Originally published under the title, "The British Capacity Market: Reflections on a Visible Hand," issue #11, December 2014, in Energy Market Insights, a publication by NERA Economic Consulting.

By George Anstey and Marco Schönborn

Editorial note by Jonathan Falk, Vice President: Capacity markets for electricity occupy an odd space in human endeavour. They are a market that only exists because of distrust in markets. Rather than the spontaneous creation of buyers and sellers to find benefits from trade, they are regulatory mechanisms to compel transactions that parties are unwilling to commit to in the absence of the mechanism. There are no incentives to participate on the buy-side, only force, and the incentives to participate on the sell-side are blunted by regulations to ensure that no party is seen to profit unnecessarily. If they weren’t called capacity “markets,” they would be largely unrecognisable as markets at all. Markets are led to efficiency “by an Invisible Hand” but regulatory intervention is all too visible, and, by at least the best-connected parties, manipulable. George Anstey and Marco Schönborn explore some of the interesting facets of a world in which market-sceptics become market-makers.

Overview1

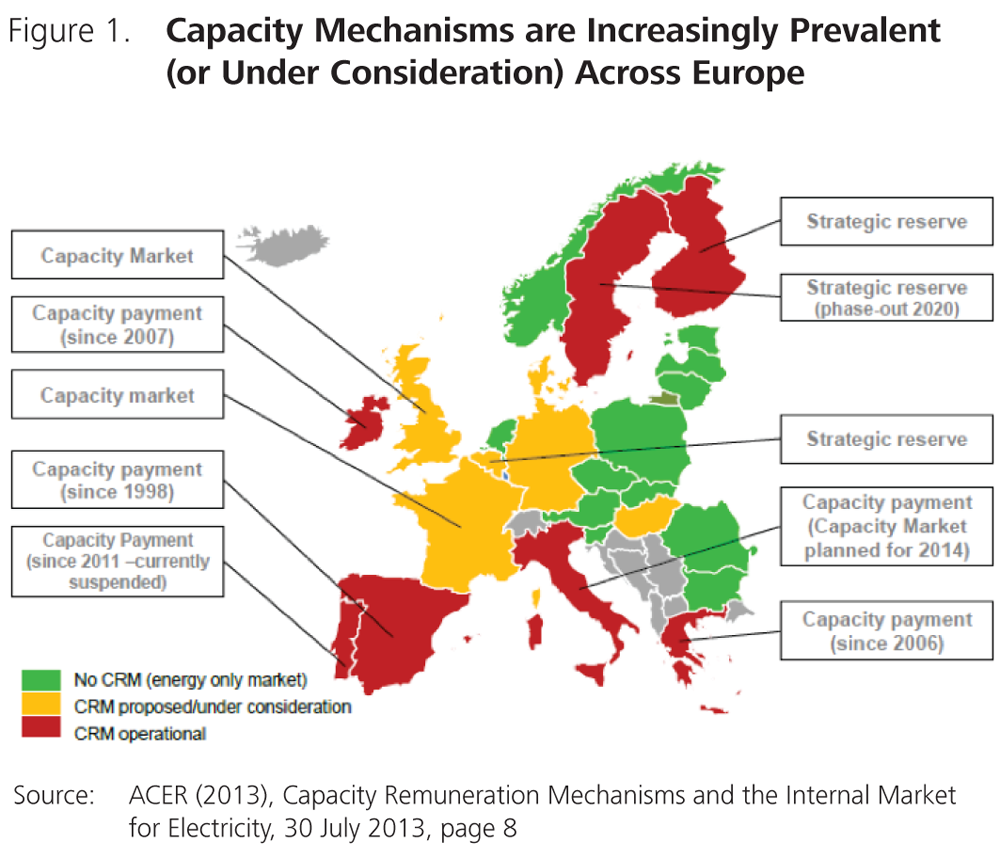

Europe is in the middle of a debate that will reshape its electricity markets. National authorities are gradually implementing EU policy initiatives with the objective of completing the single market in energy and achieving European renewable energy targets. At the same time, growing integration of intermittent generation and a general distrust of markets is prompting governments across the EU to review possible interventions to protect security of supply, foremost among which are capacity mechanisms. ACER’s examination of capacity remuneration mechanisms and the internal market for electricity, published last year, set out the then-current state of capacity mechanisms across Europe (see Figure 1). Since then, capacity markets have been adopted in Belgium and Italy and national authorities have plans to replace the payment mechanism in Ireland with a market as well.

