IPPSO FACTO would like to thank Charles Kamin and Andrew Kilonzo, energy development professionals in Kenya, for providing much of the background information for this article.

Kenya, like many parts of Africa, represents a field rich with opportunity for entrepreneurs interested in developing and building new businesses in the power sector. The sector is inviting in several respects as the country is actively recruiting investors to participate in a range of opportunities including renewable power generation, fossil power plants, transmission lines, and potentially new nuclear generation. Generators in Africa can barely keep up with current levels of demand, as consumption is growing at rates far outstripping those in North America.

Those who come to Kenya will find a market that derives its appeal from a combination of factors:

• Relatively high current rates of economic growth

• The ability to support rapid development of new infrastructure, as the power sector attempts to catch up following a long period of underinvestment

• Legal, regulatory and financial systems that are relatively stable and familiar to western corporate professionals.

Although similar conditions exist throughout much of East Africa, Kenya is the starting point for many interested in the region due to its central location and reasonably mature government and infrastructure. Kenyan government agencies are emphasizing near term opportunities in geothermal power project development, coal mining, coal-fired power generation, hydroelectric power development, transformer manufacture, solar, wind, biofuel and nuclear energy projects. Private capital is entirely welcome either on its own or through partnerships with Kenyan government agencies.

Kenya has long been known, despite some political growing pains, as the most stable and economically advanced country in East Africa. Western organizations tend to have their regional operations headquartered there. The government is projecting and preparing for two decades of mushrooming economic growth, and presenting the country as an investment opportunity, highlighting plans to more than quadruple its electrical capacity over the next two decades. Herewith, a summary of developments and trends in the sector in Kenya, and touching on other countries in the region.

Two notes of caution: It can be difficult to be certain of having fully up-to-date information from emerging economies. Best efforts have been made to include current data, but what follows may vary in that respect. And, as always, articles in IPPSO FACTO should not be interpreted as endorsement of any particular investment opportunity – readers should consult a qualified investment professional before making significant financial commitments.

A basic picture of Kenya’s energy system

Electric power supply in Kenya at present falls far below potential demand. Estimates of current peak demand vary slightly: a presentation by the Kenya Electricity Transmission Company (KETRACO), dated October 2010, puts peak demand for 2009/10 at 1,107 MW; the 2010/2011 Prospectus for the Geothermal Development Company (GDC) puts it at 1,200 MW. Both, however, consider that there is considerable unmet potential demand.

Installed capacity is 1,473 MW, according to the KETRACO report. GDC puts it at 1,338 MW, the difference probably being capacity on prolonged outage.

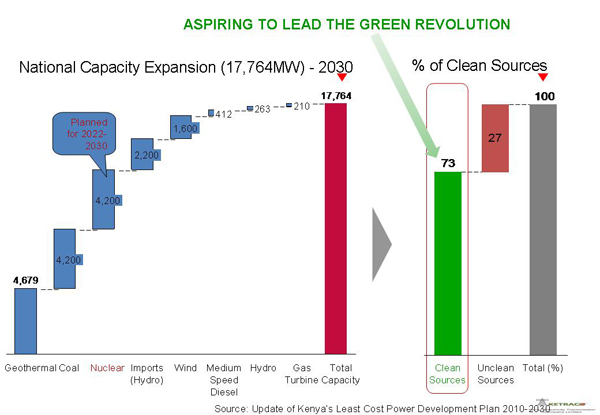

Demand is projected to grow exponentially over the next 20 years (see graph). Demand growth is driven by an accelerated consumer connection policy and anticipated robust economic growth performance. Annual electricity consumer connections rose sharply, from 67,105 to 214,488 per year between Fiscal Year 2005/06 and FY2009/10. Governmental policy is to connect 200,000 new consumers annually as part of its millennium development goals.

To meet growing demand, plans are to expand capacity to 17,764 MW by 2030. Most of that is to be in “clean” sources of power, notably geothermal, of which Kenya has abundant potential in the Rift Valley, but also counting nuclear, wind and hydro. These supply projections use an in-built reserve (security) margin of 15% above peak demand.

