by Mark A. Gabriel, Senior Vice President for Power – North America, for Halcrow Inc.

Preface

The electricity industry is hugely complex and works on long cycles, particularly when it comes to building generation and transmission infrastructure. And yet, like everyone else, I’m so involved in fighting off the alligators that I don’t have time to think about the longer-term issues affecting our industry, and therefore the opportunities that may exist. I met Mark Gabriel at a conference last winter and was struck by the breadth of his knowledge. Not only does he see the big-picture issues, he has a grasp of the details that allow him to see through and debunk the myths. Set aside the minutiae for a few minutes and enjoy his article!

- Tony Anderson, Chief Financial Officer, Northland Power Income Fund

The energy enterprise, from electricity and gas to oil and its potential replacements, is being more radically altered than any time in the last 100 years. Not since the initial discovery and expansion of the energy systems in the late 1800s has such a dramatic change taken place—and not since that time have there been as many opportunities and challenges.

The goal is to find the overarching, immutable megatrends or “destinies,” analyze current business and capabilities in light of those megatrends and build a robust set of companies in support of the changes that will occur as a result. The concept of a megatrend is simple: it is occurring regardless of efforts to change its outcome. No amount of “will” or “desire,” personal, corporate or governmental can prevent it from happening. Megatrends can rarely even be affected by those forces. They can be nudged in certain directions, but cannot be stopped or altered in any major way.

Planning around these megatrends is significantly different from scenario development. Almost by definition, scenario planning is wrong. Scenarios that are developed are never realized in their entirely. They can be useful from a discussion perspective but tend to the extreme and therefore of limited use.

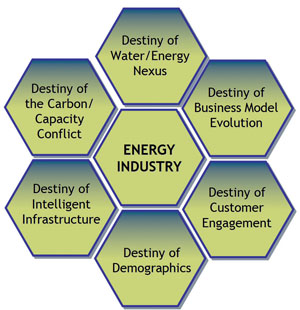

In looking across energy enterprises and industries, there are six megatrends that appear to meet the simple criteria of immutability. These trends are major, industry, company and societally changing and are occurring now. While there are variations on these trends, the basic themes remain. The question is how the company best can position itself to take advantage of these changes. Each one of these trends spins off in a number of directions and has subsets or mini-trends.

The six megatrends are as follows:

• Aging Workforce

• Growing infrastructure intelligence

• Carbon and capacity challenges

• Business model revolution

• Customer engagement

• Water/Energy Nexus

In examining each of these destinies it is important to recognize the current political, financial, social and technical forces that exert an influence on the trends. However, they are merely reactive factors, not causal.

• Retirement ages may be pushed ahead but the population still ages

• Regulators may incentivize utilities to build the smart grid (and should) but utilities, oil companies and alike are matching communications and the microchip regardless because it is more efficient for economic reasons.

• An increased focus on climate change (whether or not it turns out to be real) will mean stricter regulations but generation needs to be built no matter what

• Bankers may want different types of securitization but changes will continue to occur in how the business is conducted

• Open retail access may be delayed or expanded, regardless, consumers are demanding differentiation and levels of service.

Another key element of these destinies is the coupling of immutability with a long timeframe. These are issues that are not quickly or ever “resolved.” There may be periods of rapid change or slow movement, but the megatrends occur nevertheless. There is no “end” to the megatrends—just waypoints down the path. This means that company planning has to continue its evolution and cannot be content that a solution has been found.

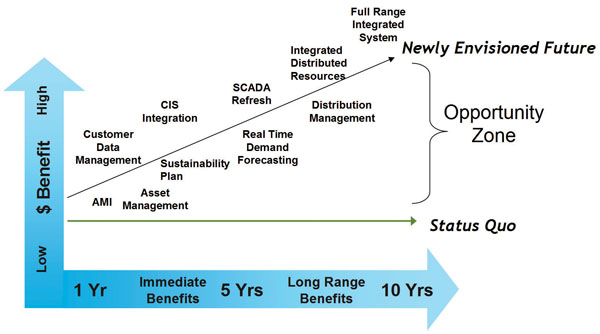

This paper looks briefly at the six destinies and suggests some areas of opportunity that will result. A capabilities gap analysis is the next step in this process, followed by a sifting activity to outline specific opportunities for the company.

