IPPSO FACTO sought the opinion of a wide range of experts in various fields – legal, finance, environment, customer representatives, distributors and academia, on the import of Bill 75 and the expected merger of the OPA and the IESO. Their responses have been collected here under common headings that emerged, quoted at length where it seemed appropriate to preserve the nuances in their comments. Best effort has been exercised to represent everyone’s comments briefly but fairly.

The general reaction

Although overall reaction to Bill 75 varies, certain themes seem to be echoed across sub-sectors. For example, the difficulty of managing an agency with multiple objectives, uncertainty about how provincial plans will be reviewed, and concern over the potential for expanded political influence – all were mentioned by more than one source. Some experts, though not all, find the bill overall benign, or even as a continuation, roughly speaking, of the status quo.

Northland Power President John Brace takes a pragmatic view: “The merging of OPA and IESO seems like a wise move by the government to ensure that our power system continues to work efficiently and effectively,” he said in a brief statement. “We support any well thought-through attempt to streamline planning and operational processes for the benefit of consumers, generators and transmitters/distributers alike. To ensure a successful transition, we trust that no key functions of the former OPA or IESO, such as procurement and planning, will be eliminated or diluted as a result of the shift. The transition process should also unfold in a way that does not delay a number of important and time sensitive power generation matters currently on the OPA’s plate.”

Naturally, the ultimate effect of the legislation will depend on the details of its implementation, a set of factors that can only be assessed over time. Despite that, a healthy range of insights is on offer, falling under three broad headings.

System efficiency and likely cost savings

The presentation of Bill 75 to the public centred on the cost savings the amalgamation is expected to achieve. The Drummond report made a recommendation on the subject, number 12-16, saying only “Review the roles of various electricity sector agencies to identify areas for economies in administration. This could include investigating the potential to co-ordinate back-office functions."

Reaction to the expected savings varied widely among the experts who provided their opinions.

Among those who accept the likelihood of the savings foreseen by the bill’s proponents is Paul Manning, at Manning Environmental Law. The Drummond recommendation is a prudent step, he said. However, he foresees difficulty reconciling some of the planning and procurement functions of the OPA with the IESO’s responsibilities to administer and enforce the market rules: “Formerly, the OPA had the responsibility to make an integrated energy system plan (the IPSP) for Ontario’s energy supply and procurement. The IESO’s regulation of market participants includes potential parties to OPA procurement. Bill 75 recognizes this and tries to cure the potential for conflict in several ways:

• The Minister takes back responsibility for procurement decisions

• The board of directors of the OESO is required to ensure that there is an effective separation of functions and activities of the OESO relating to its market operations and its procurement and contract management activities

• The OESO is prohibited from conducting itself in a manner that could unduly advantage or disadvantage any market participant or any party to a procurement contract or interfere with, reduce or impede a market participant’s non-discriminatory access to transmission systems or distribution systems

• The board of directors is required to ensure that confidentiality is maintained.

“However, the OESO will still have the power and responsibility to implement the Minister’s procurement decisions. It is not immediately clear how the board of directors of OESO will keep these conflicting functions separate without, in effect, keeping the two former organizations separate under one roof.”

The government says it expects some $25 million in cost savings. Again, opinion varies on the achievability of that figure. Some observe that $25 million is a relative drop in the bucket (Glenn Zacher), and query whether it will even deliver that, with minimal savings to consumers. Savings from a combined board of directors, and some streamlining in senior management, are quite possible, and perhaps in some other areas like the legal or regulatory offices. But Zacher thinks both organizations already have relatively lean departments in those areas, and they're focused on different matters. As a result, no substantial savings are likely from combining them. The operational people also work on different things. Some people want the IESO to do even more, he says, but they are hard-pressed with existing staff to deliver on their core services, let alone add to their responsibilities. There might conceivably be some benefit from coordination in areas like the SE91 initiative dealing with curtailment and other renewables integration issues, he allows, so that renewable generators only need to deal with one organization.

Charles Keizer at Torys adds that the merger could assist some generators who are facing issues with their contracts; for example, where the market operator puts forward potential market rule changes that are not reflected in their contracts. "Now, instead of getting bounced back and forth between the OPA and the IESO, they will be able to go to one place."

