By Jake Brooks

The rate at which Ontario exports electricity to customers in the US has risen rapidly in recent years, far outpacing average growth rates in the economy, and potentially becoming a bright opportunity for the province to take a leadership role in low-carbon economic growth. The expansion of exports since 2010 has been enabled by new Ontario generation that has relatively low marginal costs compared to available alternatives for many US customers. Much of this generation capacity, primarily nuclear and renewable energy, produces low or zero carbon emissions, a characteristic that may be helping to support the growing export volumes.

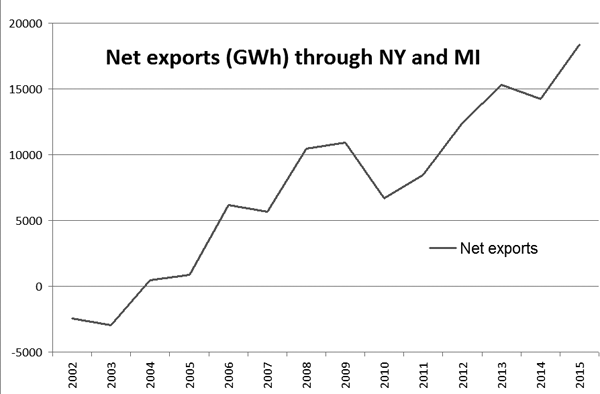

Net power exports from Ontario through the New York and Michigan interties has nearly tripled from 6,678 GWh in 2010 to 18,306 GWh in 2015. While export volumes can be as volatile as stock markets, the long term trend is unmistakable. On average, the net exports from Ontario to customers in New York and Michigan grew by an average of almost 24% per year since 2010. Although much of this power is exported at night when prices are relatively low, the rising volume of exports represents substantial revenue to Ontario based companies, and possibly points to a future growth industry in Canada as US customers look for lower-cost power, and economic ways to reduce their carbon footprint. Much of the growth in export volumes took place before recent increases in the spread between US and Canadian currency values.

Net power exports from Ontario through the New York and Michigan interties has nearly tripled from 6,678 GWh in 2010 to 18,306 GWh in 2015. While export volumes can be as volatile as stock markets, the long term trend is unmistakable. On average, the net exports from Ontario to customers in New York and Michigan grew by an average of almost 24% per year since 2010. Although much of this power is exported at night when prices are relatively low, the rising volume of exports represents substantial revenue to Ontario based companies, and possibly points to a future growth industry in Canada as US customers look for lower-cost power, and economic ways to reduce their carbon footprint. Much of the growth in export volumes took place before recent increases in the spread between US and Canadian currency values.

The IESO notes that, “Imports and exports help the province’s electricity system and market to be more reliable, cost-effective and competitive. … Being interconnected means that when unexpected problems occur on the system, such as generation unexpectedly tripping off, neighbouring states and provinces can quickly help make up the power shortfall.”

US-Canada energy trade appears to be attracting growing interest in the business community. New opportunities for various forms of cross-border arbitrage become available almost continually as technologies for energy supply and trading evolve. In addition, a number of proposals are afoot to build infrastructure that would facilitate increased cross-border trade in power. The organizers of a cross-border energy conference scheduled for Boston in March 2016 say, “Several new cross-border projects have been proposed — mostly to bring large-scale hydropower in to New England from Canada.” Their conference will explore policy questions and tensions between competitive energy markets, regulators, and the public with regard to concerns over costs, impacts to the local economy, and siting. It also intends to evaluate the potential of hydropower projects bid into the New England Clean Energy RFP — a multi-state request for new clean energy and transmission projects — in addition to projects that would develop offshore wind resources and increase US/Canadian access to natural gas. Participants are expecting to address issues like the following:

• The relative role of hydropower imports, natural gas, renewables and offshore wind in New England’s future power supply mix

• The market for carbon emission reductions and trade in emission offsets

• The potential for new and re-purposed Canadian infrastructure supporting cross-border energy trade

• Legislative initiatives and policy considerations for cross-border trade

• Project proposals to expand US and Canadian access to natural gas

• Needs, constraints and opportunities for increased LNG and pipeline capacity.

Exports contribute to Ontario revenue and reliability

Although the contracted pricing of this exported power is not public information, it is likely producing revenues for Ontario companies in the hundreds of millions of dollars per year, possibly approaching a billion dollars per year.

IESO officials hasten to point out that although economics often determine the level of trade, the growth of exports would never be allowed to affect the availability of electricity for Ontario consumers. The grid is always managed so as to place the safety and security of Ontario consumers first. Exports and imports are only commercially scheduled through the IESO administered markets at times when they would have a net positive benefit to consumers in the province.

Exports are used by the IESO to support reliability and to improve the operation of the system from an efficiency perspective. The active use of the interties gives the IESO additional options for managing reliability, and has a net positive impact on reliability.

Many factors affect export volumes

The actual level of exports at any one moment is the result of interplay between numerous factors. First of all, there has to be a willing buyer and a willing seller on each side of the transaction, with a contract for a wholesale amount of power, or provision for spot market trades. Second, contractual conditions have to be met for both sides, including for example certain levels of power prices, currency rates, and the operational state of both parties’ equipment. Third, the physical connection between the two entities has to be available to transmit the power, usually scheduled in advance with market operators on both sides of the border.