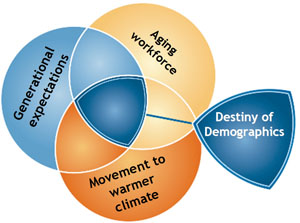

The Destiny of Demographics

There is no issue that will impact the electricity, oil and gas industry over the next 20 years more than the aging workforce, the lack of trained personnel and the current pressure to reduce staff at a time when additional personnel are needed to meet the demands of infrastructure expansion, environmental controls and increasingly complex system operations.

The average age of utility workers is approaching 48 years, with linemen an average of 52 years old. Unlike some more traditional white collar jobs, there is an age factor after which some of the industry’s most critical field workers will no longer be able to handle the physical requirements of the positions. Hiring freezes (many of which are starting to be lifted) coupled with a lack of sufficient training programs and candidates will make mobilizing sufficient staffing in the field will present a huge challenge that will only accelerate in severity over the next 10-15 years.

According to Science and Engineering Indicators, published by the National Science Foundation, nearly 30% of the labor force with science and engineering degrees is older than 50 with a dramatic increase in retirements expecting to continue. From the engineering side, fewer electrical engineers are interested in the energy business, and universities have been eliminating or drastically reducing power engineering programs. The reduction in the nuclear Navy and negative perception of nuclear power will leave that industry segment in particular straits just as it may find new plant orders coming after a 20 year hiatus. Many students graduating with EE degrees are choosing the more lucrative and attractive high technology industries. Increasingly, electric and gas utilities are competing with the oil and gas business for skilled workers.

Many power plants operating today have a very small and aging cadre of workers with the inside knowledge of plant operations—knowledge that has yet to be captured and passed down to a new generation of employees. Even outsourced operating companies are struggling to build staff capable of managing complex systems.

Mergers, the pressure to reduce costs, rate freezes and a short-term focus on the bottom line have resulted in early and forced retirements, hiring curtailment as well as elimination of apprentice training programs. In continuing a trend started in 1995, several large utilities outsourced significant portions of their operations. NiSource recently signed a $1.6 billion, 10-year agreement with IBM for business process outsourcing.

While part of the solution will be to have more employees working later into their retirement years, this will not be possible in many physically demanding positions. A recent three month advertising effort to attract linemen in the Florida market resulted in the hiring of a single lineman—and that at a 30% premium in pay.

The movement to aggregate outside service providers in this arena began three years ago as utilities spun off their engineering groups and will continue strongly for the foreseeable future, further narrowing the field of candidates. And, as system complexity grows, the demand for highly trained operators and installers similarly expands.

The Destiny of Intelligent Infrastructure

One way to ameliorate some of the aging workforce challenge is in developing more sophisticated and reliable tools and technology for system operations. From production and delivery to system management and consumer interfaces, the industries are being revolutionized by communications, the microchip and advanced computational tools.

This trend is occurring across all markets. From the smart oil field that analyzes flow rates, spots leaks and automatically balances CO2 injection, to the smart grid that automatically phase shifts, adaptive islanding capabilities and projects cable failures just prior to their occurrence, meshing intelligence with physical systems will put significant new demands on companies.

In the U.S., the “smart grid” or overlaying of communications and computing to basic electric and gas infrastructure has become the overnight sensation after more than a dozen years in discussion. Much of this has been stimulated by the American Recovery and Reinvestment Act’s $3.2 billion cash infusion to 100 projects across the country in areas ranging from synchrophasors to advanced metering infrastructure, which will be matched by another $3.2 billion from utilities across the U.S. In Ontario, Hydro One is completing a multi-million unit deployment of AMI as well as opening the region to various renewable resources, all of which need to be controlled and managed via a smart grid.

While the regulated businesses have been waiting for regulatory blessings on these systematic additions (at least publicly), most have been quietly making changes to their systems. The rapid advent of automated metering infrastructure (AMI) — or at least the pressure to make it occur — will forever change the way the system operates. A view of an electronically integrated energy provider is emerging that bridges information technology with system operations, power plant dispatch, and trading all the way to the customer end of the business. For these systems to work, an extreme amount of native intelligence is needed in all devices, across all platforms and through each operating system.