Cliff Hamal at Navigant Economics finds a tension between efficiency in terms of agency structure, and the efficiencies that come from market competition:

"Combining the IESO and OPA will allow for closer integration of planning, contracting and operations could potentially provide for a more efficient system. But that same theory would imply that an integrated utility would be better still, and the industry moved toward competition in the first place in a search for a better outcome. A fully integrated operation misses the benefits of competition, and the relentless challenge to be better that comes with it. Where competition is not workable, there needs to be effective oversight. Under Bill 75, the OESO will provide services that are not subject to competition. Therefore, the OESO could be part of an efficient market structure, but the details will be important. We need to be sure that the OESO will be sufficiently transparent and subject to effective oversight. The parts of the market where competition does occur need to have confidence in the system: its fairness, openness and consistency.

"Competition is a relentless task-master, and when consumers focus on price and quality, suppliers focus on those attributes or fail. If the OESO becomes less predictable in its actions and less clear about its objectives, costs and prices could rise. The shift could occur for many reasons, as the Bill calls for competing priorities involving diversification, environmental benefits, short/medium/long term planning horizons and support for alternative supply options. There is a call for customer rate stability, but no specific objective of lowering costs. And it appears that decision making will be more susceptible to political considerations, which adds even more uncertainty.

"While a consensus once seemed to be building toward what would be considered an ideal competitive market structure for the industry, that is no longer true. In building the perfect electricity market there are tradeoffs between short-run and long-run efficiencies, and between the costs inherent in creating competition and the benefits that competition can provide. Ontario chose to move in its own direction years ago, and Bill 75 is a dramatic step further in a unique direction. There is the promise of increased efficiencies in generation procurement, joint optimization of transmission, generation and operational options, and long-term portfolio risk management. As has already been recognized, competitive solicitations and long-term contracts can result in lower cost supplies. Further refinements in solicitation with improved coordination of reliability and adequacy needs could lower costs further.

"This is uncharted territory. Of course there will be problems, and transparency and fairness will inevitably be challenged. But at the end of the day success will largely be driven by how well this new regime maintains reliability and minimizes costs, while trying to meet the many other objectives involving supply mix, renewables, conservation, etc. Those other objectives can get expensive and political influences can be significant. In the end I suspect that the overall success of this approach will not rest on market design or OESO operations, but whether those political objectives are considered worthwhile when the time comes to pay for them."

Risks of combining two formerly separate operations under one roof, while avoiding conflict between roles

Some elements of the OPA and the IESO's functions are better suited to integration than others, Paul Manning, for one, believes. “For example, the IESO’s short term forecasting and coordination functions should integrate well with the OPA’s longer term forecasting and planning functions,” he said. But concerns persist as noted below, under Planning.

Marion Fraser, who has worked within government on conservation issues, and as an independent consultant, thinks the primary effects might be beneficial: "The IESO has demonstrated an ability to manage the large moving parts of the industry without micro-managing the sub-parts. Not so for the OPA. This is evidenced in the overkill of the contracts with the LDCs on conservation. Ontario will be better served if the more strategic approach of the IESO is maintained in the new OESO." Referring specifically to dispatch protocols, she adds, “Hopefully the merger will create a more proactive approach to monitoring, predicting and managing the contribution of intermittent renewable energy such as those practices in Spain or California. To these ends, greater synergies between the smart grid and distributed energy of all types are critical, including the development and use of storage options.”

While accepting that efficiencies may flow from the consolidation, and structural impediments to energy supply contracts may be removed, Chris Ball at Corpfinance International says CFI does have a high-level concern that it will be very difficult to accommodate the merging of the two functions “... in an unblemished fashion. The IESO’s mandate is that it operates, and is seen as operating, the electricity system in a reliable manner and that the electricity markets evolve to promote economic efficiency. The participants in the IESO markets include generation and load, which obviously are impacted in significantly different manners to any particular rule change, which the IESO may entertain in pursuit of these goals. These participants must believe that the IESO is a fair arbiter of their perspectives. The ability of the reformed consolidated entity to be seen as operating fairly is tarnished if future market rule changes will have a direct impact to the entity itself in its capacity of purchaser of energy supply under various existing and future contracts.” If a given market rule change were to benefit the central purchaser, how would the market be able to assess whether such a decision was arrived at impartially?

