There are a lot of stresses and strains on North America’s natural gas and electricity systems, but contrary to some people’s impressions, Ontario’s natural gas-fired power generators are well-positioned to act as a force for stability and reliability across the region. This capability may become particularly important as regulators and system managers move to implement changes in various parts of the systems. In fact the natural gas and electricity grids are being seen increasingly as an integrated pair, and are being developed to work in closer co-ordination than ever before.

“Some people, even a few in the power industry, are under the mistaken impression that natural gas supply for power generation in Ontario is a risky proposition. But nothing could be further from the truth,” says APPrO’s President Dave Butters. “Although some of our American friends may have fuel delivery arrangements that are subject to interruption under certain conditions, generators in Ontario have access to fuel supply services that are rock solid.”

The winter of 2013-2014 exposed weaknesses in the North American grid.

Extreme weather and other factors put a lot of strain on the natural gas and electricity grids in North America during the winter of 2013-2014 and sustained natural gas price spikes resulted, in general, from physical infrastructure constraints. Alarming headlines in the media referred to dramatic price spikes, delivery restrictions, and natural gas supply shortages, often without all the relevant qualifications. Prominent figures broadcasted comments suggesting that rising natural gas prices might soon drive up electricity prices. While there were supply problems in the US, the actual circumstances were more complex than some of the headlines suggested. Estimates from the consulting firm ICF International indicated that PJM lost 20% of its available capacity on January 9, amounting to 38 GW, related largely to difficulties securing adequate firm supplies of natural gas, and other electricity system /operators saw similar problems. Andy Weissman of EBW AnalyticsGroup told GDF SUEZ that “[the] Winter of 2013–2014 revealed huge structural deficiencies in the U.S. market.” But these high-level messages largely obscured a more telling picture behind the scenes: Without minimizing the challenges that need to be faced, both the natural gas and electricity systems are reasonably efficient, responded effectively to recent incidents, and are adapting to new challenges. In Ontario, all firm customers received firm service throughout the winter. While a small number of interruptible gas customers were curtailed per agreement, contracts were honored and critical obligations were fulfilled without any major dislocations. Ontario is fortunate to have a robust system, and needs to ensure that investment continues in way that supports that robustness.

The physical characteristics of natural gas and electricity seem to suggest that they are destined to work together. Electricity has the unique capability of being able to be transmitted great distances in the blink of an eye, whereas natural gas has the added value of being able to be stored economically. Electricity generation can convert the output from many sources of energy into a single form that will effectively serve a huge variety of end-uses, while Ontario natural gas generators, with access to high deliverability storage at the Union Gas Dawn Hub and firm short-notice services on the Union Gas, Enbridge Gas Distribution and TransCanada Mainline systems, have the ability to start up and shut down quickly. These are complementary capabilities. When there are critical demands on the natural gas and electricity systems, the strengths of each can become extremely helpful in responding to unexpected changes experienced by the other.

Reinforcing the system

In fact, the extreme weather and unexpected incidents last winter seem to have spurred regulators and owners of gas and electricity assets to redouble their efforts at reinforcing the system to withstand more and tougher challenges. Even before these recent developments, the US FERC (Federal Energy Regulatory Commission) had begun a natural gas-electric co-ordination initiative, intended to ensure that the increasingly interconnected natural gas and electricity grids have the equipment and business tools necessary to work together efficiently, achieving greater reliability at lower cost than if they worked in isolation.

The FERC initiative is remarkably similar to Ontario’s Natural Gas Electricity Interface Review (NGEIR) of 2005-2008, which resulted in a series of new natural gas supply services being made available to Ontario natural gas fired power generators. When the major new generators under Ontario’s CES (Clean Energy Supply) program went into operation in late 2008, Ontario’s natural gas supply controllers and the Independent Electricity System Operator were ready to run the new services and primed to monitor them closely for implementation problems. (See the sidebar below for a summary of the natural gas delivery services designed for power generation.) Reportedly, the services have worked well, have benefited from refinements, and are now relied upon for the great majority of critical natural gas fired power generation in Ontario.

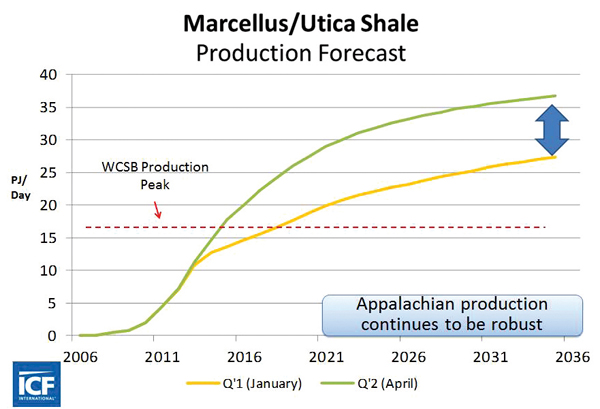

In addition to setting up the natural gas delivery services, Ontario’s natural gas distribution companies have also been working to expand the physical capabilities of the system. This includes development of high deliverability storage at both Union Gas and Enbridge Gas Distribution storage facilities, and special distribution laterals and reinforcement of the distribution systems. The Ontario natural gas network has been expanded and will continue to expand in 2015-2017 to provide increased access to diverse supplies of natural gas at Dawn/Niagara. Recent examples are Enbridge Gas Distribution’s GTA reinforcement, Union Gas’ Dawn to Parkway projects (including Parkway reinforcement and expansion), and TransCanada’s King’s North expansion. In addition, projects such as Spectra Energy / DTE Energy’s proposed NEXUS Gas Transmission project will move new supplies of natural gas from the Marcellus and Utica basins to Ontario and markets further east.

