By Stephen Kishewitsch

On one side of President Street, in a neighborhood in Brooklyn in the spring of 2016, a few homes with rooftop solar panels became able to sell power directly to a few homes on the other side of the street. The pilot is one of a number of distributed energy systems, of a kind that New York State is encouraging under its Reforming the Energy Vision (REV) program, partly as a grid resilience measure, a lesson learned after Hurricane Sandy.

IPPSO FACTO has reported on similar, neighborhood-scale microgrid pilots in Canada, for example PowerStream (now part of Alectra) in Vaughan and Penetanguishene, Ontario. What’s different about the system in Brooklyn is that the exchange was not run by the local utility – the trades take place directly between any two households involved, and do so autonomously whenever conditions are right, according to preferences set by each participant. What makes the difference is the blockchain network in the middle, managing and recording transactions without need for human oversight. Power exchange without a utility in the middle is a challenging and potentially far-reaching concept for the energy sector.

Blockchain is the computer system behind bitcoin, one of now several computer-based currencies that began to enter general awareness in the last 5 or 6 years. The basic technology has more recently acquired new capacities, and by some accounts, blockchain software now bids to transform every aspect of daily life, or at least those with economic aspects. Major institutions have already begun trading bitcoins and other cryptocurrencies, as they’re called. In the electricity sector, it promises, or threatens, to change the way utilities do business. In particular, it may form the key enabling technology distributed energy has been waiting for to take its place as a major component of the power supply system.

Canadian authors Don and Alex Tapscott, in their 2016 book Blockchain Revolution: How the technology behind bitcoin is changing money, business and the world, suggest a number of ways blockchain systems will allow new modes of transaction, across every aspect of the economy that some entrepreneur can think of. For example:

• It will allow financial transactions to take advantage of the near-instantaneous processing power and network speed of today’s computerized, fibre optic world, freeing industries from financial and accounting models that date back to the nineteenth century.

• It will allow property rights to be quickly and securely created and transferred, without the need for certification by record-keeping third parties.

• It will allow any two participants to transact directly, without the need for intermediaries, opening up possibilities especially for innovative startups and hundreds of thousands of small participants.

In particular, in the world of electrical power generation and consumption, it promises to allow the grid to operate more resiliently, more efficiently and to accommodate more variable renewable sources, by allowing prosumers to generate and trade power themselves, and devices to make decisions based on economic efficiency.

Of course, the technology is evolving quickly and new offshoots are forming continually. As a result the blockchain system may be quite different before it is able to realize all the promise imagined for it.

The technology

A blockchain record is a digital ledger, a decentralized database that records transactions. The magazine New Scientist describes it as “a cryptographically secure ledger of every transaction made in a system, stored across every computer in its network. As every computer has a continually updating copy of the ledger, no central authority is in control. Instead, the computers essentially monitor each other to prevent fraud.”

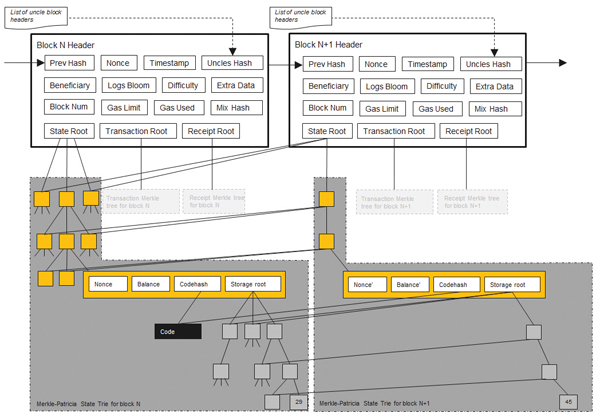

{mosmages} Each transaction becomes part of a “chain,” a running history of transactions kept in a computer file rather than tracked via a paper trail, and multiple copies of which exist across a network of nodes. Because each instance of the ledger is encrypted, and the copies are distributed across the network, it’s considered to be exceedingly difficult to tamper with or hack. Members on the nodes compete with each other to validate ledgers as they are created or updated, with the winner receiving a fee, the original expression of blockchain technology – a process known as mining. A ledger’s simultaneous existence on multiple nodes is an effective guarantee of its security, as any attempt to corrupt it would involve an infeasible amount of effort (see diagram).

