by John Wolnik

Haynesville, Horn River, Utica, Antrim, Collingwood and Marcellus are all becoming part of the natural gas lexicon in North America. These names refer to a few of the many new natural gas shale based reserves that are actively being explored and developed to supplement traditional supplies of natural gas. Declining conventional gas reserves and recent high gas prices have been a catalyst for new technological developments in drilling and completion, which has resulted in these shale gas supplies becoming commercially feasible at relatively low full cycle costs. These reserves and the related production are becoming so abundant that they are being referred to as the ‘game changer’ in the industry. These shale gas supplies will influence gas prices and gas flows for all consumers of natural gas including gas fired power generators. Figure 1 illustrates the current shale gas deposits in North America.

Non Utility Gas (NUG) generators have been using large volumes of natural gas to produce power in Ontario for almost two decades. The gas supplies that these generators have been using have been from conventional natural gas reserves and have been traditionally sourced from the Western Canadian Sedimentary Basin (WCSB). Many of these NUG generators have also relied on companion pipeline capacity from Western Canada to transport WCSB supplies to Ontario. More recently, new gas fired generators under Clean Energy Supply (CES), Accelerated Clean Energy Supply (ACES) as well as Combined Heat and Power (CHP) and other power arrangements contracted by the Ontario Power Authority (OPA) have generally been sourcing their gas at the Dawn Hub and using intra-provincial pipeline transportation to get gas to their plant. Other gas fired generators that have contract flexibility may also opt for acquiring a portion of their natural gas supplies in Ontario.

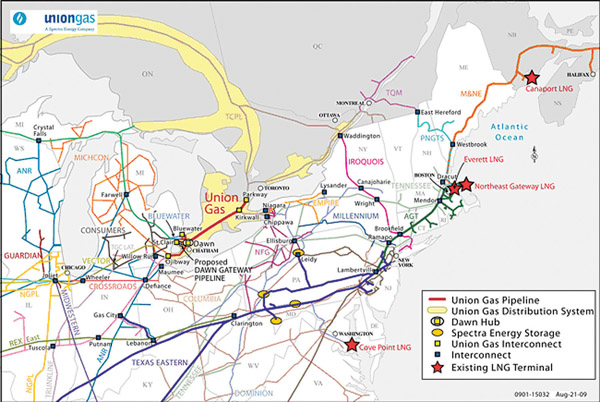

The Dawn Hub is a natural gas market centre operated by Union Gas, physically situated at their Dawn Compressor Station near Sarnia Ontario. This Hub can currently access natural gas from the WCSB as well as a number of American supply basins through a variety of pipelines feeding into Dawn. This Hub is characterized by several pipelines feeding into the Hub as well as the 6.8 PJ/d Union Dawn-Trafalgar system transporting gas from the Dawn Hub easterly to interconnections with Enbridge Gas Distribution, for service within its franchise area, as well as with TransCanada Pipelines for delivery of gas to Eastern Ontario, Quebec and several export points to the US Northeast. Approximately 265 PJ of underground gas storage owned and operated by Union and Enbridge also connect into the Dawn Hub providing further flexibility. This storage allows surplus supplies of natural gas to be injected during the off-peak periods and withdrawn during the peak periods. The Dawn Hub is the most liquid trading point in Eastern Canada and the Northeast US. The supply and demand dynamics at this location result in gas prices being set based on these dynamics; essentially a made-in-Ontario gas price that reflects all of the supplies from the various basins as well as the ongoing demands for natural gas in eastern Canada and the Northeast US. Gas trades at the Hub using both an electronic trading platform operated by NGX as well as a vibrant over the counter market. Union Gas notes that title changes at Dawn can be as high as 10 PJ/d, which denotes a very liquid market, well in excess of the physical capacity at the Dawn Hub. Figure 2 illustrates the various connection points to the Dawn Hub (Figure 3 also illustrates the pipeline network in the region in more detail).

With the Dawn Hub being at the crossroads of a number of pipelines from many different supply basins, customers buying gas at the Dawn Hub will benefit from the discovery and production of shale gas supplies. One discovery in the Appalachian area is the Marcellus shale gas. The Marcellus shale gas is found in much of Pennsylvania and West Virginia, southern New York State, eastern Ohio, western New Jersey and western Maryland. The Marcellus shale formation also extends beneath Lake Erie into southern Ontario into the St. Thomas area, but it is not clear at this time if the Marcellus shale extending into southern Ontario contains commercial quantities of natural gas.

