A worked-out iron mine in southern Ontario is poised to provide a new and different kind of value to the province, this time to Ontario’s power supply. Like the only other facility of its type in Ontario aside from the one at Sir Adam Beck generating station, the Marmora pumped-storage facility will take power produced when it’s cheap, or when there’s more than the grid can use – that could be when Ontario’s windfarms are cranking out more than consumers need at the moment, or it could be in the middle of the night when the nuclear operators would like some place to put surplus power– and use it to pump water uphill, then run it downhill again when there is higher value for the electricity.

Had the facility been available between 2009-2011, for example, when the embarrassment of riches known as “surplus baseload generation” was just coming into focus, Navigant Consulting calculates that Marmora would have allowed the province to make use of .7 TWh, or 35% of the surplus that instead, at the time, the system operator had to curtail, with a value about $34 million.

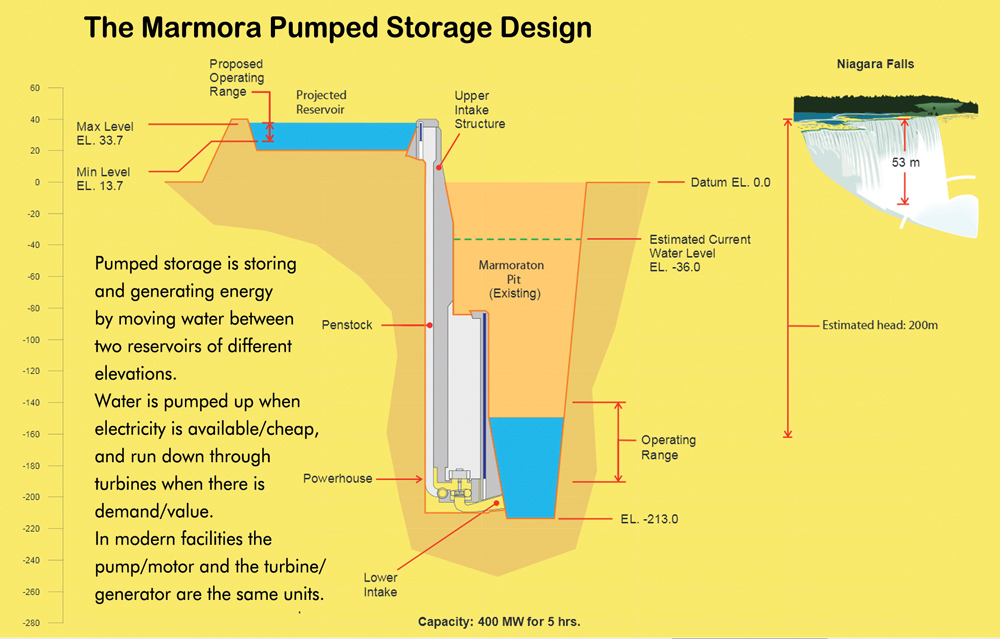

The project offers so many advantages some will wonder why it hasn’t been built already. As a video from Northland explains, thanks to its earlier existence as an open-pit mine, the lower storage containment, over 213 metres deep (Niagara Falls is 53 metres), is ready and waiting, and already nearly full of water. Material to form the upper storage containment, in the form of the rock excavated from the mine, is likewise sitting right next to it – all together making for a huge savings in developing the project.

Even aside from that, pumped storage generally has lower capital costs per MW of capacity than wind, solar, conventional hydro, or nuclear power, Northland Power says in an informational video, and lower life-cycle costs as well. Eighty-five percent of the energy that goes into pumping the water uphill comes back out as energy to the grid. The Marmora site is just eight kilometres from the major transmission corridor between Ottawa and Toronto, which has ample capacity to take the power. There is no natural water body involved to have its ecosystem functioning disrupted; everything is human-built. And the townsfolk of Marmora would like nothing better than to see their old mine produce jobs again. In fact, in the emerging spirit of the times, one of the first things Northland Power did in developing the project was conduct a community meeting in the early stages in 2010.

John Wright, Northland’s Executive Director of business development, explained in a phone conversation that Northland was pleased to see the government identifying the important role of energy storage in the newest LTEP.

“We saw the opportunity and Marmora, saw storage coming to the fore,” Wright says. “California’s Public Utilities Commission has issued a directive for 1300 MW of storage. In Europe, there is about 3000 MW of storage in design and construction. Jurisdictions with more penetration of renewables are seeing storage as the big shock absorber. We saw it happening here too, with the Green Energy Act.”

What the facility would do, aside from making use of otherwise surplus baseload generation, is allow variable generation from windfarms to maximize their capacity factors, rather than having to curtail them, Wright says. “Right now, with the wind capacity in existence, in round figures say 1000 MW and operating at 30% capacity factor at night for 300 MW, the Marmora facility would be able to absorb a lot of that for hours. This would allow province to get the best value out of its wind installations.”

On the continuum of energy storage technologies, the Marmora project, at 400 MW of generating capacity and an 800 MW operating range (400 MW generation and 400 MW load), would be in the bulk grid scale storage class. It’s complementary to other storage technologies such as batteries and flywheels with millisecond response times but shorter duration, which are also helpful in supporting the grid.

“The Marmora facility, once built, can be the go-to tool for the system operator to help balance the system,” Wright says. “This has certainly been the case where a system operator using a 600 MW facility in the US says it’s the most valuable asset on the system, because it has so much flexibility.”

As for the LTEP’s invitation for 50 MW worth of storage to be procured in 2014, that’s just a toe in the door compared to the typical size of a pumped storage project. In the LTEP, pumped storage is identified along with hydro power, rather than storage per se. The Ontario Waterpower Association foresees a potential in the province of over 1000 MW of pumped storage. Northland Power has secured the rights to a potential development of the Adams mine in near Kirkland Lake, in the near north of Ontario – arguably a much better use than the earlier controversial proposal to use the site for waste disposal.

On the face of it, at least, it’s hard to see a downside.

“We’re encouraging the provincial government to move along on the pumped storage aspect of the LTEP,” says Wright. “We remain hopeful they will be engaged on that. There’s a year and a half of permitting to go through, once we know we have a contract. Then three to four years of construction. If we started now, it would come online in 2020. We need to work out all the aspects of costs, operations and contracting, through the IESO and OPA. All three political parties support the project and public support has been phenomenal. The Minister is on record as saying he would like to enable it. He just wants to make sure the economics are such that there’s no adverse impact, say on electricity rates. That’s the current focus of discussions. … It’s in the government’s hands as to when we can start work, for example on permitting. It can be done in parallel with the 50 MW in the LTEP. The economics are viable. It’s a matter of getting to the table, putting the scoping on all aspects of the project, so it’s clear there are no questions remaining on the economics, and how it will be used within the system – all the values to the system will be clear for everyone.”