Ontario’s power system is undergoing major change, and from whatever angle the change is viewed, natural gas, with all its unique characteristics, is going to be a much larger part of the picture. With a dramatic increase in the use of gas fired power generation, Ontario has joined a large number of North American jurisdictions who are treating gas as a strategic option, and simultaneously focusing attention on a range of related issues with significant implications that might have been brushed off as marginal a few years ago. Nearly 3000 MW of gas-fired capacity will be added to Ontario’s power system in the next few months, opening up potent questions about how the new capacity will affect the dynamics of Ontario’s power market, the pace of convergence between the gas and electricity sectors, the pressure to build additional gas distribution infrastructure, the prospects for new forward market mechanisms, and a host of other questions.

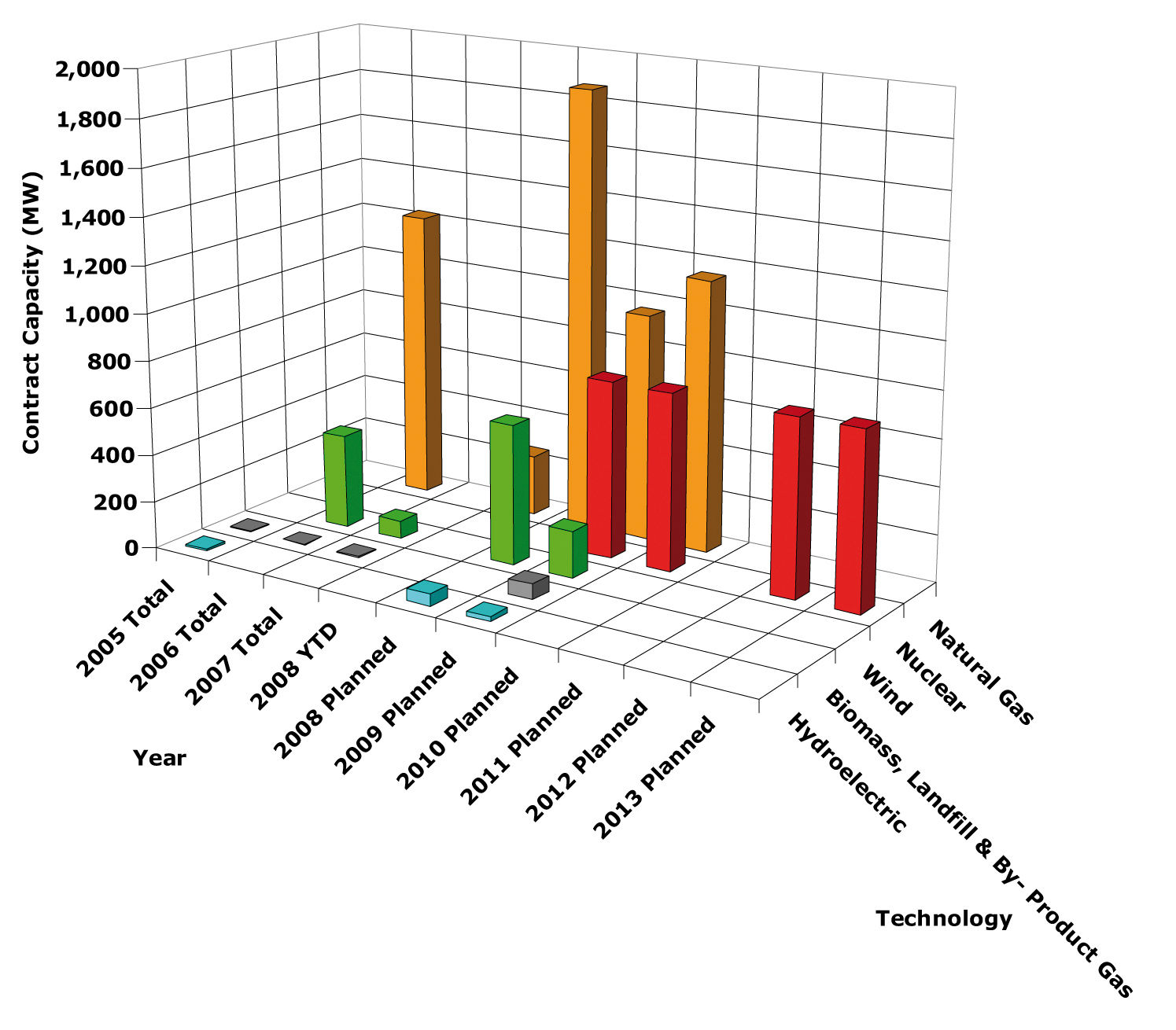

The Ontario Power Authority has signed contracts for 4,267 MW of new gas fired generation, some of which is already in service, and it has plans to add another 2,786 MW by 2014. In total, 7,053 MW of new gas fired generation, an increase of 140%, is expected to be added to the system by 2014. As a result of this change, gas generation will grow from about 10% of installed generating capacity in Ontario, to nearly 25% over a 7-year period. The increases in projected gas consumption are more modest but nonetheless significant. Perhaps most important from a public policy perspective, the added gas capacity will make it possible to phase out most if not all of the coal-fired power plants that have been central to Ontario’s electric system for more than a generation.

