that three key solutions for emission reduction can make a difference. These include renewables, energy efficiency in buildings and appliances, and electrification of transportation. In Canada, the country is projected to miss its industry target for 2030 by 100-240 megatons of CO2 emissions. Furthermore, the increased integration of DER, as suggested by the Long-Term Energy Plan, will be more disruptive than the integration of renewables Ontario has seen so far.

Mr. Vrins also touched on the growing importance of sustainability and reducing greenhouse gas emissions. Citing the UNEP Emissions Gap report, Mr. Vrins said current Nationally Determined Contributions will amount to just one-third of the required global greenhouse gas emissions reductions, but that three key solutions for emission reduction can make a difference. These include renewables, energy efficiency in buildings and appliances, and electrification of transportation. In Canada, the country is projected to miss its industry target for 2030 by 100-240 megatons of CO2 emissions. Furthermore, the increased integration of DER, as suggested by the Long-Term Energy Plan, will be more disruptive than the integration of renewables Ontario has seen so far.

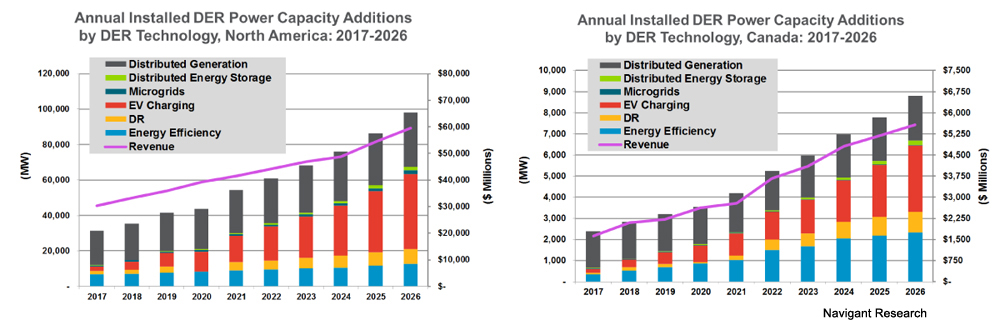

According to Navigant Research, installed DER power capacity additions in Canada are expected to reach 15 gigawatts (GW) in just the next five years. This is projected to occur in the form of distributed generation (DG), demand response (DR), electric vehicle (EV) charging load and energy efficiency. This will bring a significant shift of value from generation to newer business models such as behind-the-meter energy solutions, Energy-as-a-Service and Energy Cloud platforms, creating a $1.3 trillion market between now and 2030.

According to Navigant Research, installed DER power capacity additions in Canada are expected to reach 15 gigawatts (GW) in just the next five years. This is projected to occur in the form of distributed generation (DG), demand response (DR), electric vehicle (EV) charging load and energy efficiency. This will bring a significant shift of value from generation to newer business models such as behind-the-meter energy solutions, Energy-as-a-Service and Energy Cloud platforms, creating a $1.3 trillion market between now and 2030.

