The storage of bulk electricity, having played only a minor part in the wholesale electric grid to date, may be headed into a period of rapid expansion as a range of new and different roles are being seriously considered for it. The impetus for increasing use of storage comes simultaneously from three sources: First, the technologies for storage have been improving, becoming more adaptable and reducing costs while increasing the number of economically attractive applications for storage. Second, public policy mandates are being created to encourage the development of storage for environmental and industrial development reasons. (Witness the Ontario government’s recent directive to procure 50 MW of storage by the end of this year, see "IESO issues RFP for energy storage services".) Third, the increasingly challenging conditions under which grid operation must occur, with load volatility, constraints on new infrastructure, and expectations for ever more precise management of bottlenecked areas, is raising the economic value of site-specific storage.

The wholesale electric grid has been designed and built on assumptions about storage that date back to the early 20th century. With few exceptions, bulk storage of electricity has been considered too expensive to form a major part of the power system. Consequently the electric grid, the dispatch system, and the wholesale market itself, have been designed on the general assumption that electricity cannot be stored and that supply must be precisely matched to load on a second-by-second basis. “Although the no-storage assumption has served the system reasonably well for many years, there are more and more examples where service can be improved and money can be saved by managing flow using various types of situation-specific storage technology,” says APPrO Executive Director Jake Brooks. Financial savings are possible in several areas including avoidance of peak-priced power, reduced need for transmission and distribution infrastructure, improved power quality and various forms of ancillary services that become available with certain kinds of storage technology. The owner and operator of storage is in a position to become an active consumer, sometimes generating incremental revenue for specialized power services, in addition to saving costs.

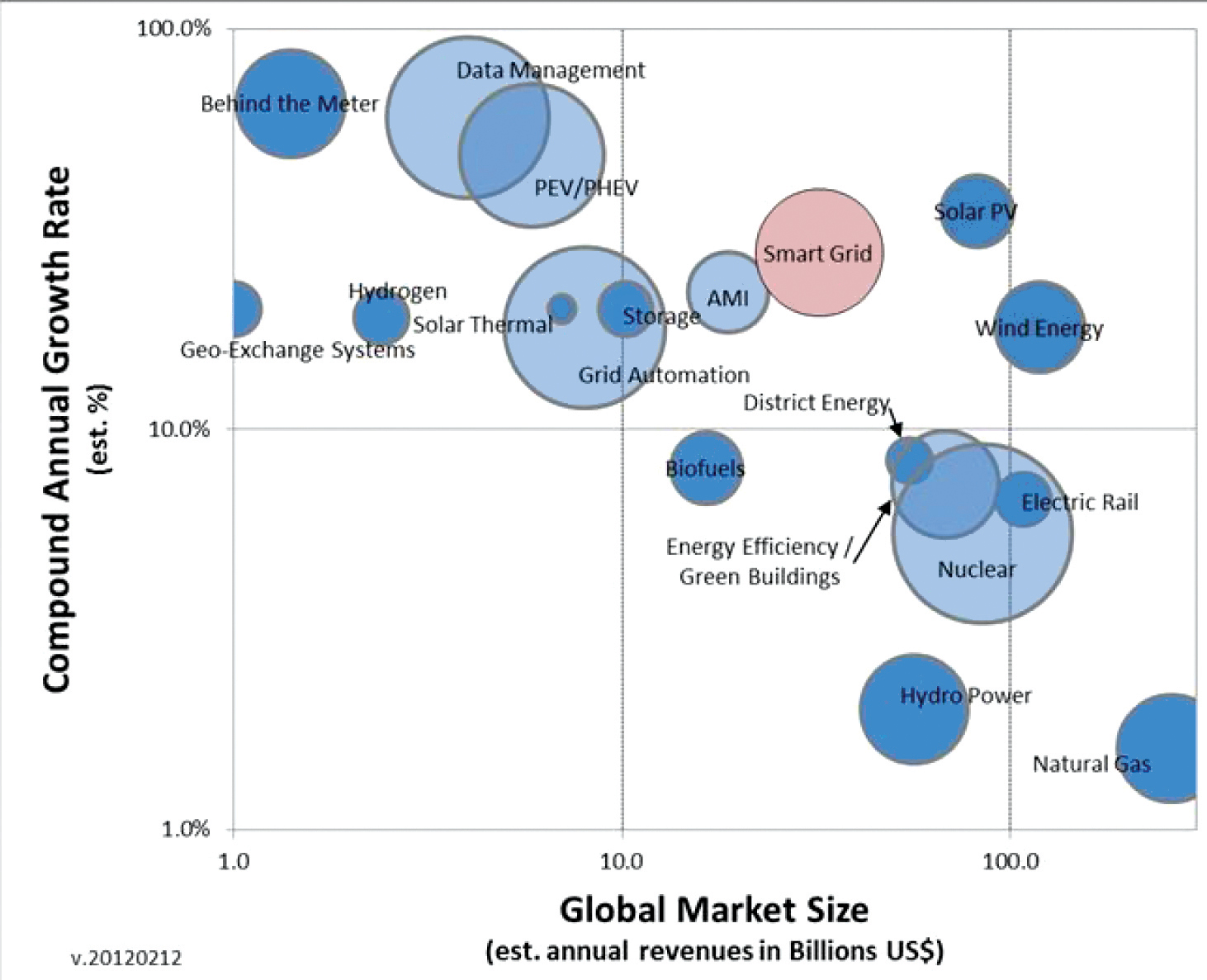

“The net effect, considering the mushrooming of new smart grid technology that can be combined with storage, is a multitude of new business opportunities for storage and storage-connected facilities, an entirely new area for energy entrepreneurs. It’s anyone’s guess where a field like that will go or when it will stop growing,” Brooks says. While the electric power system as a whole is considered a mature industry with relatively modest expectations for growth and change, it is intricately welded together with this dynamic new sub-sector that has untold potential for growth and change. Some established players will likely form alliances with new startups to stay abreast of this kind of innovation. Others will watch from the sidelines, trying to pick the best time to jump in. And of course, a few power companies are showing they want to be leaders and innovators, getting a head start in what may be a reshaping of key parts of the power industry.

In this issue of IPPSO FACTO we examine some of the key questions that will determine how the field will develop. What storage technologies are showing the most promise for various types of grid applications? What real-world business proposals are on the table incorporating storage into the system as we speak? Is it appropriate for the designers of the future electric grid to assume that the scale of wholesale power storage will continue to be minimal? Would the grid be expanded differently if we make different assumptions about the future penetration of storage into the system? How are regulatory attitudes to investment in storage and storage-related infrastructure evolving?

It is a highly interesting and exciting area to be in. We invite input and comment from the readers of IPPSO FACTO on how the sector, regulators and policy makers should be responding to these new challenges.

Further stories in this feature:

IESO issues RFP for energy storage services

How the IESO and OPA framed the 50 MW of services from storage

Kim Warren comments on the storage RFP

Expert advice on the development of a market for storage

Northland’s Marmora pumped storage to provide multiple values

Ancillary services and energy storage technologies

Storage projects in Ontario today

Related stories in recent issues of IPPSO FACTO magazine