The debate about the future of capacity mechanisms is currently particularly strong in Europe’s largest energy market, Germany. The German government is on the brink of deciding the future shape of the electricity market, having published a green book in October 2014 which will be followed by a white paper by the end of May 2015. The background to the debate in Germany is that electricity generators have closed or mothballed a number of conventional plants over the last few years as ever more renewable generation comes on the market. A reduction in supply capacity is a natural consequence of a market marked by excess supply – as is the case at the moment. Yet the question emerges as to what extent the liberalised energy-only market coupled with significant intermittent renewable generation will be able to incentivise efficient investments in conventional generation going forward and therefore to “keep the lights on” in the long-term.

The debate about the future of capacity mechanisms is currently particularly strong in Europe’s largest energy market, Germany. The German government is on the brink of deciding the future shape of the electricity market, having published a green book in October 2014 which will be followed by a white paper by the end of May 2015. The background to the debate in Germany is that electricity generators have closed or mothballed a number of conventional plants over the last few years as ever more renewable generation comes on the market. A reduction in supply capacity is a natural consequence of a market marked by excess supply – as is the case at the moment. Yet the question emerges as to what extent the liberalised energy-only market coupled with significant intermittent renewable generation will be able to incentivise efficient investments in conventional generation going forward and therefore to “keep the lights on” in the long-term.

In this article, we describe the recent introduction of a capacity mechanism in Britain and draw out lessons for continental-European markets undergoing a similar process, with particular reference to the German market. We start with how Britain ended up with a capacity market, what the market itself looks like and how the market continued to change in the run up to the first auction, with plans for further adjustments for future auctions. Capacity markets will only prove an effective solution to security of supply problems if the capacity market itself can provide credible signals for investment. With the first auction just concluded, the jury is still out on whether the British mechanism will be able to offer those signals.

A Capacity Market is a Centrally-Planned Response to a Perceived Market Failure Problem

EMR began life in early 2010 with a high-level options paper, in which the government stated its priorities for reform of the electricity market were to “effectively deliver secure supplies, the low-carbon investment needed in the long-term and a fair deal for the consumer”.2 Nearly five years later the first capacity market auction, aimed at improving security of supply, finished on 18 December and provisional results were released the following day.3 The auction offers the first payment for capacity in the British market since the abolition of the England & Wales Pool, and with it the VOLL×LOLP payments,4 fourteen years ago.

It was not inevitable from the outset of the process that EMR would result in a capacity payment or what form it would take. In March 2010, the government’s Energy Market Assessment (EMA) recognised that introducing sharper price signals in the market (“cash-out reform”) or a capacity mechanism could be potential substitutes to achieve security of supply.5

However, by the time of the publication of the consultation document for EMR in December that year, the government had decided an additional capacity remuneration mechanism would be necessary.6 Without any obvious underlying economic reasoning, the government argued that investors would under-invest in peaking plant as a result of uncertainty over whether they would actually capture peak prices and that might cause low capacity margins in some years.7 The German government itself has relied on much the same reasoning by arguing that the “crux of the debate is the question of whether a liberalised market will invest in rarely-used but necessary capacity”.8 Analysis published by the British regulator, Ofgem, suggested that reserve margins would only be improved by 1-2 per cent by sharpening cash-out prices. At the time, this potential increase in the reserve margin was insufficient to assuage the government’s concerns.9

