It is now less than 5 months until the entire Japanese retail electricity market will be open for competition. As of this coming April, around 77 million Japanese residential and 7.4 million commercial electric customers will be able to choose their electricity service provider.

It is now less than 5 months until the entire Japanese retail electricity market will be open for competition. As of this coming April, around 77 million Japanese residential and 7.4 million commercial electric customers will be able to choose their electricity service provider.

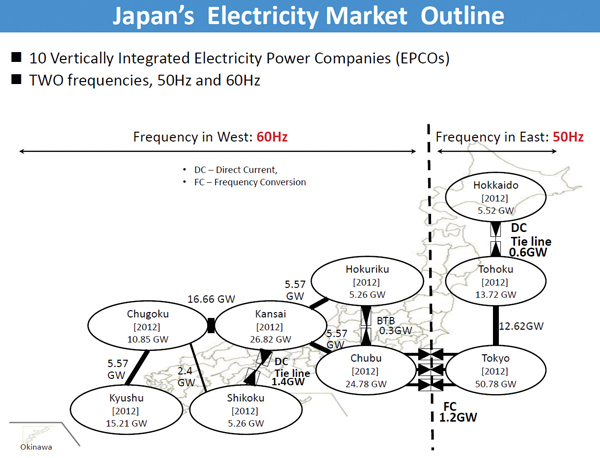

The triple-disaster of the tsunami, earthquakes and nuclear melt-down of March 2011 was a wake-up call to re-examine the current electricity infrastructure. Some areas of Japan experienced rolling blackouts due to the temporary shut-down of the country’s nuclear power reactors, which used to provide 25% of the nation’s demand. This was complicated by the existence of two different transmission grid systems, which makes it difficult to move electricity to the eastern part of Japan from the western part.

The eastern sector of Japan operates its transmission at 50 hertz while the western operates at 60 hertz. “Because of that (two frequencies), we have a frequency conversion system, but it is very tiny. Only 1.2 GW in capacity,” said Takuya Yamazaki, Director for Electricity Market Reform at Japan’s Ministry of Economy, Trade and Industry (METI) at a seminar in the U.S., addressing the cross-regional energy supply issue.

The eastern sector of Japan operates its transmission at 50 hertz while the western operates at 60 hertz. “Because of that (two frequencies), we have a frequency conversion system, but it is very tiny. Only 1.2 GW in capacity,” said Takuya Yamazaki, Director for Electricity Market Reform at Japan’s Ministry of Economy, Trade and Industry (METI) at a seminar in the U.S., addressing the cross-regional energy supply issue.

Further complicating the situation, the supply constraint after the disasters caused large electricity rate hikes. With the coming deregulation, questions emerge such as whether the country will be able to offer lower prices and more options at the same time as securing reliable supply. And will it be able to stimulate competition from inside and outside the nation?

EPCOs defending market shares by bundling services

The ten regional, vertically-integrated, investor-owned utilities (IOU), known also as Electric Power Companies (EPCOs), have enjoyed regional monopolies for the last 60 years. Since 1995, the Japanese government has attempted to open up the nation’s electricity market in phases. As of today, 62% of the total market is, in fact, open for competition. However, the EPCOs still control over 95% of the retail market.

It appears the EPCOs have every intention of retaining their market shares. As the date of retail deregulation gets nearer, the EPCOs have rolled out what defense strategies to protect their own existing markets while expanding into new territories.

It appears the EPCOs have every intention of retaining their market shares. As the date of retail deregulation gets nearer, the EPCOs have rolled out what defense strategies to protect their own existing markets while expanding into new territories.

Tokyo Electric Power Company (TEPCO), Japan’s largest incumbent electric utility, has unveiled a new marketing strategy. TEPCO Energy Partner, TEPCO’s newly-created retail business unit, has been negotiating with leading service companies to team up and bundle power supply with other retail customer services. The utility recently sealed a deal with a major wireless carrier, SoftBank Corp.

By bundling together a number of frequently used services, TEPCO and its partners can expand into new markets while protecting their revenue streams in their established markets. Customers who sign up for the bundled service with TEPCO and its partners will be able to receive and accumulate “reward points.” Points can be later used toward payments for electricity or wireless services or purchases for other services and goods offered by TEPCO’s partners. Quite possibly, the reward program will keep their customers from switching to other service providers.

Kansai Electric Power Company (KEPCO), the second largest electric utility, Shikoku Electric and Chubu Electric also are negotiating with wireless service providers for nationwide partnerships.

Chubu Electric Power Company is expanding its reward points program not only with NTT Docomo, the nationwide wireless carrier, but also with regional service providers such as Nagoya Railways and Nagoya Transportation Department (local bus services) to protect its current territory.

