A major set of changes is underway affecting how renewable power supplies will be managed on the provincial grid. Much like other jurisdictions, Ontario has to devise ways of coping with increasing volumes of variable generation, recognizing the unique characteristics of each type of supply. But unlike most other jurisdictions, Ontario has to adapt quickly to accommodate relatively large amounts of renewables in short order, starting from a position with surplus baseload generation. The province’s Long Term Energy Plan (LTEP) calls for 10,700 MW of new renewables, not counting hydro, by 2018. That’s out of a total, as of February 13, of 35,850 MW. Of that, nearly 2000 MW is already connected to the distribution and transmission system. The IESO is preparing for 3,200 MW of renewable supply, to be added to the transmission system alone, between this writing and the summer of 2014. Change is a forgone conclusion – the only question is how.

Recognizing all of this, Ontario’s IESO began consulting stakeholders on renewables integration in 2009 with the first set of rule changes (centralized forecasting and visibility requirements) proposed in April 2011 and implemented in November 2011. Dispatch rules are being implemented in 2013, with certain pieces deployed earlier or set to take effect later this year.

In this special feature we will examine key questions including:

• What are the main things the IESO is doing to adapt to the increasing level of renewables?

• How does this differ from what other jurisdictions are doing?

• How is it affecting consumers or the nature of the grid?

• How do generators feel about the changes?

It was probably obvious to all concerned, from the arrival of the first windfarm, that a new style of generation – the “variable generator,” as it’s defined in the market rules – was entering the picture and that Ontario was going to have to do something about it. The concerns it poses are by now familiar – Nature doesn’t provide the resource, hour by hour or season by season, with any concern for society’s momentary energy needs. The wind could be howling and the turbines cranking it out while the province can’t even find a use for everything the nuclear units, and the must-run hydro, are producing, say in the middle of the night. The air conditioners can be sucking power furiously while the turbine blades are motionless. The old standby coal, with its convenient flexibility, is one step away from being history. (These concerns apply as well to solar power, though in a different way. For one thing, its contribution is currently less than wind, and it is more closely matched to demand on hot summer afternoons.)

IESO consultation, forecasting and visibility

While the issue had been under discussion for some years, the IESO began its concentrated effort at variable generation integration with its stakeholder engagement process, SE-91, in November 2010. That meeting analyzed the issue into three fundamental components, forecasting, dispatch and visibility[1]. Some of the procedures and rules that the IESO and stakeholders have been developing are now in effect, and the rest will come by the end of this year.

Forecasting: Formerly the responsibility of the individual variable generator operators, forecasting in Ontario is now done centrally, as in most other jurisdictions with substantial wind and solar integration. Using raw meteorological data provided from the wind and solar facilities themselves, together with data from government meteorological offices, third-party forecaster AWS Truepower now provides the IESO with day-ahead and hour-ahead forecasts, at an accuracy of 92% and 95% respectively (January’s statistics). Testing started up in March of 2012, and implementation began in the fall of last year. Come this fall, the IESO will begin implementation of a solar forecast, as well as a new 5-minute forecast that will provide an outlook in 5-minute increments for the next 2 hours. The 5-minute forecast will be integrated into IESO tools to assist with dispatch (see below), and to calculate congestion management settlement credits (CMSC) for generators that have been dispatched down; that is, required to generate less than the wind resource at the time would have enabled them to.

Visibility: Ontario is looking for a total of 10,700 MW worth of capacity from renewables on the grid, both transmission and distribution-connected. As for the latter, once all the anticipated facilities have been built, there will be the equivalent of approximately 2 nuclear units worth of variable generation on the province’s distribution lines, which the IESO does not and has no plans to dispatch (except for those that have registered as market participants – a small fraction of the total). It does receive current production data, forwarded through Hydro One, of generation units 5 MW and up located on Hydro One’s distribution lines, and once the full procedures are in place, will also receive such data from generation on all the other utilities’ distribution lines. (See also the conversation with Darren Finkbeiner, page 25). The data may be forwarded from the utility, or sent directly, from the generator.

New dispatch procedures and floor prices

Dispatch: With the IESO already having the tools it needs to dispatch conventional resources, the SE-91 discussions focused on how to dispatch wind and solar (always with a view to finding the most efficient order in which to dispatch all resources). (Again, see the conversation with Darren Finkbeiner for a more thorough discussion.) Dispatch for these is guided by the forecast, and covers three conditions, two of them already familiar:

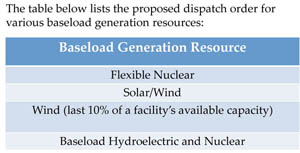

• Surplus generation. Dispatch order will be determined by floor price (see illustration).

