Current market conditions for financing Ontario power projects are relatively positive, with a wide range of lenders and investors prepared to compete for opportunities to finance and fund new generation. This kind of competition is translating into attractive rates and more financing options in the electricity sector, reflecting both the nature of power contracts and current conditions in the capital market.

The upbeat outlook for power project financing shows itself in a number of ways – from the volumes of capital that are available, to the variety of structures that are being used to help structure deals, sometimes amongst multiple institutions. A range of assessments reinforcing the level of interest and the corresponding innovation was presented by seven experts from across the financial industry as they spoke to the APPrO 2013 conference on November 19 2013.

For example, John Pak, a Director at National Bank Financial, reports that his company has enjoyed a strong year in the debt capital market, with project finance “an important driver of our platform.” Canadian banks see power projects as high quality assets, he says, and it’s reasonable to expect they will increase their holdings in the area over time. Beth Waters of Bank of Tokyo-Mitsubishi stressed that there is more than enough liquidity in the field, with many kinds of investors competing to fund power projects. “Because of all this liquidity you are seeing margins coming down on the bank side of the market. That is good for you as sponsors.”

Jared Waldron of Northleaf Capital agrees that this kind of underlying strength is reflected in the effective cost of capital: “The returns that are being bid are very competitive because it’s such an attractive market.”

Michael Switt, Managing Director at The Manufacturers Life Insurance Company, likely the top investor in the field of Ontario power projects, identified key issues his company is grappling with, and shared a list of agreements and contracts that should be in place before a project financing can close. Lenders typically have to answer such questions as:

• Can the Project be constructed on time and on budget?

• Can the Project be operated at output and efficiency levels projected?

• Can counterparties meet their obligations?

• Can the Project withstand resource fluctuations/operating and economic shocks?

• Are risks well-mitigated by obligations of counter-parties under contracts, statistical evidence, expert opinion or through transactional structure?

Over the last few years, the FIT program has led to a large number of power purchase agreements (PPAs) in Ontario. Since 2010 the Manulife Toronto team has been active as a lead lender and arranger on over 29 transactions:

|

| Transactions

| Transaction Size1

|

| Wind

| 14

| $1,575 million

|

| Solar

| 11

| $700 million

|

| Hydro

| 4

| $550 million

|

1. A portion of these amounts were syndicated to other institutional investors

After the financial crisis of 2008, many lenders had exited the market and spreads had widened. In 2009 though, the FIT program encouraged lending, and investors from all over the world began participating.

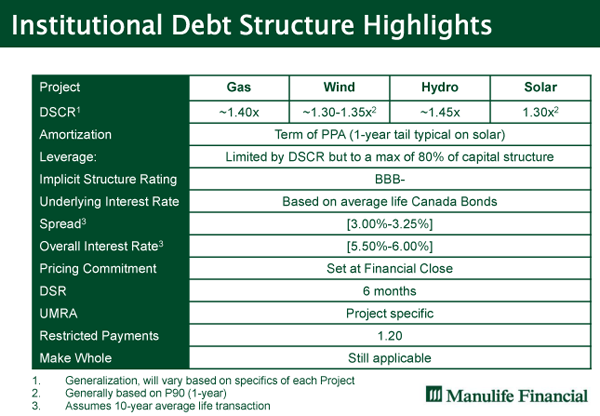

Regarding deal structures, natural gas and hydro terms have stayed about the same and these projects are expected to provide a 1.4-1.45 debt service coverage ratio. Wind and solar project structures have changed over the years and are now expected to provide about a 1.3 debt service coverage ratio. Lenders prefer projects to be structured such that they have an equivalent to triple BBB- rating.

Over the past 3 to 4 years, ten-year Canadian bond rates have been at an all-time low. Spreads charged by project finance lenders were fairly constant at 300 to 325 basis points over their benchmark.

Mr. Switt identified a number of current issues that lenders see today, such as the ability of equipment installers to install and commission on time, and the technology used in installations. Lenders prefer well-established technologies with large installed fleets. He also identified the structure of contracts as an issue. Hydro developers are more often acting as their own contractors with cost plus contracts compared to 5-6 years ago. Lenders are happy to work with cost plus contracts but may require lower leverage or other mitigations.

