60% of the kilowatt-hours produced in Ontario in 2012. The largest construction projects in the country. $30 billion of the $87 billion Long Term Energy Plan. Ontario's nuclear industry is both the backbone of the province's current power supply and the expected focus of new investment in power generation over the coming decade. It would actually be an understatement to say that every second school, hospital and factory in Ontario is powered by nuclear energy. For such a crucial part of the energy system, it comes as a surprise to many to learn that the sector is grappling with problematic uncertainties on basic policy questions. These are the kind of questions that make some people uncomfortable: the answers to them can be expected to produce long term commitments and determine fundamental principles underlying the direction and the timing of growth, not just in the nuclear field, but in the economy as a whole.

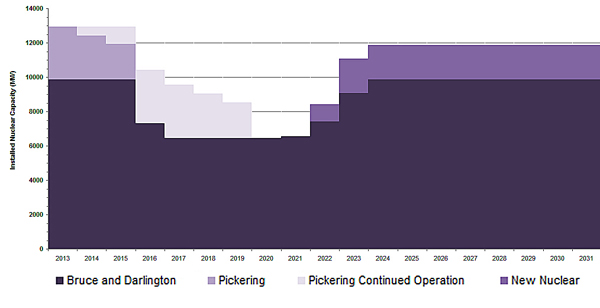

Currently representing 13,000 MW (when Bruce and Pickering 1 are online) Ontario's nuclear fleet is one of the most mature in the world, with some reactors having undergone mid-life refurbishment, and others facing critical decisions of life extension, asset management or potential early retirement and replacement. Much as Ontario serves as the industrial centre of Canada, the nuclear power industry functions as the core of the power system. At the same time, nuclear energy is the primary reason the province can maintain its relatively low level of carbon emissions while supporting a major industrial economy.

Currently representing 13,000 MW (when Bruce and Pickering 1 are online) Ontario's nuclear fleet is one of the most mature in the world, with some reactors having undergone mid-life refurbishment, and others facing critical decisions of life extension, asset management or potential early retirement and replacement. Much as Ontario serves as the industrial centre of Canada, the nuclear power industry functions as the core of the power system. At the same time, nuclear energy is the primary reason the province can maintain its relatively low level of carbon emissions while supporting a major industrial economy.

The World Energy Council compared the situation before and after Fukushima and it concluded that there are almost 50 countries that are operating, building, or simply considering nuclear generation as a viable solution for electricity generation. Half of them are “newcomers.” More than 60 nuclear power plants are now under construction, in China, India, Russia, Korea, France, Finland and the UAE. These numbers speak to large underlying investments that indicate that nuclear power is likely to continue as a formidable player well into the future.

Following are some noteworthy facts drawn from the World Energy Council’s report.

• In March 2011, more new reactors were being built, planned or proposed (482) than the number in operation (442).

• China alone has more new reactors already under construction (27) than Germany and Switzerland together will close down – and China plans or proposes 160 more.

• India and Russia were each building, planning or proposing more new reactors (63 and 55) than the total number that were in use in Japan prior to the tsunami.

• Germany’s neighbors, Poland, the Czech Republic, and Turkey, planned a total of 12 new reactors.

It's hard to overstate the importance of nuclear energy in Ontario's long term energy plans. While the province's Long term Energy Plan (LTEP) is central to just about everything in the sector, for nuclear energy the LTEP is almost existential, setting out in broad terms what is expected to come and what is expected to go. By the same token, the Ontario grid as presently constructed could not meet current demand without the backbone of nuclear, and the LTEP would be very difficult to reconceive without its nuclear component.

Playing such a major role in the province’s energy plans, developers of power plants, nuclear and non-nuclear alike, depend on accurate projections as to the amount of nuclear capacity expected in the coming decade. The problem is, accuracy is hard to come by, given that future capacity is so much a function of policy decisions that are subject to change. One can only guess at how this kind of large-scale uncertainty premium is factored into private capital costs across the province, continually affecting the underlying costs of power in both the public and private sectors.

In the case of nuclear energy in Ontario, the uncertainty over future decisions by government looms particularly large. Even though the government has given its energy planner, the Ontario Power Authority, a supply mix directive that provides for significant new nuclear capacity, and even though there is a major nuclear component in the government's Long Term Energy Plan, it remains unclear as to exactly when and how the province will proceed with further nuclear capacity. In contrast to other power sources, each new nuclear generation unit requires individual approval by the government.

"Although there's little doubt that the province is committed to further nuclear development, the specifics of that commitment are not yet definite enough to motivate the kind of private sector investment that would be needed to fully implement the plan," says APPrO Executive Director Jake Brooks.

