Three long-term trends are converging unexpectedly rapidly, causing fundamental change in the global energy landscape, with potentially major impacts on Canada’s energy-based economy. If properly positioned, Canada could lead much of the transition and benefit from supplying both energy and energy technology to global markets in the near future. These are amongst the conclusions of a study recently completed for the government of Canada.

1. The price of batteries is falling precipitously

2. Recent declines in the cost of renewable electricity could continue, and

3. A broad-based shift is underway to “an electricity-dominated global energy mix.”

The report highlights that, “In combination, these drivers could lead to renewable-sourced electricity replacing fossil fuels as the dominant form of primary energy used in the global economy for most industrial, commercial and personal activity.”

Consistent with recent findings from numerous sources around the globe, the “Changing Landscape” report suggests that policy makers at all levels will have to take account of these long term trends to ensure the Canadian economy is properly prepared to supply the energy markets of the future, and that it is not unduly exposed to costs resulting from market disruptions. The report was produced by Policy Horizons Canada, a strategic foresight group within the federal public service.

The research team produced the report by scanning for early signals of change in the global energy system and “exploring the potential for those changes to create alternate plausible futures for energy systems in a timeframe of 10 to 15 years.” Because Canada’s economy is relatively heavily based on the energy industry, the implications for the national economy are both positive and negative: There are opportunities to be a global leader in applying the new technologies, and risks to existing industries using existing technology.

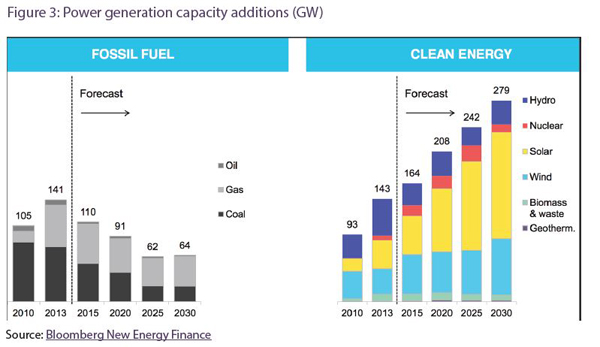

The study authors say, “The world’s energy landscape is transforming rapidly as the cost of renewable-based electricity, particularly from wind and solar, declines to become competitive with or lower than the price of electricity generated by fossil fuel and nuclear power plants. Power utilities and companies are increasingly choosing to increase their generating capacity using renewable sources rather than fossil power as the perceived problems of intermittent supply from solar and wind are addressed with better supply and demand management using a combination of integrated smart grids and battery storage.” At the same time as the fuel sources are changing, there is also a trend toward greater use of electricity: “the shift to an electricity-dominated global energy mix will be accelerated as decreasing costs combine with increasing government and private sector concerns over climate change, energy security and air pollution.”

It notes that “the emergence of cheap, reliable, abundant and non-polluting electricity combined with affordable energy-dense battery storage could accelerate the evolution of an electricity-based technological and industrial ecosystem that could out-compete and largely replace the current fossil-fuel based system.”

The economic benefits could be significant, the study finds: “Canada also has significant potential to increase its total electricity production and to shift its electricity production further to low-carbon sources. These factors place Canada in an enviable position to export low-carbon electricity directly to markets in the U.S. and Mexico. Both economies could be expected to see increasing electricity demand while seeking to reduce their greenhouse gas emissions. The potential for long-distance transmission to further markets could increase as technology advances. Canada could also export technology, software and expertise in electrical energy production, particularly from hydro-electricity, as well as in electricity distribution, management, use and storage. Canada could become a global player in the emerging electrical industrial ecosystem in a number of ways. By hosting data centres, Canada could provide a significant share of the rapidly growing global electrical energy demand from the rising digital economy. As the economy becomes more digitally-based and additive manufacturing expands, many areas of production could be re-shored. Electricity could be exported to support similar re-shoring in the U.S. and Mexico. The cost competitiveness or preference for Canadian products or services produced with clean electrical energy could be increased in a carbon-constrained world. Canada could export low-carbon energy embodied in products or services by attracting production of goods or services that require a lot of electricity but are currently being produced in other countries using relatively high percentages of electricity generated using fossil fuels.”

