by Stephen Kishewitsch

Ontario has had one of the most reliable electricity systems in the world for generations. For many years that reliability has depended on significant quantities of centrally located predictable coal-fired generation. But the province took an abrupt turn with the election of the McGuinty government in 2003 and is now driving unmistakably in the direction of eliminating coal from the system. To maintain reliability in an era with little or no coal-fired generation and increasing levels of renewable generation will require substantial changes to the supply mix, transmission and distribution infrastructure, grid management strategies, demand response, new technology and more. It will also mean significant business opportunities for people in a number of fields.

Ontario could find itself pioneering in some new approaches to grid management, and in the application of new technologies to maintain reliability. The power sector here expects to build on its existing expertise, and integrate new operating techniques used in other jurisdictions. Distributed generation, smart grid technology and infrastructure reinforcement will all have roles to play.

A solid base to start from

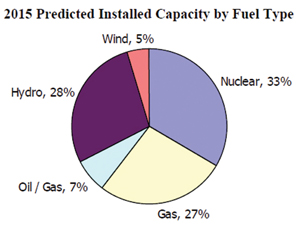

The economic slowdown has given the reliability managers at the IESO a little breathing room and they are quite confident about maintaining reliability of the system over the next three to five years. They will need to use some new techniques to deal with the increasingly variable supply mix, but reliability can be maintained at traditional levels – and in keeping with the international standards set by the North American Electric Reliability Corporation (NERC) and the Northeast Power Coordinating Council (NPCC). In fact the IESO has all the tools and regulatory powers necessary to maintain high levels of reliability well beyond 2015, but a number of unpredictable factors could change the context post-2015 and oblige the IESO to step into new territory. IESO staff monitor these issues closely and have begun a close examination of the range of options they may need to deploy if certain scenarios become realities.

It’s notable how quickly some factors affecting reliability can change, even though the underlying concerns have been known for a while. As Kim Warren, Director of Planning and Assessments at the IESO, put it in a recent conversation with APPrO, a mere three years ago the Integrated Power System Plan (IPSP) anticipated Ontario gaining about 5000 MW of wind over 10 years, in increments of about 500 MW a year. But now, he noted, with the Green Energy Act and the Ontario Power Authority’s Feed-in Tariff (FIT) Program in full force, Ontario could have 4000 MW of wind on the system in two years.

This presents challenges in terms of accommodating the variable output patterns of certain types of generation, particularly wind power, and dealing with generators that are embedded within local distribution systems.

As the IESO’s President and CEO Paul Murphy put it, “Although we do have a positive reliability outlook over the next few years, meeting adequacy requirements beyond 2014 is less clear at this point.” There are “big decisions that require long lead times to coordinate and to implement. They will have significant impacts on how we manage the reliability of the system in the second half of the decade.”

What coal did for us

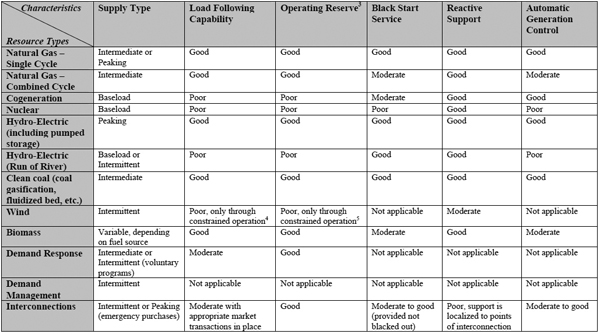

With the regrettable exception of its well-known effects on air quality, from acid rain to ozone to heavy metals to carbon dioxide, coal has been good for Ontario. (Other jurisdictions are investigating technical solutions to those problems, collectively called clean coal, but the technologies are still at early stages and Ontario has decided not to go that route.) The Nanticoke, Lambton, Lakeview, Thunder Bay and Atikokan power stations provided Ontario with a good proportion of its baseload, reliably cranking away day and night. The coal-fired units – eight of them at Nanticoke, eight at Lakeview, and so on – were also the facilities that provided load balancing to the province, instructed by the IESO to ramp up and ramp down as demand came on and dropped off. Coal has also provided a separate package of critical technical services: voltage control, frequency control, peaking supply, reserve, inertia – typically the coal-fired plants have been able to do whatever they were asked to do, even on short notice. If you look at a table of the various functions coal can be asked to serve, it ranks highly in every category, in a way that not many other resources do. To top it off, coal is cheap and plentiful.

Ontario is poised to lose that convenient package of services. As a result, those functions will have to be parceled out in a different way, some to be provided by one resource and others by other resources. In some cases, even loads could have the capacity to provide some of those functions. In other words, providing the same level of services is going to be more complicated.

