Canada’s investment in public infrastructure, a key plank in the federal government’s economic strategy, has been growing steadily, with power generation projects playing a leading role. The top 100 infrastructure projects underway in 2017 total a breathtaking $186 billion, money that will likely provide economic stimulus while also improving the delivery of a range of services to Canadians. Of this total nearly half, or $83 billion, are energy projects. The chart below from top100projects.ca shows that of Canada’s top ten infrastructure projects, eight are in the power industry.

Ontario is at the centre of this major infrastructure buildout, hosting 41% of the $186 billion national total. This includes 6 energy projects, 19 transit and transportation projects, and 8 major buildings.

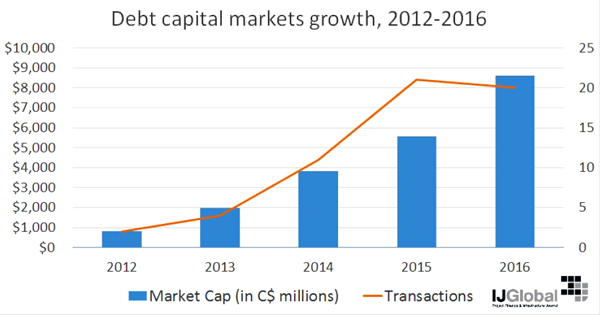

Canadian power financing 2012-2016 total value from IJ Global January 2017

In terms of power project financing, the last few years have shown impressive growth. Chase Collum of IJGlobal reports for example that Canada’s debt capital market for power has mushroomed since 2012, growing from less than $1 billion to more than $8 billion by the end of 2016. In 2016 20 new facilities were financed, totaling $8.6 billion. (See chart “Canadian power financing 2012-2016 total value.”)

Canadian power financing 2012-2016 total value from IJ Global January 2017

In terms of power project financing, the last few years have shown impressive growth. Chase Collum of IJGlobal reports for example that Canada’s debt capital market for power has mushroomed since 2012, growing from less than $1 billion to more than $8 billion by the end of 2016. In 2016 20 new facilities were financed, totaling $8.6 billion. (See chart “Canadian power financing 2012-2016 total value.”)

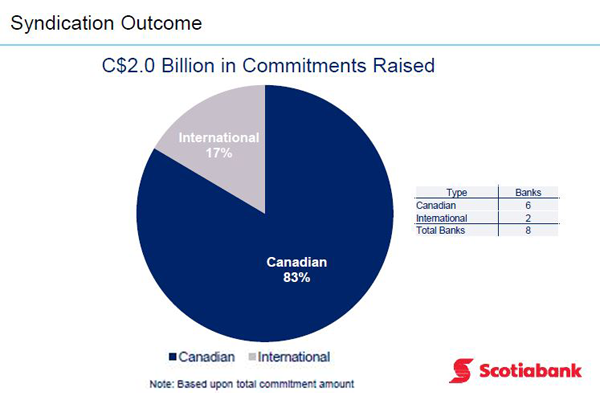

Bruce Power Syndication outcome, as of January 2017. Courtesy McCarthy Tetrault.

Bruce Power, the proponent of Canada's top infrastructure project, the refurbishment and life extension of 6 nuclear reactors, says it “will invest about $13 billion of private dollars into units 3-8 which are still owned by Ontario taxpayers.” It adds that “in the short-term, between 2016 and 2020, the company will be investing approximately $2.3 billion ($2014) as part of this plan. This is incremental to the company’s ongoing financial investments to sustain eight units of operation.” The life-extension of each unit will add approximately 30 to 35 years of operational life, while other investments will add a combined 30 reactor years of operational life to the units. The program will secure an estimated 22,000 jobs directly and indirectly from operations, and an additional 3,000-5,000 jobs annually throughout the investment program.

Bruce Power Syndication outcome, as of January 2017. Courtesy McCarthy Tetrault.

Bruce Power, the proponent of Canada's top infrastructure project, the refurbishment and life extension of 6 nuclear reactors, says it “will invest about $13 billion of private dollars into units 3-8 which are still owned by Ontario taxpayers.” It adds that “in the short-term, between 2016 and 2020, the company will be investing approximately $2.3 billion ($2014) as part of this plan. This is incremental to the company’s ongoing financial investments to sustain eight units of operation.” The life-extension of each unit will add approximately 30 to 35 years of operational life, while other investments will add a combined 30 reactor years of operational life to the units. The program will secure an estimated 22,000 jobs directly and indirectly from operations, and an additional 3,000-5,000 jobs annually throughout the investment program.

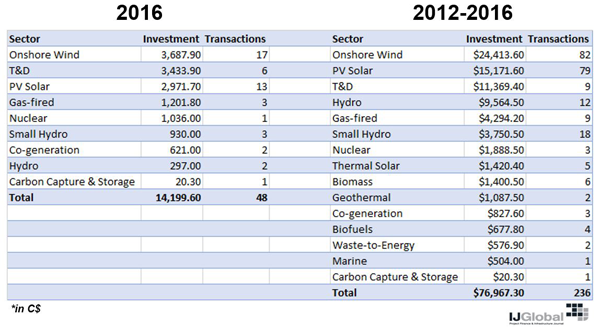

In the five years between 2012 and 2016 Canadian power financings have been led by onshore wind, with 82 transactions totaling $24.4 billion. Photovoltaic solar was next, with 79 transactions totaling $15.1 billion. Transmission and distribution investments totaled $11.3 billion and hydroelectric was $9.5 billion. See the chart (Canadian power financing by energy source 2012-2016) for the full comparison.

