Toronto: There were a number of changes underway in the power sector already, but the introduction of the Green Energy Act in Ontario tops them all, and means that forecasters and planners will have to revise their models significantly in the near future. The consulting group Power Advisory LLC (PA) recently released its 2009 Ontario Market Assessment, containing the results of an extensive analysis and a number of observations along these lines that will interest just about anyone in the power sector.

A wide-ranging study, the Ontario Market Assessment reconsiders the basic assumptions underlying Ontario’s Integrated Power System Plan (IPSP) including demand projections, capacity projections, and market structure, and concludes with a price forecast that is likely to attract attention in the industry.

The report starts off with the observation that one can not properly assess the Ontario power market with models that were built before the introduction of the Green Energy Act (GEA). John Dalton, the principal author of the Assessment, observes that “The Green Energy Act represents a fundamentally different approach to the electricity system. … (It) rejects the idea of least-cost planning.” It does not rely on an economic analysis, even an environmental economic analysis that includes the costs of externalities (air and water pollution, noise, etc.).” The GEA also says that “transmitters and distributors must discriminate in favor of renewables for access to the grid,” replacing the previous requirement of non-discriminatory access. Unlike the approach used in the IPSP to date, the new policy environment does not consider levelized unit energy costs (LUEC) when comparing supply options, or use them as inputs to arrive at a least-cost portfolio. Instead it seeks to maximize all forms of renewable energy and conservation without limits or targets.

The public policy commitment to green energy is carried forward in a number of ways “that give priority or resources to the production of energy from renewable resources and to conservation without regard to comparison of costs among them,” the report says. “The role of planning in this context is to plan for transmission to incorporate the energy that is forthcoming and to plan for and procure any residual needs that are not met by the renewable resources.” As noted elsewhere, the GEA creates a number of new powers for the minister and adds green energy objectives to the mandate of the Ontario Energy Board. It is a fundamental shift in the way alternative options are assessed, the function of planners, and the responsibilities of regulators.

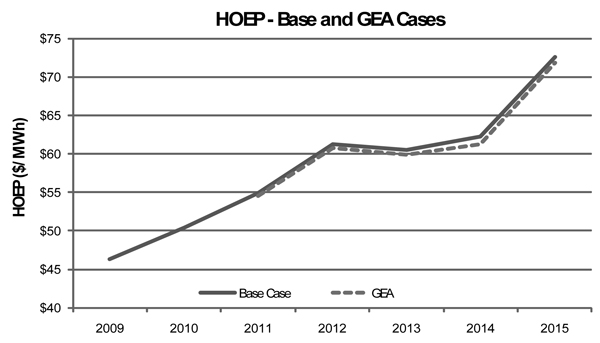

A particularly significant aspect of the PA report is that it forecasts a gradual recovery in hourly energy prices. The market price for electricity, currently experiencing record lows, is projected to return to its previous levels near 6 cents per kWh by the middle of 2012. While some market participants suffering from the effects of the relatively low prevailing prices of the day may consider this a small ray of hope, many will likely continue to have questions about how well prices reflect the value of the commodity. (See chart)

Several trends observed by PA are cause for concern. For example:

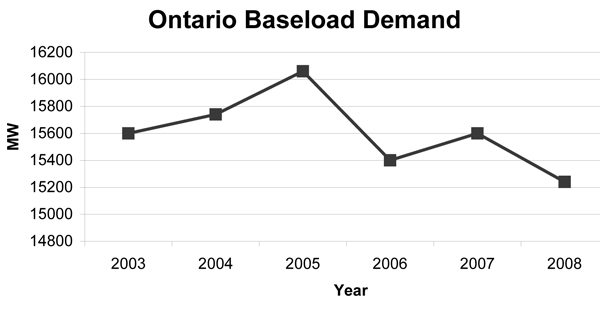

• The system peak load is increasing even though base load is in decline, making relatively expensive peaking capacity more important to the system.

•lang=EN-CA style='mso-bidi-font-size:11.0pt;mso-bidi-font-family: Arial;mso-ansi-language:EN-CA'> Surplus baseload generation (SBG) is expected to be a problem for the next few years.

• Price volatility will be relatively low.

• The HOEP will be relied upon less as a measure of value.

• There is low probability of significant short term progress towards a fully competitive wholesale market.

• Policy-driven investment will dominate the sector.

