By Stephen Kishewitsch

Energy storage, depending on which figures you look at, is a worldwide market of $10 billion and growing at 20%, or maybe 36%, or in North America at a compound rate approaching 86%. Whichever rate you believe, the reason seems to come down to what storage can do to help a grid facing structural changes – notably an increasing contribution from variable resources like renewables.

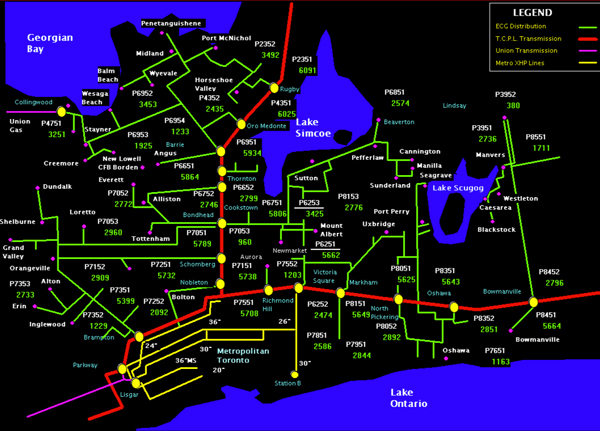

A number of energy storage pilot projects are underway in Ontario. Here are some examples, along with the services they are designed to perform:

• The Hydrostor facility in deep water just off Ward Island opposite downtown Toronto, which can store and deliver four MWh of electricity to downtown Toronto, alleviating periods of high demand in a constrained part of the city's grid.

• The Temporal Power flywheel pilot, in collaboration with the Centre for Urban Energy at Ryerson University, providing voltage support.

• Toronto Hydro, working with (eventually) three lithium polymer battery units in North York by eCamion to provide distributed grid support and integrate variable generation from renewables. ECamion's batteries can deliver 250 kWh of energy at 500 kW.

• Hydrogenics, working with Enbridge Inc. to generate hydrogen from times of surplus power and store it as a mix with natural gas on Enbridge's pipeline system. The Portlands Energy Centre in downtown Toronto is also considering generating hydrogen during off-peak hours and storing it on-site for use during peak demand. Hydrogen has an appreciably higher energy content than natural gas, explains PEC's General Manager Chris Mahoney.

And, as David Teichroeb, in charge of business development, alternative and emerging technology at Enbridge Inc. points out, with all the local opposition to various highly-visible energy facilities in recent news, small, inconspicuous embedded storage looks like a good way to gain community acceptance – particularly if it can piggyback on existing assets like pipelines.

A number of agencies – the Ontario Centres of Excellence, Sustainable Development Technology Canada, the National Sciences and Engineering Research Council, the MaRS Centre, along with the commercial partners, have been assisting the various technologies get off the ground. But the main issue is one familiar to providers of ancillary services everywhere: how to find a way to monetize the various values available in storage and get them into the market, at a price that makes it work.

"We need new contracting methods to test the potential value of these new technologies," said Teichroeb. "The need is technical, but we also need to validate that contracts can provide value to consumers, investors and the system at large. Our present market structure makes it hard for storage to attract investment – we need to monetize the system benefits, rather than just relying on the basic commodity revenues to pay for storage."

Robert Stasko from Science Concepts International, which organized the one-day conference, made the same point: "How our market is configured right now makes it impossible for anyone to do so in a business model that makes any sense. We have to change the market rules. We also have to look at regulations that encourage early adopters to put pilots in place, and not punish them for it."

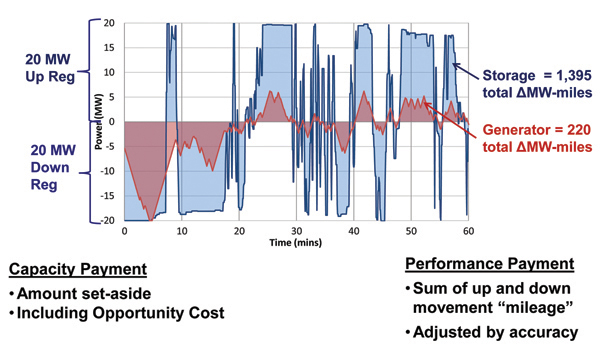

The PJM regional transmitter has taken such a step. It has adapted the ancillary service it found most valuable for storage, frequency regulation, by factoring in response time. Facilities seeking to provide the service bid on two components, energy and response time. As the graph shows, near-instantaneous response technologies like batteries, flywheels and ultracapacitors, in addition to matching a rapidly changing load much more closely, can also provide much more of the energy balancing, up and down, than traditional load-following from generation that needs minutes to ramp up and down. Provisional service providers on PJM's system need to pass a test and are measured on their performance.

Let's get going on this, argues Teichroeb. We don't need more demonstration projects, which he defines as one-off affairs that just test the technology, might run for a while and then disappear. Let's have some solid pilots, he says, that also test the business model, generate income, validate long-term reliability and are able to grow into part of the full system. Unlike a FIT program, pilot contracts attract the initial investments without the promise of future contracts. The future storage investments can be justified on their evolving merit within Ontario’s contracting, market design and long-term planning environment.

As to whose job it is to alleviate barriers to storage, general opinion seems to be that everyone needs to pitch in. In the US, it was an industry association, the Energy Storage Association and its Advocacy Council that made the case before the Federal Energy Regulatory Commission, which responded with Order 755. All the utilities and/or the regional providers are now working on implementation, with PJM apparently at the head of the line.

In Ontario, Teichroeb suggests, Ontario’s experience with Clean Energy Supply (CES) agreements could be tailored to support storage pilots, with participation from the OPA, the IESO, government and industry all taking a hand to create an environment to learn about the value of storage while also balancing consumer and investor interests. Industry collaboration will get the discussion going.

And indeed there are movements underway towards a more pervasive approach. In January 2013 OCE & NSERC will release a request for expressions of interest (RFI) regarding the integration of power and gas, following up on the early Hydrogenics / Enbridge developments. The OCE has in fact identified 24 R&D opportunities in the area. There is also funding that should be very interesting. The OCE will match a private commitment for collaborative R&D (not ruling out pilots) dollar for dollar. NSERC will then match both, and if the project is a joint project between Ontario and Alberta, including funding from Alberta, then NSERC will match all three, for a possible total multiplier of six.

The IESO has issued an RFP for 10 MW for alternative sources of ancillary services.