A survey of US utility executives confirms that most of them believe their future lies in distributed generation and related businesses. Many uncertainties lie ahead of course, and as a result a great deal of attention is likely to be focused on systems designed to manage a shift from highly centralized grid designs to network designs heavily loaded with DG. “If utilities abandon traditional utility profit centers of the past, regulators must enable them to adopt new business models,” says Utility Dive in its “2015 State of the Electric Utility” report, published in association with Siemens. Utility Dive surveyed 433 U.S. electric utility executives to prepare the report.

• Utilities will move away from the traditional vertically integrated utility model towards a more distributed, service-based model.

• The industry’s three biggest growth opportunities are distributed energy resources, the customer relationship, and transmission.

• The industry’s three most pressing challenges are old infrastructure, the aging workforce, and the current regulatory model.

• The vast majority of utilities are seeing minimal, stagnant or even negative load growth in their service territories. The industry is undecided on how to best address the issue of depressed electricity sales growth.

• Utilities plan to use more natural gas, solar, wind, distributed energy resources, and energy efficiency over the next 20 years. Meanwhile, the industry expects to use significantly less coal and oil.

• Utilities see a big opportunity in distributed energy resources, but are unsure of the best business models.

The report went on to say, “... policies and regulations were designed for a system where utility revenue stems from electricity sales, not energy savings. Utilities think it’s time to shed some of these old rules. ... Energy efficiency cannot be a utility business model without a new regulatory model.”

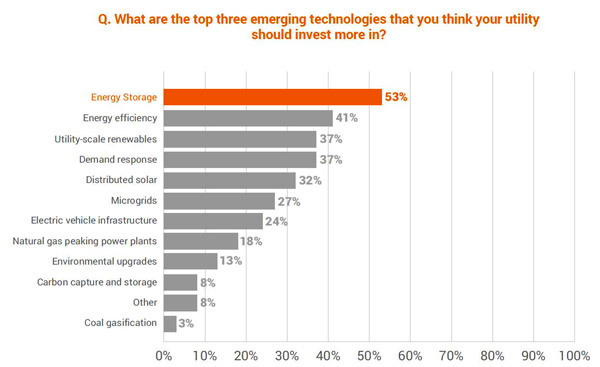

Executives were surprisingly bullish about storage capacity as an investment. More than half think it’s one of the best investment opportunities in the industry.

The report contained many more findings and is available online through Utility Dive (“State of the Electric Utility Report”).