• Local congestion

• Ramping events. These are of particular importance in relation to wind, as for example when a heavy windstorm is expected to blow in. Rather than allow a thousand or more additional megawatts onto the grid in the space of a few minutes, straining the ability of other resources to respond downwards in time, the IESO will start ramping windfarms down (or up, as the storm passes) in advance. To a degree this happens now, but will obviously become more important as the resource increases. At time of writing there are 1723 MW of wind on the transmission system, with a very large influx of new wind coming in the next eighteen months. That will amount to another 3200 MW of renewable supply, including the first two transmission-connected solar farms, to be added to the transmission system by the summer of 2014. (The current 18-month forecast counts approximately 6800 MW of wind and solar generation on the grid, providing some 14.9 TWh of energy annually, by August 2014.) Forecasting will be essential to make all this manageable.

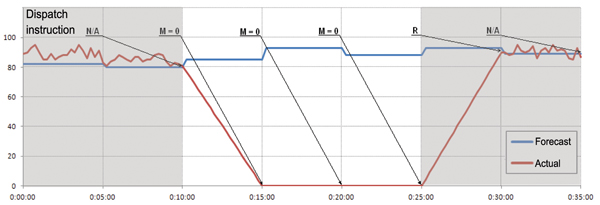

Wind and solar farms will be free to generate whatever Nature provides, until a dispatch instruction is sent. At that time, they will be constrained to operate within a ‘deadband’, defined as follows[2]:

• For facilities >=30 MW, the deadband is the greater of ± 15 MW or ± 2% of the dispatch instruction

• For facilities < 30 MW, the deadband is ± 10 MW from the dispatch instruction.

When the constrained condition is past, a release notification is sent and the facilities can go back to generating what the sun or wind allow (see illustration).

Again, the only units susceptible to dispatch are those on the transmission system, and the few facilities on the distribution system that are registered as market participants. Dispatch order is determined by floor prices, as follows after consultation with stakeholders: at a price of -$5 flexible nuclear (steam condenser discharge valves (SCDV) at the Bruce station can provide up to 2400 MW of flexibility; at -$10 windfarms can turn down generation as far as the last ten percent worth; and at -$15 they can turn off the last 10% (this means actually turning off wind turbines, which imposes additional costs on the operation). [3]

The OPA explains the payment process as follows: when the market rules do implement renewable integration, generators who are IESO market participants will be classified as dispatchable resources. Dispatchable resources are paid the Market Clearing Price (MCP), rather than the HOEP – which as intermittent resources is what they are currently paid by the IESO. The contract amendment for these facilities will settle on MCP rather than HOEP, to reflect this change in market revenue.

The IESO has prepared training sessions, which it will take to operators’ control centres, and is developing a training manual. The OPA will work with the IESO in developing a training strategy for industry related to the settlements process. The IESO has also proposed creating an Implementation Working Group that will focus on the registration, training and technical activities for the implementation of dispatch. It will also offer training sessions to wind facility and operations staff, as well as an opportunity for market trials to ensure a smooth transition to the new process.

After some discussion, the IESO decided that sending dispatch instructions over the internet, with suitable security measures, would be sufficient, rather than using the legacy dedicated wires.

See also the following related story:

Renewables integration – the wider issues: A conversation

Sidebars:

How Germany integrates renewables

Germany, with a similar legacy of centralized generation, is facing some of the same issues, integrating increasing amounts of variable, renewable generation from distributed sources. Visit the following for recent information on how Germany is integrating variable renewables: http://www.renewableenergyworld.com/rea/news/article/2013/03/germanys-grid-expansion

What the generators think

IPPSO FACTO contacted a number of representatives on the generation side, to learn what they think of the results so far. As reported in the last issue of this magazine (“Wind generators appeal IESO rule,” February issue, page 10), a number of renewables generators with contracts under the earlier RES processes (the “RES group”) had instituted an appeal at the OEB over the way the proposed rules would affect their contracts with the OPA. After further negotiations, that appeal has now been withdrawn without going to hearing, to the participants’ general satisfaction, though some were unwilling to speak on the record at this point, perhaps due to ongoing contract discussions. Beyond that, there seem to be few or no serious issues outstanding.

For its part, Ontario Power Generation is satisfied with the outcome of the stakeholdering. “From a high level,” David Peterson, Manager of market monitoring, explained, “OPG’s concern was that because we have a significant portion of the dispatchable resources in the province, we were the ones that absorbed a great deal of the SBG response, as well as during periods of ramping or local surplus. Now, having a larger pool of other participants [i.e., the windfarms on the transmission grid] capable of responding to what’s happening on the system is beneficial.” As long as they’re dispatchable, having the wind on the system is not an issue, he said, and in fact OPG won’t have to do anything different from how it already operates.