As far as we know, the British government never fully explained why it believed the market would fail to deliver the efficient mix of capacity. In principle, if prices reflect marginal costs, including the costs of curtailment at peak times, a competitive energy-only market will remunerate all capacity including peaking plant. In practice, electricity markets may fail to reflect the marginal costs of electricity for a number of reasons, including explicit caps on market prices in the market rules or implicit caps on prices in the form of political or regulatory intervention.10 Such price caps can take a number of guises. In Britain, for example the rules of the balancing market set prices equal to average costs of the last 500 MW of accepted bids instead of the true marginal costs. In Germany, the push for renewable technologies, especially solar power, as well as the uncertainty about their future development can have significant repercussions on peak pricing. The standard argument for capacity remuneration mechanisms in the economic literature is that they provide an additional source of value and replace the “missing money” that results from these price caps.

The British Capacity Market is Market-Wide because Targeted Mechanisms Would Not Replace the “Missing Money”

In 2010, it was not clear exactly how DECC intended to replace the missing money and the initial consultation contained multiple options for reform.11 Following concerns that a regulated payment for capacity or a bilaterally-traded obligation could be inefficient, DECC focussed in on two centrally-organised market designs: a market-wide mechanism or a targeted strategic reserve. Influenced by the Swedish model, the government leaned towards a strategic reserve.12

Targeted mechanisms, although a means for incentivising investments in flexibility, do not in general deal with a resource adequacy problem over the long term. Additional capacity on the system paid for through a targeted mechanism would depress peak prices, further reducing the incentives to invest in new capacity. A targeted mechanism risks appropriating value from all generators and worsening security of supply, and is more distortionary than a market wide scheme.13

The problems with a targeted mechanism were not lost on generators in GB: In the response to the consultation, a number of stakeholders argued that a targeted mechanism was the beginning of a “slippery slope” towards decreasing security of supply and the unravelling of the market itself.14 Eventually, under pressure from respondents, the government relented and the final Energy Bill provided for a market-wide scheme.

The debate has progressed differently in other European markets, with targeted mechanisms already introduced to deal with perceived short-term security of supply concerns. For example, the Belgian government introduced a targeted 850 MW capacity mechanism for the winter 2014-2015, notwithstanding any concerns about the ability of a targeted mechanism to add to security of supply.15 It remains to be seen if the German government will also eventually decide in favour of a capacity mechanism of either kind. In contrast with Germany, which currently benefits from excess supply, the need for new generation investments in Britain is greater, which might have influenced the British and other European governments in taking a more cautious approach and firming up incentives in new generation investments through a formalised capacity mechanism. Germany might yet bide its time and see how a reformed energy-only market delivers.

