In the next 25 years natural gas could overtake coal as the primary fuel for U.S. power generation while the market share of renewable energy will double, Black & Veatch’s year-end Energy Market Perspective (EMP) forecasts.

“Organizations will continue building out renewable energy projects at a furious pace to take advantage of tax credit incentives as well as to meet state renewable portfolio standards,” said Robert Patrylak, Managing Director of Black & Veatch’s EMP service. “Additionally, the presumed abundance of a reliable, cost-effective domestic natural gas supply supports continued construction of natural gas-fueled power generation.”

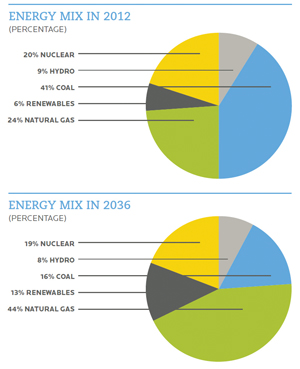

This continued growth of renewable and natural gas-fueled generation will offset anticipated declines from coal-fired generation due to increasing regulations. In a major role reversal, the share of U.S. electric power generated from natural gas is expected to increase from the 24 percent expected for 2012 to 44 percent by 2036, while coal decreases from a 41 percent share in 2012 to 16 percent by 2036. Renewables’ share of electric energy production will increase from 6 percent to 13 percent over the same period (Figure 1).

Renewable generating capacity is expected to more than triple over the period, mostly from wind resources, supplemented by solar and other resources, the EMP forecasts. “As part of our year-end forecast, we completed a detailed study of potential economic coal plant retirements resulting from the compliance cost of EPA requirements on air emissions,” said Patrylak. “Our analysis suggests up to 61,500 megawatts – approximately 20 percent of today’s coal fleet – could be retired by 2020.”

The Black & Veatch EMP is updated semi-annually and is intended to provide “a holistic view of how the energy industry is likely to evolve.” The subscription-based service provides Black & Veatch clients with a “base case of how key issues, such as regulation, legislation, technology, fuel supply, fuel prices and economic growth, will affect the energy markets.”

“Understanding the impact of such significant changes in the capacity resource mix and developing utility strategies to replace this capacity is the largest challenge that our clients face today,” said Patrylak. EMP claims analytical neutrality, saying its perspective is neither “conservative” nor “aggressive” to advocate certain technologies or agendas. The EMP is based in Black & Veatch’s Integrated Market Modeling process to prepare an integrated long-term view of the energy markets. The semiannual forecasts are conducted to provide a base line or “expected value” forecast around which clients can build their own scenarios.

— B&V Energy Strategies report Dec 21 2011