China about to enter the world market as a major exporter

The following material is excerpted and adapted from China Wind Power Outlook 2010. See full reference below.

- - - -

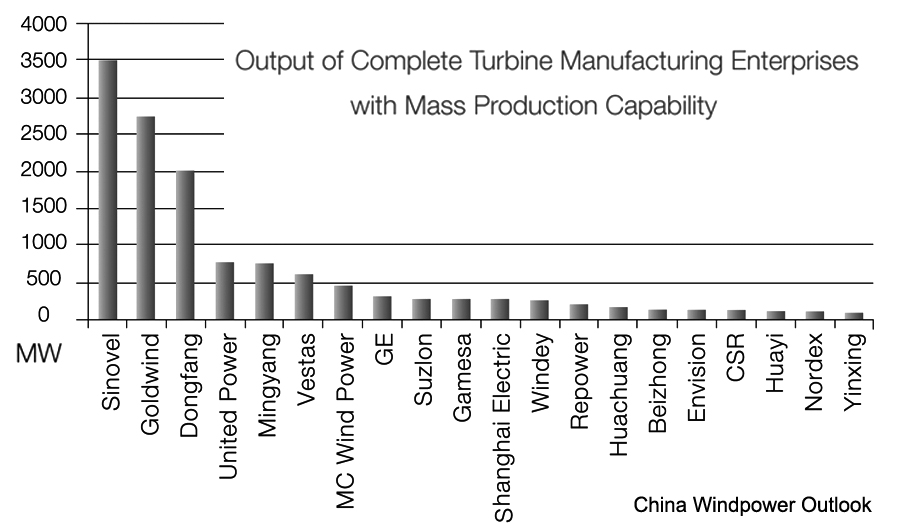

In a few years China’s domestic industry has gone from a near-complete reliance on imported equipment to having three manufacturers in the global top 10 (Sinovel, Goldwind and Dongfang Electric) and five in the top 15, supplying more than 80% of the domestic market; and is entering the export market in a serious way. Construction was completed on China’s first offshore wind farm in the first half of 2010. - From the foreword by Steve Sawyer Secretary General, Global Wind Energy Council

- - - -

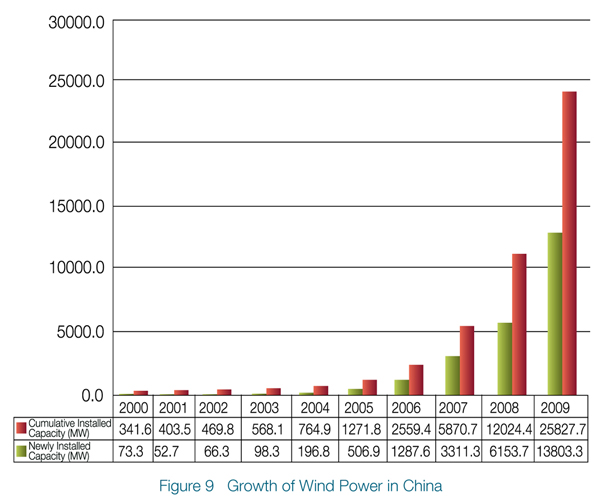

• In 2009, the Chinese wind power industry doubled its capacity over the previous year – in fact the fourth consecutive year it had done so, reaching 10,129 MW and incidentally overtaking the US for new installations. Installed capacity thus reached 25.8 GW by the end of that year. Newly installed capacity was the largest in the world. Its cumulative installed capacity now ranks second in the world. The country’s equipment manufacturing capability also took first place in the world. In 2009 China produced wind turbines with a total capacity of over 15 GW. Experts from the Chinese Academy of Engineering and the National Development and Reform Commission have projected in 2008 that under low, medium and high growth outcomes Chinese wind power capacity will reach either 100, 150 or 200 GW by 2020. The Global Wind Energy Council has higher estimates, possible 253 GW by 2020 and 509 GW by 2030.

• Sinovel, Goldwind, XEMC, Shanghai Electric Group and Mingyang produce turbines of 2MW capacity or greater, and are all developing 5 MW or larger turbines and can be expected to produce competitive and technically mature machines – though more than one commentator cautions that quality remains a concern.

• All the top 10 enterprises have established their own R&D centers. The emphasis originally placed on purchasing a production license has changed to the manufacture of complete turbines. Licensed designs, joint designs and independent designs have become the main methods for Chinese companies to obtain their own independent technology.

• In 2009 China also ranked first in production of photovoltaic panels for the third consecutive year, accounting for approximately 40% of the global market.

• Among other things, the government of China has committed to seven 10-GW-scale “wind power bases” in various parts of the country, including Inner Mongolia, to contain a total 138 GW by 2020. Planning began in 2008 and is well underway, according to the latest China Wind Power Outlook (see URL below).

• In an echo of China’s two-per-week rate of coal plant construction, a foreword by Greenpeace International Executive Director Kumi Naidoo notes that China is also now putting up two wind turbines every hour.

• A total of 20 enterprises had newly installed capacity of more than 100 MW in 2009, including ten central government-owned enterprises, six state-owned local energy enterprises and four private and foreign-funded enterprises.