As Kim Warren explains, all Nanticoke units were the same, likewise the units at Lambton and, to some degree, the former Lakeview plant. Each of them responds in basically the same predictable way to dispatch instructions. Similarly, scheduling maintenance is comparable for each unit. Now, he says, the grid operator must deal with multiple generators, of diverse sizes, and with diverse operating characteristics and locations, each of that will potentially respond in a different way to dispatch – while continuing to provide the same range and level of reliability services across the province. Again, by comparison with the coal-fired stations, there used to be a suite of maintenance crews, who when they were done with one unit at a plant would move on to the next. Now there’s no such regularity to the maintenance schedules of the different crews on all the different facilities.

Darren Finkbeiner, Manager of Market Development at the IESO, shed some further light on the use of gas as a substitute for coal. First, Finkbeiner says, studies the IESO has done indicate that natural gas is shaping up well as a general purpose replacement for coal, in quantity and, to a degree, in its generation characteristics. “Everything we’ve seen with the performance of the new gas units suggests the coal replacement will go smoothly. In fact some of it is being accelerated,” he said. This is not to say that gas and coal behave identically. Unexpectedly, at least for those who might assume that gas-fired generation is in all respects nimbler than coal, it turns out that coal provides greater flexibility. As Finkbeiner explained, a 500MW coal unit coming on line has a relatively short minimum-run time and a relatively low minimum loading point. That is, such a unit could, if need be, be throttled back to perhaps 100 MW, and might have to run for a minimum of four hours. An equivalent 500 MW gas plant might have a minimum load point of 300 MW, below that it cannot go, and might have to run for a minimum run time of 12 hours. Gas has a good ramp rate once it’s on, but a 500 MW gas plant with a 300 MW minimum only gives 200 MW of dispatch flexibility, compared to 400 MW of flexibility for the same size of coal plant. So adjustments have to be made to the protocols for dispatching gas versus coal.

These new variables can be managed, Warren emphasizes, but it’s a completely different ball game than a few years ago.

Accommodating wind

The most obvious issue is the intermittency of wind, the major form of renewable energy that is being added to the system. What tools and techniques does the IESO have available to accommodate greatly increased levels of variable generation? How should it deal with the fact that even the amount of wind generation capacity to be added to the system is itself an unknown variable? Warren observes that the transmission system could handle another 2500 to 3000 MW of new generation today. In two years there could be 4000 MW of wind power capacity on the system. Moreover, the primary power source will move around, depending on where the wind is blowing: on the shores of Lake Superior today, Lake Ontario tomorrow. That means different issues for anyone dispatching resources on the system. Balancing will be different; operating reserve, voltage control, the use of automatic generation control, assessing transmission outages – all will have to adapt, Warren says.

An appreciable amount of the new generation – wind and others – will be on the distribution system rather than being transmission-connected. At present the IESO can’t even “see” that distribution-connected generation from its operation centre, much less control it. At the moment it adds up to only about 400 MW, not enough to complicate matters. But that is changing rapidly as generators develop plans to add major new capacity at the distribution level. If the level of new embedded resources reaches a certain threshold, Warren says the IESO could, if necessary, leverage off the LDC capabilities, with control instructions passed from IESO to LDC to generator. Of course the question becomes: What systems and equipment will have to be in place, and how soon, to allow for that visibility and control?

Retrofitting legacy systems, trying new techniques

It’s been observed often enough that the distribution system wasn’t built to handle energy flows in two directions, sometimes at the same time. What has to be changed to facilitate the increasing volumes and multiplicity of power flows expected on those systems? In addition, while at present the generation on the distribution system has tended to increase or decrease in the same direction as the load, with customer-driven generation for example, these larger amounts being added won’t necessarily be doing so.

Centralized forecasting of wind energy production will be a necessity. At present each generator does its own forecasting, but as the volume of generation and number of generators increases, the IESO will take over that function, and the generators will pay the IESO for forecasting services, instead of their present forecasting providers.

What new use can be made of load control to enhance reliability? Loads already provide operating reserve, and do it well. The IESO would never have contemplated that 10 years ago. It’s the presence of the wholesale power market that’s generated that type of interest, opportunity and creativity, Warren observes.

