Excerpted and condensed from a July 15 UBS client call led by Julien Dumoulin Smith, Executive Director, UBS Investment Research. Julien hosted Jason Chee-Aloy, Managing Director of Power Advisory LLC, and Kris Aksomitis, Director in their Calgary office. The three experts discussed Alberta’s evolving electricity market and investment opportunities.

A transformation is under way in Alberta's electricity supply system – specifically, as driven by the increasing role of renewables in the supply mix there. Partly as a result, changes are expected in the structure of the power market, and the implementation will be of interest. There will be implications for incumbents in Alberta's changing supply mix, but also opportunities for new entrants.

By way of an introduction, Alberta is roughly a 16,000 to 17,000 megawatt market, with a peak demand roughly about 11,000 MW. Most of the generation mix right now is fossil, a mixture of coal and gas. The market was restructured around the same time as many of the other markets in North America, in the late 90s. Alberta stands out in one way because it was one of the first to restructure and it's an energy-only market, without a day-ahead market and without locational prices, and no capacity market. The government plans to retire all coal fired generation units by 2030. At present coal accounts for about 6,000 MW, or about 60% of Alberta's energy supply.

To partially make up for the difference, the government plans a procurement program to incent the development of renewable generation in the near future. There will also be opportunities to develop natural gas fired generation as well, to balance the system, as well as an energy efficiency program. The present conversation, however, was to focus on the larger forms of generation that will be connected to the transmission system.

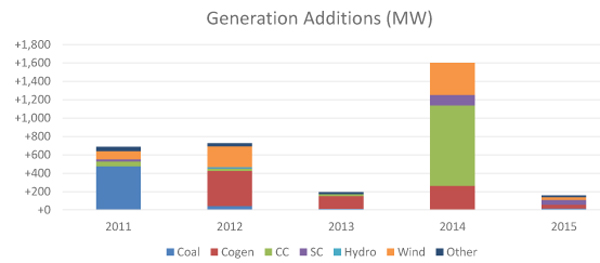

In the last five years generation has grown by over 1000 megawatts, with additions from coal, cogen, combined cycle and simple cycle. As a result, despite being an energy only market over that timeframe, Alberta has attracted a fair amount of investment on a merchant basis. The market is now quite oversupplied. At the same time the recession through low oil prices has hit Alberta.

In the last five years generation has grown by over 1000 megawatts, with additions from coal, cogen, combined cycle and simple cycle. As a result, despite being an energy only market over that timeframe, Alberta has attracted a fair amount of investment on a merchant basis. The market is now quite oversupplied. At the same time the recession through low oil prices has hit Alberta.

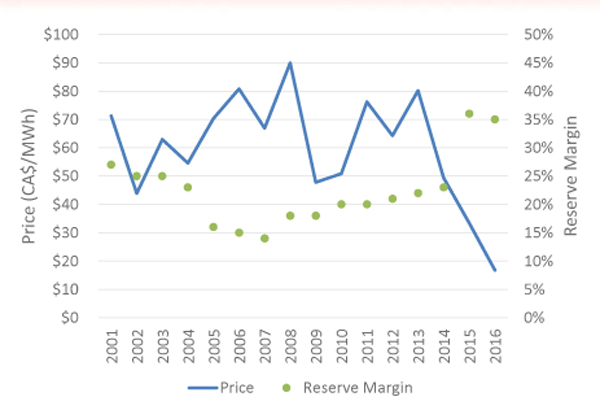

The blue line in the above graph shows the recent history of prices. The individual dots in green show the reserve margin. The dramatic change that hits in 2015 and 2016 is clear, as the market prices dropped to levels that have never been seen in the deregulated market. On top of that, we're seeing a record high reserve margin of 35%, where historically a balanced market in Alberta prior to 2015 has ranged around 20% – as low as 13% up to 27%. So we're looking really at a market that's over 1000 MW over supplied as this new policy is being rolled out.

The blue line in the above graph shows the recent history of prices. The individual dots in green show the reserve margin. The dramatic change that hits in 2015 and 2016 is clear, as the market prices dropped to levels that have never been seen in the deregulated market. On top of that, we're seeing a record high reserve margin of 35%, where historically a balanced market in Alberta prior to 2015 has ranged around 20% – as low as 13% up to 27%. So we're looking really at a market that's over 1000 MW over supplied as this new policy is being rolled out.