The Ontario Power Authority has signed contracts for 4,267 MW of new gas fired generation, some of which is already in service, and it has plans to add another 2,786 MW by 2014. In total, 7,053 MW of new gas fired generation, an increase of 140%, is expected to be added to the system by 2014. As a result of this change, gas generation will grow from about 10% of installed generating capacity in Ontario, to nearly 25% over a 7-year period. The increases in projected gas consumption are more modest but nonetheless significant. Perhaps most important from a public policy perspective, the added gas capacity will make it possible to phase out most if not all of the coal-fired power plants that have been central to Ontario’s electric system for more than a generation.

Although Ontario’s Integrated Power Supply Plan (IPSP) has been clear from the outset that natural gas is not the first choice as a source of bulk power, it is certainly expected to play a strategic role, one that will be sharply increasing in importance as new generation capacity goes into operation over the next 10 months. The IPSP places a heavy reliance on gas to make the electric system more responsive, to manage risks, and to keep infrastructure costs down. The use of natural gas has been described as an “insurance policy” to help deal with many of the unknowns in Ontario’s energy market.

Explicitly adopting what it calls a “smart gas strategy,” the Ontario Power Authority has said that it wants to increase the amount of large-scale gas fired power generation capacity to help the province respond to peak demand during times of system stress, to increase the reliability of supply in several areas of the province, and to help meet the province’s policy of phasing out coal-fired power generation. APPrO President Dave Butters notes that, while other supply options can produce less expensive bulk power, “gas-fired generation is the quickest and least expensive way to add large amounts of new capacity able to respond on short notice with a modest environmental impact.” With these characteristics, new gas capacity is crucial for the success of the province’s plan to phase out the use of coal for power generation while adding large amounts of intermittent renewables to the supply mix.

How will the market change?

The increasing use of gas is expected to open up new energy trading opportunities for Ontario consumers, while making the province more integrated with broader North American energy markets. Economic circumstances in the US may spill over to Canada in part through the interconnected gas and electricity markets, with a number of potential economic benefits for Canadians and a few risks. Both supply and prices on each side of the border will tend to converge as the two markets become more interconnected. Ontario’s energy imports, as with much of Canada, will likely be modest because of the availability of domestic resources, but natural gas is an increasingly continental market. Day to day electricity prices will be determined by continental supply and demand conditions for gas much more readily than they would for coal. In fact, many economic models assume that during times of high demand for power, the marginal cost of additional electricity on an hourly basis will be directly related to the cost of firing up incremental gas-fired generation.

The increasing use of gas is expected to open up new energy trading opportunities for Ontario consumers, while making the province more integrated with broader North American energy markets. Economic circumstances in the US may spill over to Canada in part through the interconnected gas and electricity markets, with a number of potential economic benefits for Canadians and a few risks. Both supply and prices on each side of the border will tend to converge as the two markets become more interconnected. Ontario’s energy imports, as with much of Canada, will likely be modest because of the availability of domestic resources, but natural gas is an increasingly continental market. Day to day electricity prices will be determined by continental supply and demand conditions for gas much more readily than they would for coal. In fact, many economic models assume that during times of high demand for power, the marginal cost of additional electricity on an hourly basis will be directly related to the cost of firing up incremental gas-fired generation.

It is expected that natural gas will be on the margin in Ontario’s dispatch and pricing systems for a growing proportion of the time in the next 12 years of Ontario’s integrated power supply plan, 2009-2021, until less expensive alternatives start to play a greater role. Projections by the OPA indicate that gas is likely to be on the margin, setting the marginal price for power, 50% or more of the time in the years 2018 and 2019 before it starts to decline. Clearly, some investors will be concerned that if capital investment as a whole is slowed down across North America, the supply mix anticipated in the first few years of the plan may persist longer than originally expected. Today’s gas fired power generation could be called upon to run longer and harder than currently projected, and to some extent, that is part of its strategic value.