Tohoku Electric Power Company and Tokyo Gas Company have jointly established a new retail electricity provider called “Synergy Power” to provide electricity to customers with demand for over 50 kW in the Kanto Region. This partnership will utilize each other’s assets: Tokyo Gas Company, having its customer-base in the Kanto Region, can provide access to new customers for Tohoku Electric, which in return can provide electricity from its own power plants. The joint company does not have a plan to expand its service to the residential segment yet.

Besides strengthening the retail business, TEPCO and Chubu Power Electric have established a new power company called JERA to develop new power plants together, consolidate fuel purchasing, and provide cross-regional supply. Having the two EPCOs together, the combined entity may be able to dominate the nation’s supply chain. If this allows them to control the retail market in certain regions, it could be more difficult for newcomers to compete at the wholesale level.

New regulations supporting competition or suppressing competition?

While the EPCOs are trying to solidify their customer bases and possibly building new entry barriers, agencies of the national government have been implementing new regulations in an attempt to stimulate competition.

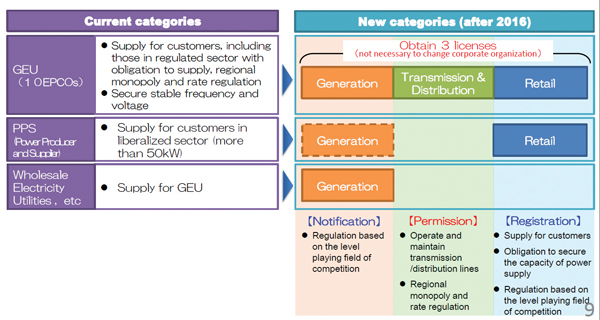

As part of the Reform, business license categories for the electricity industry are revised from the current (1) General Electricity Utilities (EPCOs), (2) Power Producers Suppliers and (3) Wholesale Electricity Utilities into (1) Generation, (2) Transmission and Distribution and (3) Retail.

In the partially deregulated market (demand over 50 kW), a company registered as a Power Producer and Supplier (PPS) can produce and sell electricity. As of September 18, there were 762 entities registered as PPSs at METI.

In the partially deregulated market (demand over 50 kW), a company registered as a Power Producer and Supplier (PPS) can produce and sell electricity. As of September 18, there were 762 entities registered as PPSs at METI.

Because of the new categorization, METI now requires companies, including PPSs, to register as Retail Electricity Providers (REP) if they are planning to sell electricity directly to retail customers. This new requirement also applies to the EPCOs. All applicants are legally obligated to ensure adequate supply and to submit balanced energy schedules showing load projected and energy required to serve the load, upon registration.

The registration started in August 2015. As of this writing, out of 762 PPSs, only 82 have applied for REP registration.

In addition, those who wish to sell retail electricity must become members at the Organization for Cross-regional Coordination of Transmission Operations (OCCTO), prior to registration as REP. Inaugurated in April 2015, OCCTO is mandated to achieve more efficient management of electricity supply and demand nationwide, promoting cross-regional energy supply. The organization is to review the EPCOs’ supply-demand and grid plans, to oversee cost allocation among Transmission and Distribution System Operators (TDSO), and to order EPCOs to increase or reinforce power generation and power interchanges. “The role of OCCTO is very critical for a fair and clean competition,” said Ethan Zindler of Bloomberg New Energy Finance.

In September, METI also established the Electricity Market Surveillance Commission (EMSC) to monitor electricity trading and to enforce neutral access to the transmission network in the newly liberalized electric market. The Commission also review applications for REP registrations.

The low registration rate of PPSs as REPs may be an indication that the majority of PPSs will enter into the new deregulated market as generators, not retail providers. It could also suggest that some small-scale PPSs are overwhelmed by the new regulations to comply.

Possibility of nuclear power re-launch and more coal to provide cheaper electricity

When PPSs try to sell electricity, sometimes they may need to buy electricity from a wholesale market, in situations where demand exceeds supply or their generators have trouble. Founded in 2003, Japan Electricity Power eXchange (JEPX) is responsible for overseeing and administering Japan’s competitive wholesale electricity market. As of October 10, it had 119 members, including the 10 EPCOs. “Only 1.3% of wholesale electricity is traded at JEPX. It is tiny. It is not so competitive now, “said Yamazaki.

This means that the volumes available to purchase and resell are relatively small for PPSs who can only buy excess power production from either the EPCOs or IPPs. Some PPSs have asked METI to require the EPCOs to trade about 30% of their electricity at the JEPX. This would further strengthen the wholesale market and as the trading volume increases, it would help new entrants to be more competitive.

Although most of the new entrants claim to offer lower rates than the incumbents, some experts expect that it may be difficult to live up to these claims, unless they manage to secure a significant amount of the current supply, or build new, cost-effective generators.

