The Government of Alberta (GOA), the Alberta Electric System Operator (AESO), and stakeholders active in the electricity sector are currently engaged in an intensive period of consultations expected to determine the shape of the province’s electricity system for the next decade or more. At stake is the design of a new capacity market, the definition of resource adequacy, and series of other choices that will likely set key aspects of the business conditions for consumers, developers and investors planning to operate in the Alberta electricity sector. Timelines are tight in part because a goal has been fixed to run the first province-wide capacity auction by the end of 2019.

Development of the AESO’s recommendations process

Market participants, electricity industry stakeholders and others interested in the Alberta electricity market have generally acknowledged that the broad outlines of the capacity market design accompanied by eventual changes to the wholesale energy market design must be determined in the next few months. This is primarily because the relevant agencies will need certainty on the basic terms of the market design by the summer of 2018, in order to be ready for the capacity auction a year later.

Development of the AESO’s recommendations process

Market participants, electricity industry stakeholders and others interested in the Alberta electricity market have generally acknowledged that the broad outlines of the capacity market design accompanied by eventual changes to the wholesale energy market design must be determined in the next few months. This is primarily because the relevant agencies will need certainty on the basic terms of the market design by the summer of 2018, in order to be ready for the capacity auction a year later.

The AESO has established five Working Groups to develop the market design in key areas. The AESO is running a series of consultations that will likely interest many market participants, depending on the nature of their business in Alberta. In addition, the Department of Energy (GOA’s Ministry) is coordinating higher level input on policy design through a series of stakeholder sessions to be held in November 2017.

Christine Runge

“The quarterly AESO stakeholder sessions provide an opportunity for parties not participating in the AESO Working Groups to provide input into the Alberta market design,” says Christine Runge, a Senior Consultant with Power Advisory LLC, a consulting group which is working with a number of active parties in Alberta, including generators. In fact, Power Advisory has been retained to represent the Cogeneration Working Group, an alliance of existing cogeneration operators in Alberta, on three of the AESO Working Groups.

Christine Runge

“The quarterly AESO stakeholder sessions provide an opportunity for parties not participating in the AESO Working Groups to provide input into the Alberta market design,” says Christine Runge, a Senior Consultant with Power Advisory LLC, a consulting group which is working with a number of active parties in Alberta, including generators. In fact, Power Advisory has been retained to represent the Cogeneration Working Group, an alliance of existing cogeneration operators in Alberta, on three of the AESO Working Groups.

The remaining quarterly stakeholder sessions are scheduled for December 11, 2017, March 29, 2018, and July 19, 2018. The AESO will post material in advance of each session and provide stakeholders approximately two weeks to submit written comments. However, after that point, in most cases the issues discussed in each session will be considered effectively closed, and the opportunities for input on such issues will be extremely limited. Ms. Runge notes that exceptions are possible. “While some issues will move to a vote quite quickly, on other issues, debate will continue in the Working Group meetings after the stakeholder sessions and to the extent new material is submitted the AESO cannot prevent further stakeholder comment at the next quarterly session.” The AESO explains that a balance needs to be struck between achieving timely progress on design and encouraging stakeholders to participate in the process and comment on issues.

Important to bear in mind, to achieve its goal of completing the capacity market design by July 2018, some of the most important directional design decisions are likely to be finalized following the upcoming stakeholder session in December 2017. Although the stakeholder sessions in 2018 will deal with important issues of their own, the later sessions are expected to focus more on technical issues, interdependencies and implementation, more than on overall terms and direction.

Ms. Runge says, “I would encourage parties to pay attention to the information being distributed by the AESO on a weekly basis. Generators interested in participating in the Alberta market would be well advised to review the published materials well in advance of the December stakeholder session and think about what the implications of various design choices are, so that they are prepared to submit well-developed comments in the week or so following the meeting on December 11.”

Ministry consultations in November

In addition to the stakeholder sessions, the Ministry is running a consultation process expected to reach its peak level of engagement during November 2017. In September, it released a policy paper on the capacity market setting out some of its key principles. Three primary areas are still under exploration: resource adequacy, capacity market stakeholder involvement, and cost allocation. Engagements are expected to take place during November in these areas. Many generators are particularly concerned about the resource adequacy discussions because they could impact the methods used for setting the demand curve in the capacity auction, and GOA targets for capacity to be procured through auction. Decisions on resource adequacy issues could well affect patterns of supply and volatility, the characteristics of supply cushions, and other issues of concern. Prior to the full consultation in November, participants are anticipating a statement from the government with further guidance on its anticipated policy approach. The Ministry will be inviting in-person and written input during November – one of the few opportunities for direct input to the Ministry on Alberta’s market design.