Maintaining economic efficiency

Perhaps unexpectedly, Finkbeiner characterizes the matter of what to do with wind as an issue of what to do with surplus baseload generation (SBG). Under the original market rules developed to transition from the old Ontario Hydro centralized planning system, special provision was made for intermittent, typically renewable, generation. Under those rules, that are still in effect, the IESO cannot, unless it is volunteered, tell a direct-connected wind farm to dispatch off, or down, for any reason but reliability concerns. But since the rules were written, two new factors have entered the picture. First, when the rules were formulated they did not anticipate, any time soon, the development of enough wind capacity to actually affect system operation – but now Ontario is inviting several thousand megawatts of wind power capacity, with the GEA and the FIT program. In a few years there could be seven or eight thousand MW.

Second, in just the last year we have seen the emergence of SBG as a concern. Given those two factors, Finkbeiner presents a likely scenario, as follows: let’s say it’s the middle of the night, and baseload – somewhere around 12,000 to 14,000 MW – is being fully supplied by nuclear and hydropower. Now say the various wind farms around the province are receiving enough wind to allow them to generate 500 MW of power at a given moment, and that happens to be 500 MW more than the current demand adds up to. For various reasons, including safe operation of the waterways, the waterpower can’t be turned down any lower. The IESO then has a decision to make: tell the wind generator not to produce the power, or turn off an 800MW nuclear unit to make room on the grid for the wind power? If the latter, well, you don’t tell a nuclear generator to throttle back by 500 MW; it wants to be either on or off. But once the nuclear generating unit has been turned off, it’s not ready to be turned on again three hours later when the wind dies down again: It needs two to three days to come back on. Well, now that the coal is no longer available to make up the difference on short notice, it will have to be a natural gas-fired plant that does so. Depending on market prices, gas can be relatively expensive. This can result in an inefficient outcome in the power marketplace, and maintaining an efficient marketplace is the IESO’s other mandate.

Now, there are contractual provisions in the FIT program for renewable-source generators to offer a kind of dispatchability. Under the condition described above, they would face negative prices if they offered their power during a surplus and the Ontario price falls below zero. Wind’s contract price, for example, is $135 / MW. If the Ontario clearing price goes to $-20, the wind farms get paid the net figure: $115. The economic incentive to them is to offer dispatch services, that is, to allow themselves to be dispatched off. Then they instead get the full $135 /MW for what they could have produced. This provides the IESO with another alternative – to use the wind resource when it’s more efficient than using the nuclear resource to meet a particular need, and to dispatch it off if that’s the best option at a given point in time.

One piece needed to complete the picture is a set of rules and protocols allowing the IESO to dispatch such resources off for reasons of economic efficiency, rather than for technical or reliability reasons. This is one of several things the IESO is working on – driven, in part, by the phase-out of coal (in addition to all the other policy decisions at work). The IESO is looking at 2011-12 for implementation of those dispatch solutions, depending on the take-up and in-service dates of generation under the FIT. While the FIT generators all have these curtailment provisions in their contracts, earlier renewable contracts generally did not provide the same curtailment treatment.

Dealing with future unknowns

While the immediate challenges are well in hand, the IESO readily acknowledges there are major factors that will greatly affect the approach to reliability in years to come.

Some other issues posed by the replacement of coal with variable, renewable generation under the FIT program:

• Can distribution-connected generation be expected to contribute more to reliability than previously? The IESO and the LDCs have started working together to define the kinds of communications, agreements and processes needed to coordinate embedded generation – something that must be in place before large volumes of FIT generation are on the system. An agreed-on set of protocols will allow optimal decisions to be made as to whether a particular generator is dispatched off or not, depending on the needs of both the LDC and IESO.

• The IESO has a project team in place studying user and system requirements for wind forecasting, from an hour ahead to at least a day ahead, using a centralized model as mentioned above. It will probably run a pilot to evaluate the various weather model vendors available. For the present, it will cover wind only, though inclusion of the solar resource – obviously a less complicated matter – will probably be added at some point to allow a more comprehensive picture.

• To keep the number of distribution-connected generators that need monitoring and control to something more easily manageable, an individual project floor size of 5 MW will be set, on the principle that all the smaller projects will average each other out. Those above will be eligible for the additional dispatch-off contract payment.

• In addition, NERC has a task force on Integration of Variable Generation (IVGTF) looking at what new standards are needed in North America to allow integration of renewables, for example new reserve requirements or load-following standards for systems with appreciable amounts of wind power. Ontario is working in concert with other NERC members to develop consistent reliability standards. The new standards for operation of wind power are expected in a couple of years.

And just to make things interesting for the longer term, it’s still undetermined what will be done with the nuclear fleet after 2014.

The IESO is also working with the New York Independent System Operator on a “Broader Regional Markets” proposal the NYISO has put forward. A number of reliability benefits are expected with broader regional markets. See “NYISO seeks coordination with other ISOs,” page 35.