Mercom Capital Group, llc, a market intelligence, consulting and communications firm, released its 2010 report on merger and acquisition (M&A) and funding activity for the cleantech sectors of solar, smart grid and wind on January 18.

In the report’s major findings:

• 2010 venture capital activity came in at $1.67 billion in 65 transactions, up 18 percent over 2009 ($1.4 billion, all figures $US). There was increased activity in large-scale solar project funding as well as debt and other funding types, pointing to an easing in the availability of credit after a challenging 2009. A total of 148 different investors participated in VC funding rounds in 2010. Credit facilities provided to Chinese companies by Chinese banks came in at $34 billion, dwarfing all other transactions in solar in 2010.

• Solar mergers & acquisition transactions in 2010 totaled $2 billion in 44 deals. Solar project M&A activity amounted to another $450 million in 18 deals, out of which only four were disclosed.

• Large-scale project funding came in at $4.1 billion in 2010, while debt and other funding types logged in $36 billion. Of those, $34 billion were in the form of credit facilities provided by Chinese Government Banks to Chinese companies, which included LDK Solar, Yingli Solar, JA Solar, Suntech and Trina Solar.

“Considering 2009 was a recession year, solar was only slightly up in 2010. After a good second quarter, venture capital investments trended down in Q3 and Q4,” commented Raj Prabhu, Managing Partner at Mercom Capital Group. “It was a banner year for Smart Grid in terms of VC funding and M&A activity, with VC funding almost doubling compared to 2009. Eighty-seven different investors participated in VC rounds in 2010,”

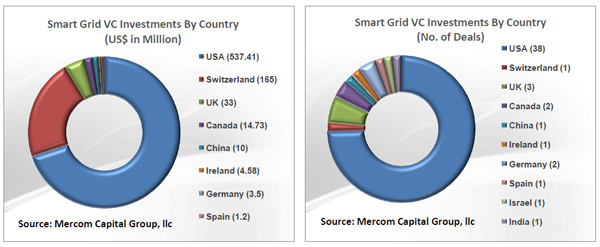

VC funding in the smart grid sector was at its highest compared to the previous two years with $769 million in 51 deals, an 88 percent increase over 2009 ($410 million). M&A activity was also robust for the sector in 2010 with 40 transactions. Only four were disclosed for a total of $1.3 billion, of which $1 billion was the acquisition of Ventyx by ABB.

The wind sector also saw a 40 percent increase in VC and PE activity in 2010 with $277 million invested compared to $198 million in 2009. Large offshore wind projects boosted project funding activity to over $9 billion in 2010. M&A transactions in the Wind sector came to $1.3 billion in 23 deals, with the $860 million acquisition of John Deere Renewables by Exelon making up the bulk of it.

For a copy of the complete annual report for all sectors, visit http://www.mercomcapital.com/cleanenergyreports.php.