A recent report suggests that battery storage has significant opportunities to make inroads into markets currently served by gas-fired peaking plants. GTM Research has found that, with about 120 GW of gas-fired peaker plants in the US, the fleet has a median capacity factor of just 3%.

Within 9 years, 4-hour storage always wins over gas-fired peakers on cost. 4-hour storage would be enough to meet peaker needs about 40% of the time

GTM notes that 91.5 GW worth, or 84% of that total capacity, had an average capacity factor of 10% or less. 73%, or 80 GW of that capacity is used for 8 hours at a time or less, every time it’s started up. In other words, most of the time these peaker plants ran for a length of time that a battery storage facility could also supply before the batteries were drained.

Within 9 years, 4-hour storage always wins over gas-fired peakers on cost. 4-hour storage would be enough to meet peaker needs about 40% of the time

GTM notes that 91.5 GW worth, or 84% of that total capacity, had an average capacity factor of 10% or less. 73%, or 80 GW of that capacity is used for 8 hours at a time or less, every time it’s started up. In other words, most of the time these peaker plants ran for a length of time that a battery storage facility could also supply before the batteries were drained.

Then, looking at capacity factor plus run time together, 67% of those peaker plants were used less than 10% of the time and never ran for more than 8 hours at a time. Looking at the median for those figures, median capacity factor was 3%, and median duration of a unit’s operation per start, i.e., every time it ran, was 5.2 hours.

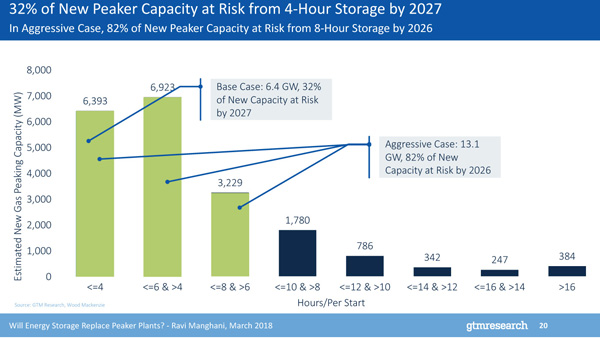

The US has 20 additional GW of gas peakers planned for the next decade, GTM says. Under GTM’S aggressive price scenario, 82% of 8-hour storage would be competitive on price with gas-fired peakers by 2026.

GTM’S analysis is based on lithium-ion batteries. Other technologies would result in a somewhat different analysis. For example, the research firm explains, flow batteries can easily add more capacity to accommodate longer peak demand. It’s also possible for gas plant facilities to add battery storage for their faster response times. In addition, adding the other potential values that storage can fulfil, such as energy arbitrage or ancillary services, changes the analysis in a still more favourable direction for storage.