Separation between the market function and the contract function within a single organization is not unusual, says Charles Keizer. “There are system operators in other provinces that, although they carry out system planning functions, also have separate operators by way of protocols. This kind of ring-fencing structure has been considered by FERC with respect to transmission organizations that also have a generation arm. It’s been applied in Quebec: Hydro-Quebec Trans-Energie is the transmission portion of Hydro-Quebec.”

Sean Conway, a cabinet minister in the earlier Liberal government under David Peterson and now a senior advisor at Gowlings, suggested a potential concern arising out of one of the IESO’s other roles, market discipline: “The new consolidated body will go on doing what the IESO does: it manages the market, but it also has to be able to discipline market participants. One of its critical functions is to make sure the marketplace works – matching supply and demand, making sure people are playing by the rules, not gaming the system. That's a core part of its function, and it's done a very good job. Now, under the same roof the OESO will have the job of contracting with these players for longer-term supply – in other words, on the one hand policing people and on the other making nice with them while working out long-term contracts. I assume people will behave themselves, but there is still potential conflict of interest, and you want a system in which people have confidence in its fairness and efficacy. In 2007 the Arnett committee gave the government good advice in pointing out the potential conflict, and in recommending the responsibility for policing the market be given over entirely to the Market Surveillance Panel, which exists under the OEB. That would be my preference. The government in effect has said in the legislation that it's relying on a board of directors of the highest quality to protect against the conflict. That's laudable but I think there was a better way.”

But Charles Keizer observes, “The IESO does have a compliance function under the market rules, but there is a higher function under the Market Surveillance Panel, part of the OEB, which uses the IESO staff to carry out its functions. Hence, the market surveillance function remains intact under the OEB. I don’t think it will be altered under this legislation.”

The effect on planning, how it’s done, and by whom

A number of respondents flagged this as the most significant feature of the Bill, with several expressing concern that it means the Ministry taking a great deal of the planning function back into itself, leading to a potential reduction in transparency and accountability.

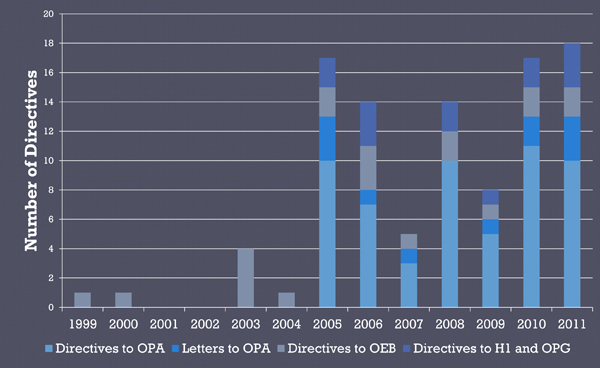

Citing section 25.30 (1) of the Bill: “The Minister may, in consultation with the OESO or any other person, develop and, with the approval of the Lieutenant Governor in Council, issue energy plans." Professor Guy Holburn at the University of Western Ontario said, “It's a step backwards to the old command and control regime, where Ministers dictate the outlines and details of energy policy. The intent in creating the OPA was to create an agency of experts that could do planning based on facts, not politics. The government understood that there's a benefit from having experts giving independent advice on energy planning. This is now reversing that original intent of delegating planning to independent professionals. It enables the minister to micro-manage the planning process. ... It creates an element of risk. On average we've had a dozen directives in the energy sector every year since 2005, a marked contrast to the period beforehand. ... We did a survey of over 100 energy companies in 2008, and the single biggest problem they saw was the lack of policy stability.”

Citing section 25.30 (1) of the Bill: “The Minister may, in consultation with the OESO or any other person, develop and, with the approval of the Lieutenant Governor in Council, issue energy plans." Professor Guy Holburn at the University of Western Ontario said, “It's a step backwards to the old command and control regime, where Ministers dictate the outlines and details of energy policy. The intent in creating the OPA was to create an agency of experts that could do planning based on facts, not politics. The government understood that there's a benefit from having experts giving independent advice on energy planning. This is now reversing that original intent of delegating planning to independent professionals. It enables the minister to micro-manage the planning process. ... It creates an element of risk. On average we've had a dozen directives in the energy sector every year since 2005, a marked contrast to the period beforehand. ... We did a survey of over 100 energy companies in 2008, and the single biggest problem they saw was the lack of policy stability.”