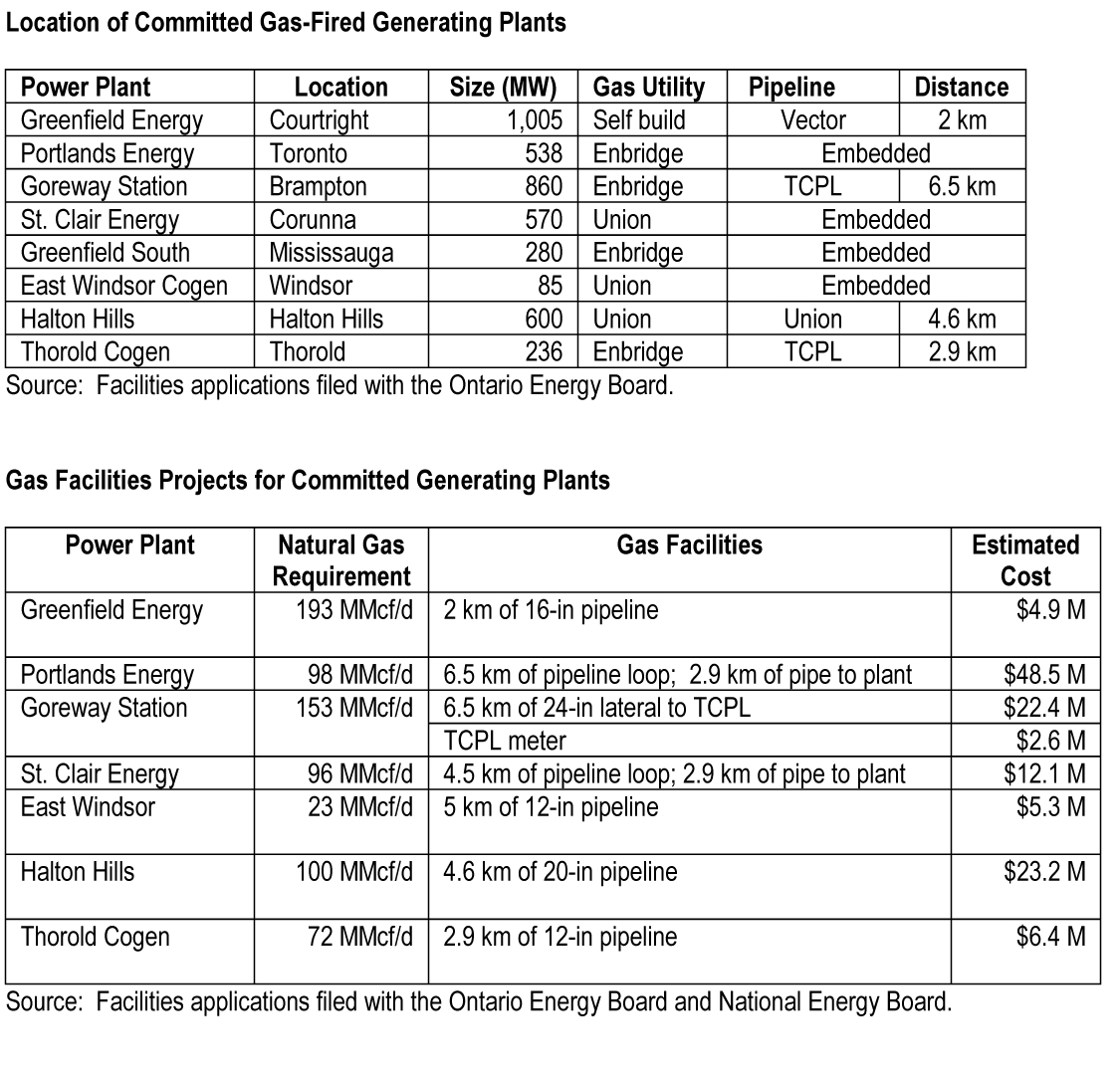

Current projections about the strength of the natural gas market are relatively bullish. Consultants’ reports filed with the Ontario Energy Board last summer indicate that supply in Central Canada will be more than adequate to cover the anticipated growth in demand, that the delivery infrastructure is robust, and that the added demand will have minimal impact on gas prices. “(L)ong term forecasts from sources such as the National Energy Board and the U.S. Energy Information Administration indicate that natural gas supplies will be adequate to meet existing requirements and support growth in Canadian and U.S. markets without large increases in natural gas prices,” wrote North Side Energy. “Even at its peak, the estimated increase in annual natural gas use for electricity generation in Ontario represents less than one-half of one percent of the total North American market. … Any increase in the natural gas price at Dawn compared to other markets would be mitigated, however, by the ability of gas market participants to shift gas supplies within the larger Northeast market area. This would increase the available supply of gas in Ontario—either by delivering more gas into the province, or by substituting natural gas from other lower-priced areas for natural gas that is currently flowing through Ontario to downstream markets.” (Natural Gas-Fired Generation In The Integrated Power System Plan,” EB-2007-0707, Exhibit I-12-34, Attachment 1, by North Side Energy LLC.)