ManuLife’s expectations of the market going forward remain positive. By 2015-2016, ManuLife expects most FIT contracts to have worked their way through the market. They expect a smaller FIT 3.0 and believe the outcome of the Basel 3 convention will affect Japanese and European banks’ participation in longer tenure deals. A new group of PPAs is expected in Quebec and shorter tenure bank deals will be refinanced going forward. Typically with wind and solar projects, 20 year financing is used. This is driven by the length of PPAs and the life of equipment. Combined Heat and Power financing has typically been 25 years and lenders are happy to go as long as 45 years for hydro depending on the tenure of the PPA.

He noted that lenders are happy to lend to a merchant project but the question is always what should the pricing and leverage be compared to PPA projects. He speculates that as the number of PPAs in North America shrinks, more merchant projects may be financed.

Jonathan Weisz, Partner at Torys LLP, observed that 2013 was a phenomenal year for the industry in terms of portfolio financing, acquisition financing, and re-financings. For example, there was a $1.6 billion financing of GDF Suez Canada’s renewable power portfolio. This financing was the first time the Japanese Bank for International Cooperation has done a deal in Canadian dollars. Mr. Weisz also mentioned the Samsung/Pattern South Kent 270MW wind project, the Goreway combined cycle project refinancing, and 2 biomass projects. Biomass financing has traditionally been very complex and it is noteworthy that two projects were financed in 2013.

Mr. Weisz commented that the experience of how the various players resolved differences over the IESO”s MR381 rule change in 2013 has helped to instill confidence. The OPA and government came up with a compromise, players acted in a mature and commercial manner, and as a result curtailment risk was shared between owners and rate payers in a way that has worked out very well. He expects that if the market curtailment rules are extended to LDC-connected projects, a similar compromise will likely be arrived at.

With respect to the difficulty developers in Ontario can face in obtaining renewable energy approvals, he noted there has been opposition in the approval process but in almost every case developers have been able to secure their approvals, although subject to time delays. He has started to see new arguments coming up from opponents, but these often appear to be desperate measures from people opposed to renewable power in general. He encouraged any lenders and developers not familiar with these new arguments to talk to their lawyers.

There have been some cases where REA approvals required changes to a project’s design, something that lenders dislike when they reopen the approval process. He suggested developers speak with their consultants and independent engineers so that the lenders can be assured there are no significant anticipated impacts. If there are, financing could be affected.

Mr. Weisz expressed his pleasure at seeing a range of First Nations and Community projects coming up for financing and noted the projects are very good from a number of perspectives, including soft benefits to the communities. There is strong political support for First Nation-led projects, making approvals easier at provincial and local levels. He also pointed to the OFINA Aboriginal loan guarantee program that offers loan guarantee support for equity and senior project loans for up to $50 million, noting that these only cover principal and interest. He cautioned that there is some risk regarding change of control with First Nations and community projects. Developers and lenders should be aware of the impacts of one or more owners deciding to sell to a non-community developer.

Regarding swaps, Mr. Weisz recommended that a swap expert be consulted whenever a swap is used. Swap deals are subject to increasing regulatory complexity. He noted as an example of the complexity that eligible swap parties must have at least $10 million of net assets under new US legislation, which typical financing vehicles do not have before project close. Swap rules should be kept in mind and a swap expert should be consulted early. (An interest rate swap occurs, for example, when a party borrows on a floating rate basis, say Prime plus 250 basis points, and exchanges or swaps that floating interest rate for a fixed rate for whatever term the parties are prepared to swap, often the remaining term of the debt.)

Mr. Weisz suggested that green bonds seem to be a possible way of the future. The big issue he sees with green bonds is securing an investment-grade rating. While government green bonds provide recourse back to the government, securing them a AAA or AA rating, project-specific green bonds rely on the credit of the project or portfolio itself. He expects to see more project-level bonds as more projects reach COD and as more portfolios come together to mitigate risk.

A number of topics related to financing considerations were covered in the subsequent interactive discussion led by Mary Hemmingsen, Power and Utilities Sector Lead and Partner at KPMG LLP. Among them, panelists were asked to characterize the potential impact that current market volatility and rising interest rates might have on financing and capital investment.

John Pak explained that while the equity capital markets have been agitated in recent years, the Canadian debt capital markets have been strong. This has been supported by attractive interest rates which, although they have increased from 12-15 months ago, are still very attractive for borrowers. In addition, there is an expanding market for amortizing bonds that have traditionally had a different investor base than bullet bonds because of their reinvestment risk. In general, involvement in infrastructure projects and power finance is seen as a flight to quality because of the strong provincial counterparty and cash flows.