These tools and technologies are necessary for efficient operations and will become the de facto standard if companies are to play in a broader context. The expansion of regional transmission organizations will require bringing more intelligence to the electrical network. Companies involved in actively trading and manipulating their natural gas supplies will be forced to bring their systems up to standards that have yet to be established. Whole classes of smaller clients run the risk of being left behind as surrounding areas move further into 21st century—and left with significant costs as they play catch-up across a customer base that is too small.

Adapting to and taking advantage of the added intelligence of operations will require a new way of thinking about management and operations. The constant flow of information means a company can operate in real time using real data as opposed to computer models. These changes will result in the need for process reorientation — and that is for those who currently understand their processes. Firms that have not yet begun the effort to build process models will be even farther behind as systems become smarter and more robust. Managing the enormous amounts of system data will require levels of artificial intelligence as companies move from monthly reads of meter data (number of customers x 12) to 15 minute intervals (number of customers x 96 daily reads x 365 days). Analyzing loop flows in transmission and automatically determining injection points coupled with intermittent renewable resources will become a normal part of operations.

The good news is that these changes are occurring and continuing to occur. The bad news is that many companies are unprepared for the impacts.

The Destiny of Carbon Constraints and Capacity Demands

The need for expanding capacity and the movement towards a carbon constrained world are on a direct collision course in the next 5-20 years. Nearly 35% of the U.S. will be short on generation by the year 2016—and that assumes the rapidly escalating demand curve in electricity is ameliorated by energy efficiency, demand response and the active management of the smart grid. The current drop in demand due to economic conditions is expected to return to a growth rate of 1-1.5 % in the next two years. And, to make matters even more challenging, the loads are building in areas such as the Southwest and Southeast, which require more electrical energy due to cooling needs. Couple this with an aging population that will need technologically driven health care, demand appliances and home features that consume more energy (in 1986 the average television was 24 inches and used 42 watts; today the average TV being sold is 42 inches and uses 240 watts) and the challenge is obvious.

The lack of new plant construction (other than natural gas) is matched with an unrealistic expectation that renewables and efficiency will be able to keep up with the growth needs, much less the plant replacement numbers. Even wind, which grew by leaps and bounds in 2009, is expecting to see a slow down in construction as well as the challenge of transmission constraints given the location of the wind versus the location of the load.

The capacity needs of the world also must be balanced against the growing call for carbon constraints. The debate over the need to do something about global warming is over in the public perception, regardless of the scientific evidence in either direction. Nor does the public understand the immediate, significant and almost unmanageable cost impacts. The markets in electricity and oil are being forced to take action that will have huge economic costs even if the benefits are not realized.

The recent call to electric vehicles (EVs) and plug-in electric vehicles (PHEVs), coupled with the BP spill in the Gulf, will put even more pressure on generation in North America. It has been estimated by the independent system operators that by 2015, if PHEV/EV numbers are as high as anticipated, the U.S. will need an additional 3,800 megawatts of generation—and that assumes the nighttime charging schemes are correct (which they might not be).

Integrated resource plans, once a balance between supply and some demand side resources, will grow in complexity as companies are forced to choose between the same competitive resources. The renewables market, spurred by the pressure over carbon and stimulated by uneconomic subsidies, may make the cost of new nuclear seem cheap by comparison. The driver of time also enters into this megatrend in the inability to develop new, carbon free technologies (aside from nuclear), even assuming they are possible.

The Destiny of Business Evolution

The scope and scale of projects, complexity of operating systems and the need for significant influxes of capital into the energy industry will continue to drive dramatic changes in the way the business is done across the globe.

After 70 years of relative calm and stable models in energy, the changes over the last decade have set dramatic forces in motion that will require electric, gas and oil entities to continually reinvent themselves in order to stay competitive and in business. This holds true for public power as much as for big oil, for building large scale generating stations to interlinking distributed resources, from managing bits and bytes across electrical systems to integrating hydrogen into the existing natural gas pipelines.