Canadian power financing by energy source 2012-2016

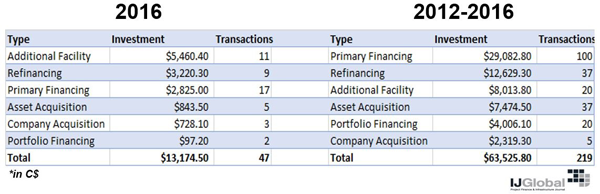

A closer examination reveals that there has been significant change in the types of financings. Although primary financings were the largest category of investments over the 5 year period as a whole, their relative proportion of the total has tailed off in the last year. This is likely because provincial renewable energy procurement programs such as Ontario’s have been revised downward in the last year or two. Refinancing of existing power projects has been a steady focus of attention in the Canadian power finance market and there is every indication that category will remain strong. Refinancings have been bolstered by the relatively low long-term interest rates that are currently available, combined with the fact that many major projects are reaching a state of maturity where refinancing is often attractive. Another category of financing, additional facilities, appears strong. This category represents additional debt facilities that are drawn against existing projects that have previously reached financial close. As an example, these can come in the form of term loans that are aimed at repaying existing indebtedness that is coming due. For details, see chart “Canadian power financing by type 2012-2016”.

Canadian power financing by energy source 2012-2016

A closer examination reveals that there has been significant change in the types of financings. Although primary financings were the largest category of investments over the 5 year period as a whole, their relative proportion of the total has tailed off in the last year. This is likely because provincial renewable energy procurement programs such as Ontario’s have been revised downward in the last year or two. Refinancing of existing power projects has been a steady focus of attention in the Canadian power finance market and there is every indication that category will remain strong. Refinancings have been bolstered by the relatively low long-term interest rates that are currently available, combined with the fact that many major projects are reaching a state of maturity where refinancing is often attractive. Another category of financing, additional facilities, appears strong. This category represents additional debt facilities that are drawn against existing projects that have previously reached financial close. As an example, these can come in the form of term loans that are aimed at repaying existing indebtedness that is coming due. For details, see chart “Canadian power financing by type 2012-2016”.

Canadian power financing by type 2012-2016

The Canadian power finance business appears to be anticipating a slowdown in new renewable energy financing in the wake of indications from the government of Ontario that it is rethinking its systems for procurement of large renewables. However these volumes will likely be more than replaced by the massive new investment going into Ontario’s existing nuclear facilities at Bruce and Darlington. In addition, Alberta and other provinces appear ready to increase their investment in new renewable energy capacity, likely offsetting some of the decline in new project investment in Ontario.

Canadian power financing by type 2012-2016

The Canadian power finance business appears to be anticipating a slowdown in new renewable energy financing in the wake of indications from the government of Ontario that it is rethinking its systems for procurement of large renewables. However these volumes will likely be more than replaced by the massive new investment going into Ontario’s existing nuclear facilities at Bruce and Darlington. In addition, Alberta and other provinces appear ready to increase their investment in new renewable energy capacity, likely offsetting some of the decline in new project investment in Ontario.

Andrew Macklin, the editor of ReNew Canada, notes that during the course of 2017 there is potential for significant growth in energy infrastructure investment beyond the figures cited above. Several cross-border transmission projects are under development. For example, there is the Manitoba-Minnesota project, the Lake Erie Connector, and the Atlantic Link Transmission project. The Lake Erie Connector is estimated to be a $534 million project on the Canadian side. In New Brunswick, the Mactaquac GS ‘life achievement’ project, one that would extend the life of the station to 2068, is estimated at $2.9 billion to $3.6 billion.

All things considered, the last five years have been a period of solid growth in power finance in Canada, and there are signs of a very healthy market for power project development, both in 2017 and well into the future.

Canada's top 10 public sector infrastructure projects for 2017

|

Rank |

Project Name |

Project Value |

|

1 |

Bruce Power Refurbishment |

$13,000,000,000 |

|

2 |

Darlington Nuclear Refurbishment |

$12,800,000,000 |

|

3 |

Muskrat Falls Project |

$9,100,000,000 |

|

4 |

Eglinton Crosstown LRT |

$9,100,000,000 |

|

5 |

Site C Clean Energy Project |

$8,775,000,000 |

|

6 |

Romaine Complex |

$6,500,000,000 |

|

7 |

Keeyask Hydroelectric Project |

$6,496,000,000 |

|

8 |

Réseau électrique métropolitain |

$5,900,000,000 |

|

9 |

Southwest Calgary Ring Road |

$5,000,000,000 |

|

10 |

Bipole III Transmission Line |

$4,900,000,000 |

http://top100projects.ca/2017filters/

Courtesy of ReNew Canada.

— Jake Brooks