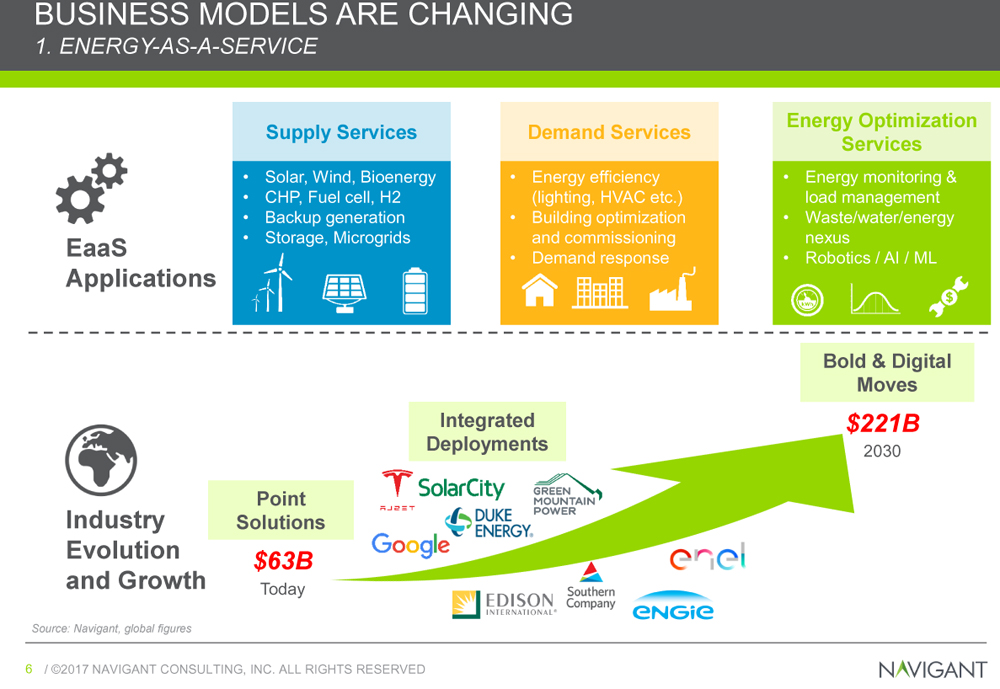

Mr. Vrins further elaborated on these emerging business models as follows:

• Energy-as-a-Service: Providing demand (building efficiency, optimization, commissioning and DR), supply (renewable, backup generation, storage, microgrids) and optimization services (monitoring, load management, waste/water/energy nexus and robotics/artificial intelligence [AI]/machine learning) to commercial, industrial and residential customers. As an example, ENGIE North America Inc. signed with Axium Infrastructure to manage The Ohio State University’s (one of the largest university campuses in the US) sustainability programs.

• Energy-as-a-Service: Providing demand (building efficiency, optimization, commissioning and DR), supply (renewable, backup generation, storage, microgrids) and optimization services (monitoring, load management, waste/water/energy nexus and robotics/artificial intelligence [AI]/machine learning) to commercial, industrial and residential customers. As an example, ENGIE North America Inc. signed with Axium Infrastructure to manage The Ohio State University’s (one of the largest university campuses in the US) sustainability programs.

• Energy Cloud platforms: Because any single technology (e.g., rooftop solar) is susceptible to erosion over time due to competition, there is a need for utilities to create platforms with assets, infrastructure, smart applications, data analytics and products and services that address value proposition for customers.

• Energy Cloud platforms: Because any single technology (e.g., rooftop solar) is susceptible to erosion over time due to competition, there is a need for utilities to create platforms with assets, infrastructure, smart applications, data analytics and products and services that address value proposition for customers.

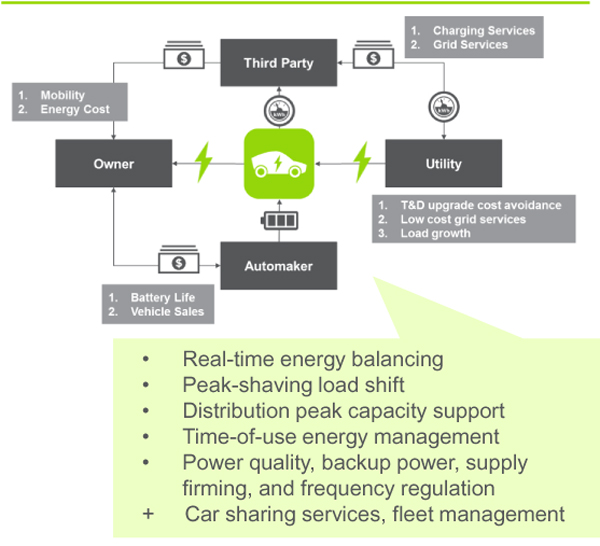

The traditional utility may not exist 20 years from now. Instead, it is more likely to become a network orchestrator, managing different types of platforms with collaboration among communities and product and service providers. Under this business model, utilities would focus on integrated DER and microgrids instead of power plants, optimization of usage and production of energy in buildings, transportation, behind-the-meter and Internet of Things energy solutions, peer-to-peer energy transactions and smart cities. Mr. Vrins cited an example of a EV platform that has been tested in Denmark, and is being introduced in the UK, Germany and Italy.