The staid model of vertically integrated utilities is gone forever as the investment community continues its pushing of players toward economic efficiencies. This is occurring down to the smallest player in the marketplaces as the availability of capital hinges on terms and conditions that require market model changes. The de-lamination of both the electric and gas industry has led to the creation of new entities which, in turn, developed new funding and financing models. Financial guarantees now require a level of complexity unheard of in the past with the simple balance of debt to equity ratios overtaken by deals involving a whole host of new financial tools.

Construction of billion dollar power plants, the investment of tens of billions in advanced infrastructure, clean technology funds pushing the edge of generation resources, coal to liquids replacing traditional oil — all will require different business models.

The Destiny of Customer Engagement

Every market has undergone a dramatic evolution in which the customer is more engaged at a deeper level than ever before. This change in engagement models means expectations are raised in terms of value, time and knowledge of an individual customer’s situation. This also means that the demands of the marketplace can outpace the energy industry’s ability to keep up with that market—and turmoil may be the result.

It is obvious that the internet has changed everything in terms of the customer’s involvement in markets, but this is not the only way in which the never satisfied consumer has seen increased power. Whether it is McDonald’s marketing “Have it Your Way” to self selection of music through IPods, consumers are conditioned to increased flexibility and better pricing, as well as extensive choice in their buying decisions (i.e., zero percent financing or $1,000 cash back).

Besides the societal “training” of consumers to have more choice in everything, the technology of demand has changed as well. The need for dramatically increased power quality, reliability, availability and security means that the consumer now has back-up batteries for their home offices (but cannot understand why they should have to pay). Consumers have learned that nights and weekends are “free” and that it takes two to drive in the commuter lane.

Google and Microsoft’s entry into the energy markets, coupled with CISCO and others, will make the relationship with the customer even more interesting than all of the discussions of deregulation in the 1990s. Google is already offering its own Power Meter for consumers and web users can add an imputed KWh usage to their iGoogle home page.

This will be translated into the energy business as areas of demand response, time of use rates; advanced purchases of natural gas and oil for the winter and pre-payment of energy costs all take hold in bigger and broader venues. Savvy customers will also flow down the knowledge they have gained in negotiating better rates for their businesses, both industrial and commercial, into residential. More and more customers will seek out and deploy distributed resources due to financial and well as perceived moral analysis.

Customers will engage in markets in new and unusual ways, creating opportunities as well as challenges for those companies supplying the marketplace. Customer choice in electricity will not require formal deregulation—the clients will deregulate themselves, disengaging from the market via energy efficiency, renewables or even their own production.

The face of customer engagement will change the face of the energy industry.

The Destiny of the Water/Energy Nexus

The final destiny (added since Visions for a Sustainable Energy Future was published in late 2008) is that of the increasing challenge of balancing water and energy. Society cannot have water without electricity and cannot generate electricity without water. The dueling impacts will be felt in increasing ways over the coming decades, as water scarcity and the demand for electricity grow in everything from traditional power plants to utility-scale solar thermal, which requires water as a transport and cooling mechanism.

Evidence of this growing destiny abounds. In 2008, the Oconee Nuclear Generating station was nearly forced to shut down as the water level came within three feet of its intake pipes. This occurred near the summer peak in the Southeastern U.S. All generators in the U.S. are having to review their cooling system plans as hydro-electric dams are under increasing pressure to spill water for fish protection—replacing run-of-river generation with more carbon intense or expensive renewable alternatives.

It is not just coal, nuclear and hydro systems that are facing this challenge. In Louisiana and Pennsylvania, the sites of the largest and most exciting finds in shale natural gas, drinking well contamination is becoming a greater and greater concern. This is both in terms of gas contaminating wells as well as the quantity of water and chemicals added to the water necessary to extract the shale gas.

Using the Destines to Advantage

Understanding the destinies in the energy industry allows companies to predict and plan and not fall into the trap of chasing market trends. As hockey great Wayne Gretsky replied when he was asked why he was so good, he replied, “I skate to where the puck is going to be.”

Mark Gabriel is the Senior Vice President for Power—North America, for Halcrow Inc. a global consulting and engineering firm. His book, Visions for a Sustainable Energy Future (Fairmont Press) won the 2009 Indie Award for Excellence in Environmental Writing. He is based in Denver, Colorado and can be reached at