There are also participants that do not have OPG’s experience with dispatch. Some have less, and operators of wind and solar facilities have never been dispatched in Ontario, and will need to be introduced to the techniques. At least one has described training as its largest remaining concern, saying they are not sure there is enough time by September 11 to have everything in place. Nonetheless, the IESO will shortly begin training sessions, and as Darren Finkbeiner said in the accompanying piece (see “A conversation,” page 25) “we’re working with all of them to equalize that learning curve, and keep the implementation of the training and the technology as low-cost and low-complexity as possible.”

One other concern that may remain is the need to reconcile provisions in OPA contracts, which generally pay generators on the basis of hourly averages, with actual IESO calculations that will be based on 5-minute intervals starting in September. Wind and solar operators may be looking for further clarification on how the 5-minute settlement process is going to work. Industry preference on this topic seems to be for the settlement system to be developed jointly by the IESO and the OPA, and incorporated into the planned training sessions, and in fact the OPA says it will be working with the IESO to do just that. The OPA says its settlement system meets all the current settlement demands and is a robust system that is able to adopt the new requirements associated with 5-minute pricing.

A number of more technical issues have been raised in stakeholder letters going back to last June, and have either been or are being addressed – accuracy and completeness of meteorological data, including the density of air at different temperatures, or the way floor prices are determined, have apparently been settled – again, some participants were unwilling to go into details, but the withdrawal of the complaint at the OEB would seem to serve as an indicator. A windfarm that cannot adjust blade angle and so has to turn off individual turbines completely, or inverters on solar farms with particular limitations, are apparently being resolved. “We won’t ask any generator to do anything they’re not capable of,” says Finkbeiner.

A report summarizing the presentations and discussions that occurred at the Stakeholder Summit is now available at www.ieso.ca/summit.report.

Renewables integration south of the border

Ontario is well ahead of its neighbours to the south in the amount of wind being integrated – proportionally, and even in absolute terms. As Darren Finkbeiner observes on this page (starting above, third column), NYISO has only about 1600 MW of wind on the system now, and only about 100 of that on the distribution system. In the next 3 ½ years Ontario is going to have three times as much on its system as them, and NYISO’s system is bigger by about 5000 MW. The entire PJM system lists 6,456 MW worth of wind, nominal capacity, end of 2012, out of a total system capacity of 180,660 MW. At the end of last September the Ontario Power Authority had 2,015 MW of wind contracts in operation, with another 3,776 under development, out of a total system capacity of 35,850 MW, as of February 13 this year.

That proportional difference has made the big difference in how Ontario needs to manage its system. To put it briefly, the approach south of the border relies heavily on being able to move wind from areas of local surplus to areas of demand, using the transmission grid, rather than on finding ways to dispatch wind during times of excess production. In an extensive study commissioned by the Department of Energy in 2007 for the eastern interconnection (Eastern Wind Integration and Transmission Study, EWITS, plus a companion study for the western interconnection), the recommendation is that wind will be allowed to run, using transmission enhancements to shift the power as needed out of the immediate area to load centres elsewhere. Basically, the US operators for the present will rely on their larger service areas, plus enhanced transmission as needed, to absorb variable output from wind.

“High penetrations of wind generation—20% to 30% of the electrical energy requirements of the Eastern Interconnection—are technically feasible with significant expansion of the transmission infrastructure. ... Without transmission enhancements, substantial curtailment (shutting down) of wind generation would be required for all the 20% scenarios. ... With large balancing areas and fully developed regional markets, the cost of integration for all scenarios is about $5 (US$ 2009) per megawatt-hour (MWh) of wind, or about $0.005 per kilowatt-hour (kWh) of electricity used by customers. ... This and other recent studies reinforce the concept that large operating areas—in terms of load, generating units, and geography—combined with adequate transmission, are the most effective measures for managing wind generation.” – EWITS, various pages.

Any dispatching beyond that will be done using conventional sources, basically coal and natural gas.

Ray Dotter, Manager of Strategic Communications at PJM, explains that they are only recently starting to see surplus baseload generation in a few locations, and the approach to date has been to define a condition called light load. Where the condition has been identified, developers of new wind power are required to pay for additional reinforcement to their area’s transmission system so as to be able to move their potential excess power to other parts of the grid. (This might mean extra wires, but might also mean additional transformers at an under-resourced switching station, for example.) PJM has had some discussions, he said, around developing dispatch for wind, but sees little need for it yet.

[1] The IESO set up a Visibility Technical Working Group for centralized forecasting and visibility, a Dispatch Technical Working Group to look at the dispatch requirements, and a Floor Price Focus Group. There is also an Implementation Working Group.

[2] These conditions apply to all dispatchable generators, not just wind and solar.

[3] Additional floor prices for wind have been proposed, and will be finalized through further consultation in 2013.