Other policy objectives are:

• Upgrading and strengthening the national electricity grid to provide constant high quality power, especially to industrial consumers; and reducing the incidences of power outages

Kenya plans to undertake the following:

• Increase geothermal power generation

• Increase co-generation and municipal waste power generation

• Increase power generation using renewable energy sources like solar and wind.

• Install rural and community based mini-hydropower systems

• Increase the domestic manufacture/fabrication of electrical equipment like transformers, cables, switchgear, wind and mini-hydro turbines, and solar photovoltaic cells.

• Increase hydropower development in western Kenya

• Construction of a gas pipeline from Dar es-Salaam to Mombasa

• Kenya Power and Lighting Company has begun an extensive distribution system upgrade and reinforcement

• Interconnections within Eastern Africa.

This projected growth rate in demand will require corresponding increases in capital outlay to provide the needed incremental generation capacity and associated supply and distribution infrastructure. It is envisaged that the private sector will play a key role in providing the required capital either on its own or through Public Private Partnerships. The projected growth in electricity demand, therefore, presents a golden opportunity to invest in the energy sector. Summarized below are some of the priority projects that present immediate opportunities for private sector investments.

Kenya Power & Lighting company is Kenya’s grid operator. Principal operators in the sector are the Kenya Electricity Generating Company (KenGen), which accounts for close to 80% of generation. Five independents provide the balance: Iberafrica Power (EA) Ltd, Tsavo Power Company Ltd, OrPower4 Inc and Mumias Sugar Company Ltd. A sixth IPP, Rabai Power Ltd. commenced operations in October 2009.

Current power sector opportunities in Kenya

Transformer manufacturing

In order to achieve the government’s objective of connecting one million customers, a total of 60,000 transformers will be required. It is also estimated that an additional 2,000 transformers will require repairs annually. In addition, there exists a high potential for manufacturing of other related equipment such as switchgear, insulators and meters. Indeed, the proposed factory for the manufacture of transformers will also benefit from both the EAC (East African Community) and COMESA (Common Market for Eastern and Southern Africa) markets.

Geothermal

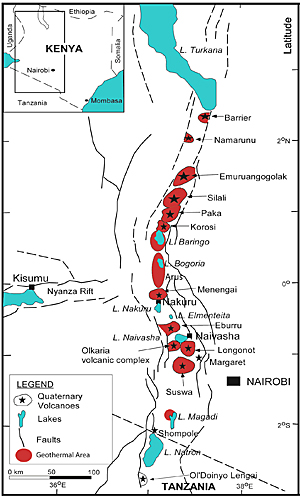

Geothermal resources in Kenya are concentrated in the Rift Valley, with an estimated potential of 7,000 to 10,000 MW. Out of this resource potential, 130 MW has been developed for electricity generation. The government is seeking to develop this resource through both its central agency, and through structured collaborations with the private sector.

The Government of Kenya (GoK) is planning for the development of 2,200 MW at an approximate cost of US$ 2,566 million. The GDC 10 year plan requires drilling 566 wells. GDC will raise the initial capital investment amounting to US$ 1,011 million (39%) from Government and development financial institutions (DFI) while the balance, amounting to US$ 1,555 million, is expected to come from net steam sales revenues (61%). This will open opportunities for both local and international firms in the areas of generation, supply of drilling and generation equipment and drilling materials. GoK is currently drilling for steam for a 280 MW power project at Olkaria scheduled for commissioning in 2013. This is in addition to the development of 400 MW geothermal power plants projected for completion by 2014.

GoK will engage investors/partners to install the first four power plants each of at least 100 MW at its Menengai Prospect. Under this project, GoK will undertake resource development and management covering the development of civil infrastructure, exploration and appraisal drilling, feasibility studies, production drilling, reservoir management and the brine rejection system.