The Alberta government wants to replace two-thirds of the present 6,000 MW of coal supply with renewables, which amounts to 4200 MW. For various reasons most of that is likely to be in wind, which has a good track record of being developed in the province. To do that the Alberta electricity system operator (AESO) is designing a procurement, the Renewable Energy Program. It's likely to follow a phased approach, in the form likely of request for proposals over a timeframe starting later this year and stretching out to 2030. That works out to 300 megawatts a year, although the AESO has not yet declared what the phases will look like. Nor have they declared exactly what the design will look like within the REP. The AESO has made its recommendations to the government.

Many of the developers who chased the opportunities in Ontario are now working in Alberta. The resource in Alberta is probably amongst the best in Canada for both wind and solar, so that the costs on the wind side depending on the contract structure could be relatively economic. Solar is trickier because there hasn’t been much solar development yet in Alberta. Capacity factors for wind look to be in the mid to higher 30s for the newest projects and in fact many people believe that the newest technologies in Alberta should be getting closer to 40% capacity factors at the best sites.

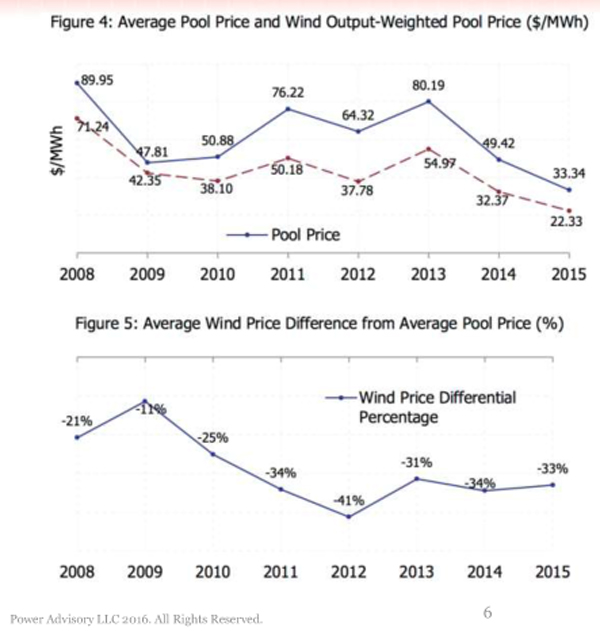

The best wind resource in Alberta is concentrated in just a few areas. When the wind is good, all the turbines are spinning because they're located pretty centrally in the same areas. The wholesale energy price or the pool price that wind actually realizes in the real-time markets is at a discount to the pool prices at other times. That will make contract design tricky.

The best wind resource in Alberta is concentrated in just a few areas. When the wind is good, all the turbines are spinning because they're located pretty centrally in the same areas. The wholesale energy price or the pool price that wind actually realizes in the real-time markets is at a discount to the pool prices at other times. That will make contract design tricky.

Two camps have emerged on that subject. One says, the market works – don't worry about the contract design, just get it going. The other side, that has typically done things through non-recourse project financing, is saying there's a lot of uncertainty. If you leave parts of the contract open to merchant risk, then we'd like that risk addressed with a different type of contract design to enable project financing that could result in overall less expensive projects; a contract for differences, for example.

The discussion turned to the carbon tax that the new government has declared as part of its policy. For the power sector, the tax will be against an emissions standard that will be set in such a way that the new combined-cycle gas plants, that are expected to be built, will pay no tax. The remaining coal-fired plants can expect to face a tax of $18 to $20 per megawatt-hour starting in 2018. That will mean that coal's variable costs, historically $10– $15, will rise to between the high $20s and mid- to high $30s.

The key impact that we're likely to see is a much higher priced floor in the market, from 2018 onwards. These analysts are saying that to date this year we're seeing a lot of prices between $10, $20 due to the oversupply. If nothing else happens in the market aside from the carbon tax, they expect to see a lift to the $30 to $35 range for the majority of hours.

That has some implications for wind generators. It's going to change their realized prices. It's also beneficial for natural gas developers because they'll now have an inherent cost advantage against the coal suite. As a result it’s likely to change “the dynamic of what we're seeing in the day-to-day market.”