The traditional utility may not exist 20 years from now. Instead, it is more likely to become a network orchestrator, managing different types of platforms with collaboration among communities and product and service providers. Under this business model, utilities would focus on integrated DER and microgrids instead of power plants, optimization of usage and production of energy in buildings, transportation, behind-the-meter and Internet of Things energy solutions, peer-to-peer energy transactions and smart cities. Mr. Vrins cited an example of a EV platform that has been tested in Denmark, and is being introduced in the UK, Germany and Italy.

This involves a vehicle-to-grid platform such that EV owners get up to €1,500 a year for parking their cars in designated parking spaces where the local utility has access to the feed. Such solutions will be pursued in North America as well.

This involves a vehicle-to-grid platform such that EV owners get up to €1,500 a year for parking their cars in designated parking spaces where the local utility has access to the feed. Such solutions will be pursued in North America as well.

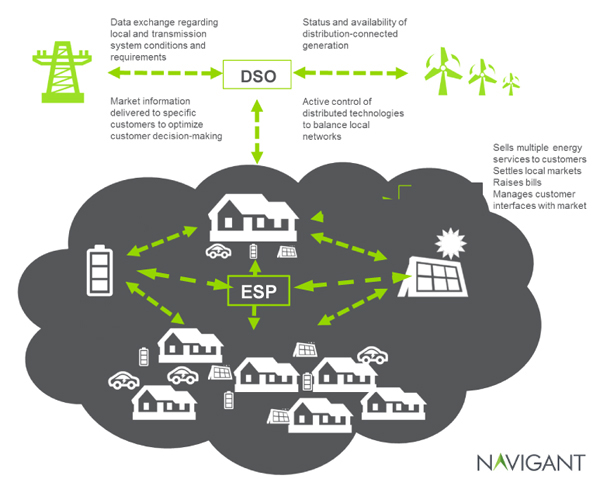

On the changing roles of the local distribution company, Mr. Vrins argued that in addition to changing their business models, utilities would evolve into Energy Cloud platform orchestrators to increase customer and shareholder value, and distributors would change to distribution system orchestrators to manage the intelligent, neural and mobile grid. Regulatory, technology/DER, data analytics, and AI capabilities are key in this transformation. Underutilized or stranded assets are the biggest risks arising from integrating DER technology without proper business models. Furthermore, the Energy Cloud could lead to the re-bundling of services. Instead of the conventional unbundled service markets, which are helpful for facilitating competition, re-bundling may be needed to ensure availability of the relatively sophisticated processes and data required to manage the full impact of DER.

On the changing roles of the local distribution company, Mr. Vrins argued that in addition to changing their business models, utilities would evolve into Energy Cloud platform orchestrators to increase customer and shareholder value, and distributors would change to distribution system orchestrators to manage the intelligent, neural and mobile grid. Regulatory, technology/DER, data analytics, and AI capabilities are key in this transformation. Underutilized or stranded assets are the biggest risks arising from integrating DER technology without proper business models. Furthermore, the Energy Cloud could lead to the re-bundling of services. Instead of the conventional unbundled service markets, which are helpful for facilitating competition, re-bundling may be needed to ensure availability of the relatively sophisticated processes and data required to manage the full impact of DER.

For power producers, there will be a shift from traditional centralized generation to some centralized generation complimented by DG, storage and clean fuel production. The customer base will expand from utilities, wholesale markets and government to include commercial and industrial customers and communities. Success factors that focus on project development, construction management, low-cost capital, project finance and operations efficiency will be replaced with others focused on innovation in technology and business models, the ability to scale, integrate and orchestrate, as well as data analytics. The role of the power producer will change from the “opportunity pursuer” to “opportunity maker.” To maintain shareholder value and customer value, power producers need to both optimize and ensure resilience of the current business model, while beginning investment in Energy Cloud platforms.

Mr. Vrins left the audience thinking about whether the Energy Cloud has already emerged, and considering whether the traditional knowledge of generation, transmission and distribution requirements, and price of power may need to give way to new types of knowledge. Business models and regulations will very likely need to adapt quickly to changing customer preferences, technologies and policies.

— Report prepared by Najiba Hussain with edits by APPrO.

See also the related report "Challenging propositions at the APPrO 2017 conference"