The Marcellus shale gas supplies are expected to be a significant source of natural gas production. Penn State University has estimated that recoverable reserves from Marcellus are nearly 500 trillion cubic feet1. This formation is at the early commercial development stages, but significant activity is underway to secure land rights, and drill new wells. Given the size and location of the shale formation, new pipeline infrastructure will be needed to deliver the shale gas to market. The actual rate of production of the shale gas will be a function of both the drilling activity and development of the related pipeline infrastructure to get the gas to market. Gas pricing levels of course also will influence the investment in development of the reserves. ICF estimates that by 2015, Marcellus production could range from 2-5 bcfd2. Similarly Tennessee Gas Pipeline, one of the large pipeline companies serving the Northeast US from the Gulf Coast areas, also predicts significant growth in Marcellus supplies. They note that Marcellus supplies will continue to grow from 0.5 bcfd that they currently transport from Marcellus to 3-6 bcfd by 20153. Bentek Energy, a natural gas and energy market analytics firm, indicates that Marcellus production could reach 4-6 bcfd by 2014. TransCanada, on the other hand forecasts a production level from Marcellus of 2-3 bcfd by 20154. The question becomes how much, how fast and where does Marcellus gas get to market.

To put the size of Marcellus in perspective, a few statistics on the Canadian natural gas market

• 2008 gas production in Western Canada – 6.74 tcf5

• 2008 gas production in Ontario – 9.4 bcf6

• Western Canadian production from 1971 to2008 – 203 tcf7

• 2008 Remaining Established Reserves – Canada 62 tcf8

(Note: remaining established reserves are defined by CAPP to include recoverable reserves under current technology and economic conditions, these volumes would exclude most of the recent shale gas discoveries in Western Canada and some other non conventional supplies.)

• Annual Ontario Consumption – approximately 1 tcf (approximately 3 bcfd)

In addition the total annual consumption in the Northeast States (Maine, Vermont, New Hampshire, Connecticut, Rhode Island, Massachusetts, New York, New Jersey and Pennsylvania) is just 3.2 tcf annually or about 8.75 bcfd. The Northeast gas market is approximately 1/3 residential, 1/3 commercial/industrial and 1/3 power generation. At a 5 bcfd production level, Marcellus could theoretically meet over ½ of the region’s average daily gas requirement.

Figure 3 illustrates the pipeline network in Eastern Canada and the Northeast US.

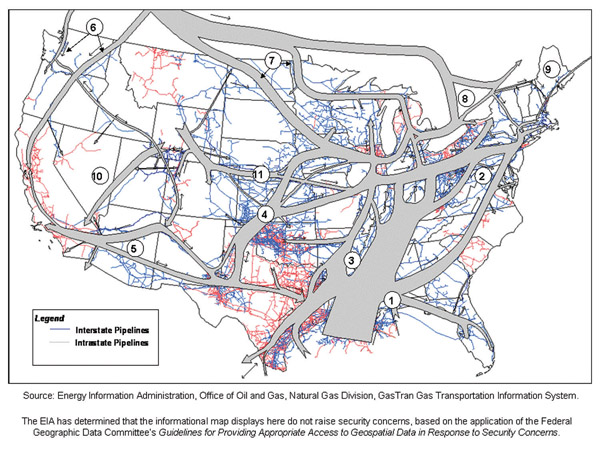

The main consuming regions of the Northeast US are situated along the Atlantic seaboard. The Marcellus formation is generally situated west of the Appalachian Mountains. Increasing the pipeline capacity to Northeast markets therefore will be expensive and take time to permit and develop the large diameter pipelines to integrate into the pipeline network. Figure 4 illustrates indicative pipeline flows in North America with the width of the arrows being proportional to the amount of gas flow in the respective corridors shown. It is evident from this illustration that this region is currently gets much of its natural gas from the gulf coast region. Some gas supplies also come from the Rockies as well as from Canada through export locations in Eastern Canada (Niagara, Chippewa, Waddington, East Herford and St. Stephen).

As Marcellus supplies begin to come on line, it is expected that these shale gas supplies will be integrated into the pipeline grid to serve market requirements. This suggests that provided the price is competitive, these supplies will displace other supplies that would otherwise be transported greater distances. The locational advantage of Marcellus gas for Northeast Markets is that transportation pipeline costs and fuel savings from transporting the gas shorter distances provide a natural competitive advantage over more distant supplies. These more distant supplies that are displaced by Marcellus gas will then look for other markets. The current supply sources for Northeast markets that will be affected include gas from the WCSB that has been traditionally transported by TransCanada Pipelines and exported through Niagara and other export points in Eastern Canada as well as supplies from the US mid-continent area which are transported south of the Great Lakes. Marcellus gas is also expected to displace some supplies from the Gulf Coast area currently feeding the Northeast.