However, not all gas industry participants agree that adequacy of future natural gas supply will be without significant cost increases for Ontario consumers. For example, Murray Newton, the President of the Industrial Gas Users Association (IGUA), suggests Ontario gas consumers could see significant increases in the prices paid for natural gas supply, depending on the energy industry’s ability to make available additional gas supply from non-traditional WCSB supply sources, as well as the future demand for natural gas in other North American markets. Mr. Newton commented that “While North American gas producers have consistently demonstrated their ability to bring on required new gas supply in a timely manner, the price associated with that incremental gas supply may be alarmingly high, depending on whole host of unforecastable considerations. This could have grave implications for the Ontario and Québec economies as well as the thousands of people employed by energy intensive industry.” Mr. Newton also raised a concern about the prospects for continued large increases in gas transport and distribution costs caused by regulated gas utilities’ efforts to convince their regulators to increase their regulated rates of return. According to Mr. Newton, “This is an important consideration recognizing that various gas utility executives are on record as warning that future gas transport and distribution infrastructure development could be frustrated absent significant increases to their current regulated cost of capital.”

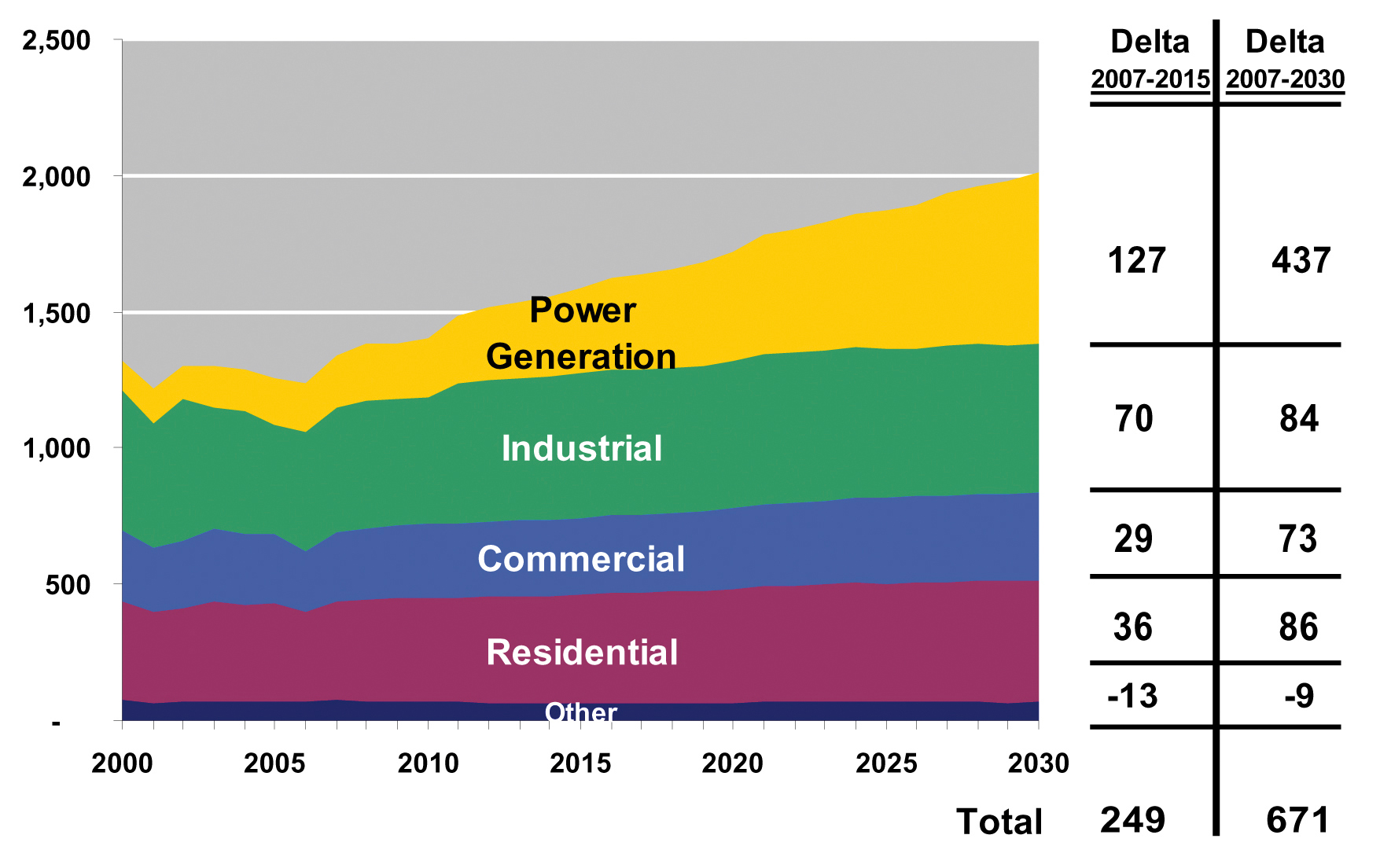

A key consideration for planners working in Ontario is that load on the province’s electric system peaks in the summer, whereas load on the gas system peaks in the winter. With increasing convergence between the two systems brought about by new gas-fired power generation, there could be opportunities to address disparities in utilization levels, potentially resulting in more efficient use of capital infrastructure overall. The net effect could well be reduced total costs for consumers over time. In fact the difference between winter and summer peak levels on the gas system is projected to decline to virtual parity by 2014.

A key consideration for planners working in Ontario is that load on the province’s electric system peaks in the summer, whereas load on the gas system peaks in the winter. With increasing convergence between the two systems brought about by new gas-fired power generation, there could be opportunities to address disparities in utilization levels, potentially resulting in more efficient use of capital infrastructure overall. The net effect could well be reduced total costs for consumers over time. In fact the difference between winter and summer peak levels on the gas system is projected to decline to virtual parity by 2014.