The government of Alberta has appointed a negotiator to sit down with the companies that own the coal fired facilities and to hammer out a deal essentially to retire the plants. One thing to bear in mind is, because of Canadian federal regulations, roughly about 3700 MW or so of coal were already scheduled to retire in 2030. Therefore, the negotiations will likely focus on about 2,500 MW of coal that, as you can see from the graphic, weren't scheduled to retire until 2060. The market needs to pay close attention to the outcome of these negotiations because decisions on the retirement schedule of the coal fleet will in part drive development opportunities for renewables and gas-fired generation.

The government of Alberta has appointed a negotiator to sit down with the companies that own the coal fired facilities and to hammer out a deal essentially to retire the plants. One thing to bear in mind is, because of Canadian federal regulations, roughly about 3700 MW or so of coal were already scheduled to retire in 2030. Therefore, the negotiations will likely focus on about 2,500 MW of coal that, as you can see from the graphic, weren't scheduled to retire until 2060. The market needs to pay close attention to the outcome of these negotiations because decisions on the retirement schedule of the coal fleet will in part drive development opportunities for renewables and gas-fired generation.

Historically load growth in Alberta has been strong, but in the last year to 18 months it's become nil to slightly negative. Nonetheless, the AESO's May 2016 forecast still projects growth between two and three percent a year. That's an uncertainty that means Alberta could need new baseload combined cycle capacity as early as 2021. On the other hand, if load growth is dramatically slower, it pushes the need for new capacity to line up with coal retirements. In other words, load growth could drive investment needs as early as 2020, 2021 or it could be as late as the mid-2020s. From the mid-2020s onward what is driving the capacity need is mandatory coal retirements. But in total even in the low load growth scenario that the AESO put forth, they're expecting to need about 7000 megawatts of total new capacity by 2030.

If you ignore load growth, it's probably more like 4500 megawatts of capacity that are needed just to replace the retiring coal and bring the reserve margin back down to historical type levels. But if you take the AESO's numbers, it amounts to total capital spending requirements of around $20 billion. And that's a pretty substantial amount of investment for the Alberta market structure as it's currently set up to attract.

Alberta's market structure is really predicated on scarcity pricing up to the maximum market clearing price, where the vast majority of the value in Alberta's market occurs in a small number of the high priced hours. As the market gets tight and there's not much supply left to be dispensed, the price escalates very rapidly. It's sort of the classic hockey stick type offer curve. In the tightest market hours the average price exceeds $900 per megawatt hour. And then as you get to the rest of the hours where supply exceeds load by over 1400 megawatts, effectively that's marginal cost hours in Alberta. So the value in the market occurs only in those hours where there's not a large amount of excess supply.

Renewables basically challenge that whole model because they reduce the number of hours where scarcity is likely to occur without providing the firm capacity in a smaller number of hours. Therefore, our analysis suggests that the renewables challenge the scarcity pricing model and make it harder for the markets to attract sufficient investment to meet resource adequacy because of the dampening of pool prices and therefore less energy market revenues. Our modeling consistently comes up with the result that the energy only market as it's currently structured with the current base cap will not attract sufficient future generation investment to meet the reliability targets [emphasis added].

On transmission: Power Advisory thinks the transmission planning framework is going to come into question. The AESO produces transmission plans and it's underpinned by regulation, and the general framework in Alberta is to build the transmission to accommodate the generation. Considering that development of renewables will likely not occur in the same location of the retiring coal units, there is potential for new transmission to be developed to accommodate renewables. If this occurs, it will put upward pressure on transmission rates, and Alberta's cost to customer transmission rates are already some of the highest across Canada.

On the stranded cost implications of the planned coal retirements: the newest of the coal-fired plants were built or came online in 2011, and are now facing a mandatory retirement in 2030. That's a lot of stranded capital when you give up 30 years, give or take, of expected operations. There's roughly 2500 megawatts that that conversation applies to. What are the stranded costs that have been created by this policy and how should they be compensated for those costs?

A secondary conversation that should be taking place, but it isn't clear, is how do you stagger coal retirements over the next 15 years in a transparent and sustainable way. Where is the funding for this stranded cost coming from? Is this like a utility distribution level bill adder? The carbon tax itself that they're collecting could be a funder. There's numerous ways they could structure this but it's unclear whether it has been discussed publicly.