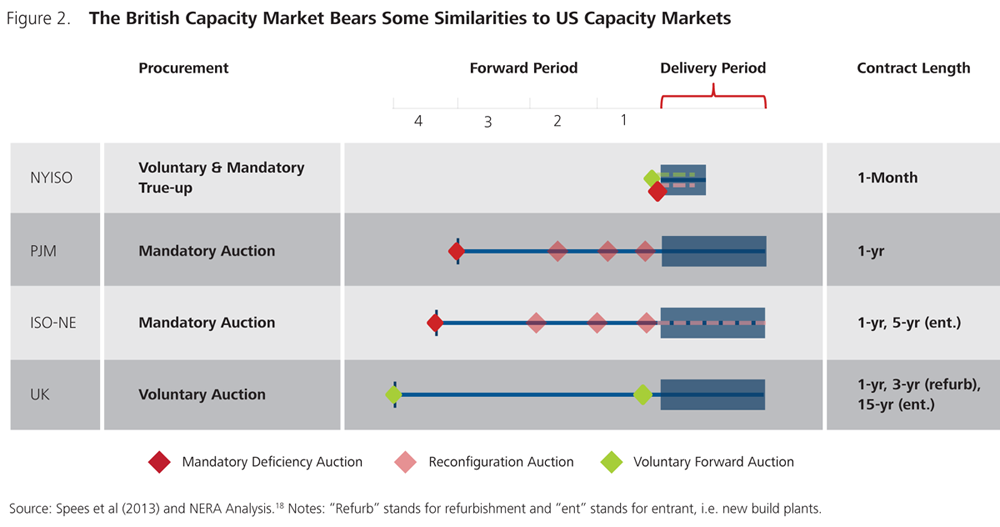

The eventual design adopted in Britain is a form of a “central comprehensive capacity market” (discussed as an option in Germany) and a close relative of the capacity mechanisms that exist in US electricity markets, such as the ISO-NE or PJM (see Figure 2 below).16 The market offers the potential for additional remuneration to all generation not already receiving support as part of the government’s low carbon measures. Demand Side Response (DSR) is eligible to participate. The British mechanism, like ISO-NE or the PJM markets, consists of two auctions: One auction four-years ahead (the “T-4” auction) and one a year-ahead (the “T-1” auction) of the year of delivery.

Pre-qualification for the auction is mandatory, but participation is voluntary. Participants who opt-out of the mechanism may choose to tell the TSO that they will remain operational or that they intend to close.

Pre-qualification for the auction is mandatory, but participation is voluntary. Participants who opt-out of the mechanism may choose to tell the TSO that they will remain operational or that they intend to close.

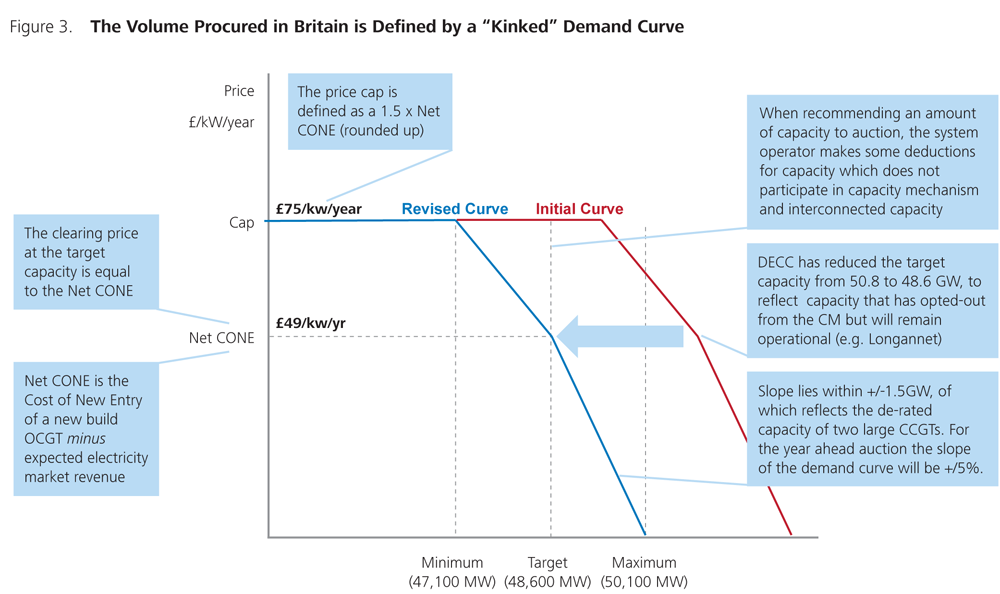

The Secretary of State for Energy and Climate Change sets the level of demand to be procured in the auction on a recommendation from National Grid the GB TSO as well as the split between the T-4 and the T-1 auctions. For the first delivery year 2018/19, the TSO targeted 48,600 MW of capacity in the T-4 auction, with a target volume of 2,500 MW in the T-1 auction, although the actual volume procured will depend on the prevailing price, depending on the demand curve published in advance of the auction (see Figure 3).

The auction itself is in a descending clock format, which starts at the cap and decreases in £5 increments. Bidders submit an “exit” bid when they are no longer willing to keep supplying. The auction finishes once the offered capacity matches the “kinked” demand curve. Although an auction in form, in practice, the bidding is subject to controls on participants’ bids which ensure that “price-taking” generation cannot withdraw from the auction until the price falls below £25/kW.

