2015 has been shaping up as a watershed year for the low-carbon economy, investment giant Goldman Sachs says in a study released November 30. Wind and solar are on track to exceed 100 GW in new installations for the first time. Meanwhile, market capitalization of the top four US coal companies has dropped by over 90% in 2015 as they have struggled with a combination of cheap gas, renewables, emission regulations and weak exports. In the UK, the government has announced that coal-fired power generation will cease altogether by 2025.

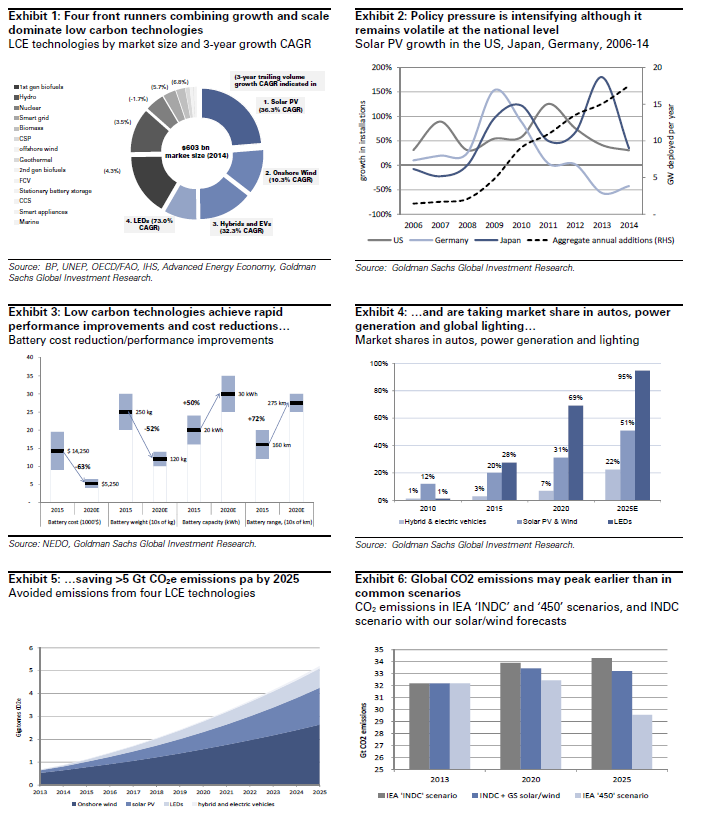

“While the policy debates often center on 2030 forecasts and 2050 targets,” the authors say in an overview, “we expect the greatest market dislocations to occur between 2015 and 2025. We estimate that in 2015-2020, new wind and solar installations will add the oil equivalent of 6.2 mn barrels per day (mbpd) to global energy supply. This is more than the 5.7 mbpd US shale oil production added over 2010-15. Our analysts expect China to add 23 GW coal and 40 GW gas power capacity by 2020, but this compares to 193 GW of wind and solar the country will add at the same time. In lighting, our analysts forecast that LEDs will account for 69% of light bulbs sold and over 60% of the installed global base by 2020. In autos, our analysts expect carmakers to sell c.25 mn hybrid and electric vehicles by 2025 – 10x more than today and a $600 bn+ revenue opportunity.”

“While the policy debates often center on 2030 forecasts and 2050 targets,” the authors say in an overview, “we expect the greatest market dislocations to occur between 2015 and 2025. We estimate that in 2015-2020, new wind and solar installations will add the oil equivalent of 6.2 mn barrels per day (mbpd) to global energy supply. This is more than the 5.7 mbpd US shale oil production added over 2010-15. Our analysts expect China to add 23 GW coal and 40 GW gas power capacity by 2020, but this compares to 193 GW of wind and solar the country will add at the same time. In lighting, our analysts forecast that LEDs will account for 69% of light bulbs sold and over 60% of the installed global base by 2020. In autos, our analysts expect carmakers to sell c.25 mn hybrid and electric vehicles by 2025 – 10x more than today and a $600 bn+ revenue opportunity.”

The advance of the various low-carbon technologies is being driven by a combination of policy support, market acceptance, technical advances and cost reductions, in the authors’ analysis:

(1) A low carbon footprint attracts regulatory incentives and investment (2009-14 solar & wind investment was >$1 tn).

(2) R&D and rapid volume growth deliver cost reductions and performance improvements (we expect >60% lower cost and >70% range improvements for EV batteries by 2020).

(3) This transforms niche applications into viable alternatives to incumbent technology (LED market share has gone from 1% in 2010 to 28% in 2015), which

(4) drives customer acceptance and allows continued scaling (we expect sales in grid connected vehicles to increase 7.7x by 2020 to 2.5 mn vehicles). In turn, this

(5) reinforces regulatory support and drives further cost reductions (China just increased its 2020 solar target by 50% to 150 GW, India raised its 2022 target 5x to 100 GW).

Excerpted from “The Low Carbon Economy” by Goldman Sachs, November 20 2015.