Two critical government decisions on nuclear procurement are needed, not just to provide clarity for the nuclear industry, but to help resolve the rest of the province’s energy plans. The first critical decision is when to start actually building new nuclear capacity, and the second is whether and when to formally restart the technology procurement process that got sidetracked a couple of years ago. OPG took an important first step in June of this year when it signed contracts with two potential suppliers for cost estimates for two new reactors. (While it signed agreements with Westinghouse and Candu Energy Inc. to prepare detailed construction plans, schedules and cost estimates for two potential nuclear reactors at Darlington, the final decision on actual construction remains with the provincial government.)

The procurement process has had its share of challenges. Its timing was thrown off schedule when nuclear plant vendors and Infrastructure Ontario concluded a few years ago that they could not agree on a risk allocation and related cost model. Further delay occurred when AECL’s commercial reactor division (the incumbent supplier of the province’s CANDU® reactor technology) was privatized by the federal government in 2011. The privatized company now operates as Candu Energy Inc., a wholly-owned subsidiary of SNC-Lavalin. Quite possibly, with all the private capital involved, risk is being broken down and allocated in much more detail than ever before. Although the critical actors seem to be nearing a resolution on these questions, the delays have added complications. Key decisions in the rest of the power sector, and indeed the rest of the economy, hang in the balance.

OPG plans to refurbish Darlington and build new reactors

The installation of two new reactors at OPG’s Darlington site is expected to be one of the largest capital infrastructure projects in Canada. Combined with the refurbishment of existing units at Darlington, OPG will be overseeing huge volumes of investment and job creation, largely in Central Ontario, in the coming decade. The planning of the refurbishment work is progressing on two tracks: the environmental and safety approvals process; and the station condition assessment and infrastructure development process.

On March 1, 2012, in a joint venture with SNC-Lavalin Nuclear Inc. and Aecon Construction Group Inc., OPG officially signed the Retube and Feeder Replacement (R&FR) contract, a significant step toward the refurbishment of the Darlington Nuclear Station. The R&FR contract covers some of the most critical work in the refurbishment of the four reactors, including the planning and execution of significant refurbishment activities, such as the removal and replacement of the 480 pressure tubes, calandria tubes and feeder pipes for each of the station’s four reactors. This work is required to extend the service life of Darlington Nuclear by 25 to 30 years, OPG explains. The contract also includes the development of specialized tooling, design and construction of a reactor mock-up for training purposes prior to refurbishment.

As discussed earlier, OPG is also moving forward on the proposed construction and operation of new nuclear power reactors at its Darlington site. The project is expected to provide up to 60 years of electricity supply to the provincial grid. As a major capital infrastructure project, it will generate economic benefits for many years including employment, business and supplier opportunities and increased municipal revenue.

In May 2012, the Federal Government approved the Darlington New Nuclear Project Environmental Assessment, which concluded that the project will not result in any significant adverse environmental effects, given mitigation. OPG now awaits a decision by the Joint Review Panel, as a panel of the Canadian Nuclear Safety Commission, on the next key milestone: the issuance of the site preparation license. The site preparation license is the first of three licenses required to build and operate a new nuclear facility in Canada.

As mentioned above, in June OPG announced it had signed agreements with two companies, Westinghouse and SNC-Lavalin/Candu Energy Inc., to prepare detailed construction plans, schedules and cost estimates for two potential nuclear reactors at the Darlington Nuclear site in Clarington.

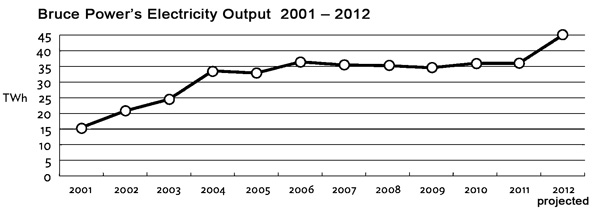

Bruce Power’s massive investment in restarts and asset management

Bruce Power, the operator of the Bruce nuclear station, has achieved remarkable performance and made headlines in a number of categories. Having taken over the management of the province’s largest nuclear site from OPG, in little more than a decade the company reports having significantly improved the station’s performance, reliability and capacity, while achieving exceptional workplace results. Since 2001 Bruce Power has injected more than $7 billion into power generation infrastructure in Ontario, and it is not stopping there. When the current restarts are completed, likely later this year, the Bruce site will be the largest operating nuclear power facility in the world.

Bruce Power proudly disseminates statistics showing how its performance improved markedly as it gained experience with the site: "Through the construction activities on Units 1 and 2, we not only completed a number of innovative, first-of-a-kind work programs, but we also improved as we progressed, building on lessons learned as we moved forward. All activities were carried out on Unit 2 first, followed by Unit 1. In every major area of project work we demonstrated significant improvements:

Bruce Power proudly disseminates statistics showing how its performance improved markedly as it gained experience with the site: "Through the construction activities on Units 1 and 2, we not only completed a number of innovative, first-of-a-kind work programs, but we also improved as we progressed, building on lessons learned as we moved forward. All activities were carried out on Unit 2 first, followed by Unit 1. In every major area of project work we demonstrated significant improvements:

• Steam generator replacement: 57% faster

• Cleaning/preparation of reactor: 53% faster

• Removal of pressure tubes: 8% faster

• Installation of pressure tubes: 42% faster

• Removal of calandria tubes: 77% faster

• Electric system refurbishment: 50% faster.”

