Research Triangle Park, NC: Not only has the renewable energy program in North Carolina created thousands of jobs, but it can be expected to reduce overall electricity rates for consumers by a modest amount. These unexpected findings are part of an economic study conducted by RTI International and published in February titled “The Economic, Utility Portfolio, and Rate Impact of Clean Energy Development in North Carolina.”

The consultants used an economic input-output model to predict the costs and benefits of North Carolina continuing to pursue its current clean energy program, compared to using a portfolio of conventional power supply options over the next 13 years. The clean energy program contained a mix of power from renewable energy sources and significant amounts of conservation. North Carolina does not have a lot of indigenous petroleum resources so the investments in renewable energy and conservation have the effect of bringing additional employment to the state.

In the short run the cost to consumers of the clean energy program is essentially the same, RTI found, but over time the costs of conventional energy supply rise more quickly than do the costs of a bundle of renewable energy and efficiency investments. This led to the conclusion that the program is expected to reduce bills for consumers.

The study’s authors predict that the state will more than recoup the cost of its investments in clean energy: “[A]fter accounting for the tax credit, the fiscal impact is a net positive of $112.9 million for the state. Renewable energy projects are underway across the state and future tax credit obligations are being generated. However, the substitution of conventional energy purchased from outside of North Carolina with in-state renewable energy is expected to fully recover any future tax credits through state and local tax revenues over the lifetime of the projects (National Renewable Energy Laboratory [NREL], 2010).”

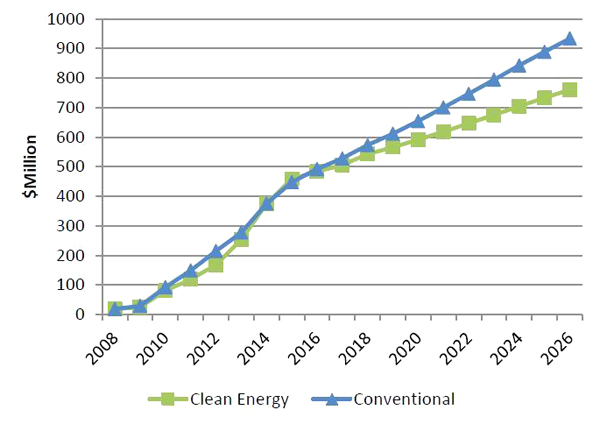

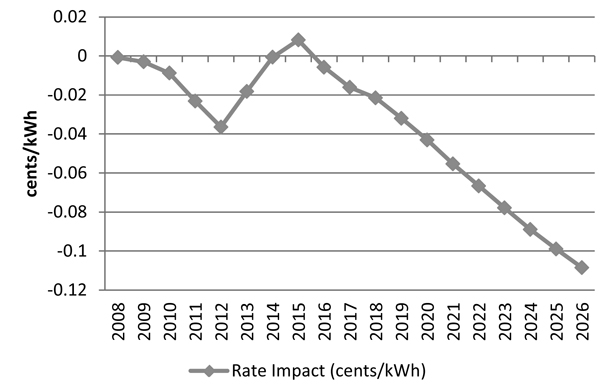

Figure 4-4 compares the incremental costs of the Clean Energy Portfolio and the Conventional Portfolio. The report observes that, “The costs of the two portfolios are quite similar through 2016, but thereafter the Clean Energy Portfolio begins to show a lower cost trajectory than the Conventional Portfolio. By 2026, the Clean Energy Portfolio provides about $173 million in generation cost savings compared with the Conventional Portfolio. These cost savings are largely due to expansion of energy efficiency programs, which are forecasted to continue to be cost-effective compared with existing, conventional supply resources.”

The authors go on to say that, “Overall, we conclude that the rate impact of clean energy policies is quite minor, and, based on the assumptions in our analyses, generally results in savings for North Carolina ratepayers over the study period. Of course, changes in certain assumptions, such as the specific renewable build-out and availability of energy efficiency, will affect the actual rate impacts, but even accounting for possible changes in these values, it appears that the REPS (Renewable Energy and Energy Efficiency Portfolio Standard), as currently enacted and implemented to date, leads to no appreciable rate impact on North Carolina ratepayers.”

In a related story, it was reported in March that “Unsubsidized renewable energy is now cheaper than electricity from new-build coal- and gas-fired power stations in Australia,” according to a new analysis from Bloomberg New Energy Finance (BNEF).

For more information, the study is available online at http://energync.org/assets/files/RTI%20Study%202013.pdf.