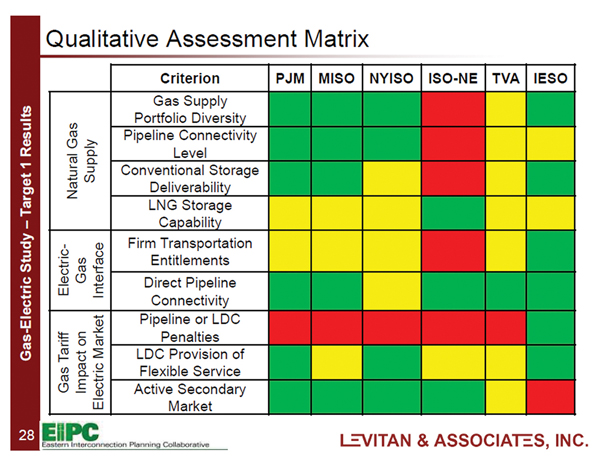

The net result of these and other changes has been that Ontario’s natural gas fired generators have access to certain kinds of firm natural gas delivery services that their American cousins are only now trying to put into place. A recent US report by Levitan and Associates1[7] found that, “[in the U.S.] operating conditions during the heating season typically expose natural gas-fired generators to potential curtailment or interruptions, particularly during cold snaps.” No one would suggest that Ontario’s system is perfect. For example, the National Energy Board’s approval of a new framework for TCPL’s mainline tolls is needed to ensure open access to natural gas at Dawn/Niagara, but there has been a significant effort to ensure that when the electricity system looks to natural gas-fired generators to meet reliability requirements, the generation will be ready and available. Multi-stakeholder efforts are underway in the US to set up similar arrangements south of the border.

The net result of these and other changes has been that Ontario’s natural gas fired generators have access to certain kinds of firm natural gas delivery services that their American cousins are only now trying to put into place. A recent US report by Levitan and Associates1[7] found that, “[in the U.S.] operating conditions during the heating season typically expose natural gas-fired generators to potential curtailment or interruptions, particularly during cold snaps.” No one would suggest that Ontario’s system is perfect. For example, the National Energy Board’s approval of a new framework for TCPL’s mainline tolls is needed to ensure open access to natural gas at Dawn/Niagara, but there has been a significant effort to ensure that when the electricity system looks to natural gas-fired generators to meet reliability requirements, the generation will be ready and available. Multi-stakeholder efforts are underway in the US to set up similar arrangements south of the border.

Popular misconceptions

The incorrect assumption that natural gas fired power generators can’t contract secure supplies of natural gas in Ontario appears to exist in several parts of the energy sector. There are two or three reasons that this kind of misunderstanding may be so widespread. First of all, many in the power sector tend to assume that fuel delivery contracts are essentially the same in the US and Canada. Secondly, people tend to remember news stories that talk about sudden price spikes, even if the spikes are short-lived and have little impact on the total cost over a month or a year. And third, natural gas industry representatives and regulators in North America have prompted some necessary public discussions about the need to expand and reinforce the natural gas delivery system. While it is true that the North American system needs to be built out to accommodate growth in many areas, it is not at or near the point of causing interruptions in service, at least not in Ontario.

Some price volatility is a fact of life

Thanks to abundant new North American supplies, natural gas prices have steadily declined over the past 10 years and long-term forecasts suggest that natural gas will continue to be the most economical source of energy for decades to come. Sustained natural gas price spikes that occurred this past winter across North America were generally caused by physical infrastructure constraints. Many in the industry hasten to point out however that, while Ontario generators can contract reliable supplies of natural gas, there will always be a market-based element to their costs. The natural gas system is designed to provide reliability, but not to insulate against occasional price volatility. It is entirely possible that there will be market-based price volatility in the future as supply and demand grow and infrastructure is expanded in stages to serve the increasing supply and customer base. Of course there are a number of tools available to generators and other fuel customers to help manage price volatility. Examples are high deliverability storage, firm transmission and distribution contracts, and various short-notice load balancing services.

With all these options available to natural gas-fired generators, it is clear that natural gas generators are able to tailor gas services to their specific requirements. A baseload natural gas generator’s needs are different than those of an intermediate load’s, and vastly different than those of a peaker. In Ontario, natural gas generators can contract the appropriate services to ensure reliable natural gas supply and optimize their costs.