Considering that the level of demand and price for electricity changes frequently on both sides of the border, sometimes dramatically, the volume of export transactions can shift widely even over the course of a single hour.

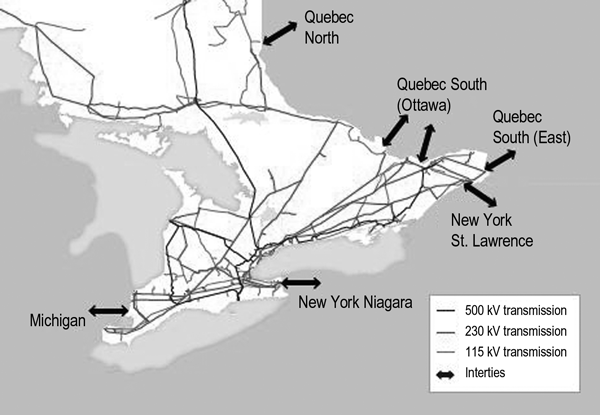

For a number of years between 2000 and 2012 Ontario import and export volumes were complicated by a phenomenon known as “loop flow.” In many cases power trades made between US suppliers and customers in New York and Michigan would result in power flowing through Ontario, effectively as the path of least resistance to transmit the power. These trades could tie up the use of transmission lines, even though neither the buyer nor seller were located in Ontario. The level of these transactions declined significantly in 2012 when Ontario completed the installation of phase angle regulators that limited the amounts of power taking that route. (See “Michigan Phase Angle Regulators to help with loop flow,” IPPSO FACTO, April 2012.)

The conditions driving current levels of export, although impactful at the moment, are subject to change. For example, on the US side, customers may be impacted by weak demand and softening prices for off-peak power. Variations of that nature can affect Ontario exports considerably, and on very short notice.

Implications for planning and public policy

In 2014, at the request of Ontario Energy Minister Bob Chiarelli, the IESO released a study on the potential for expanded use of the interties. It concluded that although the province’s interties are very helpful in terms of providing operational flexibility, they may not be sufficient to support a major increase in the level of firm imports to Ontario.

The IESO report said, “The firm import capacity is currently limited. There would need to be significant upgrades, including new transmission elements, to Ontario’s transmission system and possibly new intertie capabilities to meet any marked increase in firm imports. The cost of those enhancements would vary depending on the quantity of capacity being imported. ... Transmission upgrades would also require regulatory and environmental assessment processes with long lead times, which brings into question the feasibility of firm import arrangements to meet the future baseload needs of the system identified in the 2013 Long Term Energy Plan (LTEP). All of these factors could result in paying significantly more for firm imports than could be achieved through addressing supply needs with internal resources.” The report, titled “Review of Ontario Interties,” was released by the IESO on October 14, 2014 and is available on the IESO website.

The IESO report said, “The firm import capacity is currently limited. There would need to be significant upgrades, including new transmission elements, to Ontario’s transmission system and possibly new intertie capabilities to meet any marked increase in firm imports. The cost of those enhancements would vary depending on the quantity of capacity being imported. ... Transmission upgrades would also require regulatory and environmental assessment processes with long lead times, which brings into question the feasibility of firm import arrangements to meet the future baseload needs of the system identified in the 2013 Long Term Energy Plan (LTEP). All of these factors could result in paying significantly more for firm imports than could be achieved through addressing supply needs with internal resources.” The report, titled “Review of Ontario Interties,” was released by the IESO on October 14, 2014 and is available on the IESO website.

In addition to considering the potential for clean energy imports from Quebec and Manitoba, the report included the following recommendations:

“3. The IESO should allow for capacity imports and exports in developing the design for a potential capacity market for Ontario.

4. In providing for capacity imports and exports, the current ability of the interconnections to support reliability and operating flexibility should be maintained. This will mean that only a portion of intertie capacity could be allocated for capacity imports.

5. Opportunities to enhance the benefits of the interties should be pursued by the IESO, including more frequent intertie scheduling, and expanded provision of ancillary services through intertie transactions.”

Quite likely the IESO will consider exports and imports carefully as it develops its plans for an Ontario capacity auction. In a similar vein, the Ministry of Energy may well identify clarified functions for exports and imports in the 2017 Long Term Energy Plan, expected later this year.

Without much fanfare or public attention, Ontario’s clean power exports have grown to a multi-million dollar industry. Considering prevailing economic conditions, the likelihood of further procurement of renewable energy, and an interest on both sides of the border in meeting increasingly stringent emission requirements, it appears that the prospect for power exports from Ontario are fairly bright.

For more information, readers may wish to visit the IESO website,

http://www.ieso.ca/Pages/Media/Imports-and-Exports.aspx.

See also related stories: “Grid developments likely to expand cross border trade,” "Vermont OK’s transmission line from Quebec border," and "Line approved to deliver Canadian hydro to U.S.," also in this issue; and “Picking on exports,” IPPSO FACTO, June 2011.