Bitcoins were the original expression of the blockchain system, and seemed to exist as a unit in a self-contained financial world, until quite recently distributed ledger models aroused interest in just about every imaginable sector. One development of the technology in particular, known as Ethereum, has been described as a major extension of the system in allowing self-executing contracts between peers, and has ushered in opportunities for individuals to generate and sell power without any transactional overhead or friction. Entrepreneurial companies are now developing their own variants of executable digital ledgers, on which more below.

As to their application in electric power transactions, analyst Isaac Brown at Lux Research commented, “Units of power and energy are a strong fit for smart contracts, as they are concrete and discrete, and meters can feed directly into blockchain logic.”

This is how the project in Brooklyn works. Reportedly the first energy blockchain pilot in the United States, the pilot was developed by LO3 Energy in Brooklyn’s Boerum Hill, Park Slope, and Gowanus neighborhoods.

A sample schematic indication of the complexity by which a blockchain ledger file maintains its identity and integrity

In a phone conversation, Director of Business Development Scott Kessler explained why they may be the first with a pilot on the ground, while everyone else is still studying the matter: “We’re doing the Brooklyn microgrid on our own because we didn’t want to wait for utility participation. We also wanted to have a project we owned, to showcase to everyone else what’s possible. We eventually see the utility providing this platform, but we think it starts with us in this more disruptive manner.”

A sample schematic indication of the complexity by which a blockchain ledger file maintains its identity and integrity

In a phone conversation, Director of Business Development Scott Kessler explained why they may be the first with a pilot on the ground, while everyone else is still studying the matter: “We’re doing the Brooklyn microgrid on our own because we didn’t want to wait for utility participation. We also wanted to have a project we owned, to showcase to everyone else what’s possible. We eventually see the utility providing this platform, but we think it starts with us in this more disruptive manner.”

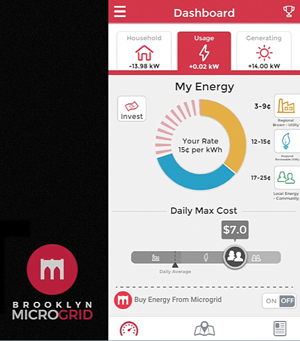

LO3’s app dashboard, showing several functions including power saved

Kessler describes LO3’s project as a community energy marketplace. The company provides a platform consisting of both hardware and software – the hardware is a smart meter installed on the customer’s site and runs the blockchain; the software runs across all the meters in the project and maintains the ledger. The company worked with blockchain developer ConsenSys on the first proof of concept, in April 2016 using Ethereum. In the deployment of the pilot, LO3 employs their own private system, a development of Ethereum.

LO3’s app dashboard, showing several functions including power saved

Kessler describes LO3’s project as a community energy marketplace. The company provides a platform consisting of both hardware and software – the hardware is a smart meter installed on the customer’s site and runs the blockchain; the software runs across all the meters in the project and maintains the ledger. The company worked with blockchain developer ConsenSys on the first proof of concept, in April 2016 using Ethereum. In the deployment of the pilot, LO3 employs their own private system, a development of Ethereum.

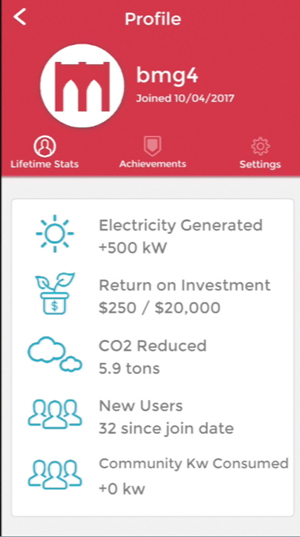

LO3’s app showing personal profile

Traditionally blockchain is primarily a system for financial transactions, Kessler explains. New blockchain systems, such as Ethereum extends the capability to do financial transactions with any commodity, not just currency. “So we don’t transact currency, we transact energy and energy attributes. If I have a rooftop solar system we know what my production is, what your energy consumption is, and we can transact that.