The investor’s role will include financing, design, construction, operation and maintenance of the power plants. In addition, GoK will require the selected investor to partner in financing the steam development. While the steam field is under development, the investor will have the opportunity to install wellhead generation units for early power generation.

A special purpose government-owned company, Geothermal Development Company (GDC) has been set up to undertake geothermal resource assessment activities. GDC will float tenders for conversion of steam into electricity. Private sector companies will be expected to bid alongside the government-owned utility KenGen for such steam to electricity power conversion projects. The lowest-price bidder will be awarded a 20 year contract during which period GDC will guarantee continuous availability of steam.

In the first 10 years, GDC plans to prove steam equivalent to 2,200 MW and invest in 12 rigs that will be used to carry out the drilling work. Two rigs are already at work in Menengai, with two more, funded by France’s Agency for Development (AFD) scheduled for delivery in the 3rd or 4th quarter of 2011. GDC is currently drilling for steam for a 280 MW power project at Olkaria scheduled for commissioning in 2013.

The plan is to have a continuous drilling campaign to provide adequate steam for development of another 490MW of geothermal plants by the year indicated in the table below after the 70MW Olkaria IV power plant.

Project Name Capacity Year

1 Longonot I 70 MW 2012

2 Menengai I 70 MW 2013

3 Menengai II 70 MW 2014

4 Longonot II 70 MW 2015

5 Suswa I 70 MW 2016

6 North Rift I 70 MW 2018

7 North Rift II 70 MW 2019

Source: Kenya Investment Authority.

A news item dated January 16 in Alternative Energy Africa online magazine said Olkaria II, a 35-MW expansion to the Olkara geothermal power plant, made the overall Olkaria Geothermal Power Project the largest geothermal plant in Africa and the third biggest project fully completed in 2010. The 35 MW upped the total generating capacity of the geothermal plant to 105 MW. The project is located about 120 km southwest of Nairobi in the Rift Valley.

Public-private partnership will also be encouraged to minimize perceived investor risks. The Government has identified raising of the initial investment capital as the main challenge and is now focused on sourcing for funds. It is recognized that the 5000 MW will only be realized with the participation by the public, the donor community and the private sector.

The Government will raise the initial investment capital through budget support from its own resources and credit and grants obtained from development financial institutions. To date the Government through budget support has provided GDC with US$ 145 million and has obtained credit and grants amounting US$ 197 million (China Exim Bank – US$ 95.4 million, AFD-Euro 52 million, European Investment Bank – Euro 27 million). In addition, the Government has received a pledge amounting Euro 11 million from KfW of Germany. The Government is seeking to raise the balance amounting to US$ 799 million.

300 MW coal-fired power plant

The Government of Kenya commissioned a feasibility study on the establishment of a 300 MW coal power plant in Mombasa. It also identified three suitable sites for the coal plant.

The plant will require 0.9 to 1.1 million tones of coal per year, all of which will have to be landed at the Mombasa port and transported to the power station. The port currently has only two berths capable of unloading coal. However, neither is capable of handling this additional large amount of coal.

Given these constraints, the study has identified and recommended Mdugani (Dongo Kundu) within Mombasa harbour as the most feasible site because of availability of ample space, and minimal coal handling requirements between ship and plant. Also similar power plants can be constructed in the vicinity in future, taking advantage of the coal unloading facility and grid connection to be provided.

There is therefore an investment opportunity for development of a coal handling facility. The facility can also be used to serve other coal users such as cement factories in Kenya and the region.

Coal exploration and exploitation

The Government of Kenya is currently carrying out coal exploration in the Mui basin in Mwingi district, which covers an area of 400km2. This basin is 180 km northeast of Nairobi. So far 33 wells have been drilled with depths ranging from 75 to 324 meters and coal seams encountered in twenty of the wells. Coal sample analyses have revealed that the coal is sub-bituminous to bituminous in quality, with an average calorific value of 18MJ/kg.

To accelerate coal exploration, the government has also created three more coal exploration blocks in the Mui basin, which shall be leased to prospective investors for exploration and exploitation.