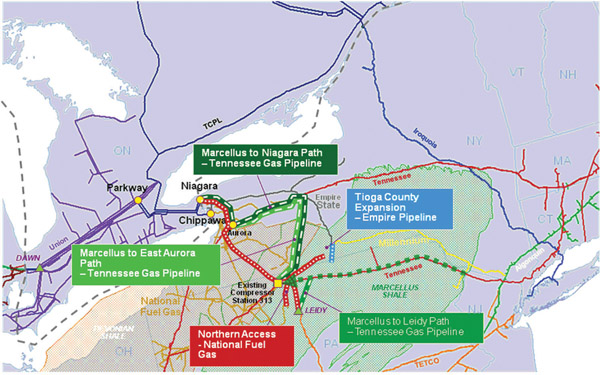

The peak export capacity in the Niagara area is approximately 1.6 bcfd9 through interconnects with National Fuel, Tennessee and Empire Pipelines (collectively referred to herein as Niagara). However, actual export flows from Canada in the Niagara region have been declining over the last several years. During 2009, flows averaged about 1/3 of the export capacity or about 500,000 mcfd10. It is likely that as Marcellus shale gas continues to grow, those parties importing gas into the US via Niagara will either i) look to replace these Canadian gas supplies with Marcellus supplies, to the extent that they have contract flexibility, or alternatively ii) if they still have gas and/or transportation capacity under contract, they may choose to replace these Canadian supplies with Marcellus gas and sell their Canadian supplies at the Dawn Hub. The supplies into the US Northeast via the Niagara area are therefore expected to decline and quite likely reverse in flow direction as Marcellus gas becomes available.

Several US and Canadian pipeline companies are also looking at system modification and expansion projects to facilitate gas being imported into Canada in the Niagara region. This gas could be transported to Dawn or other points within the province. Figure 5 illustrates several pipeline projects sponsored by National Fuel Corporation, Empire Pipeline and Tennessee Pipeline to receive and deliver Marcellus gas to the Niagara area for import into Canada. National Fuel announced in April 2010 that Statoil has contracted for the full 320,000 mcfd of available capacity on their Northern Supply Access Project which is designed to deliver gas to TransCanada at Niagara. Empire Pipeline has also announced a project to deliver up to 320,000 mcfd to TransCanada at Niagara. East Resources has been awarded 200,000 mcfd of this capacity.

Union Gas announced in February 2010, that they were conducting an open season to receive gas at Kirkwall, the interconnection with TransCanada’s line to Niagara. Union proposed to provide up to 1.5 bcfd of receipt capacity at this location. TransCanada Pipelines has also been soliciting interest in acquiring new shippers between Niagara and Kirkwall. Clearly the Niagara area interconnections with US pipelines will be an important pathway for Marcellus gas to reach Ontario markets.