LO3’s app showing personal profile

Traditionally blockchain is primarily a system for financial transactions, Kessler explains. New blockchain systems, such as Ethereum extends the capability to do financial transactions with any commodity, not just currency. “So we don’t transact currency, we transact energy and energy attributes. If I have a rooftop solar system we know what my production is, what your energy consumption is, and we can transact that.

“Eventually it starts to look somewhat similar to an energy management system, but also an energy market. I would say blockchain is a better solution than the others out there in that when we go to a grid that has millions and billions of IoT (internet of things) devices at grid edge, I cannot think of any centralized system that can process all of that information efficiently and securely, for example to allow demand response with all those devices. With blockchain all those calculations happen at the device, safely and securely.

“It gets interesting when you start combining the physical strength of the grid with the transaction. You can start to value how much money it might be worth to not overload the line you’re on. You’re providing way more granular information to the utility to provide very fine-tuned responses to congestion issues.

“Right now there are no restrictions to putting more generation on the utility grid, but down the road you might run into issues, if you’re putting enough generation on the grid where the cost of interconnection is high enough to prevent adding more generation. Right now we’re nowhere near that.”

The company is having ongoing discussions with its local utility Con Edison, and planning other demonstration projects outside of Brooklyn, primarily working with local distribution companies.

How might this happen in Canada?

A great deal has been and is being written about the promise of blockchain, but actual use cases are still few in number. Aside from Opus One’s projects in Nova Scotia and Ontario, outlined below, few if any instances are evident of blockchain-based energy systems in development in Canada. This contrasts with the apparently rapid growth of such systems in other countries as noted by the German Energy Agency DENA in their posting in this location.

The entry point for the use of blockchain technology in Canada may be electric vehicles, pilot projects for which have already been reported in Europe and Japan.

Part of the appeal of EVs became apparent in early discussions around their potential for use as a collective form of battery-powered backup for the grid, say while they sit at their charging stations while their users are at the office. According to Plug’n’Drive, as of December 2016 Ontario had just over 9,000 electric vehicles on the road. Jack Simpson at Toronto Hydro suggests that number would have to reach close to 100,000 to make it worthwhile to set up as a bulk system grid storage resource. At that point, blockchain technology could be a useful, fast, efficient way of automatically handling tens of thousands of small energy exchanges between the fleet and the grid. Vehicle owners would set their preferences as to how much of the capacity of their vehicle battery would be allowed to be diverted for that purpose. But several matters would have to be settled before that happened:

• Vehicle owners would have to overcome a degree of “range anxiety,” the worry that they will have enough charge to make it home. That can expect to be alleviated as batteries improve.

• Programs have to be in place, and drivers have to become aware of them, allowing them to get paid for providing the resource.

• Inverters have to be available to send power to the grid as well as charge the car. Likewise, the capability of the charging station has to be upgraded, in order to accommodate blockchain software. This will be a substantial investment, that again will have to wait for sufficient numbers to make it worthwhile.

• Vehicle-to-grid power services will have to wait for some kind of policy to be in place; from, say, the Ministry of Environment, or Transportation. As Jack Simpson explained, “Someone has to say ‘it’s important to us, make sure the technology is there.’ The risk of being a minority player and being left behind with a beta product puts us at risk were we to undertake such an initiative on our own. Maybe some industry association might have to move on it first, and I’m not aware of any such at present.”

In addition, the universal smart meter program that Ontario rolled out over the last few years doesn’t have the computational capacity to run blockchain-enabled smart contracts, but they’re built to last at least 15 years. Some tipping point will have to be passed to make it worthwhile to add that new capacity to them as well.

Various companies have developed their own version of a blockchain platform, including some in Canada:

• IBM Canada is a founding member of the Hyperledger project, begun with the Linux Foundation, developed using open-source code.