In making its projections of power consumption in Ontario, PA notes that over the last five years Ontario’s system load factor has been declining, and says this trend is projected to continue. Over the last six years there has been an almost continuous decline at an average rate of roughly 0.7 percent per year. There are two primary drivers of this trend: Increasing penetration of air conditioning (a very “peaky” load, adding to the summer peaks) and the decline of energy consumption in Ontario’s industrial sector. (See chart)

In terms of capacity projections, the OPA’s IPSP calls for about 8,000 MW of additional investment by 2015 beyond that already committed. The IPSP anticipates 35% of these incremental resources will be gas-fired, but PA's projections put this number significantly higher, as much as 67%. PA says, “The resources that have the greatest risk of not achieving their estimates in the IPSP are hydro and CDM.” Although nuclear energy is expected to provide incremental capacity in the post-2015 period, PA says it “does not believe that all of the new nuclear capacity planned for in Case 1B will be built.” Case 1B includes 10,185 MW of planned nuclear capacity, which assumes up to 6,785 MW of refurbished nuclear (Bruce B and Darlington) and 3,400 MW of new build nuclear.

Market forces will not be a major driver in the selection of supply options, the authors believe. "More forces push the hybrid market towards regulation than push it towards competition," they note. And initiatives that are not market-based tend to create the conditions that encourage further non-market measures. “The regulated elements tend to drive out competitive elements, causing greater reliance on regulation. The Government initially had to participate actively in the market (by procuring supply directly) because potential market participants were not willing to risk investment due to the perceived instability of government policy.”

One of the more hopeful findings in the assessment is the prospect for low-carbon energy exports from Ontario. “Higher power prices in US markets will make exporting more attractive and will increase Ontario prices as well given greater Ontario exports and fewer imports.” PA says. “To the degree that there are sustained disconnects between Ontario market prices and those in adjacent markets, carbon regulation will make exporting to adjacent markets more attractive.”

For its price forecast, PA developed a system dispatch model. The model has a single iteration, setting the market price (Hourly Ontario Energy Price, HOEP) at the marginal cost of the last unit needed to meet demand. The dispatch model is supplemented by an econometric model for net exports that draws on the historical relations between the drivers of interchange transactions and their actual amounts. Such an approach captures the impacts of “seams issues” that frequently impede inter-jurisdictional trade merely because of the complications of dealing with the differing rules at the borders. “HOEP can be viewed as the market price input to the Global Adjustments that most Ontario consumers ultimately pay,” the report notes.

Overall, PA projects that the HOEP will rise from approximately 4.6 to 6.1 cents per kWh between mid-2009 and mid-2012, in both its base case and its high wind scenario. In explaining some Ontario-specific bidding behaviour that impacts price, PA notes that a great number of generators are expected to have their basic fixed costs covered through support payments in their contracts. Because of these arrangements, “generators are incented to bid their marginal operating costs by the deemed dispatch structure. This reduces the volatility of HOEP.” Surplus baseload generation can be expected to depress average Ontario market prices for the next several years until baseload demand recovers, the authors note.

Given that most capacity additions will be attributable to decisions by a government agency responsible for reliability rather than being a response from new generators to market prices, the OPA can be expected to contract for “consistently higher reserve margins” than the market would provide on its own. This will “keep the level, as well as the volatility, of HOEP down by reducing the amount of time that the system is short of capacity and therefore forced to call on more expensive supply options,” PA says. In this way, PA notes, the OPA effectively performs the function that capacity requirements fulfill in other markets.

Explaining a key part of its short-term price projections, PA says, “Forecasted increases in natural gas prices and constraints on coal unit operations lead to price increases.” It also concludes that “Ontario’s capacity expansion, which is focused on renewables and the refurbishment and replacement of baseload (nuclear) capacity, is likely to cause the HOEP to continue to move away from being a measure of market value.”

One of the more ironic predictions in the report is that gas fired power generation will continue its upward trend in Ontario, but primarily for reliability reasons. The fact that the gas-fired power is relatively economic (i.e., low capital cost at the outset and market-responsive in operation), and able to reduce system emissions both directly and indirectly because of its dispatchability, may be attractive characteristics in the long run, but won’t likely be major factors in its adoption.

In explaining its reasons for seeing a “low probability of significant short term progress towards a fully competitive wholesale market,” PA says, "Rather than market structure, the most important impact on the market outcomes, including pricing and new capacity, in Ontario over the next five years will now be largely determined by the impact of the Green Energy Act, in particular the extent to which the Government channels investment to renewables. The price consequences of the Minister’s directions will be paid by electricity consumers through adjustments and other non-market mechanisms. Meaningful development of the forward market is unlikely."

It is clearly a different world for the power business than it was a year ago, and as the Power Advisory Ontario Market Assessment notes, participants will need to adjust their analysis.