The Ministry recently stated that there are four main areas in which policy questions remain outstanding: governance, capacity costs, managing reliability, and market integration.

AESO consultations on SAM

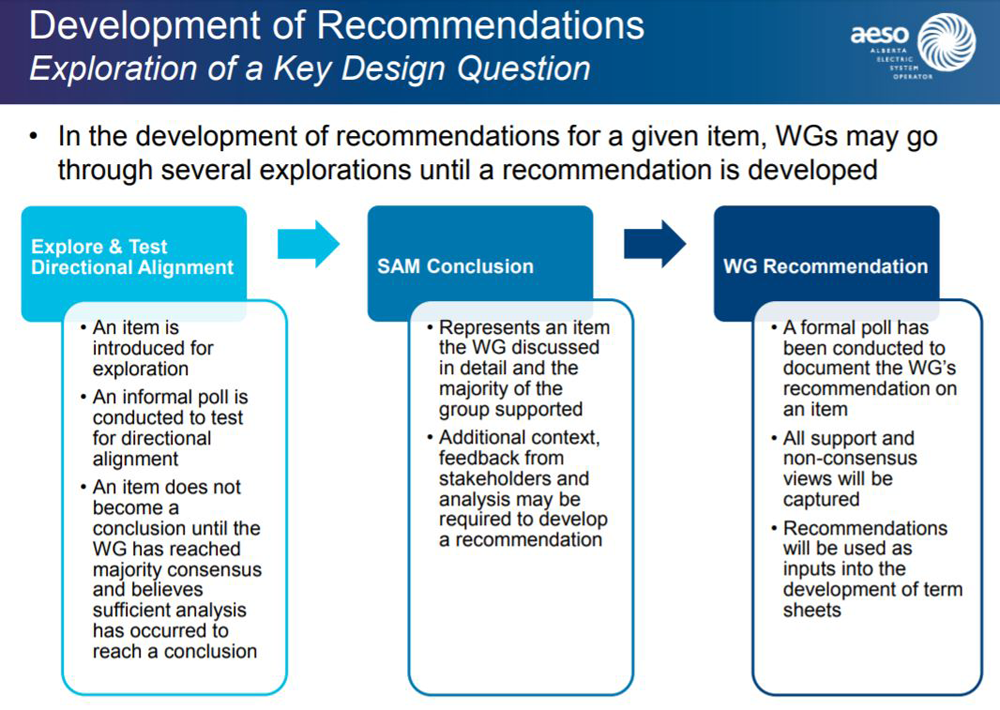

In parallel with the Ministry consultations, the AESO consultation processes will be working on a number of technical design questions between now and July 2018. Members of the AESO Working Groups are on a bi-weekly meeting cycle that ties in with the schedule of the quarterly stakeholder sessions. The intention is to publish the current status and directional alignment of each Working Group in advance of each quarterly session, and to give stakeholders who aren’t on the Working Groups an opportunity to comment on the outcomes from each process through the quarterly sessions. The reviews are organized around the successive development of a proposal known as SAM (Straw Alberta Market). Comments on the SAM 2.0 were posted on the AESO website on September 20.

The five working groups are:

• Adequacy and demand curve determination

• Eligibility and capacity value determination

• Energy and ancillary service market changes

• Market mechanics

• Procurement and hedging.

Why stakeholder input is important

One of the critical questions in the minds of many generators has been how to ensure that the capacity market design is effective from an investment perspective. This could become tied up with the perennially sensitive question of retaining capacity signals in consumer prices. Strong capacity signals are economically efficient, but by the same token, they can often be difficult to implement in policy terms. As many have learned from work in other jurisdictions, whenever new energy market legislation is being contemplated there are powerful reasons to be concerned about the potential for unintended consequences. Generators have raised concerns for example that the capacity market must continue to support the energy market. In particular, many have said that, as a result of the new market design, the capacity market should not unnecessarily remove revenues from the energy market. Stakeholders of all stripes are likely to be watching and weighing in on the safe and advisable methods of designing the legislation, in addition to all the other design work going on at a system level.