“The intent was to allow clients to keep their options open, not be locked into any blockchain fabric,” explains Manav Gupta, CTO of IBM Cloud Canada. “Hyperledger is an open source project based on a secure and scalable cloud infrastructure, with well-defined open governance, and a lot of engagement from developers around the world. We’ve had active contribution in the project, with lots of enhancements, from about 60 different companies. We offer a Blockchain service based on our Bluemix Cloud, which is based on Hyperledger, that everyone can access – you can get started literally in less than a minute. On top of hyperledger fabric we provide a UI that allows viewing of network status, blocks in your network, deployment of smart contracts.”

• BTL, with offices in Vancouver, Calgary and London UK, has developed a blockchain platform it calls Interbit, which it says is more lightweight than the conventional form, which can suffer from heavy computational requirements. BTL is working with a group of energy companies in Europe on a pilot with the objective of delivering a working prototype and the framework for a commercial application.

• EcoCoin, another open source, peer-to-peer distributed energy trading software that emerged from “hackathons” among solar experts and electrical engineers in the Netherlands, Finland and Dubai that spurred the creation of the PWR Company.

• Enerchain, by Ponton Gmbh in Germany, by which orders are sent anonymously through a trading screen, where counterparties click on an order to conclude a transaction – all done “peer-to-peer” without a marketplace operated by a third party. The tool supports energy products like day-ahead, monthly, quarterly and yearly baseload for power and gas.

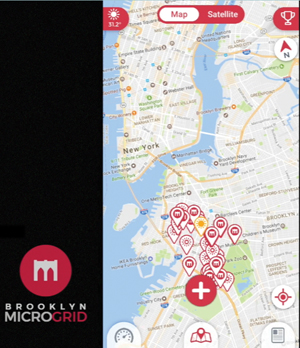

A map of the neighborhood showing houses that are actual and potential parts of the network.

• IOTA, based in Switzerland, is an open-source distributed ledger that uses what the developer calls the Tangle, instead of blockchain. It validates transactions based on what’s known as Directed Acrylic Graph structure (DAG), which is said to be lightweight, scalable, secure and enables money transfers to be made without any fees. Unlike the blockchain, the Tangle achieves its security in having transactions processed in parallel. The company characterizes its Tangle protocol as “quantum-proof, [with] unique new features like zero fees, infinite scalability, fast transactions, secure data transfer and many others. ... In order to send an IOTA transaction, a user’s device must simply confirm two other transactions on the Tangle (the network). To confirm these two transactions, a device performs low difficulty “proof of work”, which is essentially just a series of math problems. These math problems can be done by almost any modern device including laptops and phones.

A map of the neighborhood showing houses that are actual and potential parts of the network.

• IOTA, based in Switzerland, is an open-source distributed ledger that uses what the developer calls the Tangle, instead of blockchain. It validates transactions based on what’s known as Directed Acrylic Graph structure (DAG), which is said to be lightweight, scalable, secure and enables money transfers to be made without any fees. Unlike the blockchain, the Tangle achieves its security in having transactions processed in parallel. The company characterizes its Tangle protocol as “quantum-proof, [with] unique new features like zero fees, infinite scalability, fast transactions, secure data transfer and many others. ... In order to send an IOTA transaction, a user’s device must simply confirm two other transactions on the Tangle (the network). To confirm these two transactions, a device performs low difficulty “proof of work”, which is essentially just a series of math problems. These math problems can be done by almost any modern device including laptops and phones.

“The user and validator (miner, staker, etc.) are no longer decoupled entities in IOTA. This removes the need to waste large quantities of energy on mining, or risk inevitable validation centralization. Perhaps more importantly, because the Tangle eliminates the requirement of miners/stakers/etc., newly minted units of currency and transaction fees do not need to be extracted from the system to pay validation fees. The result is that IOTA has zero fees.

“Since each transaction requires the sender to verify two other transactions on the Tangle, more transactions can be confirmed as the number of users sending them increases. This means that IOTA scales proportionally to the number of transactions ad infinitum.”

