Calgary: A National Energy Board report, released November 22 and examining energy trends in Canada, projects that Canada’s energy supply to 2035 will grow to record levels and energy markets will function well, providing Canadians with adequate energy.

To gather information for the 64-page report, Canada’s Energy Future: Energy Supply and Demand Projects to 2035, the NEB held cross-Canada consultations last spring to seek the views of Canadian energy experts and other interested stakeholders, and then conducted its own extensive quantitative analysis.

NEB Chair Gaétan Caron said, “This document is a means for the NEB to fulfill our vision of contributing to the pursuit of a sustainable energy future for Canada. The 2011 report, which is based on cross-Canada research, shows Canadians can be confident about their energy future.”

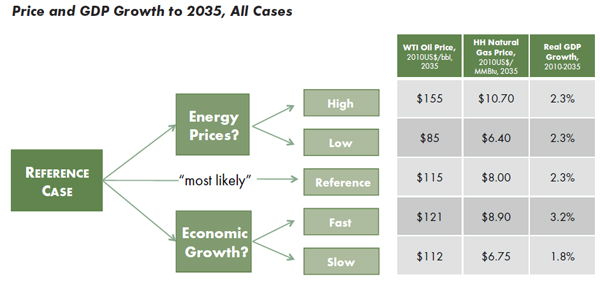

Among key findings in the report, based on a moderate “mostly likely” view of future energy prices and economic growth, are:

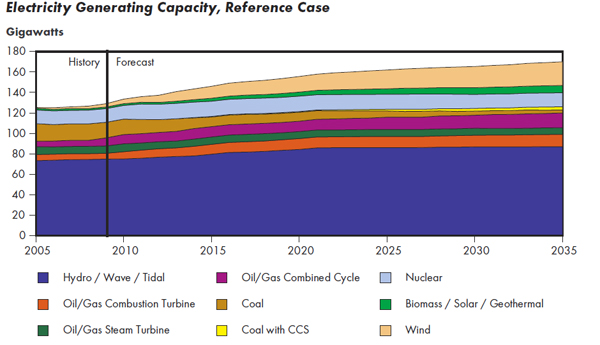

• Although energy from fossil fuels will remain the dominant source of supply, emerging fuels and technologies will gain market share as policies and programs promote growth in these areas.

• The share of biofuels in transportation-sector energy consumption triples over the projection period, from 1.1 per cent to 3.3 per cent in 2035, while the share of renewable-based electricity generation increases from 62 per cent to 67 per cent in 2035.

• Energy supply will grow to record levels fuelled by the emergence of unconventional production such as oil sands, shale gas and tight gas, and – in the area of power production – construction of new generating capacity to meet steadily increasing demand.

• Total end-use energy demand growth will slow to 1.3 per cent during the projection period, down from 1.4 per cent from 1990 to 2008.

• Factors reducing demand include slowing population growth, higher energy prices, lower economic growth, and enhanced efficiency and conservation programs. While demand will slow considerably in the residential, commercial and transportation sectors, it will be partially offset by industrial-sector demand growth.

• The industrial sector accounted for almost half of Canadian energy demand in 2010. Net crude oil available for export will more than triple by 2035, and net electricity available for export will double in that period.

• The amount of natural gas available for export is expected to gradually decline until 2020 due to increased Canadian demand for natural gas. After 2020, production growth and demand growth will be about the same.

The document also outlines four additional cases based on high and low energy prices, and fast and slow economic growth. To view the report and detailed data used to develop it, visit the Energy Reports section on the main page of the NEB website at http://www.neb-one.gc.ca.