Boulder, CO: The economics guiding US investments in electricity generation have reached a historic tipping point: combinations of solar, wind, storage, efficiency and demand response are now less expensive than most proposed gas power plant projects. According to a report released September 9 by Rocky Mountain Institute (RMI), portfolios of these clean energy resources can provide the same energy and reliability services as traditional gas power plants — but cost less.

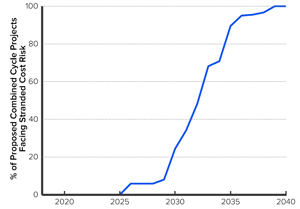

Percent of proposed combined-cycle gas plants that, if built, will face stranded cost risk

This new economic reality has profound implications for electricity consumers and industry investors, RMI emphasizes. Currently, there is an estimated $90 billion of planned investment in new gas-fired power plants and over $30 billion of planned investment in proposed gas pipelines. If clean energy replaces the proposed gas plants, consumers could save $29 billion, according to the report, The Growing Market for Clean Energy Portfolios.

Percent of proposed combined-cycle gas plants that, if built, will face stranded cost risk

This new economic reality has profound implications for electricity consumers and industry investors, RMI emphasizes. Currently, there is an estimated $90 billion of planned investment in new gas-fired power plants and over $30 billion of planned investment in proposed gas pipelines. If clean energy replaces the proposed gas plants, consumers could save $29 billion, according to the report, The Growing Market for Clean Energy Portfolios.

For investors, the report highlights the significant risk that proceeding with announced projects will result in stranded costs. By the mid-2030s, as clean energy prices continue to fall, building a new portfolio of clean energy resources will become less costly than continuing to pay the operating costs of a combined-cycle gas plant, and such a portfolio will provide the same level of energy, capacity and reliability services.

These cost trends could lead to the economic retirement of plants representing over 90% of currently proposed new combined-cycle gas capacity by 2035, resulting in a significant risk of investment capital becoming stranded. Just as coal plants have retired due to competition from low-priced natural gas in the past 10 years, the ongoing cost declines in wind, solar and battery technologies threaten to do the same to natural gas plants by the mid-2030s, according to the report. The report notes examples from Colorado, Michigan, Indiana, California and other states across the country where this trend is already on display and causing industry leaders to prioritize investment in clean energy instead of new gas infrastructure.

A companion study by RMI examines the implications of this dynamic on the economics of new gas pipelines. The report, “Prospects for Gas Pipelines in the Era of Clean Energy,” shows that power plant gas use has driven the overall increase in US natural gas consumption over the past 20 years—expectations that this growth will continue underpin the economics of proposed new pipelines.

RMI suggests that because clean energy already outcompetes gas power plants and will soon lead to their early retirement, the underlying economic justification for new pipelines is now in question. The report finds that over 95% of gas use in proposed gas-fired power plants across much of the eastern United States could be economically offset by clean energy by 2035, reducing the utilization of proposed new gas pipelines by between 20% and 60%.

The reports conclude with implications and recommendations for investors, regulators and planners, suggesting ways to capture the opportunities at hand and avoid the risks of uneconomic gas investments. In particular, the reports recommend that regulators and utilities carefully assess their systems’ needs and use open, technology-neutral planning processes to guide investment in the most economic solutions.