The Initial Auction Cleared at Around 40 Per Cent of Net CONE

At the time of writing, just five days after the first auction closed, it is too early to talk about the success of the mechanism in delivering security of supply at a lower cost to consumers, which is necessarily only observable over the long term. The market cleared within spitting distance of DECC’s capacity target at a price lower than DECC had forecast. In theory, the results are provisional until the Secretary of State approves the auction outcome seven working days after the auction has closed. In practice, it is not clear what reason the Secretary of State would have to object to the auction outcome, at least on grounds of quantity and price alone.

Participation in the first auction was well in excess of the volumes needed to meet the government’s security of supply target, with just under 65,000 MW eventually participating in the auction.18 The auction stimulated significant interest from investors in new projects: 11,250 MW of the de-rated capacity in the auction came from new build generators. National Grid awarded Capacity Agreements for over 49,250 MW of de-rated capacity, including over 2,600 MW of new build. One large gas-fired CCGT, Trafford Power Station, accounted for 1,650 MW of the new build capacity, almost all of which was awarded agreements of 15-years in length.

The market participants awarded agreements may challenge commonly-held preconceptions: Lobbyists often argue that capacity markets offer a hidden subsidy and preferential treatment to keep coal plants alive.19 In fact almost a third of the existing coal plant participating in the auction failed to be awarded an agreement, while less than 13 per cent of the cleaner gas-fired CCGTs participating suffered the same fate.20 On the other hand, evidence from US electricity markets shows that availability payments, of the form facilitated by capacity markets, enable significantly more participation by the demand side,21 which is often touted as a significant benefit of the markets themselves. In the British case, around 1,200 MW came forward to participate in the mechanism but over 70 per cent failed to get an agreement in the auction.22 Carrington, a new-build 880 MW CCGT neighbouring Trafford Power station and for which the costs had already largely been sunk failed to obtain an agreement.

Prices in the first auction have been lower than DECC anticipated. In its Final Impact Assessment, released in September, DECC forecast a clearing price of £42/kW in the first auction before falling over the subsequent two years and eventually stabilising between £29 and £37/kW.23 DECC also estimated that the Cost of New Entry net of energy market revenues (net CONE) for a new build CCGT was around £49/kW, which would suggest prices would have to rise to £49/kW in any year where a new build CCGT was the marginal entrant. In the event, the capacity market clearing price was £19.40/kW despite the entry of new plants.24

Capacity Market Rules Change Over Time as Market Participants Put Pressure on the Rules

Although the aim of the capacity market is to provide greater stability and certainty for investors by offering an alternative to peak pricing signals, the market itself has been subject to constant changes to the rules. The rules for the first auction were finally published in the autumn and since the rules were published and the prequalification process began, DECC has implemented a number of further changes.

One of the first major changes to the published rules came in the context of authorising the proposed UK capacity market under European state aid rules. The initial design offered 15-year agreements to new plants, where the rules defined all plants with capex of over £250/kW as “new”.

Yet this approach raised the concern that the artificial threshold of £250/kW encouraged plant owners to spend inefficiently on capex in order to qualify for longer term agreements. According to DECC, awarding long term agreements to existing plant would not have met the criteria set out in the Commission’s state aid decision. Accordingly, such payments would have been illegal albeit that, taking the rules “in isolation”, existing plant with capex over the threshold were eligible for 15 year agreements.25 The question over whether to amend the rules came after the pre-qualification process was already complete and resulted in the capacity market being delayed by a week. In practice, the rules were not amended as intended but DECC ensured that plants that would not meet the “new build” test did not seek to obtain 15-year agreements in the auction.