The addition of the new gas-fired generation is expected to help with meeting peak demands. At the same time, the new generation is expected to have a range of impacts on power prices, largely because it will often be setting the marginal price for power at peak times. Ontario’s current electricity supply mix is sometimes described as long on energy but short on capacity. This means that there are relatively abundant supplies of low cost baseload power, but relatively limited supplies of power that can be called up on short notice to meet peak demands. Although market behaviour is difficult to predict, it is likely that the new generation will be much more price-responsive than the system as a whole, partly because of its physical characteristics and partly because of the terms of the gas-fired power contracts with the OPA. For consumers this will probably mean lower overall prices as domestic gas-fired power replaces more expensive imports at peak times, and because there will be more competitors with a range of cost structures suited to serve at various levels of load. Nonetheless, when the gas supply system is really put to the test in mid-2009 as major demands are placed on it to meet summer electricity peaks for the first time, stakeholders will have to be vigilant to handle the potential for new operational issues that may arise.

Coordination between the gas and electric systems

The Independent Electricity System Operator and the gas industry have been preparing to deal with these issues with the assistance of an advisory team of gas and electricity specialists. Experts at the IESO, Union and Enbridge who have studied the issue are confident that both the physical infrastructure and the systems of communication between the three organizations are robust, well-prepared, and able to handle the higher volumes and the potential for sudden swings in the demand for gas next summer. The operators of the three systems have established procedures for co-ordination and communication. The current working relationship between the three agencies grew out of a collaborative grouping set up under the auspices of the Ontario Energy Board during the Natural Gas Forum proceeding in 2005. The Gas Electricity Interface Co-ordination Working Group “helped increase knowledge transfer between the gas and electricity businesses,” says the IESO’s Kim Warren. The group has evolved significantly since that time and no longer operates under the OEB.

“We’ve learned clearly how each other’s system worked,” says Brian Rivard of the IESO. “Each operator has to make sure it’s not impacting the other’s market.” The group has had generator input at several points over the last few years and expects to keep the lines of communication open with those contacts so as to be able to deal with any operational issues that come up in the future. Perhaps most telling, the gas transmitters, through the working relationship that has developed with the IESO, have established a level of collaboration on technical matters high enough that the IESO is confident of being able to meet all of its reliability requirements without placing unreasonable constraints on market functions.

Moving beyond reliability, the new gas capacity can provide other services of value to the system operator. Gas generation generally has a good deal of ramping flexibility. This can help the IESO deal with the roughly 6000 MW in swings that occur each day between the peaks and troughs of demand. Because of Ontario’s market system, most of these fluctuations can be met at moderate cost, through the normal hourly price signals combined with the 5-minute dispatch system. Gas is well-suited to provide this kind of intermediate and ramping service to the system.

