London and New York: Deep declines in wind, solar and battery technology costs will result in a grid nearly half-powered by the two fast-growing renewable energy sources by 2050, according to the latest projections from Bloomberg NEF (BNEF), in its New Energy Outlook 2019, released June 18.

Each year, NEO compares the costs of competing energy technologies through a levelized cost of energy analysis. This year, the report finds that, in approximately two-thirds of the world, wind or solar now represent the least expensive option for adding new power-generating capacity. Electricity demand is set to increase 62%, resulting in global generating capacity almost tripling between 2018 and 2050. This will attract $13.3 trillion in new investment, of which wind will take $5.3 trillion and solar $4.2 trillion. In addition to the spending on new generating plants, $840 billion will go to batteries and $11.4 trillion to grid expansion.

Each year, NEO compares the costs of competing energy technologies through a levelized cost of energy analysis. This year, the report finds that, in approximately two-thirds of the world, wind or solar now represent the least expensive option for adding new power-generating capacity. Electricity demand is set to increase 62%, resulting in global generating capacity almost tripling between 2018 and 2050. This will attract $13.3 trillion in new investment, of which wind will take $5.3 trillion and solar $4.2 trillion. In addition to the spending on new generating plants, $840 billion will go to batteries and $11.4 trillion to grid expansion.

Matthias Kimmel, NEO 2019 lead analyst, said: “Our power system analysis reinforces a key message from previous New Energy Outlooks – that solar photovoltaic modules, wind turbines and lithium-ion batteries are set to continue on aggressive cost reduction curves, of 28%, 14% and 18% respectively for every doubling in global installed capacity. By 2030, the energy generated or stored and dispatched by these three technologies will undercut electricity generated by existing coal and gas plants almost everywhere.”

Europe will decarbonize its grid the fastest with 92% of its electricity supplied by renewables in 2050, the report forecasts. Major Western European economies in particular are already on a trajectory to significantly decarbonize thanks to carbon pricing and strong policy support. The U.S., with its abundance of low-priced natural gas, and China, with its modern fleet of coal-fired plants, follow at a slower pace.

China sees its power sector emissions peaking in 2026, and then falling by more than half in the next 20 years. Asia’s electricity demand will more than double to 2050. At $5.8 trillion, the whole Asia Pacific region will account for almost half of all new capital spent globally to meet that rising demand. China and India together are a $4.3 trillion investment opportunity. The U.S. will see $1.1 trillion invested in new power capacity, with renewables more than doubling its generation share, to 43% in 2050.

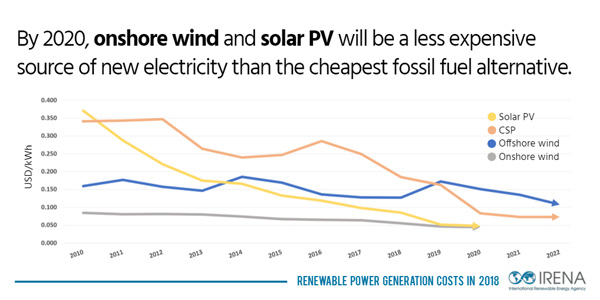

A recent report by the International Renewable Energy Agency (IRENA) comes to similar conclusions, finding that renewable power is the cheapest source of electricity in many parts of the world already today.

The costs for renewable energy technologies decreased to a record low last year, IRENA’s Renewable Power Generation Costs in 2018 says. The global weighted-average cost of electricity from concentrating solar power (CSP) declined by 26%, bioenergy by 14%, solar photovoltaics (PV) and onshore wind by 13%, hydropower by 12% and geothermal and offshore wind by 1%, respectively.

Cost reductions, particularly for solar and wind power technologies, are set to continue into the next decade, the new report finds. According to IRENA’s global database, over three-quarters of the onshore wind and four-fifths of the solar PV projects that are due to be commissioned next year will produce power at lower prices than the cheapest new coal, oil or natural gas options. Significantly, they are set to do so without government or ratepayer financial assistance.

Onshore wind and solar PV costs between three and four US cents per kilowatt hour are already possible in areas with good resources and enabling regulatory and institutional frameworks. For example, record-low auction prices for solar PV in Chile, Mexico, Peru, Saudi Arabia, and the United Arab Emirates have seen a levelized cost of electricity as low as three US cents per kilowatt hour (USD 0.03/kWh).

Bloomberg’s NEO finds that wind and solar will be capable of reaching 80% of the electricity generation mix in a number of countries by mid-century, with the help of batteries, but going beyond that will be difficult and will require other technologies to play a part – with nuclear, biogas-to-power, green hydrogen-to-power and carbon capture and storage among the contenders.

BNEF’s NEO director, Seb Henbest commented: “Our analysis suggests that governments need to do two separate things – one is to ensure their markets are friendly to the expansion of low-cost wind, solar and batteries; and the other is to back research and early deployment of these other technologies so that they can be harnessed at scale from the 2030s onwards.”