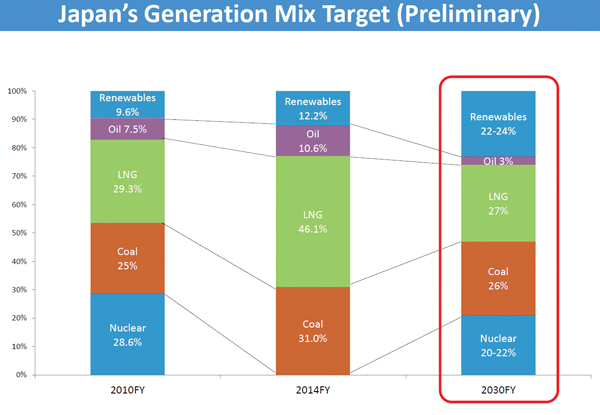

Investing in new power plants may be a tricky decision. The recent national energy mix plan announced by METI increased the expected contribution from nuclear power to 20-23% by 2030 from 0% in 2014. This means that some of the nuclear power reactors (total of 46 GW), which had be shut down after the Fukushima incident, may restart.

METI’s Yamazaki predicts that retail competition will rely heavily on the wholesale market and in order to be cost competitive, nuclear power will be back. For PPSs, if nuclear power plants owned by the EPCOs resume generation, which have historically provided cost-competitive, baseload supply, plants owned by PPS’s may end up being under-utilized, making it difficult to recoup the original investment and to be competitive in the retail market.

While the generation and retail portions of the market will be deregulated, the T&D portion will continue to be regulated so that new entrants have a fair access to the existing T&D. This means that even after the deregulation, the EPCOs will continue to own, operate, and maintain electric lines while new retailers will pay wheeling rates to transfer electricity to their customers.

In July all 10 EPCOs submitted their transmission charge proposals to METI. Proposed transmission charges for the retail market vary from ¥8.08/kWh to ¥9.76/kWh (excluding Okinawa), with the average being ¥8.63/kWh. This accounts for about one third of the current retail electricity rate. Unless newcomers manage to procure electricity cheaply or cut their profit margins, it may be difficult for them to offer competitive prices. All the rate proposals are currently under review.

Non-energy service providers entering into the new market with the strong brand recognition

While the EPCOs are busy planning to defend their own turf, new entrants are slowly emerging to get a piece of the retail market, which is worth about 7.5 trillion yen – the volume of demand from customers below 50 kW which is going to be deregulated in this coming April.

So far, new market entrants represent a range of industries including online retail, gas, oil, railroad, homebuilders, wireless communications, and trading companies. They are mostly capitalizing their established brand recognition to attract consumers and promote their new electricity service, bundling with their existing services.

Rakuten Inc., the nation’s largest e-commerce platform provider, including online retail, formed a business alliance with Marubeni Corporation, a Japanese trading company, to sell electricity to consumers with low-voltage demand. Marubeni will generate and provide electricity from power plants it owns. Rakuten will promote retail electricity sales through merchant members who sell goods and/services at Rakuten’s online retail market and hotel members who do business at a Rakuten’s travel site.

JX Nippon Oil & Energy Corporation, a Japanese petroleum company, also has an eye for the electricity market. Its businesses include the exploration, importation, and refining of crude oil, as well as the manufacture and sale of petroleum products, including fuels. Its gasoline is sold under the brand name ENEOS, which is also used for its gas stations nationwide.

The company has also developed and owned over 1.5 GW worth of power generation, including thermal power and solar photovoltaic plants. The company will offer gasoline consumers at its 11,000 gas stations nationwide special discounts on gasoline if they sign up a new electricity plan with JX. The company also formed a partnership with KDDI, a mobile service provider, to offer a bundled service.

Providing lower prices and more services while securing reliable energy supply is part of the mission established for national electricity reform. Key factors including the fate of the suspended nuclear power reactors, the expansion of cross-regional transmission capacity, and T&D cost structures remain to be resolved. Uncertainty in these areas may reduce the number of new entrants or cause them to delay the date of their entry into the new deregulated market.

Business opportunities for non-Japanese entities, as either generators or retailers, seem to be rather limited at this point because of the incumbent utilities’ aggressive defense and offense strategies. However, non-Japanese entities, many of which have experience operating in deregulated markets, can anticipate interest from Japanese companies in their expertise. In particular, expertise is expected to be needed in areas such as supporting the new infrastructure for Independent System Operators (ISO) and/or Regional Transmission Organizations (RTO), enhancing cross-regional transmission capacity, and a trading platform. There will likely be interest as well in deployment of smart meters to more effectively manage customers’ energy consumption; and in the development of a switching support system to make it seamless for consumers to switch retailers without disruption.

Junko Movellan is a renewable energy writer based in the United States.