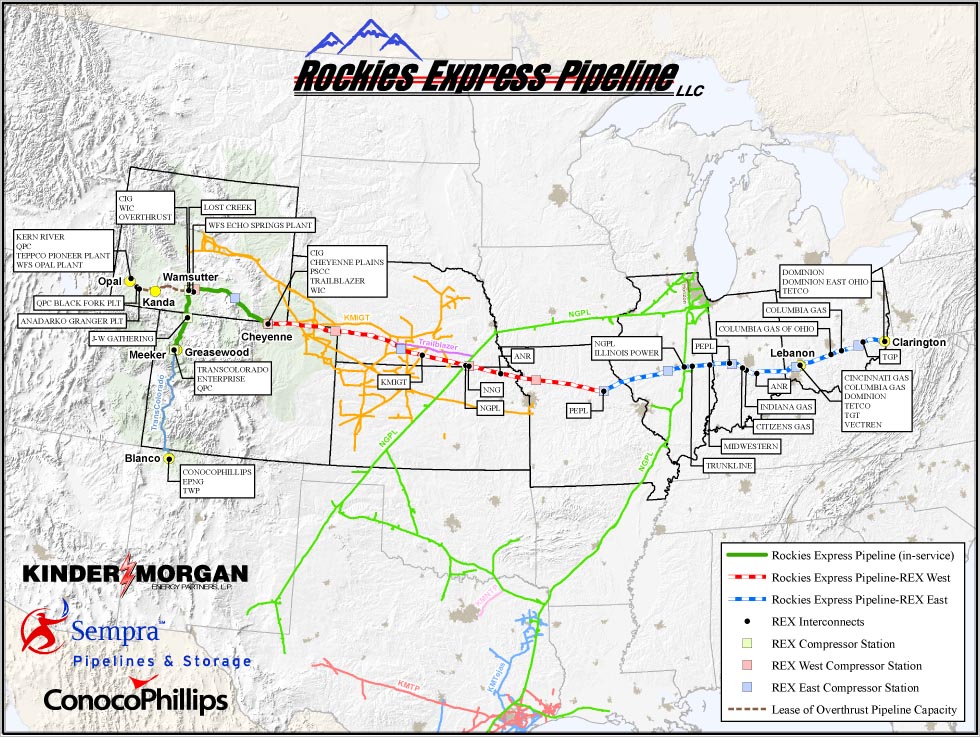

In addition to Marcellus gas reaching Ontario markets other US supplies are expected to be brought into the Ontario market. Completed in November 2009, the Rockies Express Pipeline (REX) (figure 6) is a 2800 km, 1.8 bcfd natural gas pipeline extending from the Colorado area to Ohio. The market for much of this gas was expected to be the markets in the Midwest and Northeast US. Several projects had been proposed to build additional pipeline capacity to deliver some of this gas directly to the Northeast. With Marcellus gas gaining a strong foothold, it is unclear if these downstream pipeline projects will proceed to the same degree as initially anticipated. The result will be more of this REX gas will either stay in the Midwest area or look for alternate markets such as markets at the Dawn Hub.

There are several pipelines that cross the REX pipeline including TransCanada owned ANR Pipeline, and Panhandle Eastern Pipeline. Both flow northerly into Michigan with subsequent pathways to the Dawn Hub. The ANR pipelines also access some of the Fayetteville and Haynesville shale gas plays in the southern US. These can also be transported to the Dawn Hub.

Vector Pipeline, is an existing pipeline that extends from Chicago to the Dawn Hub. Several pipelines that interconnect with REX also interconnect with Vector. Vector has indicated that it has 115,000 mcfd of long haul (from Chicago) and 300,000-500,000 mcfd of short haul (from Michigan) expansion capability into Dawn11. Vector therefore could also facilitate additional gas flow into the Dawn Hub. Spectra Energy (parent company to Union Gas) and DTE Energy also recently held an open season and received support for as well as regulatory approval to construct their new Dawn Gateway Project. This is a gas transmission project that uses a combination of existing and new pipeline facilities to be constructed to initially add 360,000 mcfd of new capacity from southeast Michigan into the Dawn Hub.

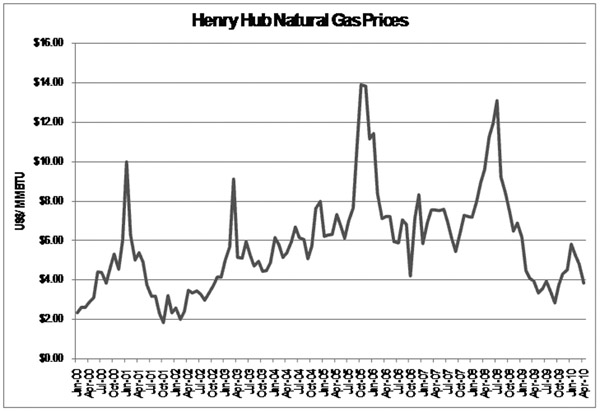

A variety of parties have come up with their estimates of the level of natural gas prices necessary to continue with shale gas production. Most estimates indicate that Henry Hub prices (figure 7) in the range of US3.5-$4.00/MMBTU12 are necessary to produce Marcellus gas with a reasonable return. It has been reported that other shale plays such as Haynesville and Fayetteville will require Henry Hub prices US$0.75-0.95/MMBTU higher13. Figure 7 provides some perspective of where Henry Hub prices have been over the last decade.

In addition to Marcellus shale gas, shale gas from the southern US will also find its way to the Dawn Hub as Marcellus backs out some of this shale gas that might have otherwise been transported to Northeast markets. The Utica shale plays in Quebec are in their early days of proving their commercial feasibility. If these supplies begin to come on line, they too will look to access markets in Eastern Canada. Other US shale plays also have the potential to access Eastern Canadian markets though existing infrastructure. Figure 1 also illustrates that Western Canadian has several significant shale plays such as Horn River and Montney which are actively being developed in British Columbia. These plays also have significant recoverable reserves and are expected to supplement traditional WCSB supplies which can access Dawn markets through existing TransCanada Pipeline systems.