The next coal basin for development is Taru basin that runs across Kwale and Kilifi Districts in Coast Province of Kenya. Geologically, this basin is in the Karoo system, which resembles the coal producing system of South Africa. The Karoo system is known for high quality coal. The Taru basin exploration is scheduled to start soon after the conclusion of the Mui basin project.

Hydropower

Kenya’s power development plan has identified a number of potential hydropower locations. Although development has not been considered economical in the past, recent oil price increases now make them more attractive. The best among the undeveloped sites are:

• Mutonga on the Tana River with an expected capacity of 60 MW and an annual average electricity generation of 336 GWh. The estimated cost of construction is US$ 270 million.

• Downstream of the Mutonga site is the Lower Grand Falls with a capacity of 140 MW and annual average electricity generation of 715 GWh.

Early this year Kenya’s Ministry of Regional Development Authority completed a feasibility study on its 1,200 MW High Grand Falls Dam hydropower project on the Tana River. The first major project on the Tana River, it is expected to cost around US$1.5 billion with construction set to begin this year, the online magazine Alternative Energy Africa reported. Funding is expected to come from a combination of sources including the government, international development agencies, and public-private partnerships.

Kenya also has plans for more hydropower plants with other dams in the pipeline in Magwagwa, Arror, and Mwache. The projects could, upon completion, have a combined capacity of 284 MW.

Canada’s Department of Foreign Affairs and International Trade also notes that the region generally has “vast” hydro resources: There is a potential of 30,000 MW in Ethiopia, 3,000 MW in Uganda, and 3,000 MW in Tanzania. While Kenya itself is largely a semi-arid country, it has plans for extensive regional transmission lines, (see below), that will be able to bring in hydro power from its neighbours.

In addition, Alternative Energy Africa reported February 16 that Kenya’s Ministry of Energy has granted Israel-based SDE Energy Ltd. rights to construct a 100 MW wave power generating plant, the first of its kind in East Africa, on the country’s coastline. An official of SDE said the energy produced by the plant will cost about $0.02 per kWh.

The plant will be constructed in conjunction with indigenous firm Sea Wave Gen. Kenyan newspaper The Daily Nation quoted a source at the Energy Ministry who said that the project was in its early stages, with SDE asked to carry out feasibility studies and build the plant if the results of the studies prove positive.

Solar power

A preliminary survey done in 2005 estimated that the annual market demand for photovoltaic panels was 500 kilowatt peak (kWp) and this was expected to grow at 15% annually. A government program that commenced in 2005 to provide basic electricity to boarding schools and health facilities in remote areas has increased the annual demand for PV panels by 100 kilowatt peak.

Out of approximately 3,000 eligible institutions, 133 have been equipped with PV systems with a combined capacity of 399 kilowatts peak as of September 2008. Another 46 institutions were earmarked to benefit from the installation of PV systems with a combined estimated capacity of 80 kilowatts peak.

There is also the wider market represented by the other member states of the East African Community and COMESA. It is estimated that the initial market demand for PV systems is one megawatt peak and this presents a significant opportunity for investors in PV panel manufacturing. An opportunity also exists for the manufacture of associated components and accessories, such as charge controllers, inverters and PV batteries.

More recently, Cologne, Germany-based Energiebau Solarstromsysteme GmbH announced February 22 that it had installed the largest on-roof solar-power system in Africa, at 515 kW, for the United Nations Environment Program. The solar-power system on the roof of the agency’s headquarters in Nairobi.

A number of companies have been at work in East Africa, providing both grid-connected and off-grid PV installations. UK-based Interplex Solar Technology announced an order for £55,000 worth of off-grid PV panels in Kenya last November. “With our do-it-yourself kit, village children would be able to do their homework at night for an outlay of about £60,” said managing director Mark Thompson.

Wind power

The Lake Turkana Wind Power Project involves the construction and operation of what is billed as the largest windfarm in Africa, a 300 MW windpower plant in Marsabit District, near Lake Turkana in the Rift Valley, in the northwestern part of Kenya.

