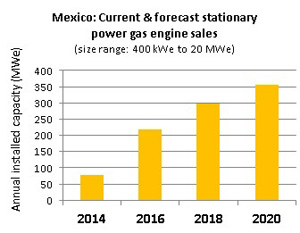

Research by Delta–Energy & Environment suggests that Mexico will become a ‘Global Top 10’ market for gas engines by 2020. The following is excerpted from their blog.

Mexico’s energy reform is likely to herald increased activity in the field of distributed power. Since the Mexican government passed an historic energy bill in December 2013 - paving the way for deregulation of the electricity sector and bringing to an end state-owned CFE’s monopoly of the market - Delta-ee has witnessed growing evidence that Mexico is currently undergoing a period of sustained market growth, particularly in the field of stationary power gas engines.

Mexico’s energy reform is likely to herald increased activity in the field of distributed power. Since the Mexican government passed an historic energy bill in December 2013 - paving the way for deregulation of the electricity sector and bringing to an end state-owned CFE’s monopoly of the market - Delta-ee has witnessed growing evidence that Mexico is currently undergoing a period of sustained market growth, particularly in the field of stationary power gas engines.

Prior to the “Electricity Law” being passed, the industry was governed by a restrictive legal framework and private investment in Mexico’s electricity infrastructure was limited to a small number of centralised generation projects; transmission and distribution sectors were completely out of bounds. Retail tariffs were set by the Department of Finance, resulting in prices rising and falling according to political impulses rather than economic realities.

Today, a competitive power sector is slowly starting to emerge. While it will likely take many years – if not a decade or more – to result in a fully functioning, market-oriented industry, we are already beginning to witness green shoots of progress.

So what will drive the gas engine market forward?

• Rising Electricity Demand: Perhaps the single biggest driver will be the almost insatiable demand for electricity.

Increasing electricity demand has followed the upward trend carved by Mexico’s strengthening economy in recent years, and forecasts suggest that Mexico will average annual 3.5% increases in electricity demand over the next 10 years. Independent Power Producers are likely to be the primary beneficiaries from this trend, and gas engines will almost certainly play a key role with gas set to account for over two-thirds of all new generating capacity coming online in the next decade.

• Cheap gas from US: Currently, cheap shale gas from north of the border is flooding in to Mexico, driving down domestic gas and electricity prices. And plans are in place to build new cross-border pipelines, further supporting the prospect of a future electricity sector underpinned by gas.

• Clean Energy Certificates: To help Mexico meet its target of obtaining 35% of electricity from clean sources by 2024, a programme of Clean Energy Certificates (CELs) is being introduced. CELs will be awarded to generators of clean energy, including renewable sources such as wind and solar, and also high-efficiency facilities using fossil fuels. For gas engines, this is good news. Biogas and landfill gas projects will be awarded with CELs for every MWh of electricity they generate. And natural gas-fuelled co-/tri-generation facilities will also benefit from CELs for the proportion of electricity that is deemed to be ‘clean’.

For more information on Delta-ee’s Distributed Power Service, including in-depth segmented data, forecasts or analysis on global distributed power markets, please contact: John Murray, Delta-ee Distributed Power Service Manager –

Reprinted with permission. Original entry at http://www.delta-ee.com/delta-ee-blog/entry/mexican-wave-of-new-gas-engine-projects