A complementary approach

Opus One Solutions Energy Corp, based in Richmond Hill, Ontario, says its GridOS provides a transactive energy system as a complementary approach to distributed energy, one designed to account for how DE must function within the larger context of the grid. The company is currently developing a utility scale Intelligent Grid with wind power for Emera Nova Scotia Power, another for Veridian in Ajax, Ontario, and was recently contracted by National Grid in New York State to provide a distributed system platform (DSP) for Buffalo Niagara Medical Campus as part of NY REV Initiative, among other projects.

Gerhard Walker, Director of Grid Evolution at Opus One, says “block chain is primarily a clearing mechanism for bilateral smart contracts without a centralized entity. As such, it allows power users on the grid to sell their power as it is produced to consumers. However, this process works only to everyone’s benefit if the distribution costs associated with the process are taken into consideration, which is part of something called transactive energy. And this is where we come in.

“There is an overlap between the two. Our work around transactive energy enables an energy market to automatically manage DERs within a distribution grid. Blockchain concentrates on financial transactions; GridOS deals with technical aspects of evaluating real-time value and managing the distribution grid and can therefore be viewed as a complementary approach to the blockchain ledger system and can do as much for distributed energy resources on grids.

“GridOS can be deployed by the utility, and allows it to manage a micro- or distribution grid, or control distributed energy resources. GridOS deals with the value of energy to the system, not just to the customer. GridOS interfaces with the larger grid, to allow microgrid operation without endangering larger grid stability. The microgrid assets that would otherwise be held only in reserve during normal grid operation could be used to bid into the general energy market. A microgrid resource can start providing energy any time the market calls for it, and that can affect grid stability. There might be local congestion, for example, and you might want to actively manage a resource. With more and more DERs coming on, utilities are going to run increasingly into wires constraints.

“Having built functionality like the transactive energy mechanisms into the GridOS Platform,” Walker concludes,” we can deliver real-time locational pricing of renewable energies, which is necessary for a true market platform. Opus One’s GridOS takes a holistic approach reflecting the grid, customer and renewable energy benefits and constraints. Technologies such as LO3’s Blockchain, can use this to ensure that their trading reflects the whole picture.”

Around the world

The IOTA tangle

» Australian company Power Ledger announced the startup of the country’s first blockchain-powered residential electricity trading market at White Gum Valley’s Gen Y home in Perth on December 1 2016. Residents in the development can now trade the electricity generated on their rooftop, and stored on batteries in their garage without the need for an energy retailer, said Jemma Green, co-founder and Chair of Power Ledger. When someone is not using their share of electricity produced they can sell their share of the energy produced to their neighbours. The system uses blockchain technology to allow residents to trade electricity amongst themselves at a price greater than available feed-in tariffs but lower than residential retail tariffs, providing an incentive for more developers to install rooftop PV on strata-titled developments.

The IOTA tangle

» Australian company Power Ledger announced the startup of the country’s first blockchain-powered residential electricity trading market at White Gum Valley’s Gen Y home in Perth on December 1 2016. Residents in the development can now trade the electricity generated on their rooftop, and stored on batteries in their garage without the need for an energy retailer, said Jemma Green, co-founder and Chair of Power Ledger. When someone is not using their share of electricity produced they can sell their share of the energy produced to their neighbours. The system uses blockchain technology to allow residents to trade electricity amongst themselves at a price greater than available feed-in tariffs but lower than residential retail tariffs, providing an incentive for more developers to install rooftop PV on strata-titled developments.

“The benefits of distributed renewable energy will flow on to those who, at the moment, can least afford to participate; we think that’s pretty special,” said Green.

The company said it is working on a 500-site trial in Auckland with New Zealand’s largest electricity distributor, and has signed a number of other projects to be unveiled in 2017.

» IBM is working with transmission operator Tennet in two projects in Europe, to manage grid stability from intermittent renewable energy sources. Such stability has been found to be necessary at the transmission as well as at the distribution level. A pilot in Netherlands works with electric vehicles to control the rates of charging and grid balancing function of EV batteries when transmission constraints prevent power, for example from the region’s offshore windfarms, from reaching local load; and in Germany to manage power from residential solar / battery storage installations, again to provide a reservoir of flexibility for grid balancing.