Warren notes that there is “a significant benefit in resources that will address minute-to-minute load following.” Generators that are able to ramp up or down on short notice can help the IESO respond to unexpected short term changes on the system. The IESO’s operability report, submitted as part of the IPSP review process, looked at future load-following capabilities and concluded that it has substantial value to the system even during off-peak hours. “In the past we had the luxury of assuming load following capability was easily obtainable,” Warren says, but with the pending retirement of coal-fired generation, gas may well be relied upon for providing this increasingly valuable service to the system.

Looking forward

There are signs that both average prices and price volatility could increase in the next few years. New power sources coming on line are significantly more expensive than the historic sources of supply. Recent energy consumption studies appear to show more growth in peak demand for power compared to growth in overall demand. (See “Outlook bright for investment in generation: Dalton,” IPPSO FACTO, April 2008.)

If volatility and prices are both on the rise, it will be more critical than ever for consumers to have the tools and information necessary to manage their exposure to risk in the energy market. Because there are a number of commercial risk management options already available, a major indicator of conditions to come will be whether government feels obligated to offer its own hedge of some sort, or simply tries to ensure that the market based options are as effective as possible. Both the need for energy retailers to help consumers manage price risk, and the challenges associated with getting the retail system working effectively, are likely to be magnified compared to when it was conceived as an integral part of Ontario’s power system ten years ago. Retail concerns have been placed on a back burner since 2002 when then-Premier Ernie Eves froze retail prices and the subsequent government installed the Residential Price Plan for small consumers.

Consumers need to have a range of economic choices; few would quarrel with that. But in order for those choices to be effective the system needs to ensure that buyers have the kind of timely and concrete information that makes choice meaningful. In many cases, some observers believe, current rules do not require the type and level of information disclosure that’s necessary for consumers to make fully informed choices. Certainly, large consumers who have market experts on their staff are able to make good use of the wholesale market systems in Ontario, but ordinary consumers could potentially benefit from certain additional kinds of disclosure. This kind of disclosure may become more critical as energy price increases and the effects of the credit crisis potentially compound each other’s impacts at nearly the same time next year.

The OPA and the IESO are working on additional market mechanisms that will allow for the creation of new risk management options for Ontario consumers in the form of an Enhanced Day Ahead Commitment Process, an Energy Forward Market, Customer Entitlement Agents and other mechanisms. The most advanced of these, the Enhanced Day Ahead Commitment Process, is expected to significantly improve the ability to project prices and load in Ontario’s power market one day ahead of actual operations. This will permit major industrial consumers as well as generators to schedule staff and supplies more accurately, and reduce energy risk for many market participants. In the process, gas generators will be able to “offer in,” based on start-up costs, minimum load levels, and incremental energy offers, and have the IESO schedule a relatively firm combination of resources for the following day. This could allow for a number of efficiencies as generators will be able to rely on more accurate predictions of their fuel consumption, and will be able to economize on the various fuel supply balancing services needed to adjust between their planned consumption levels and the actual consumption that occurs in real time. Jeanette Briggs of the IESO says, “The new process will take more of the physical characteristics of the generators into consideration during the scheduling.” The end result is expected to be less uncertainty in the market, a range of efficiencies for generators and consumers, and ultimately lower costs for consumers. “This could be an example of the system finding ways to operate smarter,” Butters says. However, as many observers have noted, the new commitment process falls short of the potential that would be available from a full-blown day-ahead market, an idea that will apparently take several more years to come to fruition.

One of the most significant variables to emerge in recent months is the potential interaction between the recent credit crisis in the U.S. and the ability to finance new generation capacity. Although it is too soon to tell what the fallout will be from the US banking industry’s woes, if international credit markets are affected in a long term way, the energy sector may be looking at changes in both the demand and supply side of the market. For example, it is possible that tightening capital markets could lead to reduced reserve margins and increasingly volatile prices, thereby placing additional stress on Ontario’s Regulated Pricing Plan and other potential mechanisms for managing consumer prices. Some of these effects could be felt in late 2009, just as the impact of changes in Global Adjustment and new transmission rates begin to affect consumers’ wallets. A US-based recession combined with large volumes of US government liquidity being dedicated to recovery could make financing for new projects more expensive and harder to find, and coincide with a general slowdown in new investment, just when such investment would have been needed to help meet climate change objectives.