The role of interconnectors in providing capacity has been controversial in the British market with complaints that the current design unfairly excluded foreign generation. As part of the state aid application, the British government agreed to include interconnectors in future auctions (the first auction being an exception). Thus, in the autumn statement, HM Treasury announced that interconnectors would participate on a case-by-case basis with the level of capacity that each interconnector can offer de-rated according to DECC’s estimate of its availability at times of system stress.26

Further pressure came on the planned rules from existing stakeholders. Providers of DSR have complained that, unlike generators, they are unable to access long term agreements, even for new resources. Moreover, the capacity market rules prevent them from entering the capacity market auctions four years ahead and simultaneously earning revenues under interim transitional arrangements to support the development of the DSR industry. Based on estimates that the cost for consumers of discouraging DSR from participating in the T-4 auction could be up to £359 million in the first year alone, the Chairman of the Energy and Climate Change Committee wrote to the Minister of State for Energy arguing that the rules surrounding DSR’s participation should be changed.27 On 4 December, providers of DSR launched an appeal at EU level to overturn the state aid decision, exposing all successful participants in the capacity market to the risk that their agreements would be cancelled on state aid grounds.28

DECC has also signalled that further changes in the capacity market rules will be necessary in the near future. In September 2014, DECC launched a consultation on the treatment of long term agreements in future auctions as well as the participation of interconnectors in future capacity auctions.29 The history of the US capacity markets shows that this evolution of the rules over time is typical of the operation of capacity markets in practice (or indeed other changes in regulation) as stakeholders engage with the rules in order to compensate for perceived problems. Significant changes underway or currently debated in US markets include the shape of the demand curve, the penalties for non-compliance with capacity obligations and the redefinition of various capacity market zones. Accordingly, it is fair to conclude that changes to the British capacity market are far from over.

Conclusion

The reform process of the British electricity market has some important commonalities with its German counterpart. In Britain the process began with concerns about decarbonisation, affordability and security of supply. The early debate focussed on whether peak pricing signals even after reforms were credible enough to incentivise investments in capacity. The British government came out one side: an energy-only market could not deliver efficient investments and a capacity market was required, albeit without clear-cut reasoning.

The government has, to some extent, been receptive to designing the mechanism itself to minimise distortions. For example, as a result of engagement with industry stakeholders, the government was diverted from taking the easy option and adopting a strategic reserve which would have distorted the market and further reduced incentives for investment. The initial auction appears to have stimulated significant interest from investors, with a large new CCGT receiving a 15-year agreement and with competition amongst new entrants and existing plant in the auction itself. The resulting prices have been below DECC’s forecast levels.

However, a number of important unresolved questions in the design still exist and the debate on the future of the mechanism rages on, as stakeholders have put the existing rules under further pressure. Those coming rule-changes and the resulting impact on prices may threaten the ability of the market to offer a credible, consistent and market-orientated signal for new investment, which is the very problem that the government wanted to solve through the capacity market in the first place. The key lesson for Germany and other European markets is that a successful market design needs to be a stable design. That necessitates complying with the EU rules to prevent last minute changes or legal challenges. It also requires the adoption of an efficient design from the outset which limits the scope for later regulatory intervention. Otherwise the capacity market, itself a regulatory construct to “fix” the market, may be subject to a downward spiral of intervention. That intervention may create an unpredictable volatility in returns and undermine the very purpose of the capacity market itself.

George Anstey is a Senior Consultant in NERA’s Energy Team. Email:

Marco Schönborn is a Senior Consultant in NERA’s Energy Team. Email:

Endnotes

1 A related version of this article will be published in German in the industry journal Energiewirtschaftliche Tagesfragen et, issue 1-2/2015.

2 HM Treasury and Department of Energy and Climate Change (2010), Energy Market Assessment, March 2010, page 3.

3 Department of Energy and Climate Change (2014), First Capacity Market auction guarantees security of supply at low cost, press release, 19 December 2014.

4 VOLL stands for value of lost load and LOLP for loss of load probability.

5 HM Treasury and Department of Energy and Climate Change (2010), Energy Market Assessment, March 2010, page 3.

6 Department of Energy and Climate Change (2010), Electricity Market Reform: Consultation Document, December 2010, page 78.