» A study by the German energy agency DENA describes a “Blockchain 1.0” pilot project in South Africa, called Bankymoon, that uses Bitcoins, and in a kind of mini-smart contract using smart prepaid meters that only release power to residential customers once they have topped up their accounts and transferred money to the electricity provider. This is still short of the full promise of the automatic, self-executing contract described below in Brooklyn.

Commercial blockchain offerings

» Early this year, Singapore-based BlockchainFirst combined blockchain and “Internet of Things” (IoT) technology in launching an EV/multipurpose charging station that accommodates electric cars, motorbikes and bicycles. In March, California cleantech developer Oxygen Initiative and Germany’s Innogy SE announced they were readying the U.S. launch of the Share&Charge EV digital wallet. Innogy Innovation Hub and Slock.it developed the e-mobility application service using Ethereum.

Commercial blockchain offerings

» Early this year, Singapore-based BlockchainFirst combined blockchain and “Internet of Things” (IoT) technology in launching an EV/multipurpose charging station that accommodates electric cars, motorbikes and bicycles. In March, California cleantech developer Oxygen Initiative and Germany’s Innogy SE announced they were readying the U.S. launch of the Share&Charge EV digital wallet. Innogy Innovation Hub and Slock.it developed the e-mobility application service using Ethereum.

What it means for the existing system

Scott Kessler at LO3 Energy identifies a number of the issues to be resolved, many of which the company itself is involved in addressing along with the other agents in the power system:

• How do you make this disruptive technology to work for the utility company, as they lose their rate base? How do we compensate them for the infrastructure they own and are required to maintain, and how do they make a profit?

• What’s the right rate consumers should be paying for energy DERs put on the grid, given that we can factor in the location of the source? What is the extra value in reducing the distance energy has to travel from producer to consumer? He suggests a system built to manage energy needs, considering the entire context of all the sources and all the consumption points on a local grid, including where and when the wires can allow it and when they’re constrained. Currently that’s still controlled centrally, by the local utility. Is the blockchain (or transactive energy) going to take that over entirely or only under certain conditions? How will the utility be involved?

Utilities need to know what the new technologies will be, Kessler suggests, and what their customers want and will want as new offerings enter the marketplace. Then, from those two factors, utilities can start to figure out what their business model should be. Do they want to just have poles and wires, or do they want to offer real time services?

• What should the rules be? Regulators are uncertain as to how to allow prosumers to participate in wider markets. What should the regulations be for a small homeowner, versus those from those for a large power plant?

• What’s the legal enforceability of these smart contracts? In late March the governor of Arizona signed into law a bill stipulating that records or signatures in electronic form cannot be denied legal effect and enforceability based on the fact they are in electronic form. The statute includes a very specific definition of “blockchain technology” as a “distributed, decentralized, shared and replicated ledger, which may be public or private, permissioned or permissionless, or driven by tokenized crypto economics or tokenless” and provides that the “data on the ledger is protected with cryptography, is immutable and auditable and provides an uncensored truth.” Vermont has enacted a similar law, and Delaware, Illinois, Maine, Nevada, and Hawaii have similar pending bills or related initiatives. How will this issue be developed – in patchwork fashion state by state, province by province, or at a national level?

• Uniformity. At present every startup seems to be employing its own proprietary executable ledger system. Surely some kind of standard will likely have to shake out, a standard that can be installed on millions of devices before large-scale investment in such systems can take place.

Limitations

Steve Wilson, Vice President and Principal Analyst at Constellation Research, cautions about what he calls the “hype” around blockchain. As he puts it, “Blockchain was designed specifically for one main goal: preventing the ‘double spend’ of electronic coins, without a central authority. Yet few of the mooted use cases are vulnerable to double spend or anything analogous. At the same time, many important security objectives are not provided by blockchain at all. Thus, blockchain is neither necessary nor sufficient for many of its suggested applications; in practice it’s massively over-engineered, or incomplete, or both.”