Once all eight units are operational, the Bruce Power site will produce 6,300 MW or well over a quarter of Ontario’s electricity. In total, the company says that its various initiatives will have doubled the number of operational units on the Bruce Power site, “transformed the workforce through new hiring and training, extended the life of operating units through innovation, and positioned the site for long-term stability.”

Once all eight units are operational, the Bruce Power site will produce 6,300 MW or well over a quarter of Ontario’s electricity. In total, the company says that its various initiatives will have doubled the number of operational units on the Bruce Power site, “transformed the workforce through new hiring and training, extended the life of operating units through innovation, and positioned the site for long-term stability.”

Bruce Power is a Canadian-owned partnership of TransCanada Corporation, Cameco Corporation, Ontario Municipal Employees Retirement System (OMERS), the Power Workers’ Union and The Society of Energy Professionals. Formed in 2001, it is Canada’s only private sector nuclear generator. Employing approximately 4,000 people, the company points out that over the last ten years it has been the single largest private investor in Ontario’s electricity infrastructure. The site is leased from the Province of Ontario under a long-term arrangement where all of the assets remain publicly owned, while the company makes annual rent payments and funds the cost of waste management and eventual decommissioning of the facilities.

The asset life management strategy for the Bruce units will see the company undertake a multi-year, multi-billion dollar investment program to make the necessary upgrades, refurbishments or replacements of key reactor components in a sequential and planned manner. Shorter planned outages will be used to extend the operating life of the Bruce units. The company notes that "the approach to asset life management through an ongoing investment program will allow the Bruce Power site to bridge the critical generation gap to the end of the decade, while the Darlington units undergo refurbishment."

A report issued in July, 2010, by the Canadian Manufacturers and Exporters, concluded Bruce Power’s eight units will generate over $1.6 billion in total economic activity for Ontario on an annual basis. This includes between 8,000 and 9,000 direct and indirect jobs for the province, primarily based in southwestern Ontario.

Patrick Dillon, Business Manager, Provincial Building & Construction Trades Council of Ontario, notes that, “The renewal and continued operation of Ontario’s nuclear fleet will mean almost 25,000 jobs and annual economic activity of over $5 billion for nearly a decade. This will be one of the most significant single drivers of infrastructure job creation in the province.”

What does the future hold?

Is government ready to take the practical steps to implement the nuclear component of the Long Term Energy Plan? Industry participants watch the sector carefully knowing that as time passes, it becomes harder and harder to ensure that half of future demand will be met by nuclear energy. Particularly if, as is likely, Ontario’s base load demand returns to previous levels, it will be important to be well down the path of new capacity development if nuclear is to relied upon to cover such increases. With a technology based on long lead times, an absence of definite commitments in this area amounts to a decision to use other technologies, likely to be predominantly fueled with natural gas, at least for the medium term.

At the same as it is seeking definite construction commitments, the nuclear power industry is recognizing that it needs to demonstrate to the public that it can implement refurbishments on time and on budget. Refurbs at both Bruce and Point Lepreau are nearing completion, and many lessons have been learned. A recent successful refurbishment of a CANDU unit in Korea showed the results of these advances. Indications are that the industry has grown significantly and has a good chance of coming through the next round of public scrutiny stronger and more capable than ever before.

A committee of the Canadian Senate released a report in July that stressed both the importance of nuclear energy and of helping Canadians to better understand the nature of the energy decisions that their representatives are facing. (See also “Senate committee stresses national energy priorities,” in this issue of IPPSO FACTO.) At least there is firm agreement on the need to deepen the public’s appreciation of nuclear issues. Whether it's the elephant in the room that remains poorly understood, or the province's strategic reserve, little can be resolved without a small number of critical decisions being made by government. As the public gains familiarity with these crucial questions, decision-makers will find themselves in a better position to make the kinds of commitments the province needs to have in place to assure its future energy supply.

See related stories:

Ontario’s nuclear future: What is the state of play for Ontario’s nuclear power industry?

Manufacturers identify spinoff benefits from nuclear refurbishment

Canada’s nuclear supply chain – generating innovation and creating jobs

Nuclear regulator enhances safety systems in wake of Fukushima

“Build for the future, even if you can’t see the future perfectly” - Interview with Denis Carpenter, President of the Canadian Nuclear Association