Paul Manning offered a further, distinctive perspective that involves the Ontario Energy Board as well. In his experience – Manning spends much of his time acting as counsel for participants in Board hearings – there is already a degree of blurring between some of the functions of the (presently) three agencies in practice, and under the Bill it’s likely to get more so. More important, in Manning’s view, than the merger of the two organizations is the abrogation by Bill 75 of

• The OPA’s power and duty to develop an IPSP for approval by the Ontario Energy Board (OEB); and

• The OEB's power and duty to review that plan for economic prudence, cost effectiveness and regulatory compliance.

“In so doing," he says, "the Government’s energy plan is removed from public scrutiny in a proceeding before the Board in which stakeholders can participate. Bill 75 replaces the IPSP with Ministerial “energy plans”. The Minister must consult with the OEB on the impact of the energy plan on a consumer’s electricity bill and on methods of managing that impact. The Minister must also refer the plan to the OEB for review of the estimated capital costs in the plan in accordance with the referral. This is a far cry from the independent review that was required by the Board of the IPSP. It deprives stakeholders the ability to test the government’s energy and procurement plans and the consequent effect of those plans on rates. It continues a trend, that was already apparent before Bill 75, for government to exert control of the activities of the OPA and the OEB by a combination of policy imperatives and directives.

That view is not universal. Glenn Zacher, as noted above, says “On paper it gives authority to government to establish plans, and the OEB has a new responsibility in giving effect to those plans – so the government has to have some things reviewed while other things are in their discretion — it's changed at a formal level, but I'm not sure how much that changes in reality. The OPA has been the planner, but much of what was to go into the IPSP and be approved by the OEB was already largely determined by government directives. ... I don't think Bill 75 will make the sector more politicized [than it is already].”

Other considerations:

On the availability of information

Marion Fraser: "The IESO has taken a transparent and open approach to information whereas the OPA seems to have equated transparency with huge information dumps from great heights. One need only look at the California Energy Commission’s 2011 Integrated Energy Policy Report issued in early 2012 to see the kind of report that would be helpful to the sector, policy staff and decision makers.”

Cliff Hamal: "Under the new structure, administrative controls will be relied upon to protect the flow of confidential information between different parts of the OESO. Functional separation comes up in many situations where there is regulation and is always inferior to the alternative of separate organizational structures. Even when working perfectly, there is always the suspicion by outsiders that information flows where it shouldn’t. I expect the separation will be particularly difficult here, because the free flow of information will generally work to the advantage of the entire organization."

Julie Girvan agrees that, "From a consumer perspective, what is ... important is transparency when it comes to things like the FIT program and Conservation."

On the dispatch function and rule-making

Charles Keizer: “We're already seeing rule-making to accommodate the integration of wind. How the government goes forward in directing energy policy; whether it's true energy policy or industrial policy or social policy – which is what to some extent the Green Energy Act has been – can trigger how dispatch will be treated. We're also going to see issues with respect to dispatch because of surplus baseload generation and how that's going to be treated with respect to energy policy – will that cause dispatch rules to be treated differently, especially over the next couple of years? We're going to see how that evolves.

On price formation:

Charles Keizer:

“I don't know what the price really means any more anyway. The market spits out a price as a result of its dispatch, but I think effectively the true price is some combination of the Hourly Ontario Energy Price and the Global Adjustment. You're certainly not going to have any greater predictability with respect to price.

On energy efficiency, conservation and demand management

Marion Fraser: “The merger should be good news on an evolving opportunity to take a longer term approach to performance based conservation, with respect to making greater use of smart meter data and integrating conservation with customer access to their own data for benchmarking, monitoring and tracking purposes as well as load forecasting purposes. Making management of that data easier for customers through bar coding of electricity bills could be giant leap forward in bill data management.

For his part, acknowledging that his organization is focused on energy efficiency programs, IndEco CEO David Heeney observes that “Although the intent of the merger was ‘to better meet today’s electricity supply needs,’ it represented an opportunity to rethink how best to promote energy efficiency, and to deliver energy efficiency programs. Unfortunately, the draft bill doesn’t do that, and pretty much just enables the current regime to continue under the new organization. The opportunity to find ways to clarify the roles of the various parties involved in conservation and demand management, and to encourage greater innovation and efficiencies has not been taken. So from a conservation perspective, it’s just rearranging the deck chairs. Hopefully, the necessary changes to meet the conservation goals in the Long Term Energy Plan and to bring about the ‘Culture of Conservation’ will be coming through other means.”

