Canada’s power generation industry has evolved in the last two decades from being dominated by a small number of crown-owned utilities, to a much more diversified structure that has attracted a wide range of competitive players, many of whom have become world leaders in producing efficient, environmentally friendly power. Reflecting the competitive outlook of the new entrants, Access Capital has been an emblematic part of this long term transition since it began, helping many of the players to find financing, and in some cases being a power project developer itself.

Based in Toronto, Access Capital’s power generation activities began in California in the mid-1980’s through its sister company, American Consumer Industries Inc. The business opportunities opened up when US PURPA legislation mandated avoided cost rates for power produced by “Qualifying Facilities” and California introduced “Standard Offer” rates. It was at that time that the father-and-son team of Willis and Rob McLeese, along with several partners, took the audacious step of putting together plans for building a power plant on an Indian Reserve in California, burning waste wood, and selling its output to the incumbent and quite dominant utility in the region, Southern California Edison. Despite many obstacles, the McLeese team prevailed, and the plant continues to produce power and has even won a Clean Air award from the American Lung Association. In fact, that project set off a chain of activity that led to the development and operation of a portfolio of projects in the US and Canada, as well as the establishment of a financing business that has helped bring countless more power generation projects from concept to operation.

The story of Access Capital is not just that of a relatively small Canadian company breaking into a business that had previously been the preserve of large players. It has also been a story of what happens when an innovator tries new approaches to technology in the power business. Imagine building a company that is focused on taking waste materials and turning them into a high value mass market product in a field dominated by players many times its size. In the case of Access Capital, the company has not only succeeded with its business ventures, but won awards for environmental excellence in the process, and expanded to finance many more projects in the aftermath. “You can do great things with difficult fuels,” says Rob McLeese, President of Access Capital.

Access Capital was founded on April 1, 1990, soon after the group had cut its teeth developing the 47 MW Colmac Energy waste wood power plant in California. Located on the Cabazon Indian Reservation near Mecca, California, the plant went into operation in 1992 after more than eight years of development that included a series of major challenges. The plant is fueled by a combination of agricultural residues, wood-waste, petroleum coke and natural gas. The natural gas and pet coke are only used for startup and occasional stabilization when needed. Despite the challenging fuel mix, the project has consistently met high standards for air emissions.

Colmac Energy faced more than the usual set of challenges during development. There was a major earthquake and the temporary loss of the lead underwriter during financial close in the fall of 1989. Even more disconcerting, after making extensive public offers of standardized power purchase agreements in the early and mid 1980s, SoCal Edison (Southern California Edison, the incumbent utility) tried to cancel many of the independent power contracts, including Colmac’s, in 1987. The McLeese group had to initiate a lawsuit to get the contract upheld.

Despite these challenges, the experience of developing the Colmac project in the late 1980’s convinced Rob that the power sector was where he wanted to focus the next phase of his career. Starting with a background as a Chartered Accountant, and having held positions with the Bank of Montreal in Corporate and Project Finance and with Midland Doherty, he transitioned from employee to business owner, as Access Capital became a significant player in the Canadian power generation sector. Since then, the team has developed many more projects and hasn’t looked back.

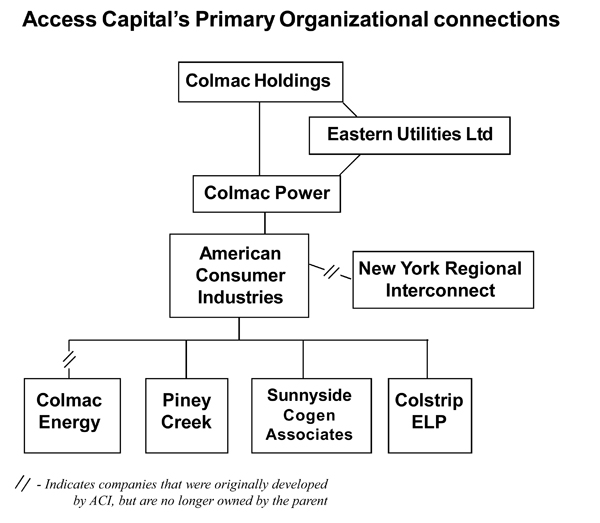

Access Capital is part of a group of companies owned primarily by the McLeese family. Central to the group is American Consumer Industries Inc. (“ACI”), the primary corporate owner or former owner of four US-based power projects:

• Colmac Energy, a 47 MW biomass plant near Mecca California (sold January 2011)

• Piney Creek, a 33 MW waste coal power plant in Clarion County, Pennsylvania

• Sunnyside Cogen, a 53 MW waste coal power plant near Sunnyside California (50% owned with Constellation Energy as the other partner) and

• Colstrip Energy Limited Partnership “CELP”, a 38 MW waste coal power plant in Montana. (ACI is limited partner there.)