With factors like these in play, Ontario and to a great extent the rest of Canada are likely to be entering a more complex phase of energy history, and one in which price volatility could become a defining factor. Price volatility is unfamiliar territory for many Canadians, so a wide range of reactions is possible. On the one hand, increasingly sophisticated market mechanisms are available that should greatly increase the scope for rational, organized management of risk, and which would in fact create strong incentives for risk to be allocated to those best able to manage it. With such systems, consumers would be incented to reduce demand on gas or power systems at critical times, for example, and cash would become available for infrastructure investments to reduce or manage bottlenecks. But the volatility might also create political pressure for government intervention to soften short term impacts. Such intervention would likely do nothing in the long term to address the underlying causes of the risk or volatility, and would likely distort the very signals necessary to manage impacts.

“It’s time to get really focused on the solutions, and identify what needs to be done,” says APPrO President Dave Butters. The situation is potentially controversial because, contrary to many people’s impressions, the regulator in Ontario does not actually have authority over electricity prices. The regulator has authority over planning and licenses, and sets rules related to the Regulated Pricing Plan, but the actual level of prices continue to be set on a market basis, subject to minor amounts of delay and smoothing. The most significant influence the public sector wields over electricity prices is the government’s ownership of the largest generator, Ontario Power Generation. Given the experience of the province with the stranded debt of Ontario Hydro, it’s likely that policy makers will think carefully before using OPG as a means of moderating prices.

Clearly, the system is going through change, possibly major change. Gas will figure prominently in the new circumstances, partly because the addition of gas fired capacity is itself a major aspect of recent shifts, and partly because gas technology and gas markets allow for a wide range of risk management strategies that were previously unavailable.

As the physical changes begin to take hold, the primary question for many will become how best to ensure the regulatory and administrative systems are adapting in step. Butters says, “The better prepared you are, the better off the whole system will be.”

Will the conditions in the gas market affect Ontario’s generation options?