A summation

Without commenting specifically on the draft language within Bill 75 and any specific cost savings that may result from the amalgamation of the IESO and OPA, Jason Chee-Aloy, Managing Director of Power Advisory LLC, offered some general commentary by way of wrapping up. He is one of few people to have worked for the IESO (market surveillance and market design) and the OPA (generation procurement and contracting) so his perspective proves to be very insightful.

“Before contemplating what the forthcoming merger between the IESO and OPA may mean," he said, "it is important to note some history. Because of a shortfall in generation supply, Ontario needed to act fast and that’s the main reason why the OPA and long-term procurement contracts were created. As a result, we’ve solved the generation shortfall problem and Ontario has been a very attractive market for investment. Now given today’s present generation oversupply coupled by the decrease in electricity demand, along with the fiscal challenges facing Ontario, it’s a logical time for things to be reviewed.”

The following table, provided by Chee-Aloy, helps to put into context who’s doing what in the electricity sector by looking at the core functions across the agencies and LDCs that are needed and have been established to ensure the reliability of Ontario’s power system and mechanisms to ensure future resource investments.

| Core Functions and Responsible Entities | ||||||

| Core Functions | IESO | OPA | Transmitters | LDCs | OEFC | Infrastructure Ontario |

| Power System Planning | √ (short-term) | √ (long-term) | √ | √ |

|

|

| Power System Operations | √ |

| √ (own lines) | √ (applicable service territory) |

|

|

| Resource Procurement (i.e., CDM and generation) | √ (ancillary services) | √ |

| √ (CDM) |

| √ (previously involved with new nuclear procurement) |

| Contract Management | √ (ancillary services) | √ |

| √ (CDM) | √ |

|

| Settlements | √ | √ |

| √ | √ |

|

“It is clear from the table that overlapping roles and responsibilities exist mostly between the IESO, OPA and LDCs," he notes. "However, overlapping roles and responsibilities with LDCs are mostly understandable, as LDCs have oversight over their distribution service territories. The strong overlaps lie between the IESO and OPA. These core functions are essential and will therefore continue once the IESO and OPA are merged. The merger provides for opportunities to improve delivery of these core functions by creating greater efficiencies and eliminating any existing seams between the IESO and OPA.”

As conveyed by other commentators, Mr. Chee-Aloy also said that transparent and effective oversight will be essential regarding the scheduling/dispatching of generation units and demand-response/dispatchable load resources, and procurement/contract management of these same generation units and demand-response resources.

“To best ensure market confidence with all market participants and stakeholders, it will be important for the merged IESO/OPA to provide sound organization structure and appropriate principles and clear guidelines conveying the integrity of market operations and process to amend Market Rules in conjunction with the design of procurements resulting from Ministerial Directives and any contract amendment decisions. These points are very manageable where appropriate structure, protocols and mechanisms can be put into place, especially when comparing Ontario’s electricity market to other restructured electricity markets. For example, PJM procures generation capacity and demand-response for multiple years through a forward capacity market, all market participants are scheduled and dispatched through the day-ahead and real-time markets, and appropriate oversight is ensured through an independent market surveillance function that must report to the FERC.”

The contributors:

Chris Ball is Executive Vice-President, Corpfinance International Limited. (CFI)

John Brace is President and Chief Executive Officer at Northland Power

Sean Conway is a public policy advisor at Gowlings. Earlier he served in the Legislative Assembly of Ontario for 28 years, including five years as a cabinet minister in the government of David Peterson

Marion Fraser is President at the independent consulting firm Fraser & Company, and a former senior policy advisor for the government of Ontario

Julie Girvan is an independent consultant and consumer advocate, working with the Consumers Council of Canada on natural gas and electricity.

Cliff Hamal is Managing Director at Navigant Economics

David Heeney is CEO & Founder of IndEco Strategic Consulting Inc.

Guy Holburn is a faculty member in the Ivey Business School, University of Western Ontario

Charles Keizer is co-head of Infrastructure and Energy Practice at Torys LLP

Paul Manning is Principal at Manning Environmental Law

Glenn Zacher is a partner in the litigation and energy section at Stikeman Elliott

Phone interviews conducted and comments assembled by Stephen Kishewitsch