Beth Waters, from the Bank of Tokyo-Mitsubishi UFJ, related that her bank has heard concern in the US and Canada about market liquidity and whether or not there is enough capital available to support all the new deals coming to market. In fact, as mentioned earlier, there is more than enough liquidity and lenders that had exited the market during the financial crisis have now re-entered, which has created competition over projects and reduced margins. Currently there is lots of interest and availability for funding deals under $300 million, with money available on 18-19 year terms. Larger deals require syndication and can typically secure 5-7 year money.

Jared Waldron, Vice President at Northleaf Capital, agreed that capital availability is not an issue in the Canadian market. Discussions have been only around pricing. Historically, as base rates rise, credit spreads fall. This should offset some of the effects of increasing rates. He also notes however, that spreads are already extremely low and may not have much room to move.

Mr. Waldron observed that for IPPs with a hedge in place needing to refinance, their gain should be crystallized to help offset some of the cost of the higher rates.

Juan Caceres, Vice President at Fiera Axium, addressed the question of how to deal with current rate volatility as the closing date for a deal approaches and rates must be set. He explained that this is an issue in transactions where time passes between purchase and sale agreement and financial close. While the best mitigation is always to reach financial close as quickly as possible, he noted that in addition to that, there are typically three ways of dealing with the issue:

• Hedge the risk. Either the vendor or purchaser hedges the risk using a forward swap or a forward bond for example.

• Share the risk. Allocate the risk using interest rate bands, for example. This option is beneficial because a limit can be set where either party can walk away from the deal if rates reach a certain level.

• Do nothing. Set up contingencies in the capital structure and/or have a buffer to pay for any increase in rates.

Ms. Waters added that pre-hedging can be expensive and it is best to do so only if there is certainty that rates will rise since the cost of pre-hedging is money lost when interest rates are not certain to rise. Pre-hedging might make sense in today’s environment because a rise in interest rates is so probable.

Considering that there is so little concern about the availability of capital, Ms. Waters said the primary consideration is often the length of tenure. For example, a $750 million deal earlier in the year required fifteen banks to share risk. There are not fifteen banks that can do 15-year financing and so mini-perm financing was used.

Responding to a question from moderator Mary Hemmingsen about alternative sources of capital, John Pak brought up the bond market as an alternative to the bank market. Mr. Pak related that projects can be financed using the unrated bond market or the rated bond market. In the unrated bond market, capacity can be an issue for financing over $300 – $400 million. In the rated bond market, capacity is strong as shown by the recent $667 million North Battleford deal. However, the rated bond market does not like construction risk and as ratings move below A, bonds can run into capacity and pricing tensions.

Beth Waters commented that internationally there are some 47 banks actively lending. Some are very selective about the kind of project, the sponsor and so on, leaving 23 that can be described as broadly active. The largest can handle entire deals, up to $500 – 700 million.

Moderator Hemmingsen turned to discussion of medium- and long-term interest rates and asked the panel to comment on suggestions and approaches to protecting equity returns.

Jared Waldron explained that theoretically, equity investing is similar to debt investing in that equity investors look for a spread above a certain bond rate. This means that as rates increase, so should equity returns. A demonstration of this occurred earlier in the year, when Fed tapering was discussed, IPPs saw their share prices move lower in anticipation of higher interest rates. Their dividend yields have to adjust accordingly.

Mr. Waldron explained that investors looking for long-term investments, holding equity investments until the end of useful life, will get whatever return they invested at. There will be some mark-to-market during the bond’s life, but if the project continues to perform the investor will get the expected yield to maturity. Shorter-term investors however, will be subject to greater exit value risk as interest rates rise and their returns may suffer.

Moderator Hemmingsen asked panelists to elaborate on how funds are using and deploying innovative structures.

Juan Caceres noted that there has been a lot of activity and innovation in the Canadian rated bond market over the previous twelve to eighteen months. Investors that initially looked only for opportunities in P3 infrastructure bonds now look for renewable project opportunities. Mr. Caceres noted four different projects that demonstrate the flexibility of the market.

• Kokish river project raised $175 million in A (low) bond offering – the first time rated bonds have been used for a hydro project that was not yet completed.