- - - -

While China’s rise as a world wind power, both in installed capacity and in manufacturing, is nothing short of startling, and it is poised to become a, or even the, major force in other countries’ markets, Zhu Junsheng, President of Chinese Renewable Energy Industries Association, had the following caution:

"China has now joined the front ranks of the world in terms of both the industrial and market scale of its wind power industry. However, in some respects China’s international position as a large manufacturing country has not been changed. China remains dependent on Europe and America for the key design technology of wind turbine generator systems; the detection and certification systems for wind turbine generator systems are not sound; the developers of Chinese wind power lack experience in the long-term operation and maintenance of wind power plants; China’s own technology for evaluation of wind resources is still at an early stage; and the cultivation and maintenance of Chinese skills in wind power remains insufficient. "

- quoted in China Wind Power Outlook 2010.

- - - -

China about the enter the world market as a major exporter

• In 2009, China started to export complete wind turbines, with a total of 20 sets with a capacity of 28.75 MW going to four countries. The main exporters were Sinovel, Sewind and Goldwind.

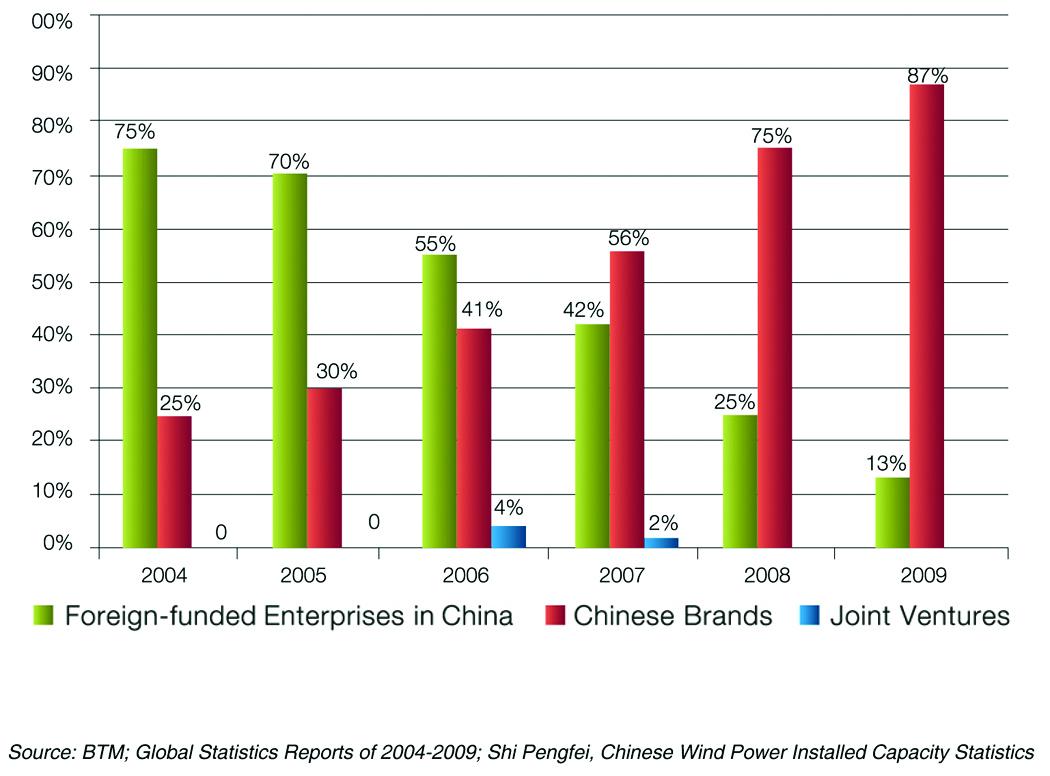

• Before 2005, foreign companies dominated the wind power market in China, accounting for more than 70% of the market. By 2009 this had decreased to about 13%. The market share of domestic manufacturers had therefore increased from 25% in 2004 to 87% in 2009. Several major international manufacturers have subsidiaries in China, including Vestas, Gamesa, GE and several others. All have built assembly lines for complete turbines and parts production facilities. The proportion of turbine parts made in China has steadily increased. [This is reflected in the experience of Spanish turbine manufacturer Gamesa, described a pair of articles in the New York Times, December 14-15, 2010. Gamesa set up manufacturing in the country, and found itself required by government policies to turn over more and more of its key processes to the local operation. However, even with the decrease in parts import from Europe, Gamesa found itself making increasing profits.]

There are, of course, also many enterprises specializing in gearboxes, blades, electric motors, hubs, main shafts, bearings, etc. By the end of December 2009, more than 50 enterprises had invested in the development of wind power and established approximately 330 project companies to participate in the development and construction of wind parks in China (see graph).

– Excerpted, except where noted, from China Wind Power Outlook 2010, published October 2010 by the Chinese Renewable Energy Industries Association (CREIA) with the support of Greenpeace and the Global Wind Energy Council (GWEC). Available for download at http://www.greenpeace.org/china/en/press/reports/wind-power-report-english-2010