By JoAnne Butler, David Butters and Barbara Ellard

The Independent Power Producers’ Society of Alberta (IPPSA) conference took place in Banff in the middle of March. Going to IPPSA was an opportunity to catch up with old friends and colleagues, understand what is happening in other markets and also provide a fresh perspective of our own market.

The first panel was entitled “Markets in Course Correction: The Good, the Bad and the Ugly” and had representatives from TransCanada, Calpine and a UK Scholar. Their review of other markets, mostly in the US and the UK, was not only informative, but enlightening – it seems that most other jurisdictions are struggling with the same issues ranging from “missing money” to attract new capacity, changing supply mix resulting in operational issues and a need for renewables integration, increasing total costs but decreasing wholesale prices, to policy objectives such as climate change impacting their electricity markets. Bill Taylor from TransCanada even concluded that Ontario actually didn’t get it wrong.

The first panel was entitled “Markets in Course Correction: The Good, the Bad and the Ugly” and had representatives from TransCanada, Calpine and a UK Scholar. Their review of other markets, mostly in the US and the UK, was not only informative, but enlightening – it seems that most other jurisdictions are struggling with the same issues ranging from “missing money” to attract new capacity, changing supply mix resulting in operational issues and a need for renewables integration, increasing total costs but decreasing wholesale prices, to policy objectives such as climate change impacting their electricity markets. Bill Taylor from TransCanada even concluded that Ontario actually didn’t get it wrong.

Alberta is on the cusp of change and facing some challenges that need to be addressed in the near to medium-term. When Alberta opened its market in 2001, the majority of their existing generation assets were guaranteed their revenues through Power Purchase Agreements (PPAs). The PPAs were a method to ‘virtually’ divest market power through an auction process as the generator remained the owner and operator of the facility. The generator (Supplier) receives a payment for their fixed and operating costs for the length of the contract term (generally 15 to 20 years). The Buyer in turn has the right to dispatch the energy from the facility into the market. Interesting to note is that a few PPAs were not sold in the auction and the counterparty to these PPAs is the Balancing Pool, a government agency, who has control to dispatch and sell the energy from these unsold PPAs into the market. Since market opening, Alberta’s installed generation has increased by over 6,000 MW without any other incentives than their ‘energy-only’ market.

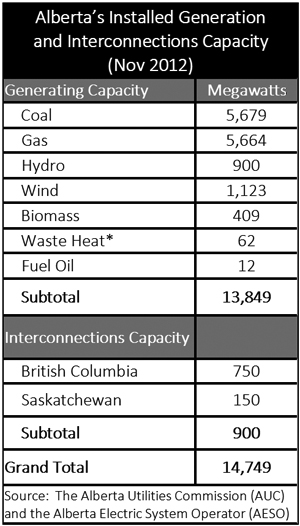

Price seems to be one of the biggest challenges that they face in the upcoming years. Their wholesale market price has been more volatile and overall decreasing as more wind is coming online. How can wind generation be economic in an energy-only market? Alberta has enacted legislation to deal with Greenhouse Gas emissions – it is based on an intensity approach, and large emitters can purchase “offsets” for their emissions in order to meet their targets. So, most of their wind generators have offset agreements that provide them with an additional revenue stream to their energy market revenues. So, while there is no Supply Mix Policy per se, their emissions policy is driving a change in their actual supply mix.

Price seems to be one of the biggest challenges that they face in the upcoming years. Their wholesale market price has been more volatile and overall decreasing as more wind is coming online. How can wind generation be economic in an energy-only market? Alberta has enacted legislation to deal with Greenhouse Gas emissions – it is based on an intensity approach, and large emitters can purchase “offsets” for their emissions in order to meet their targets. So, most of their wind generators have offset agreements that provide them with an additional revenue stream to their energy market revenues. So, while there is no Supply Mix Policy per se, their emissions policy is driving a change in their actual supply mix.

Coming back to wind and market price - as we all know, wind has no marginal energy cost and bids in a $0/MWh and therefore suppressing wholesale market price – which is true for both Ontario and Alberta (and many other markets). The issue for their “traditional” generation fleet is that they are not only running less when the wind blows but they receive less market revenues. And in periods when the wind does not blow, market prices spike. As mentioned, this form of price volatility is central to their market construct as it is the only way to recover fixed costs and also signal and incent new generation in the market. There were calls from a number of panel members for increasing the price ceiling so that generators can recover more of their fixed costs during the few times when prices spike way above their marginal cost. So, how do consumers deal with this price volatility?

The majority of residential customers (which interestingly represent less than 15% of the overall demand) are on the “Rate Regulated Option (RRO)” which is a monthly fixed price based on the forward price for the next month – while this seems to insulate most consumers from the daily and hourly price variations; it has caused some backlash from consumers. In months when the RRO was significantly higher than in previous months, consumers reacted. And how did they react? Well, just like Ontarians, they call their local Member of the provincial Legislature. Ron Liepert, a former Minister of Energy in Alberta, stated at the conference that rising electricity prices are a huge concern for voters and hence politicians, and that “political courage” to let market forces prevail “goes out of the window prior to an election”. He made it clear that Government may interfere when customers/voters are not happy. His advice was that improved communications in the sector will assist customer satisfaction which in turn ensures that government will continue to let the market ‘sort it out’.

As mentioned, opinions in Alberta are very split on whether the market, as is, will survive. Most investments have been made by ‘big companies’ based on balance sheet financing only. It seems that project financing is an impossible undertaking as no financiers are willing to take the risk of the Alberta market in the long-term. Both key note speakers Dawn Farrell (CEO of TransAlta) and Alex Pourbaix (President, Energy and Oil Pipelines, of TransCanada Energy) made it very clear that the Alberta market needs to look at changes. Existing assets will face a challenge once the PPAs expire by the end of the decade. And also it seems that neither of their companies would make any new investments in Alberta as long as it is an energy-only market. As the companies that can do this on their balance sheet, it is a sign that Alberta needs to have a dialogue on how to move forward and adapt their market construct to ensure that needed investments take place.

With the new federal emissions regulations forcing Alberta to essentially phase-out of their coal-fired generation by 2020, new generation assets are required. And the big question is how to do that while addressing the politically-sensitive issue of price volatility. It will be key for Albertans to continue the conversation on the future of their market and how to introduce changes, if at all, in a well-thought-out manner. While Ontario had its “high noon” a decade ago when residential electricity rates were frozen, followed by the creation of the OPA as a credit-worthy counterparty, it will be interesting to watch who wins this upcoming Alberta shoot-out.