He acknowledges that its most important contribution may be the new generations of distributed ledger technologies it has inspired. One of the first descendants was Ethereum, the system that initially ran the Brooklyn project, and seems to have become the root for several individual variants. Other more advanced ledgers include Hyperledger Fabric, IBM’s High Security Blockchain Network, Microsoft’s Blockchain as a Service, and R3’s Corda. He goes on to observe, however, that “Alternative reward systems for non-Bitcoin and non-payments variations on blockchain are being developed, but they are still embryonic and unproven. Blockchain’s resistance to tampering comes from the enormous number of cooperating machines in the network; shrinking or fragmenting that pool with spinoff chains degrades the security. This ledger is global and it has to be; blockchain doesn’t scale down.“

At the same time, as Wilson points out, while blockchain resists tampering once the entries have been tested and multiple copies exist across the network, the validity of each blockchain entry still rests on the account holders’ digital signatures and the unique private keys that create them. “If an attacker can steal your private key or otherwise take control of your Bitcoin wallet, then fraud can follow,” and recourse is unavailable because the ledger cannot be corrected in the event of an error. “[On the other hand, i]f the business environment involves established authorities anyway – as in healthcare, government and regulated banking – decentralized governance can become rather pointless.”

Further, “[t]he only authoritative record of anyone’s Bitcoin balance is held on the blockchain. Account holders typically operate a wallet application that shows their balance and lets them spend it, but as noted already, the wallet holds no money. All it does is control a private key and provide a user experience of the blockchain. The only way to spend the balance (that is, transfer part of it to another account address) is to use the private key. What follows from this is an unforgiving reality of Bitcoin: If a private key is lost or destroyed, then the balance associated with that key is frozen forever and cannot be spent again. … there has been a string of notorious mishaps where computers or storage devices holding Bitcoin wallets have been lost, … [and] numerous pieces of malware have – predictably – been developed to steal Bitcoin private keys from regular storage devices.”

Beyond the Hype: Understanding the Weak Links in the Blockchain is published by Constellation Research, www.constellationr.com.

German energy agency DENA comments that blockchain technology will be competing with existing solutions and has to prove its attractiveness to users. “From a market perspective, establishing Blockchain as the dominant transaction technology might be more difficult in existing markets than in new markets where new applications do not yet exist. ... Wherever a peer-to-peer trading network that does not rely on an intermediary – a trusted institution – has not yet been established on a large scale, Blockchain has the chance to become the dominant design. [But] blockchain might have a more contestable position in applications where technologically sophisticated platforms and processes already exist and are accepted among market participants, such as the European Electricity Exchange in Leipzig (EEX) that serve as platforms established to allow parties to trade energy, emissions, and their derivatives. If blockchain can demonstrate efficiencies there it can be expected to become an attractive alternative. ... The most likely way how Blockchain might influence these costs would be by accelerating the emergence of local markets with peer-to-peer trading – but this effect can only be expected in the medium to long term.

“If it caters for isolated microgrids and closed systems, such as commercial parks or autonomous energy communities with few interconnectors to the outside grid, Blockchain may become the dominant design. As soon as it starts interfering with the distribution and transmission system run by grid operators, it has to overcome similar hurdles that providers of virtual power plants or companies that offer demand response services are confronted with. Furthermore, the stability of a digital energy system is crucial; it must run without internal complications as well as be protected from external interference such as cybercrime and espionage. The impact of Blockchain on both the security of energy supply and data security has to outweigh the costs of establishing and maintaining this infrastructure. It must prove to be more effective than alternative, more centralized approaches to digitization.”

Furthermore, uncertainty around the direct costs remains to be resolved, such as the distributed computational review process performed on each block, and indirect costs of the Blockchain, and the complex cost allocation in both regulated and market-oriented segments of the electricity sector.