7 Department of Energy and Climate Change (2010), Electricity Market Reform: Consultation Document, December 2010, page 85, para 28.

8 BMWi (2014), Ein Strommarkt für die Energiewende, October 2014, p. 39. “Im Kern geht es bei der Debatte um die Frage, ob ein optimierter Strommarkt erwarten lässt, dass Investitionen in die selten genutzten, aber dennoch erforderlichen Kapazitäten getätigt werden.”

9 Department of Energy and Climate Change (2010), Electricity Market Reform: Consultation Document, December 2010, page 85, para 27.

10 See discussion in Shuttleworth, Anstey and Mair (2014), The Capacity Remuneration Mechanism in the SEM, 4 April 2014, Appendix A. A useful explanation of the conditions for efficient investments in generation capacity is contained in King, Kathleen and Hethie Parmesano (2007), “Conditions for Efficient Investment in Capacity” in King, Michael J. and Sarah Potts Voll (eds), The Line in the Sand – The Shifting Boundary between Markets and Regulation in Network Industries, pp. 293-305.

11 Department of Energy and Climate Change (2010), Electricity Market Reform: Consultation Document, December 2010, page 85, para 28.

12 Department of Energy and Climate Change (2010), Electricity Market Reform: Consultation Document, December 2010, page 94-96, paras 60-69.

13 NERA (2011), Electricity Market Reform: Assessment of a Capacity Payment Mechanism -A Report for Scottish Power.

14 Department of Energy and Climate Change (2010), Planning our electric future: a White Paper for secure, affordable and low?carbon electricity, July 2011, page 20, para 1.26.

15 Elia (2014), Press Release: Elia informs to limit the risk of power shortages as far as possible, 3/11/2014.

16 ISO-NE stands for Independent System Operator-New England and PJM for Pennsylvania-New Jersey-Maryland.

17 Spees, Kathleen; Newell, Samuel A.; Pfeifenberger, Johannes P. (2013), Capacity Markets – Lessons Learned from the First Decade, Economics of Energy and Environmental Policy.

18 National Grid (2014), Provisional Auction Results – T-4 Capacity Auction 2014, 19 December 2014, page 6.

19 See for example, E3G, Keeping Coal Alive and Kicking: Hidden Subsidies and Preferential Treatment in the UK Capacity Market: Briefing Paper, July 2014.

20 National Grid (2014), Provisional Auction Results – T-4 Capacity Auction 2014, 19 December 2014, page 12, Table 6.

21 Falk, J., Kaufman, N., and Buryk, S., Effective Use of Demand Side Resources: The Continued Need for Availability Payments, 23 October 2013.

22 National Grid (2014), Provisional Auction Results – T-4 Capacity Auction 2014, 19 December 2014, page 12, Table 6.

23 DECC (2014), Electricity Market Reform – Capacity Market: Final Impact Assessment, 04 September 2014, Table 8 page 28.

24 National Grid (2014), Provisional Auction Results – T-4 Capacity Auction 2014, 19 December 2014, page 1.

25 DECC (2014), Electricity Market Reform: Consultation on proposed amendments to the Capacity Market Rules 2014 and explanation of some immediate amendments to the Capacity Market Rules 2014, August 2014.

26 HM Treasury, National Infrastructure Plan 2014, December 2014, pp. 71-72.

27 Open Letter from Tim Yeo to Matthew Hancock MP, 9 September 2014, citing NERA (2014), The Potential Impact of Demand-Side Response on Customer Bills, 29 August 2014.

28 Tempus Energy, UK Energy Policy challenged in European Court for Needlessly Driving up Bills, Press Release, 4 December 2014.

29 Department of Energy and Climate Change (2014), Consultation on Capacity Market Supplementary Design Proposals and Transitional Arrangements, 25 September 2014.

Republished with permission. Original story here.