An industry-led Task Force on Climate-related Financial Disclosures (TCFD) released its Recommendations on Climate-Related Financial Disclosures in Late June. The Task Force, chaired by Michael R. Bloomberg, was established by the international Financial Stability Board in December 2015 to develop a set of voluntary, consistent disclosure recommendations for use by companies in providing information to investors, lenders and insurance underwriters about their climate-related financial risks.

The TCFD developed four recommendations on climate-related financial disclosures that are applicable to organisations across sectors and jurisdictions. The recommendations are structured around four thematic areas:

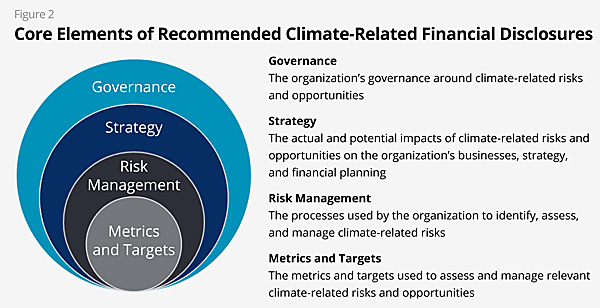

The TCFD developed four recommendations on climate-related financial disclosures that are applicable to organisations across sectors and jurisdictions. The recommendations are structured around four thematic areas:

• Governance: The organisation’s governance around climate-related risks and opportunities.

• Strategy: The actual and potential impacts of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning.

• Risk Management: The processes used by the organisation to identify, assess and manage climate-related risks.

• Metrics and Targets: The metrics and targets used to assess and manage relevant climate-related risks and opportunities.

Speaking about the work of the Task Force, FSB Chair Mark Carney said “The Task Force’s recommendations have been developed by the market for the market. They set out the disclosures that a wide range of users and preparers of financial filings have said are essential to understanding a company’s climate-related risks and opportunities. Widespread adoption will provide investors, banks and insurers with that information, helping minimise the risk that market adjustments to climate change will be incomplete, late and potentially destabilising.”

Speaking about the final recommendations, Michael R. Bloomberg said “Climate change presents global markets with risks and opportunities that cannot be ignored, which is why a framework around climate-related disclosures is so important. The Task Force brings that framework to the table, helping investors evaluate the potential risks and rewards of a transition to a lower carbon economy. We’re pleased to see so many businesses and investors around the world support the recommendations of the TCFD and hope others will be encouraged to join our initiative.

More than 100 firms, with market capitalisations of over $3.3 trillion and financial firms responsible for assets of more than $24 trillion, have provided statements of support to welcome the recommended disclosures and encourage take-up of the TCFD recommendations.

The Financial Stability Board describes itself as an international body that monitors and makes recommendations about the global financial system. It seeks to promote international financial stability “by coordinating national financial authorities and international standard-setting bodies as they work toward developing strong regulatory, supervisory and other financial sector policies. It fosters a level playing field by encouraging coherent implementation of these policies across sectors and jurisdictions.”