The wind farm will comprise 367 turbines of 850KW capacity, taking advantage of high wind speeds channeled between a pair of mountains in the area. The project will be constructed in one phase in accordance to the following schedule: installation of 1 turbine per day for a one-year period, starting July 1st, 2011. Completion date would be July 1st, 2012. Full connection to the Kenyan grid should start by completion of the 15th turbine, meaning July 15th, 2011.

Reports from late last November suggest the Turkana project, among others, may run into delays after Finance Minister Uhuru Kenyatta said that the Treasury, concerned about levels of public debt, would not grant guarantees on project funding. In mid-September the ministry had asked the European Union to set up an insurance fund to entice investors to venture into the African energy market, which may help. Investors will be forced to get help from risk underwriters, but projects already underway like the Lake Turkana Wind Project could take a hit.

The clean power output generated will supply energy to Kenya’s national grid to contribute up to 25% of the existing national installed power and will be connected at Suswa, near Naivasha. Average electricity production is estimated at 1,440 GWh per year. The government’s five-year plan is to add 500 MW of wind capacity to the national grid by 2013.

Additional opportunities for wind energy development have been identified in the Kano plains near Kisumu. The people of this region have an almost unique energy resource close at hand. The local geography creates what could be described as a giant natural heat engine. This is the wind circulation system caused by the difference in temperatures of the sun-baked Kano Plains and the cooler waters of Lake Victoria. Air rises from the plains from about 11:00 AM as they heat up; this pulls in air from the lake and a substantial wind blows throughout the area until the land cools down and temperatures equalize at about sunset.

Elsewhere, power utility KenGen commissioned a 5.1 megawatt wind farm at the Ngong hills early last September.

Bio-fuels

Jetropha, a plant grown in arid and semi-arid lands, is seen as the best source of bio-diesel across the country. Opportunities for production and processing of Jetropha and sweet sorghum into biofuel exist in Galana and other areas of the country such as Eastern, North-Eastern, Rift Valley and Nyanza Provinces. In addition, consultancy opportunities exist in research work and capacity building in bio-technology and in the related potential for industrial production of bio-fuel.

The Kenya Sugar Board (KSB) has also urged the country’s sugar producers to increase cogeneration efforts and ethanol production as sugar manufacturers are interested in cutting operating costs to become competitive internationally. The Board estimates that the industry has potential to generate up to 190 MW of electricity from bagasse, a waste product of sugar production.

Nuclear energy

Nuclear power generation has been identified as a potential source capable of providing affordable electricity to spur economic growth, consistent with Kenya’s Vision 2030 development agenda. For a start it is proposed that the private sector will be given an opportunity to develop a 300 – 1,000MW nuclear power plant over the next 7 years. A Build Own Operate Transfer (BOOT) model based on 30-year Power Purchase Agreement (PPA) will be offered to a private sector investor with requisite experience and resources to construct and operate the power plant.

A report from Bloomberg dated September 20 2010 said Kenya is planning to build its first nuclear power plant by 2017. One proposal that is being studied is to build a 1,000- megawatt nuclear power plant, probably along the coast in a joint venture with the government and private companies. A facility of those specifications using South Korean technology would cost as much as $3.5 billion to build, said Energy Ministry Permanent Secretary Patrick Nyoike.

Kenya’s Feed-in Tariff program

Kenya has instituted a FIT program for renewable energy, established in 2008 under policies set by the country’s 2006 Energy Act no. 12. The tariff was set at $US 0.12 / kWh, supplied in bulk to the grid operator at the interconnection point.

The policy covers wind, small hydro and biomass sources, for plants with capacities not exceeding 50 MW,10 MW, and 40 MW respectively. Within a couple of years of its promulgation, two power purchase agreements had been signed, negotiations were underway for power purchase agreements with another four developers, and a further twelve projects were close to completing feasibility studies, according to a document from the Ministry of Energy dated January 2010.