Facing the risk of disruption directly, the authors find that, “Low cost renewables could challenge Canadian power utilities’ business models. … The potential for unsubsidized and decentralized renewables to produce electricity for the same (or lower) cost as traditional power plants may challenge Canadian utilities to provide cost-competitive electricity under the existing central utility model. In coming years, innovation, increased mass production capacities and market expansion of Asian, European and American companies will continue to drive down the cost of renewable energy devices and could undermine the competitiveness of Canadian central utility models. Canada may face multiple pressures to deregulate its electricity markets to permit greater penetration of renewable energy production and different business models for its distribution. The rapid expansion of renewables, particularly in Asia, may lead to new business models for electricity production and distribution based on the low-cost, scalability and decentralization of renewable energy.

“Renewable energy technology producers could look to expand their global share in foreign markets. Combined with the potential trade liberalization of environmental goods through the conclusion of the Environmental Goods Agreement within the World Trade Organization, foreign-made rooftop photovoltaic power or wind turbines and storage technology may become viable economic options for Canadian electricity consumers owning buildings in commercial, agriculture, institutional, governmental and industrial sectors. Consumers at the individual and corporate level may also drive a shift towards increased share of renewables, which may not be connected to the existing grid, based on their low cost and low carbon emissions.”

At the same time, the cost of electricity from central power plants may become more expensive and the risk of asset stranding appears to be growing: “In the Canadian system in which supply from provincially-owned centralized power plants already meets demand, additions of renewable energy from other actors will offset energy production from the central power plants. Costs of electricity from provincial utilities could increase because large scale nuclear and thermal power plants are optimized for continuous operation. Varying or reducing output from them can reduce their efficiency and increase their cost of operation. Provincial utilities also have debt servicing burdens to cover as well as significant costs associated with maintenance of extensive long-distance transmission lines that may not be required by decentralized renewable-based alternatives. Uncertainty about the time frame in which energy from decentralized renewable systems becomes cost-competitive with central utilities’ energy prices could increase the risk of public investments in state-owned power plants because the revenues from large, capital-intensive new power plants may not be sufficient to service the public debt incurred to build them.”

Risks to the fossil fuel industry may be shifting from a shortage of supply to a shortage of demand. For example, “Transportation may electrify more rapidly than expected.” It says, “A significant shift to electrification of personal transport combined with the potential slowing of demand for transportation of goods and people could result in oil demand peaking sooner and declining faster than forecast. … If these trends were to continue, Canada may find that not all of its petroleum is marketable at prevailing prices, particularly if low-cost producers keep prices low by maintaining or even increasing supplies to keep market share and maximize the sale of their oil assets while oil still has economic value.”

One of the risks in the new landscape could be competition for certain minerals: “Key minerals such as those required for batteries, photovoltaic cells and electric motors may replace petroleum as

strategic energy-related assets.”

Challenging as these findings may be, there are additional benefits to consider: “Renewables enhance national energy security, productivity and economic stability,” the study notes.

The “Changing Landscape report” adds another voice to the increasingly prevalent view that adjustments of historic proportions are underway for the energy sector as a whole, and for the electricity sector in particular.

The report is available online at www.horizons.gc.ca/ > Publications and Events > Publications.

Insights

• The primary energy supply of the globe is shifting to electricity.

• Renewable-based electricity is becoming cheaper than generation by fossil fuels.

• Externality costing will accelerate the shift to renewables.

• Renewables can reduce distribution infrastructure costs.

• Storage solutions are emerging and evolving faster than anticipated.

• Electricity’s flexibility allows it to cross energy silos and substitute for fossil fuels.

• Data management will become a key element of the electrical energy system.

• Heat from renewables could reduce demand for fossil fuels.

• Renewables enhance national energy security, productivity and economic stability.

• Transportation may electrify more rapidly than expected.

Challenges and Opportunities

• A new global energy ecosystem emerges rapidly.

• Competition for emerging energy markets based on technology rather than resources.

• Minerals become strategic assets.

• Oil demand for transportation declines more rapidly than expected.

• Fossil fuels could lose their commodity status leading to splintering of the oil market.

— From the Policy Horizons report.