It is fair to say that the major players in Alberta’s power market are already involved in the formal consultation processes. However, others who are less aware of the developments in Alberta may not be properly engaged. Ms. Runge says, “If you are not already represented in the Working Groups it is very important to be aware and become active in the quarterly stakeholder consultation sessions if you want your views to be represented.”

APPrO plans to host discussion on these issues in a session focused on the Alberta power market design process at the annual APPrO 2017 Canadian Power Conference this November 21 in Toronto.

For more information:

The AESO design Working Groups web page (including all the material that is reviewed and discussed by working group members): https://www.aeso.ca/market/capacity-market-transition/design-working-groups/

The AESO’s main capacity market web page: https://www.aeso.ca/market/capacity-market-transition/news-and-updates/

Web page of SAM 2.0 stakeholder comments

https://www.aeso.ca/market/capacity-market-transition/news-and-updates/sam-2-0-stakeholder-comments/

Alberta Energy web page: http://www.energy.alberta.ca/Electricity/4467.asp

Capacity Market policy paper from the Ministry – Alberta Energy

The Cogeneration Working Group

The key objective of the Cogeneration Working Group (CWG) is to ensure that the market design supports competition on a level playing field and provides price signals that allow investors to develop efficient generation projects. It is also stressing that it is important to maintain the flexibility of industrial consumers in order to ensure they are able to manage their integrated facilities in the most efficient and cost-effective manner. Playing an active role in multiple consultations for the Alberta market design, the CWG notes that it is “open to adding new members that have a cogeneration facility in Alberta or are considering constructing a cogeneration facility in Alberta, as those parties will have similar positions to the current members.” The CWG is not one of the five AESO market design Working Groups but is a member on three of the AESO working groups.

Members, as of the SAM 2.0 comment date, were:

• TransCanada

• Suncor

• Cenovus

• Canadian Natural (CNRL)

• Dow

• Imperial

• MEG Energy

• Husky

• Nova Chemicals Corporation

• Syncrude

• Lafarge.

Published documents:

• Position on net-to-grid: https://www.aeso.ca/assets/Uploads/2017-08-24-PH-Power-Advisory-CWG-Position-Net-to-Grid-Participation.pdf

• Position on MOPR (Minimum offer price rule): https://www.aeso.ca/assets/Uploads/CWG-Position-MOPR-cover-letter-Final.pdf and https://www.aeso.ca/assets/Uploads/MOPR-position-Background-Material-Final.pdf

• SAM 2.0 comments: https://www.aeso.ca/assets/Uploads/CWG-SAM-2.0-Comment-Matrix.pdf

Parties who submitted comments on the SAM 2.0 paper

The AESO has posted all stakeholder comments regarding SAM 2.0 on its website. The AESO says it “will assign this feedback to the appropriate design stream working groups, and each group will review the feedback and consider it in light of how it may improve the capacity market design recommendations.”

• Alberta Energy Efficiency Alliance

• AltaGas

• AltaLink

• Alberta Newsprint Company

• ATCO

• CanWEA

• Capital Power

• Cenovus

• Canadian Natural Resources Limited (CNRL)

• Cogen Working Group

• Devon

• Direct Energy

• EDF EN Canada

• Emera

• Enbridge

• EnerNOC

• Enmax

• EPCOR

• Energy Storage Canada and Rocky Mountain Power

• IPCAA

• Maxim Power

• City of Medicine Hat

• MEG Energy

• Pembina Institute

• REA working group

• Rodan

• Suncor

• TransAlta

• TransCanada

• Utilities Consumer Advocate (UCA)

Alberta Policy Direction

1. Competitive forces will determine outcomes

2. The principles of fair, efficient, and open competition will apply to the capacity market

3. Consumers will continue to be able to choose their electricity retailer

4. New capacity market framework in place in 2021

5. A centralized obligation to procure capacity will be created and placed on the Alberta Electric System Operator

6. The resource adequacy criterion and targeted capacity amount for the future will be centrally determined

- From “Capacity Market Policy Webinar” presentation by the Government of Alberta, September 11 2017

This article is also available as a posting on LinkedIn where readers can add comments, share and use other social media features.