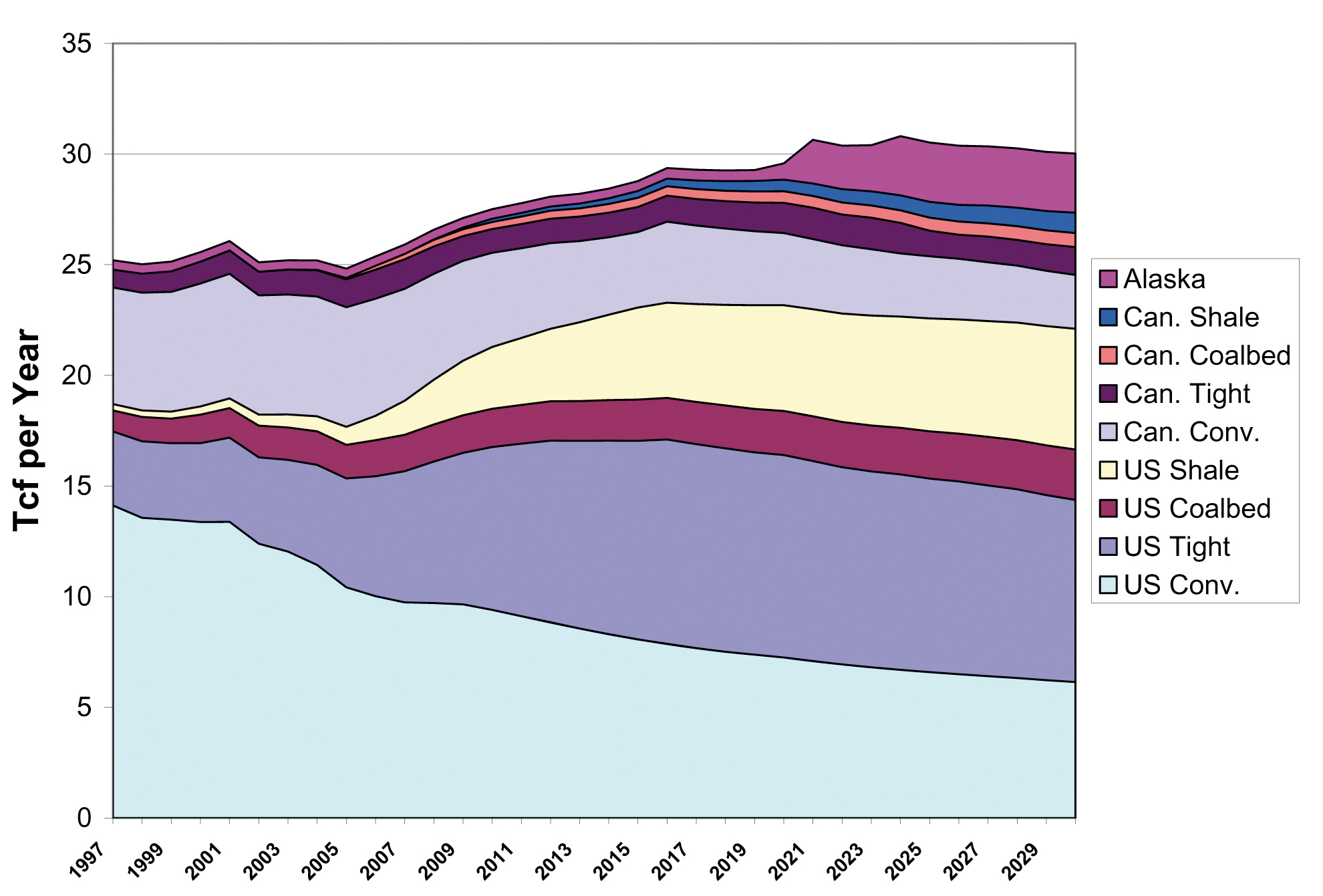

Based on a report prepared by ICF and filed with the OEB in the IPSP hearings, continental gas supplies are more than adequate to accommodate the projected increase in natural gas use in Ontario for power generation. In fact, the additional gas consumption, even though its consumption patterns will be somewhat unpredictable, is not expected to have a major impact on gas prices in Ontario.

A major factor, ICF explains, is that new sources of supply are being developed. “Natural gas supply activity has undergone a major resurgence in North America and throughout the world. Drilling activity has increased and is projected to continue to increase. Improved technology and experience in unconventional gas production, including coal bed methane, shale gas production and gas from tight formations, have boosted gas production and will contribute significantly over the coming decades. …. Ontario is well positioned to access natural gas supplies from an extremely diverse set of production basins and LNG import locations. Indeed, Ontario can access virtually all of the major gas supply areas that currently serve markets in Canada and the lower-48 states of the United States. Moreover, newly constructed pipeline projects such as Rockies Express will further integrate the growing supply areas into the mix of Ontario supply options.

In addition, distribution infrastructure can reasonably be expected to be expanded to meet new load from power generators, ICF believes. “The current gas supply infrastructure in Ontario is more than adequate to meet the projected gas demands in the province through to 2030 and beyond. … The ICF base case indicates that growing investment in pipeline, storage and LNG terminals, along with the extensive existing pipeline and storage infrastructure, is projected to assure adequate supplies to meet the projected requirements in the bases case, which includes projected consumption of gas for power generation that is larger than the gas requirements in the IPSP. Moreover, the nature of the web of interconnections into Ontario provide a diversity of supply options that is superior to most – if not all – markets of comparable size.”

The growing use of LNG creates additional options for gas consumers. “LNG supplies dedicated to the North American markets as new terminals are built are projected to grow significantly. Current firm supplies to U.S. markets are approximately 1.5 Bcf per day. Dedicated LNG supplies to North America could rise to nearly 6 Bcf per day by 2010 and to over 14 Bcf per day by 2025.”

There are alternatives to look to if gas supplies from western Canada decline in future. “The decline in the volume of gas from the WCSB that is available to serve eastern markets has been the focus of considerable discussion within Canada. The declines, however, are projected to be more than offset by increased flows into Ontario from other supply basins and, if required, a reduction in the volume of gas that transits Canada and is delivered into the markets in the Northeast United States. Natural gas supply is projected to be capable of meeting the requirements in Ontario in the ICF Base Case scenario, which is larger than requirements projected in the IPSP, despite the reduction in flows from the WCSB,” ICF says.

The outlook for gas supplies is more challenging than in the past, but presents reasonable options for increased use of gas fired power generation, the consultants suggest. ICF concludes that “while large volumes of new, high quality and long-life gas resources are being proved each year, the cost of developing those reserves is higher than in the past. Despite the higher costs, development of the reserves is economic with today’s wellhead prices. Most gas resources are being added in plays with costs of more than $4.00 per MMBtu. There is, however, the real potential for operators to reduce the cost to develop unconventional gas resources such as tight gas and shale. Such improvements could occur by either increased well recoveries or reduced development costs.”

For more information, see the following report: “Meeting Natural Gas Requirements in Ontario, Canada and the United States: Supply Source Forecast to 2030,” Jointly commissioned by Union Gas Limited and Enbridge Gas Distribution. Written by Bruce B. Henning, Vice President, Energy Regulatory and Market Analysis and E. Harry Vidas, Vice President, Natural Gas Consulting, ICF International, Fairfax, Virginia.