However, the document acknowledges that potential investors have been saying the tariffs were too low, for various reasons. As of early 2010, the tariff was set at US 12 cents per kWh for small hydro, US 7 cents for biomass and US 9 cents for wind. There were plans to expand the program to include geothermal. In April 2010 the Ministry of Energy proposed raising the wind tariff to 20 cents / kWh, for capacity between 500 kW – 100 MW, up to 300 MW of wind cumulative.

Regional initiatives

COMESA

Kenya is part of the Common Market for Eastern and Southern Africa (COMESA), which includes a free trade area and a customs union. Nairobi is the headquarters for COMESA’s Trade and Development Bank.

A February 3 news item in Kenya’s Business Daily said that COMESA, along with the Southern African Development Community (SADC), has been planning to form a larger free trade area, covering more than 527 million people with an estimated combined gross domestic product of about $624 billion. It says multi-national companies operating in Kenya have been stepping up expansion plans, with British American Tobacco (BAT), Nestle Kenya, Weetabix East Africa Limited, Bata Shoe Company and Cadbury East Africa recently announcing multi-billion shilling expansion plans in the race to tap new demand in Eastern Africa region and part of North Africa. (The Kenyan shilling is currently trading at about 86 to 1 Canadian dollar.) The Business Daily article cites World Bank estimates that East Africa will receive new investments in excess of $25 billion (Sh1.8 trillion) in the next five years, following the 2009 launch of the common market.

COMESA’s member states are Burundi, Comoros, D.R. Congo, Djibouti, Egypt, Eritrea, Ethiopia, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Sudan, Swaziland, Uganda, Zambia, and Zimbabwe.

Regional transmission

A recent listing of plans by DFAIT (Canada’s Department of Foreign Affairs and International Trade) says that in the next four years, Kenya is expected to construct over 4,000 km of high voltage transmission infrastructure at an estimated cost of US$ 1.3 billion. Proposed regional interconnections include: Uganda-Kenya, 220kV; Tanzania-Kenya, 440kV; Ethiopia-Kenya, 440kV; Zambia-Tanzania-Kenya, 400kV, plus a number of others that do not include Kenya.

RFEIs and business opportunities

The Kenyan government has released several Requests for Expressions of Interest (RFEIs):

• Technical and economic feasibility study for development of small scale grid connected renewable energy: To conduct a technical and economic study for the development of small-scale grid or isolated mini-grid connected generation plants.

Project ID No. P103037. Contact:

Mr. Isaac Bondet, Power Engineering Consultant, Ministry of Energy

Tel: +254 (20) 310112

E-mail:

• Request for proposals for consultancy services for Muhoron1 thermal power plant: The Government of Kenya has requested KenGen to construct and commission a 75 - 80 MW Medium Speed Diesel Thermal Plant.

Contact: Mr. Patrick Kimemia, Supply Chain Manager, Kenya Electricity Generating Co. Ltd.

Email:

• Consultancy services for a study on options for the development of a power market in Kenya.

Contact Mr. Isaac Bondet

The Power Engineering Consultant

Tel. 254-020-310112

E-mail:

• Consultancy services to facilitate private sector investment in the electricity sector in Kenya: To meet projected power demand and connectivity will entail investment of about US$10billion in the generation resources and US$2 billion in the transmission system expansion, with investment from the Government and the private sector. Contact Mr. Isaac Bondet

The Power Engineering Consultant

Ministry of Energy

Tel. 254-020-310112

E-mail address:

With material compiled by Stephen Kishewitsch

Sources:

• Department of Foreign Affairs and International Trade, Nairobi office, business plan on power sector

• Geothermal Development Company Ltd., 2010 / 2011 Prospectus

• A Summary Of Key Investment Opportunities In Kenya, Ministry of State for Planning, September 2008

• Alternative Energy Africa, online publication (www.ae-africa.com), various dates

• Personal communication, Charles Kamin, February 2011.