• St. Clair Holding transaction was the first time a solar project was financed with rated bonds. They raised $170 million.

• Comber Wind Farm raised $450 million with BBB flat rating – the first wind project to be re-financed with a rated bond. The project had a year and a half of operating history and set up a curtailment reserve account.

• Trillium Power raised $320 million for two wind farms with little operating history – delivery commenced only at the beginning of the month. A reserve account was set up that can be paid out as a dividend after two years or once production is proven.

Considering the range of likely changes ahead, Ms. Hemmingsen asked what are investors’ appetites for new greenfield development, and what strategic rationales are there for investors to be in Ontario or for IPPs to sell portfolio assets?

For Juan Caceres and Fiera Axium, the answer is simply that they are a Canadian fund manager and their clients want exposure to Canada and Ontario. For international clients, Ontario is seen as a safe place to invest in energy. The Japanese and Dutch investors making large solar investments in Ontario, for example, might not necessarily make those same solar investments in other jurisdictions.

Jared Waldron pointed to Ontario’s safety as an investment market, identifying Ontario’s robust contractual framework, credit quality, and long history of following contracts with enhancements as needed, as some of its strengths. While there are other jurisdictions like Australia with similar robustness, they are in different interest rate environments and Ontario’s returns have been very attractive overall.

One motivation for investors might be to move farther up the risk spectrum and invest pre-NTP (Notice to Proceed) where developers look for 20% plus returns. It seems that immediately after NTP is given, institutions get involved and look for 11% returns. Intelligent investment prior to NTP might yield better risk-adjusted returns. More clarity around the ability to complete development milestones like the REA approval process would be needed for this step.

With respect to recent merger and acquisition activity, Beth Waters identified sales of assets by parties selling partway through asset lives as an opportunity for investors to realize strong returns. For example, one of their clients wanted to de-lever and therefore sold ownership interest in assets. In her experience there are more opportunities of this nature in the U.S. because of the size of the market.

John Pak identified risk allocation as a primary motivator for M&A activity in the sector. Activity is motivated by making sure that the party best able to mitigate a certain risk is the asset owner when that risk is significant. For example, he has seen a number of forward sales where the developer took development and construction risk and forward-sold the project to a buyer who took operational risk. There are significant pools of capital available on both debt and equity side and players have been able to find creative ways of financing execution.

Juan Caceres held up Fiera Axium’s recent acquisition of Recurrent Energy’s solar projects as an example of what is happening in the industry today. The deal was structured as a forward sale so a purchase price was agreed to and not payable until construction is complete. Hedging mechanisms were used to deal with interest rate risk between now and payment.

Speaking to market features debt providers and investors might want to see to sustain investment interest, Jared Waldron pointed to the uncertainty around the future of the FIT program and how competitive procurement will work. Mr. Waldron thinks the existing contractual framework is financeable from both a debt and equity perspective and from a contractual standpoint. It is therefore important not to alter it. Depending on how the new program looks, there could be new investment opportunities. As an extreme example, if the competitive procurement looks like the process for P3s, funds will have a much easier time getting involved earlier in the process, as he noted previously.

Beth Waters said there was value in the kind of certainty that resulted from the way the OPA capped curtailment exposure. It allowed investors and lenders to use a very specific conservative assumption. This method is better than many of those used in other jurisdictions and should be carried forward.

Ms. Hemmingsen concluded by asking the panelists to comment on options for managing the risks related to permitting and the regulatory environment. Mr. Waldron noted that, in order for funds to invest earlier in the process, one of two things have to happen. Either funds need to establish large asset bases so that, in the event of a loss, the strong core portfolio mitigates the loss, or there needs to be more visibility and certainty regarding approvals and permits.

John Pak noted that although lenders generally require developers to have all permits in place before financing, if there is a shortage of projects in the market, lenders may be more willing to work with developers to get them through the process and so be involved earlier. Alternatively, if there are many projects in the market, the money will chase those that are ready to go. Lenders don’t want permitting risk and it may have to be borne by equity.

Beth Waters added that if there is a problem with permitting or approval, the bank will go to their legal counsel to see what the risks of not having that particular item are. Nowadays, bank financing involves multiple institutions, so every bank has to be comfortable with the risk. The larger the deal, the harder this is to do.

By Mitchell French, with editorial contributions from Jake Brooks and Steve Kishewitsch.

See also the following related stories:

Wall Street takes note as markets evolve