Ontario’s gas-electric control protocol

Some of the current FERC initiatives reflect the kind of arrangements Ontario has already put in place. Notably, the IESO and Ontario gas utilities have worked out an effective protocol used by their respective control rooms to promote operational predictability. Specifically, in 2008 the IESO, Union Gas, and Enbridge Gas Distribution signed on to the ‘Ontario Gas / Electric Coordination Communication Procedure’. The purpose of this document is defined as:

“This coordination procedure between the gas and electricity industries is intended to facilitate information exchanges among the parties for the resolution of operational issues under a variety of scenarios including periods of high demand, low resource availability or transmission constraints for either or both commodities as they affect Ontario natural gas fired power generation.”

The Gas / Electric Communications document sets out several levels of communication between the parties. The first are seasonal meetings (Spring and Fall) to review any constraints, outages, or areas of concern in the upcoming season. Next are weekly communications – these can be initiated by any party and will take place Friday’s to discuss the upcoming seven to ten days of operations. The final level of communications is daily – both day ahead and real time/intraday.

Again, either of the parties can initiate this level of communication, which is to determine if there is expected to be a high reliance on natural gas generators during peak conditions and if natural gas deliveries are vulnerable to a geographic area during times of high reliance on natural gas generators. The seasonal meetings are mandatory and the other levels of communication are as required.

The future looks robust

The joint evolution of the natural gas and electricity sectors has been productive. Libby Passmore, Manager of Strategic Sales at Union Gas, observes that, “The gas and electricity markets have indeed become more integrated. The better we understand how they work together, the better all stakeholders will be able to drive out the efficiencies while maintaining the reliability of the systems.”

Although it is possible to more fully integrate the natural gas and electricity systems, it is clear that tools and infrastructure have been put into place that allow for reliability-related services to be provided more effectively than ever before. Ontario consumers can rest assured that natural gas supplies for critical power generators are fully reliable. In fact, they are arguably one of the most reliable components of the power system now, and likely well into the future.

See related stories:

Ontario turns up the gas, IPPSO FACTO, November 2008

Cold weather prompts price hikes and questions about adequacy April 2014

Gas delivery services in Ontario that provide reliability to power generators

Key gas-management tools for natural gas-fired generators

• High deliverability storage

» Offered by Union Gas and Enbridge Gas Distribution

» Firm access to maximum injection and withdrawal capacity with multi intra-day nomination windows

• Firm transportation

» Offered by Union Gas, TransCanada, and Vector

» Firm service with short notice multi intra-day nomination windows

• Firm distribution services

» Offered by Enbridge Gas Distribution and Union Gas

» Firm service with short notice multi intra-day nomination windows

• Intra-day load balancing or load-shaping capability

» Offered by Union Gas, Enbridge Gas Distribution and TransCanada and Vector

» Firm service

» In-franchise or ex-franchise

» No-notice to short notice load balancing and load-shaping

• Direct access to the Dawn Supply and Storage Hub

» Over 100 buyers and sellers of gas supply

» The third largest integrated storage hub in North America

» Gas Supply traded on public electronic trading platforms allowing for full price transparency.

What is the Dawn Hub?

The Union Gas Dawn Hub is the largest “market” hub in Canada and one of the largest in North America. A market hub is often described as a liquid trading point where there are a large number of buyers and sellers of natural gas and where significant volumes are transacted daily. The Dawn Hub value is derived from three main characteristics:

a) Underground storage – Union Gas’ Dawn storage facilities comprise 23 depleted natural gas wells that provide approximately 165 PJ of capacity. All 23 wells are connected to a central compressor complex, a unique design that provides significant operational and commercial flexibility. Union Gas’ Dawn facilities are also connected via pipelines to the Enbridge Gas Tecumseh storage facility (112 PJ) and Michigan storage facilities (527-633 PJ), which leads to the next characteristic.

b) Upstream pipeline interconnects – the Dawn Hub receives gas supplies from a number of upstream pipeline interconnects: TCPL Great Lakes (1.3 PJ/d), Vector pipeline (1.6 PJ/d), Michcon (0.16 PJ/d), Panhandle pipeline (0.2 PJ/d) and Consumers Energy. These pipeline interconnections allow supplies from the major production areas (Western Canada, the U.S. Rockies, and the Gulf of Mexico) to access the Dawn Hub and provide flexibility and optionality to customers transacting at Dawn.

c) Downstream pipeline takeaway capacity – Union Gas’ Dawn-Parkway transmission system consists of four parallel pipelines (26, 34, 42, 48”), which are bi-directional and can move over 5.3 PJ/d “from” Dawn to downstream markets in Ontario, Quebec and the U.S. Northeast in the winter and also “to” Dawn in the summer from TransCanada. Union Gas’ Dawn-Parkway system connects with the TransCanada system around Toronto, which allows natural gas to access these markets.

[7]. 1. “Gas-Electric System Interface Study: Existing Natural Gas-Electric System Interfaces.” Eastern Interconnection Planning Collaborative, DOE Award Project DE-OE0000343, Levitan and Associates Inc.