By Christopher Collenette, Thomas J. Timmins and Andrew Zed

Along with other initiatives that were announced during the week of August 1st, the Province of Ontario is attempting to add greater clarity to the property tax treatment of solar energy generation facilities by introducing regulatory amendments to the Ontario Regulation 282/98 under the Assessment Act. The stated objective of the proposed amendments are to clarify the property tax treatment of renewable energy installations for property owners, municipalities and the Municipal Property Assessment Corporation in addition to ensuring that property tax does not act as a disincentive to renewable energy generation, particularly in situations where small-scale generation facilities are owned by persons who are not normally in the business of generation.

For a number of years, the property tax treatment of solar farms has been a matter of some uncertainty. Unlike wind energy, where $40,000 of value is attributed for each installed mega-watt of capacity, solar energy developments previously lacked clear assessment rules.

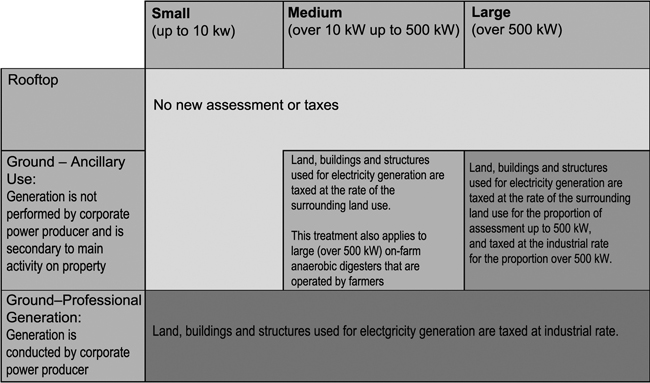

The amendments affect or clarify several categories of renewable energy facilities, including:

• First, rooftop installations will not result in a reassessment – this is very good news for the property owner.

• Second, with regard to ground installations, the value for assessment purposes will depend on the size of the facility and the entity involved in the electricity generation.

• Third, for individual persons who generate, transmit or distribute energy as an ancillary activity to their main activity on their property, there are now three classifications outlined by the regulations: (a) small-sized ground installations, up to 10kW, will not see an increase in assessment or a change in tax measures; (b) medium-size ground installations, over 10 kW and up to 500 kW, will be taxed based on the surrounding land use, whether that be residential, commercial or farm, etc; (c) large-size ground installations with a generation capacity over 500 kW will also be taxed based on the surrounding land use for the first 500 kW produced and thereafter at the industrial rate for production.

• Fourth, consistent with current treatment, ground mounted generation facilities that are operated by entities whose primary business is the generation, transmission or distribution of electricity, will be taxed at the industrial rate.

The Government has also circulated the above table to illustrate the changes under Regulation 282/98.

— Energy@Gowlings