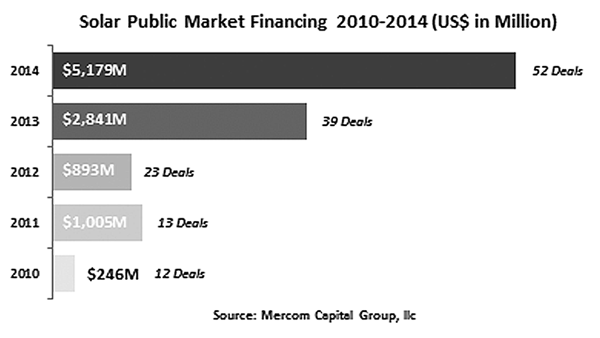

Total corporate funding into the solar sector, encompassing venture capital/private equity (VC), debt and public market financing, increased 175 percent in 2014, according to research released January 7 by Mercom Capital Group, llc, a global clean energy communications and consulting firm.

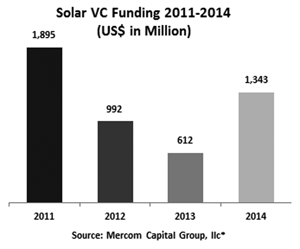

The total amounted to $26.5 billion (all figures US$), compared to $9.6B in 2013. Global VC investments more than doubled to $1.3 billion in 85 deals in 2014, compared to $612 million in 98 deals in 2013.

The total amounted to $26.5 billion (all figures US$), compared to $9.6B in 2013. Global VC investments more than doubled to $1.3 billion in 85 deals in 2014, compared to $612 million in 98 deals in 2013.

“The big story coming out of 2014 was the revival of capital markets – solar companies were able to access funding through multiple avenues like VC, public markets, IPOs and debt in record numbers, while the quest for lower cost of capital continued with Yieldcos and securitization deals. The solar sector has come a long way from being perceived as a speculative high risk investment to attracting investors based on low risk attractive dividend yields,” said Raj Prabhu, CEO of Mercom Capital Group.

“The big story coming out of 2014 was the revival of capital markets – solar companies were able to access funding through multiple avenues like VC, public markets, IPOs and debt in record numbers, while the quest for lower cost of capital continued with Yieldcos and securitization deals. The solar sector has come a long way from being perceived as a speculative high risk investment to attracting investors based on low risk attractive dividend yields,” said Raj Prabhu, CEO of Mercom Capital Group.

Solar downstream companies saw the largest amount of VC funding in 2014 with $1.1B in 44 deals, accounting for 85 percent of venture funding. Investments in PV technology companies reached $75M in 12 deals and Balance of Systems companies were close behind with $73M in seven deals. CSP companies came in at $59M in three deals, followed by thin film companies with $52M in nine deals.

Solar downstream companies saw the largest amount of VC funding in 2014 with $1.1B in 44 deals, accounting for 85 percent of venture funding. Investments in PV technology companies reached $75M in 12 deals and Balance of Systems companies were close behind with $73M in seven deals. CSP companies came in at $59M in three deals, followed by thin film companies with $52M in nine deals.

The Top 5 VC funded companies in 2014 were Sunnova Energy, which raised $505M in three deals; followed by Sunrun raising $150M; Renewable Energy Trust Capital raised in $125M; Sungevity raised $72.5M; and GlassPoint Solar raised $53M.

A total of 119 VC investors were active in 2014, with 12 investors participating in more than one round in 2014 including: Acero Capital, Acumen Fund, DBL Investors, E.ON, Ecosystem Integrity Fund, Novus Energy Partners, Omidyar Network, SolarCity, Sustainable Development Technology Canada, Trident Capital, Vision Ridge Partners and Vulcan Capital.

To learn more about the report, visit http://store.mercom.mercomcapital.com/product/2014-q4-solar-funding-report/.