Gerald Gray, Senior Program Manager for Enterprise Architecture & Integration at the Electric Power Research Institute (EPRI), citing author Clayton Christensen on new disruptive technologies, commented that at the beginning they frequently underperform existing systems. When new, smaller format hard drives became available, for example, they underperformed the ones already in the marketplace. But they created new customers, for what the new drives could do. Then as their performance improved they started eating into the established base.

“It’s hard for a new entrant to break into an existing market, so they have to find new customers. Typically they find them either in a new class of customer who wasn’t interested in the old technology, or they pick up some of the crumbs off the table of the existing customer base, small customers who tend to be overlooked by the incumbent players who are concentrating on the large slices of the pie. Picking up a small customer makes little difference to a large incumbent player, but it’s how a small new player gets its toehold in the market. Then its product improves to the point where it starts stealing away larger customers from the incumbency, and often the incumbent can’t keep up.”

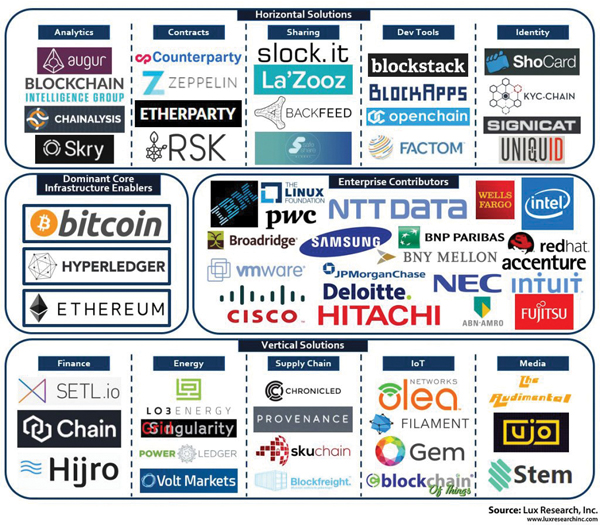

It has been emphasized by many proponents that the potential for blockchain’s distributed ledger and self-executing contracts extend to perhaps every aspect of economic activity. Existing large and medium firms, including utilities, can also expect to benefit from blockchain in their internal processes, and through their interactions with clients and customers. The illustrations above provides an indication of the range of interest and the number of services and companies already being offered: functions, such as billing, sales and marketing, automation, metering and data transfer and others; and platforms like peer-to-peer networks like the subject of this article, or business-to-business markets, including demand response and virtual power plants that use aggregators.

Online resources about blockchain technology

• Blockchain Canada

A not-for-profit organization that connects entrepreneurs, researchers, regulators, and the public to help make Canada a global leader in Blockchain technologies.

• The Enterprise Ethereum Alliance

Connects Fortune 500 enterprises, startups, academics, and technology vendors with Ethereum subject matter experts.

• Blockchain Research Institute

A multi-stakeholder partnership with government bodies, including the Canadian government and private sector companies, the organization will focus on collaborative innovation. The BRI will explore applications for the emerging technology and to bring together the top minds in public and private sector research to build blockchain-based economies around the world.

https://www.blockchainresearchinstitute.org/

• The Muskoka Group

Plans to collaborate to create a collective and highly sophisticated communications program, or campaign, to help explain the Blockchain and work to clarify many of the misconceptions. As part of this we will take steps to support the Blockchain Trust Accelerator – an organization created and sponsored by New America, The National Democratic Institute and the Bitfury Group.

• The Blockchain Alliance

A public-private forum to help combat criminal activity on the blockchain

http://www.blockchainalliance.org/

• Chamber of Digital Commerce

• Institute for Blockchain Studies Philosophy and Economic Theory, The New School for Social Research, New York NY

Office Phone Number : +1 (650) 681-9482

ZRTP & OTR :

Email : info AT BlockchainStudies.org

http://www.blockchainstudies.org/

• U.K. regulatory fintech “sandbox"

http://www.coindesk.com/uk-regulator-9-blockchain-fintech-sandbox/

• Coinfirm, a blockchain compliance and analytics platform based in London, aims to provide a standardized and blockchain agnostic platform