The Piney Creek facility in Pennsylvania is noteworthy because it makes use of waste coal. Waste coal is a lower value fuel that can be an environmental problem in its normal state. When properly collected and handled however, the company has demonstrated that it can be successfully used as a fuel for power generation. The waste ash byproduct of the power plant combustion process, which is quite alkaline, can be effectively used to remediate the land where the former waste coal piles had accumulated. (These former piles of waste coal had left an environmental challenge because of the acid leachate released when rain ran through them.) Located near several old mines, the project has been designed to use the waste material from the roof and floor of former coal seams. There is a lower BTU value derived from such fuel, but it is economic for power generation when properly handled. Similar principles are utilized in the other two waste coal facilities in which ACI is involved.

Acting primarily as a development and financing advisor, over the years Access Capital has worked with many of the most familiar names in Ontario's power generation business. Although the company doesn’t take ownership positions in its clients, it has become known for helping generators to secure financing, EPC (engineering, procurement construction) contracts, etc. Some of the groups it has worked with include:

• Cobalt Power (hydro)

• Potter Station (waste heat recovery and gas fired)

• West Windsor (gas fired cogen)

• Long Sault (hydro)

• A 500 MW combined cycle project in the UK

• The acquisition of a 25% interest in Kingston Cogen by Northland Power

They also have two hydro development investments in BC.

All of the environmental innovation by the group has not gone unnoticed. Several awards have been made to the team, for environmental achievement in particular. In 2001, ACI won the Governor’s Award for Environmental Excellence in Pennsylvania, recognizing that their Piney Creek project had converted a depository for waste coal into something of great value (i.e., fully remediated the site) and significantly improved the environmental impact of coal operations in the area.

The American Lung Association Award was given to the company in 1992 for its work with Colmac Energy. The facility now diverts wood waste from a range of sources in Riverside, San Bernadino and Imperial Counties in California near Palm Springs.

In addition, it received an Earth Day Award in Utah in 2004 for its remediation efforts in that state.

In recent years the family has taken on a new project: the development of a golf resort and residential properties near Owen Sound. Known as Cobble Beach, the golf course has won awards itself from various golf associations and media and has begun to attract a number of families to the adjoining community where relaxed living, convenient access to world class golf facilities, and high end residential options in a country setting represent a highly attractive lifestyle option for many. Not surprisingly, McLeese has ensured that the development is energy-wise and environmentally friendly: The main buildings at the Cobble Beach resort employ Geothermal Heating and Cooling and the golf course is designed to require fewer resources overall than the typical facility would, without diminishing the customers’ ability to enjoy the services.

In one of the company’s most innovative ventures, it had worked to develop a transmission line in New York state, where transmission constraints have often created congestion issues for generators and customers. The New York Regional Interconnect (NYRI) was one of the most challenging undertakings yet for the ACI/Access group. Unfortunately, ACI and its partner had to terminate the development of NYRI in June 2010 due to “insurmountable political roadblocks.”

Over the years, Rob has been an active participant in a range of public-spirited and non-profit initiatives. He has served on the APPrO Board of Directors for more than 15 years, and been a volunteer Director or Chair of the Ontario Center of Excellence for Energy, the Toronto Atmospheric Fund, and Upper Canada College's Energy & Environment Advisory Group, to name just a few. During his tenure on the APPrO Board he took part in a wide range of public policy projects, contributing to initiatives as diverse as APPrO’s position on the Ontario electricity market design and its recommendations on Ontario’s Green Energy Act. Since 1998 he has guided the work of the Toronto Board of Trade’s Electricity Task Force, serving as both Chair and Vice Chair.

Why did Rob and his father choose to focus on the power sector and on Ontario? He says he saw a clear need for this kind of business development in the province, and perhaps more important: “We live here. I always felt that we needed to give back. Since we did not live in the jurisdictions in which we were doing our Principal business, I always felt that I could help in Ontario where we resided.”

From the early stages of the US and Canadian independent power business, through the twists and turns of Ontario’s power generation sector over the last 15 years, to new ventures in transmission, it’s clear this is a company that is not easily daunted or likely to shrink from a challenge.

Looking to the future, McLeese sees a number of opportunities for expansion. Although foreign markets can be very attractive, they look forward to being able to do more work closer to home: “Canada has its moments of brilliance,” McLeese says.

Clearly, with a track record like the McLeese family, and a willingness to try new directions, the prospects are as bright as ever for this impressive Canadian team.

See related story on Colmac Energy .