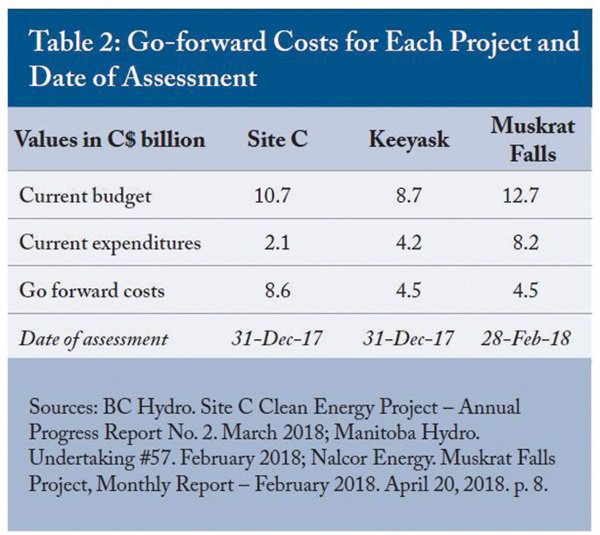

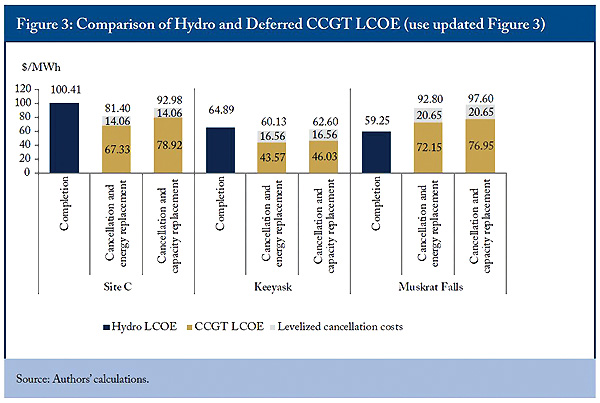

Major hydroelectric power projects, the historic backbone of Canada’s electric system, are facing new challenges from smaller and potentially lower-cost alternatives. In a report published by the CD Howe Institute on January 17, economist AJ Goulding compares the cost of three major hydro projects under construction and found that lower-cost power is readily available in two cases, even when carbon costs are factored in at $50 per tonne.

“Several large-scale Canadian hydro projects now under construction face significant cost overruns and will potentially be uneconomic for decades if completed,” he said.

Mr. Goulding stressed, “It is important to emphasize the value of optionality, which comes with the ability to build in smaller unit sizes. The North American power sector is changing rapidly: demand is slowing or negative, behind the meter production and storage is gradually becoming more economic. At the same time, decentralized power grids are becoming more feasible. Large-scale, centralized, long lead time investments like hydro stations run the risk of becoming stranded assets (assets that are no longer able to recover their costs) before they are even brought online, depending on the pace of technological change. Having the option to build something smaller and later means that provincial utilities can better tailor future investments to updated power sector dynamics, while being able to take advantage of intervening technological changes. Furthermore, the ability to spread these investments across the grid may enhance reliability and resiliency.”

Mr. Goulding concluded, “While the decision to cancel projects is politically difficult, clever regulatory accounting may enable more muted rate increases than those that have already been announced. For example, longer amortization of cancellation costs, coupled with avoidance of future costs, should enable demonstrable ratepayer benefits to be achieved. Provincial utilities sometimes point to current low rates as meaning that rate increases have limited impact. Yet those rate increases, when arising due to uneconomic choices, erode the competitive advantage of those provinces. This advantage is already under threat from lower US tax rates and falling US wholesale power prices as a result of low natural gas prices and substantial renewables production. Cancelling uneconomic projects now is the right choice. Enshrining regulatory independence and private-sector participation will help shield ratepayers from future bad decisions.”

A.J. Goulding is President of London Economics International LLC (“LEI”). He has advised provincially owned hydro companies, IPP associations, and consumer groups on Canadian and international electricity market related issues.