Howard Wetson, Chair of the Ontario Energy Board, in a speech to the Ontario Energy Network on May 13, 2010, acknowledges the potential impact of shale gas for Ontario consumers and indicated the Board’s intention to examine “The consequences of an increase in shale gas production; more particularly how greater shale gas production may change the flow pattern of natural gas in the United States and Ontario increasing the need for new pipeline services and routes and reducing the attractiveness of others.”

It’s clear that the nature of natural gas supply arrangements in Ontario is in transition. The traditional WCSB supplies of gas are being supplemented with additional supplies from shale gas from Marcellus, Fayetteville and Haynesville as well as supplies from the Rockies and British Columbia. Competition will be strong to secure market share. The Dawn Hub will see some of this competition. Based on the various projects being proposed and the new services being offered between Niagara and Dawn, it is likely that at least 0.5 bcf of new shale gas supplies will be available at the Dawn Hub. This could potentially grow up to 2 bcfd with reversal of the Niagara pipeline and other new pipeline projects from Michigan into Dawn. As the volume of shale gas delivered into Ontario grows, Ontario may require the development of additional infrastructure to get gas to market. This shale gas may also require the development of new transportation and storage services to facilitate the integration of the supply into the overall natural gas market. TransCanada Pipelines has recognized the potential implications of Marcellus shale gas. They are looking at ways to facilitate movement of shale gas into and through Ontario, and have also initiated a consultation process to identify ways to modify their rate design to better position gas supplies that use their Mainline to compete with Marcellus and other shale supplies.

What are the implications of this Marcellus shale gas for Ontario gas fired power generators?

1. In general, additional gas supplies will soon begin to arrive at Dawn either indirectly through displacement of exports or directly through physical flows. These supplies will continue to grow over time. The additional shale gas supply at Dawn Hub will act to moderate gas prices at Dawn. Summer gas prices are expected to be even lower as there is limited gas storage in the Northeast US to store surplus supplies and surplus summer supplies will be available at Dawn as an alternative supply source. This shale gas could be more competitive and displace some WCSB supplies.

2. More shale gas supply at Dawn will not only moderate gas prices; it ought to also moderate price volatility. For those generators that may need to make an intraday gas purchase on peak days, the price premium to buy such intraday supplies ought to be less with more competition from Marcellus supply.

3. Lower gas prices at the Dawn Hub will attract gas buyers who would otherwise purchase traditional supplies from the WCSB. Lower throughput on TransCanada’s Mainline could result in higher pipeline tolls under the traditional tolling methodology. Gas generators that rely on TransCanada transportation capacity could expect to see higher pipeline tolls as Marcellus displaces traditional WCSB supplies. If TransCanada is successful in their rate redesign process it could offset these higher tolls.

4. Lower gas prices should be good news for electricity consumers in Ontario. During the periods when dispatchable gas generation is the marginal supply source, the lower gas prices should be reflected in Ontario electricity prices.

Shale gas developments in Canada and the US will change the way gas is sourced in Ontario. Marcellus shale gas will become an important supply source for Ontario that not only will moderate gas prices, but will also improve the security of supply for all users of gas.

John Wolnik is an energy consultant in London Ontario. John is an Associate of Elenchus Research Associates and President of GSA Energy Company. Elenchus is firm specializing in regulatory solutions and GSA is a firm specializing in commercial and engineering support for the natural gas industry.

Endnotes

1. An Emerging Giant: Prospects and Economic Impacts of Developing the Marcellus Shale Natural Gas Play July 24, 2009

2. Union Gas Calgary Customer Meeting March 2, 2010

3. Tennessee Gas Pipeline May 2010 Shipper Meeting Presentation, Slide 30

4. T Stringer TransCanada Pipelines May 2010

5. CAPP 2009 Statistics Handbook

6. Ibid

7. Ibid

8. Ibid

9. Discussion Paper on System Supply I n Ontario, Presented by ICF Consulting, PEG, and Excel Consulting, September 2004.

10. NEB website, Monthly Export Statistics

11. October 2009 Vector Customer Meeting Presentation

12. Various sources including Talisman Energy Press Release – Nov 3 2009, Pennsylvania Beaver County Times September 27, 2009, Ross Smith Energy Group

13. Source: Ross Smith Energy Group, Tudor, Pickering, Holt & CO.

To access high resolution copies of the images in this story, please click here .

Please see the following related articles, elsewhere in this issue of IPPSO FACTO:

* How shale gas is redrawing the map for Canadian power generators

* The Marcellus Shale and gas production (backgrounder)

* Environmental considerations impact shale gas options

* Editorial: Will Ontario miss another great gas opportunity?